How To Get A Collections Stain Off Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent.

But you may want them off sooner than that unpaid collections can make you look bad to potential creditors. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

Here are steps to remove a collections account from your credit report:

Do your homework

Dispute the account if there’s an error

Ask for a goodwill deletion if you paid the collections

An unlikely option: Pay for delete

How Does Collections Affect My Credit Score

Having debt in collections definitely negatively impacts your credit score. Paying off the debt will likely improve your score with credit bureaus that use FICO 9 or Vantage Score 3.0 or 4.0 the newest versions of credit scoring.

Debt in collections is considered under payment history the biggest factor in the most common credit score, FICO. Payment history drives 35 percent of your score.

Some lenders have special policies that prohibit them from lending to people with unpaid debts in collection.

Is It Better To Pay Off Your Collections

As far as your FICO Score is concerned, two things are considered:

- has a collections appeared on your credit report

- when it was reported

So whether or not you pay your collections off is really a personal decision. Paying off a collection could cause the score to increase, decrease or have no impact at all. It depends on the change in the information reported on the collection as well as the other information in the credit report. For example, this action would likely have a lower positive impact if the individual has a lot of other negative information on his/her credit report. On the other hand, if the collection is the only negative item being reported, paying it off could help to increase the score.

Something else to keep in mind is that every lender uses its own criteria when evaluating loan decisions. Some lenders may want to see that you are paying off collections before approving your loan. So, paying off collections could very well improve your credit-worthiness in the eyes of a lender.

Collections remain on your credit report for 7 years. The best things you can do in the mean time are to continually pay all your bills on time and be responsible for your credit.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Read Also: How Often Does Bank Of America Report To Credit Bureaus

Can Medical Collections Be Removed From My Credit Report

Yes. Just like anything else on your credit report, you can remove medical collections.

Pay careful attention to each piece of information associated with the debt to give yourself the best chance to get it removed. When disputing medical collections, follow the same guidelines for any other type of collection account discussed below.

How Long Does Debt Stay In Collections

The statute of limitations that determines how long you are legally liable for your debt depends on the type of debt and the state where you live. In general, most debt comes with a statute of limitations between three and six years, but some debt is collectible for more than a decade. After the statute of limitations has passed, you are not legally required to repay the debt, though that doesn’t protect you from negative credit report impacts.

Also Check: Comenity Bank Approval Odds

Have A Professional Remove Collections From Your Credit Report

If this all seems like too much for you to handle, and you are worried about trying to take on a collection agency on your own, theres an entire industry devoted to credit repair that is ready to help you.

A professional credit repair company like Lexington Law could help restore your credit usually within three or four months.

They wont take any action you couldnt take yourself. Since credit repair is all they do, itll work faster and more efficiently.

You would need to budget some money for the monthly payments, which average about $100 depending on the plan you choose.

Theres also a one-time set-up fee for most .

But if you want to get your personal finances back on track without spending your free time on the phone or writing letters, you should consider this kind of service provider.

Debt collections come in many forms.

Whether its an unpaid medical bill, a cell phone bill, or even an $18 library book you never returned, unpaid debt can lead to negative information on your credit report.

It looks especially bad when the negative item comes from a collection agency.

Collections accounts tell other creditors you let an old debt go three or maybe even six months without paying.

When you apply for new credit, lenders know your old lenders lost money on your accounts.

So a collection account will have a negative impact on your ability to apply for new credit whether its a mortgage, a major credit card, or a personal loan.

Can You Get Collections Removed From Your Credit Reports Early

There are several approaches you can try to remove collections from your credit report. Theyre not guaranteed to work, but theres no harm in trying:

- File a credit dispute: You can dispute the collection account by sending a . Send it to the credit bureaus and the company reporting the debt and ask them to remove the collection from your credit reports.

- Goodwill deletion: If youve already paid your collection account, you may be able to get the company reporting your collection to remove it from your credit report as an act of kindness. All you need to do is send them a goodwill letter explaining your situation, e.g., why you were unable to pay the debt on time. This will work better if you had a genuinely good reason, such as unexpected medical bills that strained your finances.

- Pay for delete: If you havent paid your debt yet, you can try negotiating with whoever owns your debt to see if theyll remove the collection from your credit report in exchange for payment. To do so, youll need to send them a pay-for-delete letter.

Takeaway: Most collections can stay on your credit report for up to 7 years

Article Sources

You May Like: Paypal Credit Score Check

Best Services For Removing Collections From A Credit Report

Paying an old bill that a collection agency has asked you to pay doesnt mean it will soon be removed from your credit report. A paid collection could lower your credit score for years. The good news is that help is out there, and weve come up with a list of the best services for removing collections from a credit report.

Removing a collection account from your credit report even if the account has been settled or paid is a good idea because a collection account that has a zero balance can remain on a credit report for up to seven years from the date of the default, according to the Fair Credit Reporting Act, or FCRA.

Collections are an indication that youve previously defaulted on an account. They can lower a credit score, which is used with your credit history by future lenders to determine if youre approved for a loan and how much youll be charged for financing.

