Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Don’t Miss: Does Capital One Report Authorized Users To Credit Bureaus

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

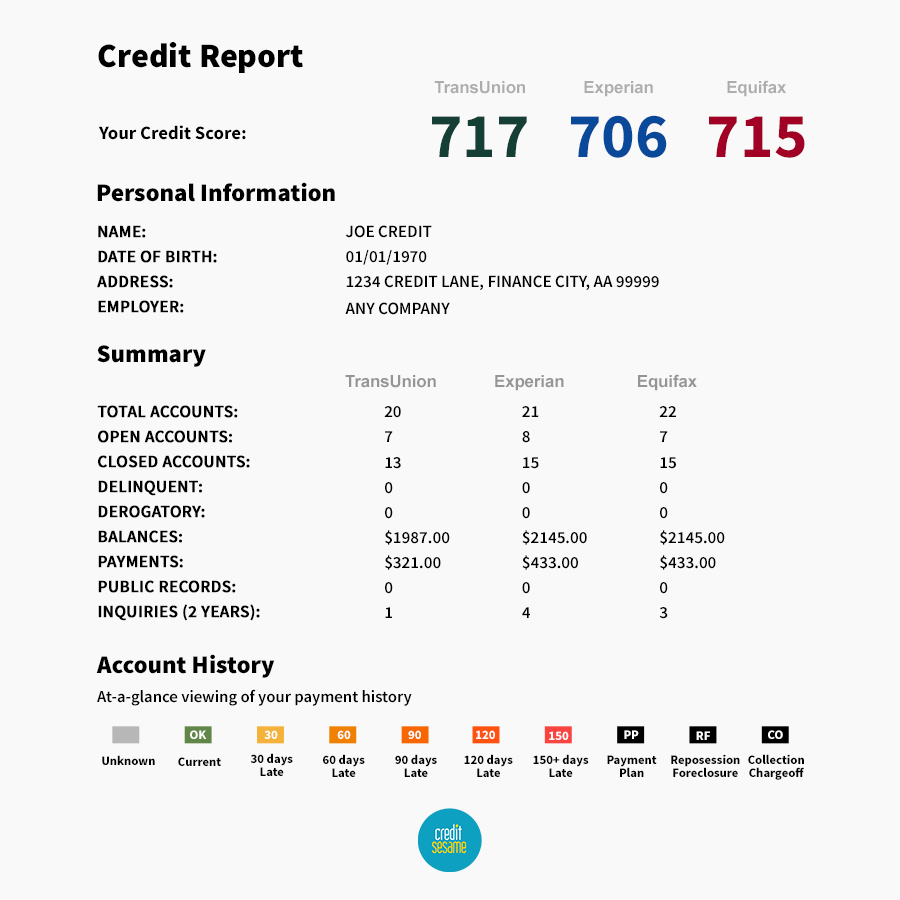

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

Also Check: Credit Report With Itin

Expired And Extraneous Information

At some point, even relevant financial information becomes old news. Following are a few examples of when items expire and should automatically drop off your credit report:

- Chapter 7 bankruptcy: 10 years

- Chapter 13 bankruptcy: 7 years

- Collection accounts: 7 years

- Late or missed payments: 7 years

- Closed credit accounts in good standing: 10 years

Your credit report also excludes personal information that is irrelevant to your credit. Examples include:

