Which Credit Score Is More Accurate Equifax Or Transunion

Neither score is more or less accurate than the other they’re only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a fair score from TransUnion is typically fair across the board.

Which Credit Scores Lenders Most Look At

Banks Editorial Team

Banks Editorial Team

How many different credit scores do you have, and what is the most important credit score when you apply for a loan or other type of credit? There are three major consumer credit bureaus whose data is used to generate credit scores. However, because there are many different credit scoring models, you may have dozens of credit scores. Which credit score is most important for a particular lender will vary depending on the type of credit for which youre applying. Heres what you should know about your credit scores.

Why Is My Experian Score So Low

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureauswhich is also unusual.

You May Like: Do Cell Phone Bills Go On Your Credit Report

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Also Check: How To Boost Your Credit Score Quickly

How Are Credit Scores Generated

When someone refers to a “credit score,” they’re generally referring to a three-digit rating that represents a borrower’s history of repaying loans and lines of credit. The credit score is generated by applying credit rating company’s algorithm like VantageScore® and FICO® to a borrower’s credit report.

Breaking Down Fico And Vantagescore

When most people think about their credit score, whether they know it or not, they are thinking about FICO. The Fair Isaac Corporation introduced FICO credit scores for consumers back in 1989, and since then the company has worked diligently to keep up with consumer behaviors and how those impact the FICO scoring calculations. Up until a decade ago, FICO was the only consumer credit score used by the three major credit reporting agencies, as well as the only score used by lenders and financial institutions.

In recent years, VantageScore has taken on the challenge of competing with FICO for its place at the top of the consumer credit scoring chain. By partnering with the three credit bureaus, VantageScore is able to use similar information and scoring models as FICO to generate individual credit scores. However, there are differences between FICO and VantageScore that consumers should be aware of.

First, it is important to understand that both the FICO and VantageScore methods draw from the same consumer information: payment history, credit usage, recent inquiries, length of credit, and type of credit. However, these details are gathered in different ways.

Read Also: When Does Your Credit Score Start

If It Doesn’t Say Fico Score It’s Probably Not A Fico Score

“62% of consumers who received a non-FICO credit score mistakenly believed they received a FICO® Score.” BAV Consulting Survey3

There’s simply no substitute for FICO Scores. Remember, before the creation of FICO Scores there was no industry-standard to make sure access to credit was more fair and accurate. When you want to know where your credit stands, it just makes sense to get the scores your lenders will use.

A note of caution: some sites may try to sell a credit score and pass it off as a FICO Score. If it doesn’t clearly say FICO Score, it’s probably not a FICO Score.

Best For Credit Monitoring: Credit Karma

-

Only offers reports from two credit bureaus

-

Account required

While you will have to create an account to use Credit Karma, you dont have to enter your credit card information or remember to cancel any free trial subscription. You can access your credit reports at any time by logging into your account either directly through your web browser or through their mobile app. Your credit report information is updated to reflect changes in your credit history and activity, giving you continued access to changes in your credit information. Although, changes my require some days to be reflected in what is shown by Credit Karma.

Youll have access to your credit report information along with an explanation of the factors that are currently contributing to your credit score. Credit Karma also uses your free credit report information to show credit card and loan offers that you may qualify for based on your credit standing. You dont have to take advantage of these offers if youre not on the market for a new credit card or loan product.

Read Also: Is Credit Report Com Accurate

Is Creditkarma Accurate

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

What Is Credit Karma

Using Credit Karma is possible if you give them some of your personal information. No need to worry they will not ask for all of your data, but rather some basic information meant to identify you. If you give them your name and your Social Security Numbers last four digits, you can start using Credit Karma.

If you give it your permission, it will also be able to access your credit reports, as well as create a VantageScore.

Read Also: Will Credit Card Companies Remove Late Payments Credit Report

How Can You Get Your Experian Credit Scores

If youd still like to access your Experian credit score, you can find it for free in several places.

Experians free CreditWorks Basic service updates your credit score every 30 days. Experian also operates freecreditscore.com, another place where you get your free Experian FICO score once a month.

Some banks and credit card issuers, like Discover, also offer complimentary Experian-based FICO® credit scores.

And if youre willing to pay, Experian and FICO both offer premium services through which you can access your credit scores on a more regular basis. These services offer other benefits, too, such as access to your credit reports and credit- and identity-theft monitoring and support. But we believe strongly that you should never have to pay to access your credit scores or credit reports.

How Does Credit Karma Compare To Actual Credit Scores

A lot of people also wonder how Credit Karma compares to actual credit scores. Well, Credit Karma generates credit reports from two of the three credit report agencies that are at the top. As already mentioned, they create these credit reports through agencies like Equifax and TransUnion. The score reported from these two is very close, and even if the points will be a bit off, they wont be by much.

The only top credit agency that does not report to Credit Karma is Experian. This is basically where the few points that are off are coming from. This relates to the actual credit or FICO score, so that is why it is affected.