Along with removing a collection account that youve paid, you may also want to remove a collection account if its incorrect or outdated. You can dispute the account with each credit bureau, and the FCRA requires them to investigate such claims.

If A Collection Is On Your Report In Error Dispute It

You may have a collections account on your credit report that shouldnt be there. Maybe its too old to still be reported, or the collection itself is incorrect.

Too old to be reported: Delinquent accounts should fall off your credit report seven years after the date they first became and remained delinquent. But that doesnt always happen. For debts that linger longer than they should, file a dispute with any credit bureau that still lists the debt.

If a credit bureau has made a mistake on your report if you dont recognize the account or a paid account shows as unpaid, for example gather documentation supporting your case. Then, file a dispute by using the credit bureau’s online process, by phone or by mail. The bureau has 30 days to respond.

Collection is incorrect: If you think the error is on the part of the debt collector, not the credit bureau, ask the collector to validate the debt to make sure its yours. Note that you have 30 days from the date the collector first contacted you to dispute the validity of the debt. If the collector cant validate, the collection should come off your reports. Follow up to make sure.

Read Also: Does Home Depot Report Authorized Users

How Do Collections Affect Your Credit Score

Having one or more collection accounts on your credit report can quickly lead to bad credit. A collection account on your credit report means you failed to make sufficient payments on a debt, which is a big red flag to lenders that you might default on a loan again. Therefore, a collection counts as a major derogatory item on your credit report, which means your credit score will likely suffer a significant drop if you have an account go into collection.

Collections are considered to be major derogatory items, so they can lead to a sharp decline in your credit score.

However, collections with low balances may not impact your score at all, depending on which credit scoring model is being used to calculate your score, such as VantageScore or a FICO credit score.

FICO scores 8 and 9 ignore both paid and unpaid collections that had an original balance of less than $100.

FICO 9, VantageScore 3.0, and VantageScore 4.0 dont count paid collection accounts against you and treat medical collections as less important than other types of collection accounts.

Unfortunately, with FICO 8 and previous versions of FICO, which most lenders today still use, all collections are highly damaging to your credit score, regardless of what type of account they are or whether the collections have been paid or not.

Review Your Credit Report For Answers

If you’re wondering when a specific collection account will fall off your credit report, pull a copy to review. You can get a free one from AnnualCreditReport.com once a year. Review the history for the original account to check the date of delinquency and add seven years to that date. That’s about when you can expect the collection account to drop off.

Recommended Reading: Care Credit Minimum Score

The Statute Of Limitations Has Passed

Dont confuse the credit reporting time limit with the statute of limitations on debt, which is the period of time that a debt is legally enforceable. The two arent related, except with court judgments in states where the statute of limitations for a judgment is longer than the credit reporting time limit.

How To Remove Collections From A Credit Report

Wrap Up

If youve been falling behind on your loan payments for a while, you may start receiving emails, phone calls, and messages from your creditor checking up on your payment status. If this is the case, you officially have outstanding debt.

But dont worry, in this article, we will explain all about collection debts and how to remove collections from a credit report, so continue reading to find out more.

Recommended Reading: Afni Pay For Delete

Types Of Debt Collector

There are many types of collection agencies. First-party agencies are often subsidiaries of the original company the debt is owed to. Third-party agencies are separate companies contracted by a company to collect debts on their behalf for a fee. Debt buyers purchase the debt at a percentage of its value, then attempt to collect it. Each country has its own rules and regulations regarding them.

S To Take When You Receive A Notice That Your Debt Is Transferred To A Collection Agency

If you receive a notice that your creditor will transfer your debt to a collection agency, contact your creditor as soon as possible.

You may be able to:

- pay a portion of the amount or the full amount owed to avoid having the debt transferred to collections

- make alternate arrangements with your creditor to pay back your debt

Recommended Reading: Who Does Chase Pull

How Many Points Will My Score Increase When A Collection Is Removed

Your credit score is always a moving target. Positive and negative events may constantly be added or subtracted from it, though most likely, theyll be added before being removed.

The latest scoring models, FICO 9 and VantageScore 4.0, mostly ignore paid collections. The accounts will still be on your credit report, but they wont hurt a score as much as not paying the account would.

Many creditors, however, may still be using older versions of FICO. FICO 8 ignores collections under $100, but the one used by mortgage lenders still counts all collection accounts. You can ask your lender which credit scoring model it uses before applying.

Its difficult to say how much a credit score can increase when a collection is removed. If you check your score regularly and know what it was before the collection was listed on your report, then you can compare it to what it was before the collection was deleted.

If your score fell 50 points when a collection was added, then it should increase by 50 when its deleted. Your lender may be able to give you an idea of what to expect.

There are reports of credit scores rising by more than 100 points within 45 days of paying off collection accounts.

When it comes to removing collections from credit reports, time is on your side.

How Long Does It Take For Collections To Fall Off Your Report

In general, collections fall off your credit report after six years. The specific amount of time that a collections account will remain on your credit report depends on the credit bureau.

Equifax and TransUnion handle collection accounts a bit differently. With Equifax, collection accounts are listed on your credit report for a period of between six and seven years, after which they are removed. TransUnion will keep a collections account on your credit report for six or seven years and then will automatically remove it from your report.