- Political affiliations

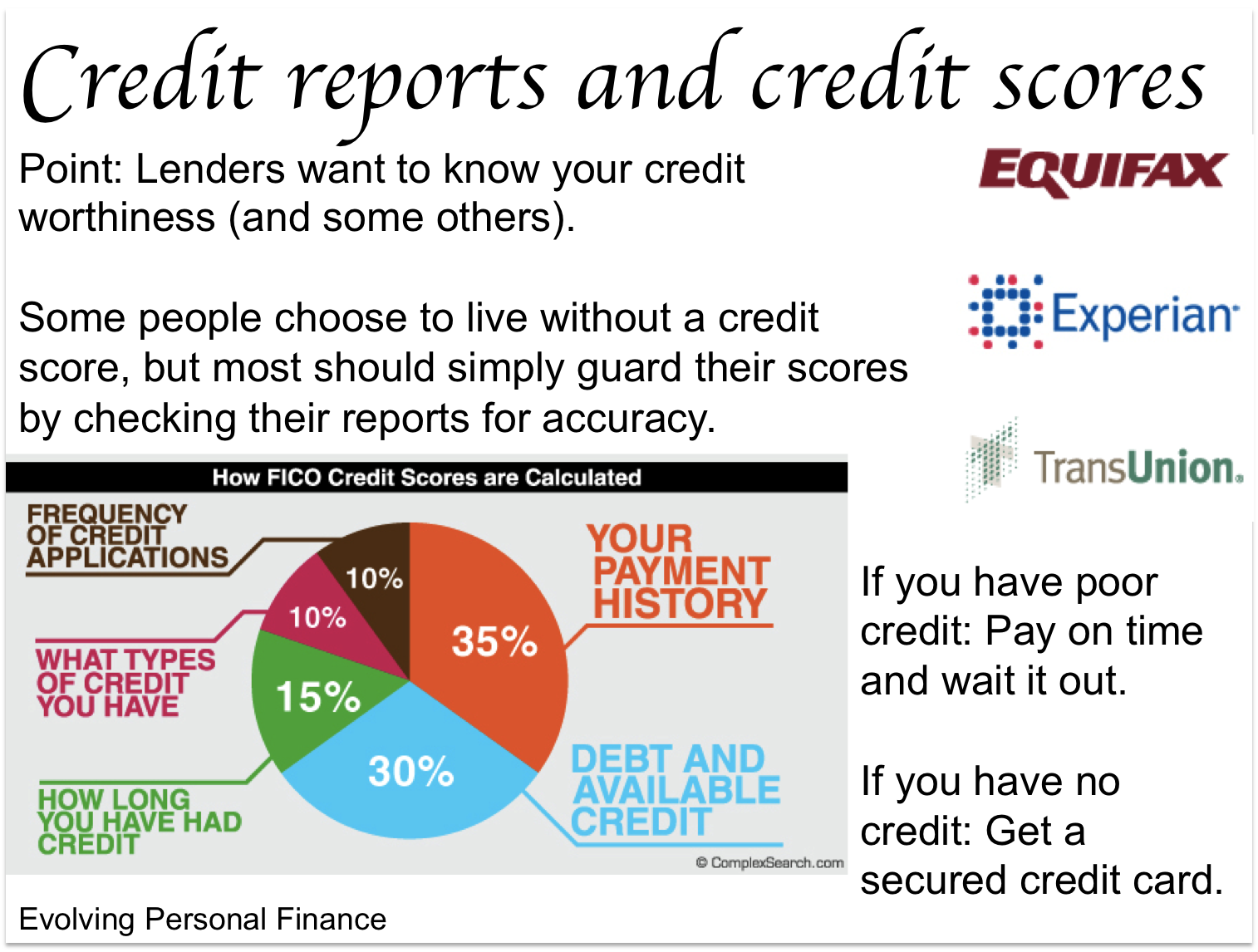

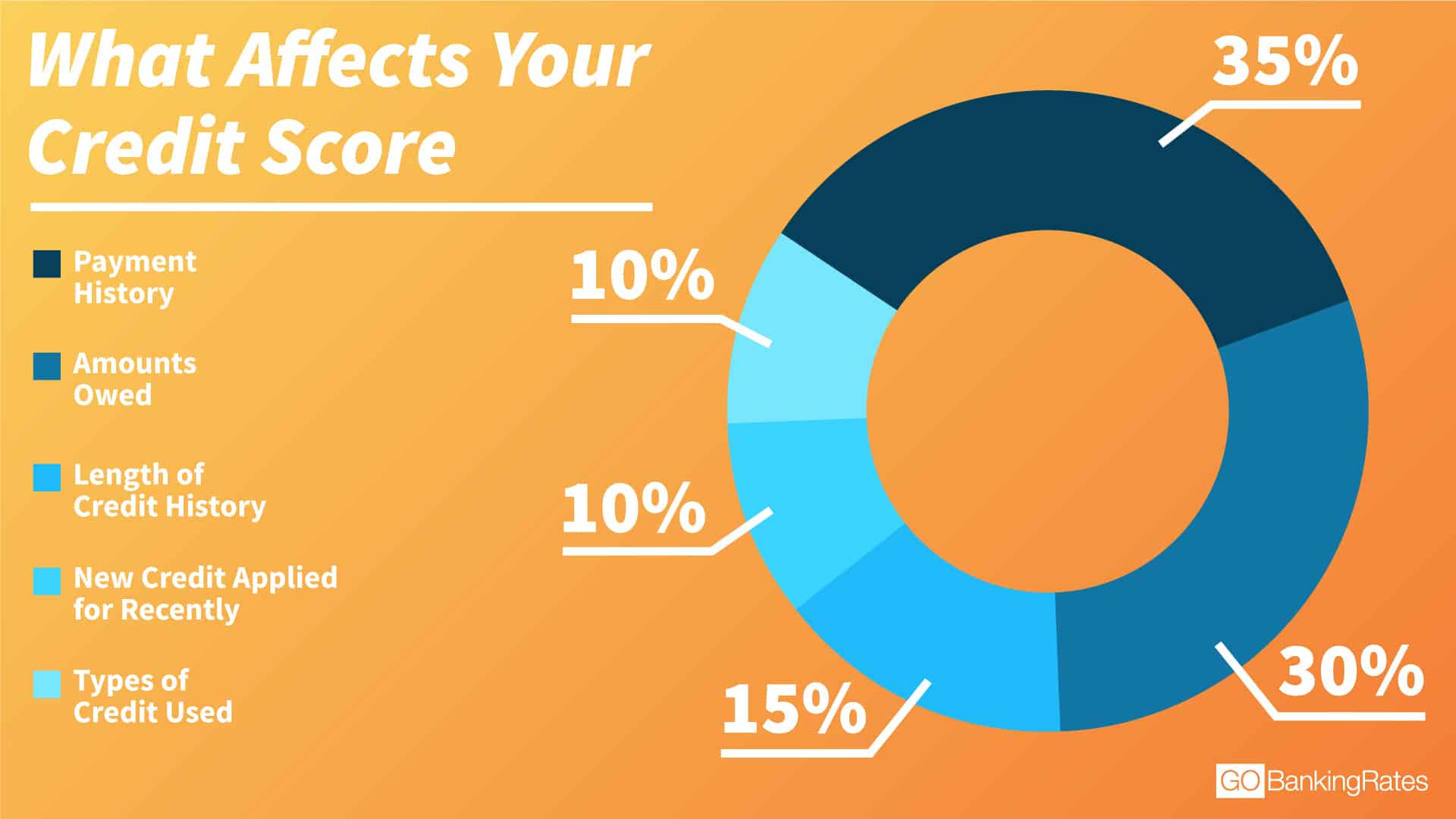

How Can I Build My Credit Score

The two biggest factors in your credit score are paying on time and managing how much of your credit limits you’re using. Thats why they come first in this list of tips:Pay all your bills, not just credit cards, on time. Late payments and accounts charged off or sent to collections will hurt your score.Use no more than 30% of your credit limit on any card less, if possible. The best scores go to people using 10% or less of their credit limits.Keep accounts open and active when possible that gives you a longer payment history and can help your “credit utilization,” or how much of your limits you’re using.Avoid opening too many new accounts at once. New accounts lower your average account age and each application causes a small ding to your score. We recommend spacing credit applications about 6 months apart.Check your credit reports and dispute errors.

You May Like: Removing Child Support From Credit Report

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

How Is Your Credit Report Prepared

In most cases, people might have more than one credit report. But, how are these reports made? Well, credit reports, in most cases, are prepared by credit reporting companies. These companies are often known as consumer reporting agencies or credit bureaus.

Now, their primary job is to find and store your data submitted by various credit card companies, lenders, financial companies, etc.

This report also includes your performance in terms of loan repayment. For example, if you have been regular in paying your EMIs, or never missed a repayment, your credit report will show that. But, if it were not so, you might have a bad impact on your credit report.

Now, this report tells your lender whether or not to lend you any more money. Lenders can access these reports whenever they apply for a loan and see your activities in the past. Based on the report, they might decide what amount at which interest they should offer you.

Other businesses around you might also want to access your credit report before allowing you any of their services. For example, if you rent a home, take cable TV connection, internet, etc., you might get a credit report check. In short, whenever you apply for any loan, job, rent, or something, you let your lender or employer look into your credit report.

Recommended Reading: Aargon Collection Agency Bbb

Know That A Freeze Doesn’t Protect Everything

A credit freeze can prevent someone from committing credit fraud by opening a credit account in your name without your permission. It can’t, however, protect you from having your identity stolen. A credit freeze has never prevented identity theft. Its purpose is to prevent use of your stolen identity to commit fraud against you.

