How Long Does It Take To Get Your Free Credit Report

Knowing how to get a free copy of your credit report and how long it will take can help you plan for major purchases. For those making large purchases that require a loan, such as buying a car or taking out a home mortgage, you might want to view your credit report right away. There are three ways you can request a credit report: online, through the phone, and by mail. Heres how long each method takes:

- Requesting a free credit report online: When you request a free credit report online, such as through AnnualCreditReport.com or through Mint, you can get your credit report immediately.

- Requesting a free credit report through phone: If you order your free credit report by calling 1.877.322.8228, your credit report will be processed and mailed to your address within 15 days.

- Requesting a free credit report through mail: You can write a letter requesting your annual credit report or fill out and mail the Annual Credit Report Request Form to the following address:

Annual Credit Report Request Service

P.O. Box 105218

Atlanta, GA 30348-5281

Requesting a free credit report through mail will be processed and mailed to your address within 15 days of receipt, which can bring your total wait time up to two to three weeks for delivery.

Follow The 50/30/20 Budget Rule

Mint.com didnt work for me, but the 50/30/20 budget rule did.

If you havent heard of it, the concept is simple: allocate 50% of your net income for needs, 30% for wants, and 20% for savings. As a freelancer, this rule worked amazingly well because it didnt require me to stick to the same rigid budget every month.

It accounted for my erratic earnings and allowed me to pay as I go into my savings account. I chose to bank with EQ Bank because I can have several accounts without paying any fees. Plus, EQ Banks Savings Plus Account offers an everyday interest rate of 1.65%*, making it one of the best high-interest savings accounts in Canada. Ive been using the 50/30/20 budget for the past year, and I can attest that its worked well for me. All my bills are paid, and I have money in the bank for emergencies, retirement, and even a family vacation.

The lesson here: start a 50/30/20 budget and watch your money pot grow!

*Interest is calculated daily on the total closing balance and paid monthly. Rates are per annum and subject to change without notice.

Is It Wrong To Dispute Correct Information

Im not the morality police, and you can do what you want to do, but you do have the right to challenge any information on your report whether its correct or not.

Its your right to have correct and verifiable information on your credit reports. I cant speak for them, but I imagine theyd also want your credit report to be fully accurate and verifiable.

Also Check: Do Balance Transfers Affect Your Credit Score

Similarities Between Fico And Vantagescore

Both the FICO Score and VantageScore models use a credit score range from 300 to 850. Both consider the same general factors when assessing your creditworthiness: your payment history, how much credit youre using, the length of your credit history, the different types of credit you have and whether youve recently applied for new credit.

Print Out Your Credit Report And Notate The Errors

In step two you printed out your original credit report. Now, youll want to notate the errors you noticed on your report by circling the items you wish to have changed. Its important that the credit bureau knows exactly what your request is about, so be extra careful here and make sure the information youre citing here matches the description on your credit report dispute form.

Also Check: Does Paying Off Collections Help Credit Score

Online Picks For A Free Credit Score

Brittney is a credit strategist and debt expert with years of experience applying her in-depth knowledge of the credit and personal finance industries to write comprehensive, user-friendly guides on the products and strategies readers can use to make smart financial decisions throughout the credit-building process.

Edited by: Lillian Guevara-Castro

Lillian brings more than 30 years of editing and journalism experience, having written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times. A former business writer and business desk editor, Lillian ensures all BadCredit.org content equips readers with financial literacy.

Consumers should be able to easily access their free credit score without credit card requirements, and while plenty of companies these days present what appears to be a free credit score service, there is often a charge on the backend.

It often seems as if every other commercial is one of these companies telling you how vital it is for you to check your credit. But luckily for you, the company will happily give you your credit report and score for free!

While the commercials arent wrong, their method of advertising certainly is. Your credit is a vital part of your personal financial life and you should definitely check it regularly but nothing free should ever require you to enter payment information.