Read Also: How To Get A 720 Credit Score In 6 Months

What Is A Credit Report

Your credit report is a collection of account history from companies youve created a credit account with or companies your creditors have designated to collect on their behalf. The information in your credit report helps new creditors and lenders decide whether to do business with you and the appropriate cost to charge you.

Why Is My Experian Credit Score Different From Credit Karma

To recap, Credit Karma provides your Equifax and TransUnion credit scores, which are different from your Experian credit score.

While the credit bureaus look at the same sort of things your payment history, credit use, length of credit history, credit mix and new credit lenders sometimes only report your account information to one or two of the bureaus instead of all three.

So if Experian has access to different information about your credit than Equifax or TransUnion, your scores from each of the bureaus might also be different.

And even though the three major credit bureaus may have the same information, each bureau has proprietary algorithms that might score you differently.

But that doesnt mean one credit score is more or less accurate than the others.

Instead of comparing your Experian credit scores to the scores you find on Credit Karma, we recommend you look at how each credit score changes over time. Is it going up or down?

Also Check: Is 739 A Good Credit Score

Why Is My Fico Score Higher Than Creditwise

Your score differs based on the information provided to each bureau, explained more next. Information provided to the credit bureaus: The credit bureaus may not receive all of the same information about your credit accounts. Surprisingly, lenders aren’t required to report to all or any of the three bureaus.

What Affects Your Credit Score

The FICO Score and VantageScore credit models take the same general factors into account when calculating your credit score, although they weigh them slightly differently.

- Payment history: Paying your bills on time is the single biggest factor in your credit score. In the FICO Score model, this comprises up to 35% of your credit score.

- The amount of credit you use as a percentage of your available credit is another important factor. To maintain a good credit score, you shouldnt use more than 30% of your credit limits. If you have a credit card with a limit of $3,000, that means your maximum balance should be $1,000. Credit utilization accounts for 30% of your FICO Score.

- Length of credit history: The longer youve had credit, the more time youve had to prove you can make your payments on time. The length of your credit history accounts for 15% of your FICO Score.

- This refers to the different types of credit you have. A mix of both installment credit and revolving credit will help boost your FICO Score this accounts for 10% of the FICO Score.

- Every time you apply for credit, the lender checks your credit report this process is known as a hard inquiry. Because a hard credit inquiry typically lowers your credit score slightly for a few months, you should avoid applying for too much credit in a short time. Having a lot of hard inquiries accounts for 10% of your FICO Score.

Also Check: How To Remove Bad Credit Rating

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Which Credit Bureau Report Or Score Is Most Accurate

If youve ever applied for a loan, apartment rental or even a job, you might have seen the 3-digit number that is your credit score. And if that number changes from day to day, or application to application, chances are youre wondering why.

What many people dont realize, however, is that there are multiple credit scores. So, if youre wondering which credit bureau, report or score is the most accurate, heres what you need to know.

Recommended Reading: How To Fix A Bad Credit Score

Other Differences To Recognize

In addition to differences between VantageScore and FICO credit score calculations, each major player in the consumer credit scoring market has had several versions designed and implemented over the years. FICO has developed no less than 56 versions of its credit score one for each of the three major credit bureaus along with one for each specific industry that may use it.

For instance, auto loan lenders have an Auto Score available from FICO that uses the same credit information to determine specific risk factors a borrower may show as it relates to defaulting on a new car loan. The same is true for credit card issuers , mortgage lenders, and general credit inquiries.

While VantageScore does not have as many iterations of its credit scoring model, there are at least two versions still in use today by consumers and some lenders. The differences between these credit scoring versions might be subtle, but the details used to calculate an individuals credit score are varied enough to create multiple scores for a single person at any given time.

Address:80 River St., STE #3C-2, Hoboken, NJ,07030

Is Credit Karma Accurate

Many people who use Credit Karma are wondering whether it is accurate or not. Since it is a free service, people want to make sure they are actually getting accurate results.

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus. Therefore, people can have peace of mind that the scores are just as accurate as they are expected to be from a free service.

While scores are accurate for the most part, there are also situations when they are not perfect. In fact, the score may be off sometimes, which is why apart from Credit Karma, you should also have a credit report done by your financer or a credit agency. After all, you need to ensure you have the right credit score if you want to get a loan, buy a car, or get a new house.

While it is not always the most accurate, Credit Karma still has enough accuracy that makes users return to it. Over time, the scores they provide have become better and more trustworthy.

Recommended Reading: Is 584 A Good Credit Score

The Importance Of Knowing Your Credit Score

There are several reasons to monitor your credit score.

- Applying for credit generates a hard inquiry into your credit report, which temporarily lowers your credit score. Knowing your credit score helps you identify the loans, credit cards, and other credit products youre likely to qualify for so you dont waste time and unnecessarily hurt your credit score.

- When you know where your credit scores range, you can take steps to improve it if necessary.