If someone steals your credit card number, they can still use your credit account to make unauthorized purchases. Also, if someone steals your Social Security number, a credit freeze won’t prevent them from filing fraudulent tax returns and health insurance claims in your name.

As a result, it’s important to remain vigilant in other areas of your financial life, especially if you’re certain that someone has stolen your personal information.

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

You May Like: How Personal Responsibility Affects Credit Report

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

You May Like: What Is Cbcinnovis On My Credit Report

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report. An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life

- disability insurance applications.

How Long Does Negative Information Stay On My Credit Report

Typically, negative information falls off your credit report 7 years after the date of first account delinquency. Bankruptcy information stays on your report for up to 10 years from the date filed, but it can be less depending on the type of bankruptcy.

Positive information remains on your report for up to 10 years from the date of last activity on the account. This information applies to installment accounts like mortgages and car loans, which are the types of agreements that have fixed terms on the number of years for repayment. For revolving accounts, such as credit cards, your positive history will stay on your report for as long as the account is active.

You May Like: Does Paypal Credit Report To Credit Bureaus

Choose A Credit Repair Firm Carefully

- Avoid offers of a quick debt reduction or debt settlement plan with high upfront fees.

- Be aware that some fraudulent agencies will get away with using a nonprofit status just to collect your money. Legitimate agencies should be willing to sit down with you and discuss your spending habits and help you come up with a budget.

- Unrealistic promises, such as erasing your debt for pennies on the dollar in a short time, or promising to reverse a bad credit score, should be red flags.

- Work with a Minnesota licensee that has a local office with staff available to answer your questions.

Length Of Credit History

If you have had credit available to you for a long time, your credit report should provide an accurate picture of how you use credit and if you had one, how you got through a difficult time. For someone who has not used credit for very long time, it is difficult to tell if they really know how to use credit responsibly.

Good or bad, most information will be automatically removed from someones credit report after 6 7 years, so the only way to keep a credit report active, is to use credit, at least very minimally, on an ongoing basis.

Time is needed to get a true picture of how responsible someone is with credit. This is why the length of your credit history is the third most important factor in your credit score calculation.

Your score will reflect how long it has been since you first obtained credit, how long each item on your credit report has been reporting and whether or not you are actively using credit right now.

If you have recently obtained credit for the first time, your credit score will not be very strong. However, if you have been using credit responsibly for many years, this factor can work in your favour.

If you have been involved in a bankruptcy, consumer proposal, orderly payment of debt or debt management program, your credit history will essentially restart whenever you complete your program.

You May Like: How To Get Credit Report With Itin Number

Hard Pulls Vs Soft Pulls

When you apply for credit of any kind, you effectively authorize a business or individual to do what is called a hard pull or hard inquiry on your credit report. There likely will be a negative effect on your credit score from hard pulls, especially if several occur over a short period of time.

Hard pulls are another issue. Hard pulls are viewed as an indication that you need financial help to complete whatever transaction you are making, thus it has a negative effect on your credit score. The effect usually is slight, maybe 5-to-7 points, but if your credit score is on the borderline, it may drop to the wrong side of that line after a hard pull and affect the interest rate you are charged.

This should not discourage you from shopping at several lenders for auto or home loans. Fair Isaac Corporation calls this rate shopping, and allows a 45-day window where the numerous hard inquiries are treated as just one.

Whats Not Included In Your Credit Report

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

When you apply for a loan or other credit, lenders want to know how you manage debt. Your credit report is meant to provide a detailed record of your relationship with debthow much of it you carry and how well you pay it off. It also includes personal identifying information that helps to verify that the information in the report is yours.

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn’t include your . For a bit more detail, let’s unpack a few types of information that don’t appear on your credit report.

Don’t Miss: Is 611 A Good Credit Score

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

How Many Times Can I Pull My Own Credit Reports Before It Impacts My Credit Score

There is good news. Pulling your own credit report is considered a consumer disclosure request and therefore your scores will never be impacted. In fact, you canget your credit score and credit report card for free right now!. If, however, you are getting your credit reports from a friend at a mortgage company or at an auto dealership your scores will be impacted. The reason is that their credit report access accounts are not setup for consumer disclosure. They are set up as lenders so the hard pull will count against the consumers score.

You May Like: Does Capital One Report Authorized Users To Credit Bureaus