| | | |

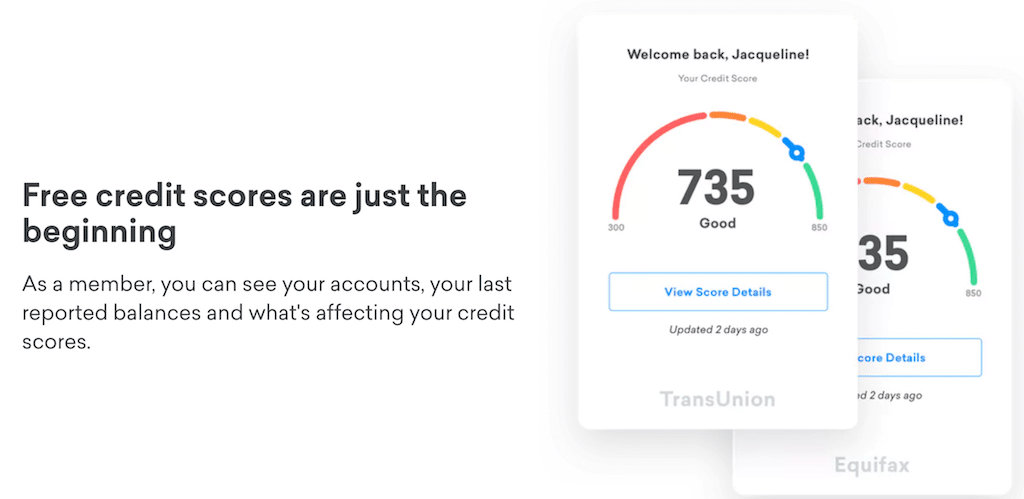

What Does Credit Karma Offer

You can get a free credit score and credit report from Credit Karma in exchange for providing some personal information. Your credit score will be calculated using the VantageScore 3.0 credit scoring model. Credit Karma also offers a wide range of other free services. For instance, you can access tools and education, such as financial calculators and useful articles, so you can learn how to make the most of your money. Based on data you share, Credit Karma makes recommendations for managing your finances.

Looking for an auto loan, home loan, credit card or other credit product? Use the site to get personalized recommendations for loans and credit cards that fit your credit profile. Credit Karma also offers free credit monitoring, which includes alerts of important changes to your TransUnion credit report this can help you spot identity theft.

Also Check: How To Build Credit Score Quickly

Mixing And Matching Services May Help Cover More Ground

When it comes to checking your credit, there are a lot of ways to go. You can select one service, or pair free services together to access your FICO score from all three major bureaus. However, if you go that route, keep in mind that you won’t have the promised credit protection and monitoring that Experian, TransUnion and Equifax offer.

Disclaimer: The information included in this article, including program features, program fees, and credits available through credit cards to apply to such programs, may change from time-to-time and are presented without warranty. When evaluating offers, please check the credit card provider’s website and review its terms and conditions for the most current offers and information.

The Dates Of Recent Updates

Lastly, the date on which your lenders send updates to the credit bureaus, as well as the dates on which your score is refreshed, can impact your score temporarily. A credit score, at least for now, is a point-in-time snapshot of your credit risk versus a real-time update.

Generally, lenders send an update with your outstanding balance and updated payment record to the credit bureaus about once every ~30 days. Imagine you do a bunch of holiday shopping one day and nearly max out your credit card, and the next day your lender updates the bureaus with your high balance. Your next credit score update may drop due to higher utilization, even if you paid it off a few days later. Not to worry: this should be resolved with the next update after your balance is paid off.

Additionally, the date your credit score is updated will impact whether or not recently received updates have yet to be factored into your score.

In summary: your score can fluctuate, sometimes significantly depending on your available credit and your balances/outstanding debt at the point in time that updates are sent to the lender. Making multiple payments per month, especially after large purchases, can help reduce these swings.

Now that you understand why its possible to have a large variety of credit scores at once, lets dig into the differences between the main models.

Also Check: How To Get A Credit Report From Credit Karma

Mint Budget App: How To Use Mint To Budget

Mint is owned by Intuit, the same company that owns TurboTax and Quickbooks. Intuit purchased the startup in 2009 when it was only 2 years old. Already, it was one of the most popular personal finance mobile apps in the United States. The mobile application connects to your bank accounts and credit cards, logging and categorizing each of your purchases.

The app gives you an updated credit score every month, alerts you about bills and lets you know when theyre due, and tells you when large transactions are processed. You can set also set your own budgets and monitor all of your spending, all in one place. Like any budgeting tool, though, it has its pros and cons. Here, Debt.com reviews the Mint budget app and how it really handles your financial needs.

Does Credit Karma Use Fico

No. However, the credit score Credit Karma provides will be similar to your FICO score. The scores and credit report information on Credit Karma come from TransUnion and Equifax, two of the three major credit bureaus. Your scores can be refreshed as often as daily for TransUnion and weekly for Equifax, with a limited number of members getting daily Equifax score checks at this time.

You May Like: When You Dispute Credit Report What Happens

Mintcom Is The Best Place To Go For Your Credit Score Report

This new feature is just an extension of Mints commitment to giving consumers like you access to critical information that influences your financial health. All you have to do to get your free credit score from Mint is log into your Mint account and get started. With Mint, you can also work toward improving your credit and financing standing overall, create a budget, and stay on top of bills. If youre not yet a member of Mint, learn more at Mint.com about becoming a member to gain access to all their helpful financial tools today!

Summary Of Money’s Guide On How To Check Your Credit Score

- You actually have numerous personal credit scores, not just one. The most popular credit scores are variations of the VantageScore and FICO score.

- A variety of free credit-score providers are out there, including credit card providers, banks, the credit bureaus themselves, dozens of credit-scoring websites and certain credit counseling agencies.

- Some companies still try to get you to pay for your personal credit score. With so many free options available, that is no longer necessary in most cases.

- Businesses also have credit scores, but they work quite differently from personal credit scores.

- Its hard to get your businesss credit score for free. Youll likely need to purchase an individual business credit report, which includes your business credit scores, or sign up for a credit-score subscription plan for your company.

- Different variations of your business credit score are available via business credit-scoring websites and major credit bureaus.