Itâs crucial to note that, contrary to what many people believe, a collection is not taken off your report as soon as you pay it. It will still stay on your report for the full six or seven years. However, if you pay off the account quickly, the negative effect on your credit score may be lessened depending on the credit scoring model the credit bureau uses.

Also Check: Credit Inquiry Removal In 24 Hour Free

How To Get Proof Of A Debt Collection

Before paying any collection, you should make sure the debt is yours. The Fair Debt Collection Practices Act allows you to request validation of a collection account within the first 30 days of the debt collector’s initial contact.

After receiving your request, the debt collector has to send you proof of the debt. The collector also cannot continue collection efforts on the debt, including reporting the account to a credit bureau, until it has sent you proof of the debt.

If the collector sends you satisfactory proof that the debt actually does belong to you, you can decide whether you want to pay. For debts that appear on just one credit report, you may offer payment in exchange for removing the debt from that credit report. If the account is in pre-collections, paying the debt will keep it from appearing on your credit report.

Paying a debt thats beyond the credit-reporting time limit doesnt benefit your credit rating, but it does get the debt collectors off your back.

Dispute The Collection If You Found An Error

If the goodwill letter falls flat and the debt collection remains on your credit report, its time for a more advanced method.

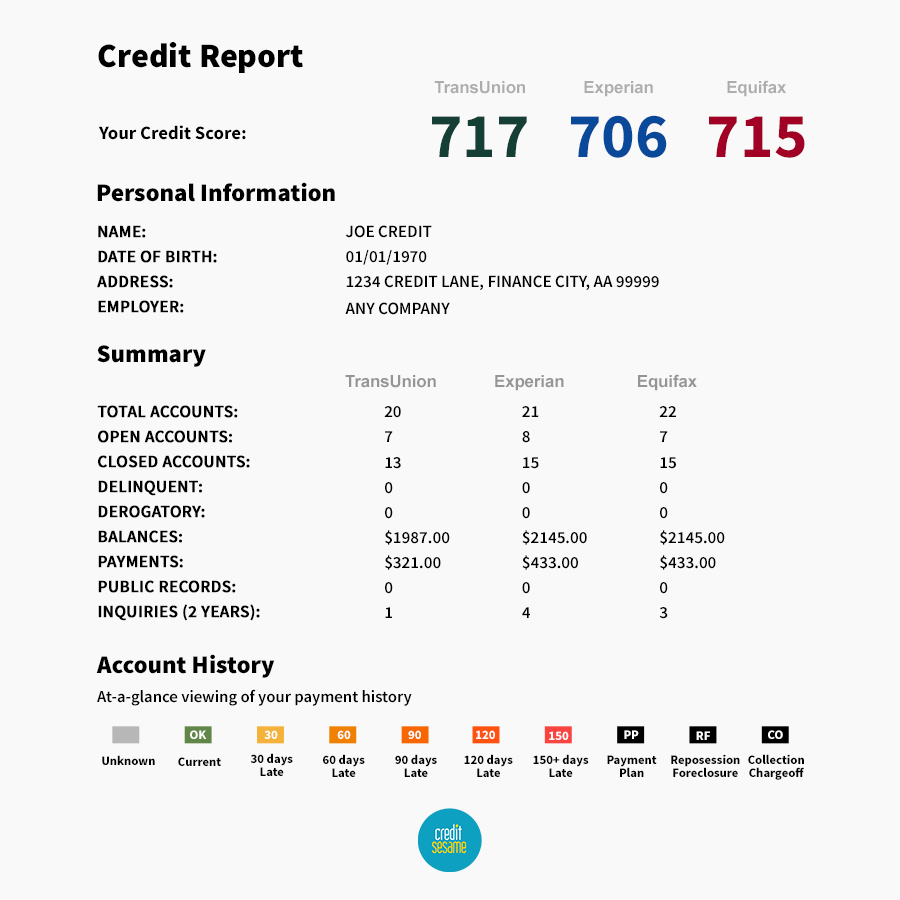

For this, you will need a current copy of your credit report. TransUnion, Experian, and Equifax provide you with a free credit report once a year.

Once you have your credit reports in hand , find the negative item youd like removed and check it out closely.

Confirm all the details and if you see anything inaccurate, report the inaccurate information to the major credit reporting agencies.

The Fair Credit Reporting Act or FCRA requires credit reporting agencies to show only accurate information in your credit history.

If you can find inaccurate information, the credit bureau will have to fix the information. Though, if it cant fix the errors, the bureau should remove the collections from your credit report.

This method can work because, rather than simply disputing the entire entry, you are going to write an advanced dispute letter that lists especially what is inaccurate.

Using this letter, you will insist that each piece of information is corrected or that the collection be removed.

This makes it more difficult for the credit agencies to verify the collection and hopefully result in them simply removing the collection altogether.

ITEMS ON THE COLLECTION ENTRY TO CHECK FOR INACCURACIES:

- Balance

- Anything else that appears to be inaccurate

Read Also: Does Zebit Report To The Credit Bureau