The Best Credit Cards For Excellent Credit

With excellent credit, you could be eligible for some of the best credit card offers.

This might include premium rewards cards that come with more-valuable rewards and top-notch perks like travel credits, free hotel nights, airport lounge access, complimentary upgrades and elite status. Keep in mind that these cards also tend to carry expensive annual fees and higher interest rates if you carry a balance. So youll have to weigh the benefits against the costs to see if its worth it for your wallet.

On the other hand, if youre paying down credit card debt, you also might see offers for the best balance transfer cards that come with longer 0% intro APR periods and higher credit limits.

Explore on Credit Karma to see whats available.

More Bargaining Power On Interest Rates

Are you aware of the fact that the interest rates vary for different loans at different banks? Some people end up getting a better deal than others. A higher CIBIL score enables you to bargain with banks for a better rate or deal. You can easily compare the offers from lenders and authoritatively negotiate as creditworthy customers are assets for any financial institution.

What Is A Good Credit Score And Tips To Maintain It

Get answers to commonly asked questions related to the credit score and credit reports

If you are wondering what exactly constitutes a good credit score and how it is calculated, we have all the details for you. Read on to find out everything about a good credit score and the various benefits it offers.

About Good Credit Score

You May Like: Is Fingerhut A Hard Inquiry

How Your Credit Score Is Calculated

Although no one knows exactly how your 786 Credit score is calculated, but as per general practices, different details from your credit report are used to formulate your credit score. The data taken from a credit report is usually a combination of five variables, where each variable is the information about credit extended to you through lenders and service providers.

Recommended Article:

Each variable has a percentage that shows its importance in formulating the credit score. If you want your credit score to fall in a Good or Excellent category and not in the Very Poor category, you need to keep these factors in your mind before applying for credit.

The five important variables are:

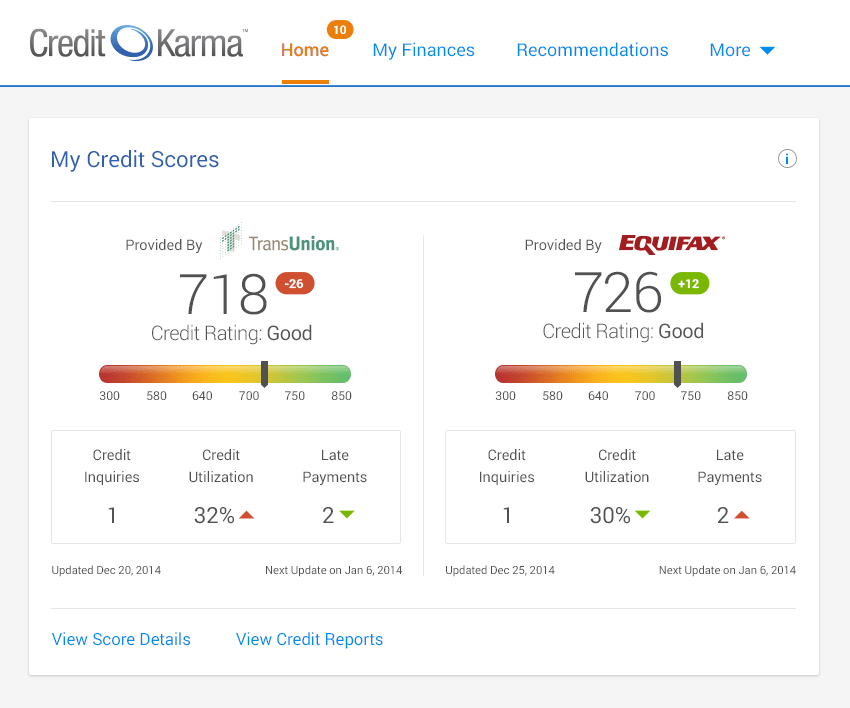

How To Request A Report

There are three major credit-reporting agencies: Equifax, TransUnion, and Experian. You can receive a free copy of your credit report once a year from AnnualCreditReport.com, which gets the reports from each of the three companies.

It is a good idea to get a copy annually so that you can check it for errors. Errors range anywhere from name misspellings and incorrect Social Security numbers to accounts being listed as still open when in fact they have been closed an error that can hurt you when you need to get a mortgage.

Your credit report also will show whether you have been the victim of identity theft. If your personal information, such as your Social Security number, has been changed, the report will reveal it.