Also Check: Does Cancelling Credit Card Affect Credit Score

Consult With A Credit Counselor

If youre new to the world of credit scores, learning about the different types of credit scores, plus where and when you can pull your score all while dodging upcharges can be a little overwhelming.

Fortunately, theres professional help out there that can walk you through your credit report, teach you all the terminology, provide tips to improve your credit score and help with . Theyre called credit counselors. In addition to general personal finance advice, some can actually provide you with your credit score, too.

The trick is finding the right one. As with most things related to finances, scammers abound. When searching for a credit counselor near you, exercise caution. Be sure the company is not a credit-repair company in disguise.

According to the Consumer Financial Protection Bureau, you can usually spot the shady actors by looking out for:

- Upfront charges

- Promises to remove negative information from your credit report

- Consultations that avoid explaining your consumer rights

- Advice that tells you not to contact credit bureaus directly

To further ensure a credit counseling organization is legitimate, you can check the list of approved counseling agencies with the Department of Justice. Better yet, pick a non-profit agency. The National Foundation for Credit Counseling and Money Management International are two non-profit agencies you can start with.

Not Every Score Is A Fico Score

The last key piece of information to keep in mind when comparing credit checking sites is the type of score they provide. In addition to your scores varying based on the credit bureau that supplied the data, your credit score will also change depending on which credit scoring model was used to calculate it.

The most frequently used scoring models are those developed by FICO, which itself uses more than two dozen different models when calculating scores. In general, the FICO Score 8 is the most commonly used score, though the auto and credit card industries use industry-specific scores such as the FICO Auto Score 8 and the FICO Bankcard Score 8, respectively.

In general, free credit score offers providing a true FICO credit score will only provide your FICO Score 8 from a single credit bureau. The only way to receive all of your FICO scores, including the industry-specific scores and variations for each credit bureau, is to purchase them directly from FICO through myFICO.com.

This table from myFICO shows the various FICO models used to generate consumer credit scores.

For the most part, the free credit scores youll receive from online companies will not actually be FICO scores of any type. Instead, the average free offer will provide a credit score based on the VantageScore 3.0 model, which was to create a more consistent score.

Don’t Miss: What Does Dt Mean On Credit Report

Top Sites For Free Credit Scores

If youre interested in seeing your actual FICO score, you might want to check with your bank or credit card company. A growing number of credit card issuers now offer truly free credit scores as a way to entice new customers. They include:

- American Express

- Discover

- Wells Fargo

Anyone else may have to pay if they want their actual FICO score by visiting myFICO.com. The site offers single-time and monthly packages. The recurring ones are $19.95 , $29.95 , or $39.95 per month, with the advanced and premier plans including identity theft monitoring.

The two single-time packages are $19.95 for a report from just one credit bureau and $59.85 for a report from all three. Of course, the more you pay, the more features you receive.

As noted above, if you just want to read your credit report without seeing your score, you can do that once a year, completely free, at AnnualCreditReport.com. The nice thing about this government-sanctioned site is that you can request reports from all three bureaus. Because some banks use only one or two of the reports to make lending decisions, its always a good idea to make sure that all three contain accurate information about your borrowing history.

Whats Turbo And Why Are We Talking About It

Turbo is part of the Intuit family of products, just like us. We work with Turbo, TurboTax and Quickbooks to get all our customers on the right track financially. While Mint provides free credit scores to our customers, Turbo combines the same score, plus other information like verified IRS filed income and debt to income ratio to create a broader financial health profile. Try out our sister app to see where you truly stand financially beyond the credit score.

Save more, spend smarter, and make your money go further

You May Like: How To Check Your Child’s Credit Report

Some Words Of Advice: How To Dispute Credit Report And Win

Wondering does disputing credit work? Unfortunately, its not always that simplebut there are certainly some things you can do to increase your odds. If you do file disputes with the credit bureaus, you should think about how to word your letter. Im not sure Id go so far as to tell them you want accurate information removed. Id simply ask that they verify whats already being reported.

After you file your dispute, the credit bureaus will contact the furnishing party, normally a lender or a collection agency. These parties are formally referred to as data furnishers or furnishers for short.

Its their responsibility to investigate your claim and get back to the credit bureaus, normally within 30 days, but there are some scenarios when it can take 45 days.

If they confirm the accuracy of the credit reporting, then youll likely have to live with it until the credit bureaus have to remove the item, which normally takes 7 years for the bad stuff.

The Credit Bureau Data Being Utilized

Behind every credit score is a credit report, a set of historical data on your past credit and lending activity. This includes credit accounts , your payment history for each, and any negative marks, which could include late or missed payments, collections, or charged-off and closed accounts. The three main providers of credit reports in the US are Experian, Equifax, and TransUnion.

While many customers may see their credit reports looking quite similar across the three bureaus, they can differ. If past lenders have sent your application, account, or payment data to only one or two of the three main bureaus, that data may differ in a way that could meaningfully impact your score.

You can access your TransUnion credit report for free on Mint, as well as being entitled to one free credit report per bureau per year via www.annualcreditreport.com.

You May Like: Does Bankruptcy Stay On Your Credit Report