Rejecting A Tenant Because Of A Poor Credit Report

If you do not rent to someone because of negative information in a credit report, or you charge someone a higher rent because of such information, you must give the prospective tenant the name and address of the agency that reported the negative information. This is a requirement of the federal Fair Credit Reporting Act. You must also tell the person that he has a right to obtain a copy of the file from the agency that reported the negative information, by requesting it within 60 days of being told that your rejection was based on the individual’s credit report. The Federal Trade Commission’s website offers helpful tips on how landlords can use consumer reports.

Integrating Rent Reporting Into Property Management

The benefits of rent payment tracking are greatly enhanced when rental applicants are aware that the landlord reports rent payments to a credit bureau. A large majority of tenants surveyed on the issue of rent reporting said that, given the option, they would choose a landlord who reports rent. Landlords who advertise rent reporting as an amenity attract the rental applicants most likely to pay on time and discourage those who do not.

LCB provides landlords with sample disclosures to inform tenants that rent payment history will be reported and will appear on the individuals consumer credit report. This language can be incorporated into the rental application so interested applicants better understand the benefits of reporting on-time rent payments each month and can opt-in and receive the most value from the service.

Additional provisions can be added to the lease agreement to inform tenants that payment and rental history will be shared. This includes positive rent payment habits as well as late or missed payments and property damage. Tenants with a positive history will be aware that they are enhancing their credit reports and developing a positive Tenant Record. Those who might otherwise delay or miss rent payments can make better decisions when it comes to managing their finances and caring for the rental property.

Have Your Landlord Report Your Rent Payments

Your landlord is another source for reporting your rent payments. Companies like TransUnion accept rent payment information directly from landlords, but your landlord will need to sign up for one of the services and pay the associated fees.

Some landlords will be inclined to skip the extra effort of signing up for a reporting service, but reporting rent to a credit bureau actually helps encourage renters to pay their rent on time, since falling behind on multiple payments can lead to negative reporting and a decreased credit score.

Recommended Reading: Does Cashnetusa Report To Credit Bureau

The Negative: Reporting Late Payments

If you do rental payment reporting and a tenant pays late or doesnt pay at all, this information will make it onto their credit report in various ways. You might get upset that a tenant keeps paying late and want to report a tenant to the credit bureau.

Most tenants will not want this to happen, so the knowledge that you report to credit bureaus monthly can help to keep tenants focused on making their payments on time. You may want to remind tenants that consistently paying late in the ways of this can affect them.

Even if late payments may not actually lower their credit score, every late payment issue will show up in the full report. If they plan to rent again in the future, this could be a problem for them. Ensuring that they know this can help encourage tenants to be more reliable while also protecting you and their future landlords.

Hire A Collection Agency

For either a flat fee or a percentage of the rent collected, you can hire a collection agency to chase delinquent rental payments and other tenancy-related debts. If the tenant does not pay, the collection agency can report the collection account on your behalf. When choosing an agency, make sure that it reports to all three credit repositories. Filing a collection account has a significant negative impact on the tenant’s credit score and may disqualify her from renting an apartment in the future.

Don’t Miss: Minimum Credit Score For Amazon Prime Rewards Visa

Use A Rent Reporting Service

There are several companies that will report rent payments on your behalf. Monthly fees vary between services, and some charge an initial enrollment fee to get started. In some cases, your landlord may have to verify your rent payments for them to be included in your credit report. Note that even when rent payments are included in your credit report, they may not be included in your credit score calculation.

What Is California Law Sb 1157 And Its Requirements

California law SB 1157 mandates the reporting of rent payments for a tenant who has been verified as having an income of under $24,000 per year or is receiving public assistance. The goal is to help low-income renters build a credit history without having to go into additional debt by using a credit card or other high-interest loans in order to build credit.

With this law, landlords have to give their tenants the option of reporting their monthly payment history and amount owed to major credit bureaus. This is true only if the tenants lease was signed after July 1, 2021, however. If a tenant wants to stop reporting rent payments to credit bureaus, they will have to give their landlord a written request. Once that tenant stops participating in the service, they cannot restart it for at least six months.

Now, this bill obviously has its pros and cons. When it comes to the cons, it can harm renters who fail to pay on time. If the landlord is reporting payments and a tenant gets behind, credit bureaus will be notified. This can then lead to higher interest rates for loans or even decreased eligibility to receive housing assistance due to late payments.

In the next section, we will cover some pros of the bill.

Read Also: Ic Systems Debt Collections

How Do You Report Tenants To A Credit Bureau

Landlords only recently gained the ability to report tenant pay habits to a credit bureau, but already this perk is catching on as more and more landlords discover the many benefits:

- Attracting tenants most likely to pay on time

- Reducing late payments and delinquencies

- Improving tenant retention

- Enhancing tenant screening abilities

- Putting landlords on par with other creditors

Tenants caught on quickly to the value of building credit through paying rent something they already are doing without the need to incur more debt or pay interest and annual fees. At the same time tenants build credit, they can create a positive Tenant Record and move to the front of the line when competing for preferred rental housing vacancies.