Also Check: 1?800?859?6412

What You Can Do

Your credit score is the single most important factor in determining your mortgage rate. Heres how you can boost it and what to do if your score wont go any higher:

Pay down credit card debt: If you have a choice between tackling debt or scraping together a larger down payment, its wiser to focus on the debt, because that should improve your credit score.

Pay monthly bills on time: Payment history plays the biggest part in your credit score. To keep from forgetting to write a check, automate your routine payments. To avoid a missed payment, build your emergency savings.

Consider an FHA or VA loan: Compared to conforming loans backed by Fannie Mae and Freddie Mac, mortgages backed by the Federal Housing Administration and the U.S. Department of Veterans Affairs carry less stringent rules about credit scores. However, the upfront fees are higher.

Know when enough is enough: The best mortgage deals go to borrowers with scores above 740, but improvements beyond that point wont do much to affect your rate. Keep an eye on your score, of course, but understand that boosting it from 790 to 800 wont get you a better deal.

What Counts Towards Your 786 Credit Score

In essence, your credit score tells you whether you have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 786 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

Also Check: Does Opensky Report To Credit Bureaus

Steering Clear Of Bankruptcy

Bankruptcy is a highly feared word in the world of finances. Its something that we all hope we will never have to endure the mere thought or possibility of it is enough to make us quiver in fear.

Bankruptcy is definitely not something that should be underestimated. It will be one of the biggest blows not only to your finances, but to your state of mind and well-being as well. Plain and simple, a bankruptcy is something that you want to avoid at all costs. And as you may have guessed, a bankruptcy is not going to look good on your credit report .

But while it is universally acknowledged that bankruptcy is something that you should try to avoid at all costs, there are still many mistaken beliefs that surround how to avoid it, too. A bankruptcy will immediately lead to a huge drop in your credit rating and will be visible on your report for over ten years at least. This means that if your credit score has already fallen thanks to late/missed payments or defaults, with a bankruptcy, things arent exactly going to look so sunny.

What if you are forced to file for bankruptcy? Is it still possible to rebuild your credit?

Yes, it still is. Even though your bankruptcy will be listed on your report for ten years, you can still slowly but steadily rebuild your credit by paying each of your bills when you need to. In this scenario, however, its vitally important that you repay each of those bills without exception.

What Is The Highest Credit Score

For most situations, 850 is the best FICO score possible. It’s extremely difficult to reach a perfect credit score, though. Only 20% of Americans have a credit score of 800 or higher. Even if you’re one of the people with the best credit score in the country, you might not reach 850.

Wondering how to get a 850 credit score? Here are some ways to improve your credit score — and move closer to the highest credit score you can get:

- Paying off your credit card balance every month

- Correcting errors on your

- Keeping an old credit card open, even if you don’t use it often

- Paying your bills on-time

- Requesting an increase to your credit limit

If you reach a FICO credit score of 800 or higher, you should congratulate yourself. Raising your credit score takes hard work, dedication, and patience. Even if you don’t have perfect credit, an excellent credit score is something to be proud of.

Also Check: How Personal Responsibility Can Affect Your Credit Report

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have a mix of installment and revolving accounts.

Of course, you also want to make sure you are making your payments on time from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an important role in your credit score. You want to show potential creditors that you have a long, positive payment history.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

Understanding Mortgage Credit Scores

Your credit report is separate from your credit score, though the score is developed from the report. In addition to viewing credit reports from the three major reporting bureaus, you also should obtain your FICO score. Your score is like a report card. Fair Isaac & Co. assigns you a number based on the information in your credit report. Since there are three credit-reporting bureaus, you have three FICO scores. Here are the scoring factors:

You May Like: Does Paypal Report To Credit Bureaus

Why Is It Important To Maintain A Good Credit Score

listed down some of the important reasons due to which you must maintain a good credit score:

improves your eligibility for loans: a good credit score improves your eligibility to get a loan faster. a good credit score means that you pay the bills or outstanding amount timely that leaves a good impression of yours on the banks or other financial institutions where you have applied for a loan.

quicker loan approvals: applicants with a good credit score and long credit history are offered pre-approved loans. moreover, the loan that you have applied for gets approved quickly and processing time is zero.

lower interest rate: with a good credit score, you can enjoy the benefit of a lower rate of interest on the loan amount that you have applied for.

you are offered credit cards with attractive benefits and rewards if you have a healthy credit score.

higher credit card limits: a good credit score not only gets you the best of credit cards with attractive benefits or lower rate of interest on the loan you have applied for but also you are eligible for getting a higher loan amount. a good credit score means that you are capable of handling the credit in the best possible manner, therefore, banks or financial institutions will consider offering you a credit card with a higher limit.