- Monitoring your credit score can help you spot financial fraud and identity theft to help protect your personal information and avoid misuse. A sudden decline in your credit score could indicate someone is making fraudulent charges or has applied for credit in your name.

Is Experian Better Than Credit Karma

While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion.

Think of it this way Credit Karma is like a newspaper that writes about the credit scores other companies give you. But we have no influence over your scores.

Recommended Reading: Is 743 A Good Credit Score

What Is The Most Accurate Credit Score

Although there are many different scores and scoring models, there is a light at the end of this confusing tunnel.

Among all the credit score models, the FICO credit score is used by more than 90% of major U.S. lenders.

You might have a different score calculated by a different scoring model with a different provider.

However, it’s very likely that the lender or creditor will use the FICO score to determine if they’ll approve your application for a new line of credit.

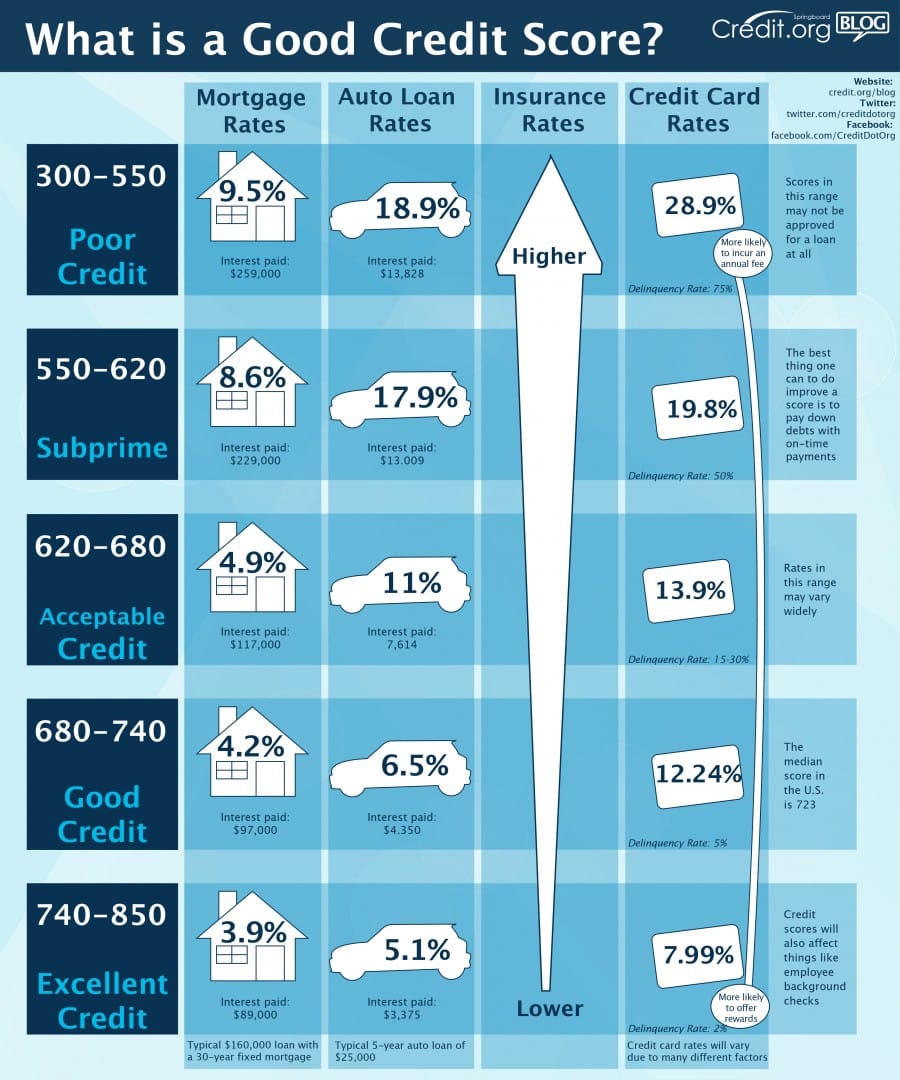

Because of this, you might want to keep your eye on your FICO score, rather than many of the others that are available, simply because this is the number the lenders care about most. A FICO score ranges from 300 to 850 .

How Accurate Is Credit Karma

One issue is that most lenders utilize the FICO model and Credit Karma uses the VantageScore Model which means that the scoring system is different from most lenders. So it is not so much that Credit Karma is inaccurate it is just that it utilizes a model that most lenders do not use.

The second issue is that Credit Karma does not provide you with an Experian score. Many lenders, including many credit card issuers, like to pull your credit score from Experian.

If your Experian credit report has different marks on it compared to your Equifax or TransUnion report, then there could be a large discrepancy between your Credit Karma score and what the credit card issuer sees. You can read on more here about which credit card issuers pull from which credit bureaus.

Tip: Use WalletFlo for all your credit card needs. Its free and will help you optimize your rewards and savings!

Also Check: Does Opening A New Credit Card Hurt Your Credit Score