How Much Is A Credit Check For A Tenant

The cost typically ranges from $25 to $50, depending on whether you request only a credit report or additional background checks.

Some states also limit the amount you can charge a tenant for credit and background checks.

For instance, New York limits the fee landlords can charge to the actual cost of the credit and background check but no more than $20.

To avoid paying multiple times, a tenant may obtain their current credit report.

Keep in mind that a landlord is not required to accept a copy in some states and can request fees to pull a new credit report.

Don’t Miss: Credit Check Without Social Security Number

Reporting Rent Payments To Credit Bureaus Helps Landlords Become More Organized

One significant benefit landlords gain by reporting rental payments is keeping organized records of which tenants are paying rent. Most property management software products help landlords automatically keep track of which tenants are paying rent. So, despite this being a normal part of the job for landlords, some rent reporting programs which can be found listed below keep track automatically. This will give a landlord more time to address other issues.

Related: Online Rent Collection: The Definitive Landlord Guide

How Landlords Can Report Resident Credit

If youre a landlord or property manager, it only takes three easy steps to report rental resident credit to the four major credit bureaus. Whether you want to report tenant payments to Experian, Equifax, TransUnion or Innovis, or all four, Datalinx can help.

As a certified partner of the credit reporting agencies, Datalinx can help you navigate this process. Our propriety software ensures that you report your data to the credit bureaus in the right format accurately and in a timely manner. Heres how:

Read Also: Old Credit Report

How Can I Do A Credit Check On A Tenant

A landlord can do a credit check on a tenant by getting the tenants permission and paying the fee directly to a credit bureau.

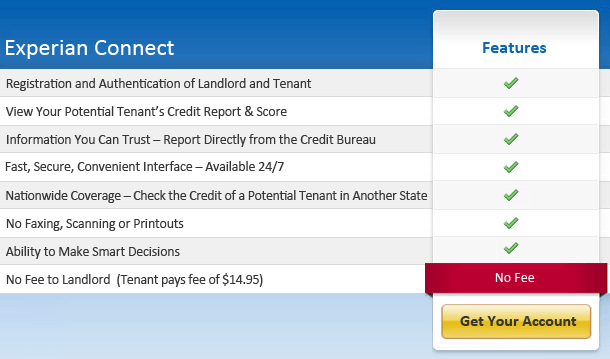

You can also use a third-party screening agency and have the tenant submit their application directly to the service, who will provide you with the credit check at no direct cost.

How Do Landlords Benefit By Reporting Rent Payments To Credit Bureaus

While it might seem that this law only benefits tenants, it can significantly help landlords as well. Whether you are in California or not, landlords have the option of reporting rent payments to credit bureaus. And there might be a lot of benefits to doing so.

For landlords, here are some of the benefits that go along with reporting rent payments to credit bureaus:

Also Check: Syncb Ppc Login

How To Get Credit For The Rent You Pay

Its important to keep in mind that the two major credit scoring companies handle rent payment information differently.

The FICO Score, which is commonly used, doesnt calculate rental payment information into scoring. But the newer versions of the report do take rental payments into account. VantageScore also incorporates rental payment information into their credit scoring.

Because renters cant report their rent payments themselves, theyll need their landlord or a third-party reporting service to report the payments for them.

How Landlords Can Report Rent Payments To Credit Bureaus

FrontLobby is a turnkey, user-friendly platform designed specially for Landlords. It makes rent reporting payments both seamless and affordable. Rent payment history added to FrontLobby each month can be shared with Landlord Credit Bureau and is added to the Tenants consumer credit report with Equifax as a trade line.

FrontLobby also offers valuable education and assistance, such as providing Landlords with sample disclosures they may use to explain to Tenants the benefits of reporting rent. FrontLobby also provides examples of lease provisions that allow Tenants to better understand their responsibilities under their lease agreement and to maximize the value of rent reporting to build credit.

Besides the Rent Reporting feature, FrontLobby offers two additional services that empower Landlords and Property Managers to secure better renters, reduce the frequency and impact of delinquencies, and drive operating efficiencies. These services include Tenant Screening for fast, easy and affordable Landlord credit reports, as well as Collect to help Landlords recover debts owed by former Tenants.

You May Like: Reporting Death To Credit Agencies

If You Report Regularly

If you report both the good and the bad about your tenants behavior on a regular basis, all you need to do is keep up with this activity. Your claim will be registered automatically.

There is a great virtue about regular reports. Firstly, it disciplines your tenants to pay on time since they know that their paying behavior is under supervision. Secondly, its easier for you to report a delayed payment or any other problem with your tenant once you are already a regular client of the credit bureaus.