Dont Apply For Loans Or Credit Cards For At Least A Year

Once youve paid down your installment loans, I suggest you stop applying for loans and credit cards altogether. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage.

When youre in this position, there is really no need to apply for more credit.

By not applying for credit, you wont get any hard inquiries on your credit report and this helps your credit score. If you need to apply for credit, just keep in mind the hard inquiries will stay on your credit for about a year.

Again, you should be in a situation by this point where you dont need anymore credit.

Also Check: How To Remove Repossession From Credit Report

How Can You Get A Good Credit Score

There are plenty of things you can do to help improve your score, but it can take time and patience, and some will-power too.

Ways to improve your score:

- Register on the electoral roll at your current address. This helps companies confirm your identity.

- Build up your credit history. If you have little or no credit history it can be difficult for companies to score you, which can result in a lower score. Thankfully, there are some relatively simple steps you can take in order to build up your credit history.

- Pay your accounts on time and in full each month. This shows lenders you’re a safe bet and can handle credit responsibly.

- Keep your credit utilisation low. This is the percentage of your credit limit you actually use. For example, if you have a limit of £3000 and you’ve used £1500 of it, your credit utilisation is 50%. A lower percentage is usually seen in a positive light and should help your score go up. To help improve your Experian Credit Score, try to keep your credit utilisation at 25%.

- Sign up to Experian Boost and see if you could raise your score instantly. By securely connecting your current account to your Experian account, you can show us how well you manage your money. Weâll look for examples of your responsible financial behaviour, such as paying your Netflix, Spotify and Council Tax on time, and paying into savings or investment accounts.

Once you’ve got your score where you want it to be, here’s our tips on how to keep it healthy:

What Does Your Credit Score Mean

Your credit score measures how often you pay bills on-time , how close you are to your credit limits , and how much experience you have with managing debt .

A higher credit score can give you more options for borrowing money. It also qualify you for low-interest loans, which can save you tens of thousands of dollars in interest.

Also Check: Syncb Credit Inquiry

Average Credit Score By State

Finances look very different across all 50 states, and the average credit score looks pretty different, too. While Mississippi has the lowest average credit score, Minnesota has the highest credit score at 720. Here’s the average credit score in each US state and the District of Columbia, according to data from Experian.

| State | Average credit score in October 2020 |

| Alabama | |

| 719 |

How Much Cibil Score Is Required For A Home Loan

The best CIBIL score for a home loan is 750 and more. That said a score of 700 and above is still good and should suffice for most lenders. However, the actual figure is lender-specific. A higher CIBIL score translates to a swifter loan approval, and on more affordable terms. So, in terms of the upper limit, its always desirable to have a higher CIBIL score.

What should Be your CIBIL score to apply for a Home Loan _ Bajaj Finserv _ HD Video

Also Check: Can Lexington Law Remove Repossessions

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often

Ways To Increase Credit Score Quickly

At times, stalling your application and improving your CIBIL score is the best way to get an affordable home loan. Here are some ways by which you can build your credit score.

-

Pay existing loan EMIs on time.

-

Pay your credit card bills within the due date, in full.

-

Monitor your credit report and rectify mistakes by intimating the credit bureau.

-

Keep your credit utilisation around or below 30%

While a CIBIL score proves your financial mettle, being able to service a loan hinges on another parameter as well such as your debt-to-income ratio. To get a home loan that matches both your CIBIL score and your debt-to-income ratio, use a home loan eligibility calculator or simply check your pre-approved offer from Bajaj Finserv before applying and avail home financing on personalised terms. Single-step verification here gives you instant approval through a customised home loan deal.Additional Read: How Credit Score can Determine your Home Loan EMIs?

Recommended Reading: Does Opensky Report To Credit Bureaus

Good Score And Bad Score

| CIBIL score | |

| Shows that you have never defaulted even once and is an excellent score. | |

| 750 â 850 | It is a fact that 79% of loans sanctioned are for people with 750+ score. Scores above 800 are considered high and you can easily ask for a lower rate on personal loans and credit cards. |

| 700 â 750 | A good score for secured loans. However, for unsecured credit, the bank might investigate further or impose slightly higher rates. |

| 500 â 700 | This shows that you have delayed or defaulted a few times in the past. Personal loans can be difficult to obtain from a bank. A private financier may levy hefty interest. |

| 300 â 500 | Such poor score indicates too many discrepancies in past loan repayments to ignore. Unless you work on credit repair or improvements, it will be impossible for you to get a loan from any bank in the country. |