Why Run A Credit Check On A Tenant

As a landlord, you may have already learned how to run a credit check on a tenant. One of the primary purposes is to gain critical insight into a renters job stability, credit history, and ability to timely pay rent.

It also helps you determine whether the tenant can afford to live in your rental property.

You May Like: Paypal Credit Score

Does Rent Payment Affect My Credit Score

Today, rent payments make up the largest expenses for most individuals across the world. Unfortunately, rental payment history does not contribute to most peoples credit reports. Meaning, paying your rent on time wont affect your credit score.

However, reporting your rent payments to credit bureaus can help change this narrative. Credit bureaus provide credit issuers and lenders with the relevant information needed to make loan decisions.

When you report your rent payments to major credit bureaus TransUnion, Experian, and Equifax they add your rent payment data in your credit reports.

Do Tenant Screening Landlord Credit Checks And Recordkeeping

Landlords using the FrontLobby platform to report rent can also conduct Tenant screening, including pulling Credit Reports, with data from Equifax and Landlord Credit Bureau.

Landlords can also keep organized records of Tenants rent payment habits. FrontLobbys Recordkeeping tool saves Landlords and Property Managers time, enabling them to focus on activities that are more productive than managing rent payments.

Recommended Reading: How Do I Remove Hard Inquiries From My Credit Report

Why Renters May Struggle To Establish Credit

Even for Tenants who always pay their full rent on time, Landlords have not had the means and tools to report rent payments to credit bureaus. This has deprived renters of a major opportunity to raise their credit score.

Today, more Tenants than ever are staying in the rental market. This is partly for lifestyle reasons and partly because of higher housing prices and tougher criteria for obtaining mortgages. Over time, these renters fall behind homeowners, whose mortgage payments get recorded by credit agencies. Many of these Tenants descend into a downward spiral of spending more and saving less, as they use much of their income to pay not only rent, but also the interest and fees associated with less desirable credit cards and loans.

But now, with support from Landlords, Tenants have a liberating new way to improve their credit score.

What To Do About Delinquent Tenants

Eviction and reporting to the credit bureaus should always be considered the last resort measures. It is safe to say that those are the most efficient ways of dealing with delinquent tenants, but there are many things you can do before going to extremes.

- Double-check the lease agreement and payment reports to make sure that your tenant is indeed late.

- Send a late rent notice saying that the rent is already past-due. Include a short warning about possible legal actions.

- Give your tenant a phone call to clarify the situation.

- Provide a quit notice that clearly conveys how much you are owed and the final due date by which the debt must be cleared. It is ok to tell about your intent to evict.

Should none of the above-mentioned measures help, feel free to report your tenant to the credit bureaus and start the eviction process.

Don’t Miss: When Does Open Sky Report To Credit Bureaus

Why You Want To Maintain A Good Credit Score

Breaking your lease may be the best solution for your current situation right now, but it’s important you make sure to protect your credit score no matter what choice you make.

It may not seem necessary now, but a good or excellent credit score can help you go far in the long run. Healthy credit scores can qualify you for lower interest rates on loans and some of the best credit cards.

For example, the Blue Cash Preferred® Card from American Express ranked as our best grocery rewards credit card but requires good or excellent credit to qualify. Cardholders receive 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases , 6% back on select U.S. streaming subscriptions, 3% back at U.S. gas stations, 3% back on transit and 1% back on other purchases. Terms apply.

The Citi® Double Cash Card ranked as our best no-annual-fee credit card and requires applicants to have good to excellent credit. Those who qualify will be rewarded with 2% cash back .

Make decisions today with your long-term finances in mind, and your credit and wallet will thank you later.

Editorial Note:

Covid + Credit: Your Rights As A Renter

During the COVID-19 pandemic, its more important than ever to be aware of your rights as a renter.

Reading time: 6 minutes

When you sign a lease, you likely arent thinking too deeply about your rights as a tenant. After all, youre probably more excited about securing a new home than agonizing about a worst-case scenario before it ever arises.

However, understanding your rights as a renter has never been more important, as millions of Americans are experiencing joblessness and pay cuts during the Coronavirus/Covid-19 pandemic. Complicating the matter, every state and city has its own rules regarding landlords and tenants, making it difficult to navigate and understand the various laws. If youre worried about being able to afford your monthly rent or simply want to better understand the protections you have under the law, well walk through the information you need.

Knowing your rights will come in handy if there’s a dispute with your landlord or your apartment is damaged, and it may help you navigate the challenges of renting during the pandemic.

Read Also: How Do I Report A Tenant To The Credit Bureau

What Do The Different Credit Scores Mean

There are two types of credit scores. Most landlords use the FICO score, but you can use VantageScore if you prefer. Both range from 300 to 850. The higher a tenant credit score, the lower the risk for you.

Its important to know what exactly a particular score means and to think about what threshold youll want from applicants for your property. There may be no need to find tenants with exceptional credit scores, but youll likely want at least a good score.