Bankruptcy Reporting On A Credit Report

Most negative entries, like slow payments and charge offs, will disappear from your report after seven years. It works a bit differently for bankruptcy filings and depends on the particular chapter.

- Chapter 7 bankruptcy. The fact that you filed a Chapter 7 bankruptcy will stay on your credit report for up to ten years. At the ten year mark, the credit bureaus should stop reporting the bankruptcy.

- Chapter 13 bankruptcy. In this chapter, the filer pays into a repayment plan for three to five years. The Chapter 13 bankruptcy filing appears on a credit report for seven years from the filing date, which is only two years beyond the longest repayment plan. This benefit serves as an incentive to filers to choose the repayment option and to repay creditors something over time.

The immediate effect of bankruptcy on your credit score will depend on whether you initially had a high or a low score, and, in most cases, a higher initial score will take a bigger hit. The exact effect is hard to predict because scoring companies keep the formulas used to calculate scores somewhat secret. However, if you’re diligent, it’s not impossible for you to reach a credit score in the 700s just two or three years after you file your Chapter 7 matter.

What Is A Public Record On Your Credit Report

Before we dive into the steps you need to take to remove public records, lets define our terms and get clear about what, exactly, were talking about.

So, which items count as derogatory public records? There are several financial scenarios in which you can end up with a public record on your credit report:

- Bankruptcies, whether personal or in a proprietary business scenario.

- Tax liens, whether you failed to file or owe the government money.

- Lawsuits and civil judgments with financial consequences, such as an accident in which you havent paid the defendant for damages or a suit against you by a former landlord. Its important to keep in mind that not all disputes will wind up on your consumer credit reports. If the two parties can reach a settlement before the case is taken to court, there will be no public record of the event on your credit report.

So, now that you know the different types of public records, how do you go about getting rid of them?

How Can I Rent If An Eviction Is Still On My Public Record

You can still rent if you have an eviction on your public record, but itll be more difficult. There are a few things that may improve your chances of getting a rental agreement.

- Explain the eviction: Be honest and upfront. If the landlord understands what happened, they might give you a better chance. If youve rectified the situation with your previous landlord, make sure the new landlord knows that.

- Provide references: To show youre a trustworthy renter, offer references in addition to the background check.

- Offer to pay more upfront: Consider paying the security deposit, first months rent and even second months rent at the time of signing a rental agreement.

- Get a co-signer: A co-signer reassures the landlord that you have someone legally and financially backing you.

- Improve your credit: A good credit score can be evidence of your ability to pay bills on time.

- Show youre financially viable to pay your rent: Provide proof of income and other successful payments, like payments on an auto loan.

Once youre accepted as a tenant, continue to prove yourself with timely payments and by properly caring for the property. You can rebuild your rental history and make it easier to rent in the future.

Don’t Miss: Credit Report With Itin Number

Lawsuit Or Judgment: Seven Years

Both paid and unpaid civil judgments used to remain on your credit report for seven years from the filing date in most cases. By April 2018, however, all three major credit agencies, Equifax, Experian, and TransUnion, had removed all civil judgments from credit reports.

Limit the damage: Check your credit report to make sure the public records section does not contain information about civil judgments, and if it does appear, ask to have it removed. Also, be sure to protect your assets.

Keeping Information Off Of Public Records

If you are facing small claims court or some other kind of financial dispute, it would be beneficial for you to settle out of court and avoid a public record on your credit report.

It is usually better to deal with your creditors directly if possible. Adverse records can affect your credit, whether they are paid or unpaid.

Criminal history is not a public record that will be included in your credit report. It is illegal for credit reporting agencies to use your past criminal history in deciding your credit score.

Have you been taken to small claims court and lost? If so, you probably have a public record of some sort on your credit report, usually in the form of a judgment.

Read Also: Does Qvc Do A Credit Check

What Does Payment After Charge Off/collection Mean

The statement, “payment after charge off/collection,” means that the account was either charged off as a loss by the company with whom you had credit, or that the account was sent to a collection agency for payment. After either one of these situations happened, the full amount owed was paid to the appropriate parties which brought the account to a zero balance.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Usaa Credit Monitoring Experian

How Do I Find Derogatory Public Records On My Credit Report

The next time you receive your free annual credit report, review it for derogatory information. According to credit scores, your mark may be derogatory. Credit report providers Equifax and TransUnion, however, display notices containing negative information. Credit reports may have derogatory marks as a result of account selection.

How Long Will Derogatory Credit Last

Derogatory credit can follow you around for a long time. Some types of derogatory informationlike a bankruptcycan remain on your credit report for up to 10 years.

Most other derogatory informationlate payments and debt collection accountswill only remain on your credit report for seven years. Typically, these items will automatically fall off your credit report once theyre past the credit reporting time limit.

Only accurate, timely, and complete information can be included on your credit report. You can dispute an error or outdated derogatory item with the credit bureaus to have it removed from your credit report.

In some cases, having negative information removed can increase your credit score, but it depends on the rest of the information on your credit report.

You May Like: What’s The Minimum Credit Score For Care Credit

Financial Information On Your Credit Report

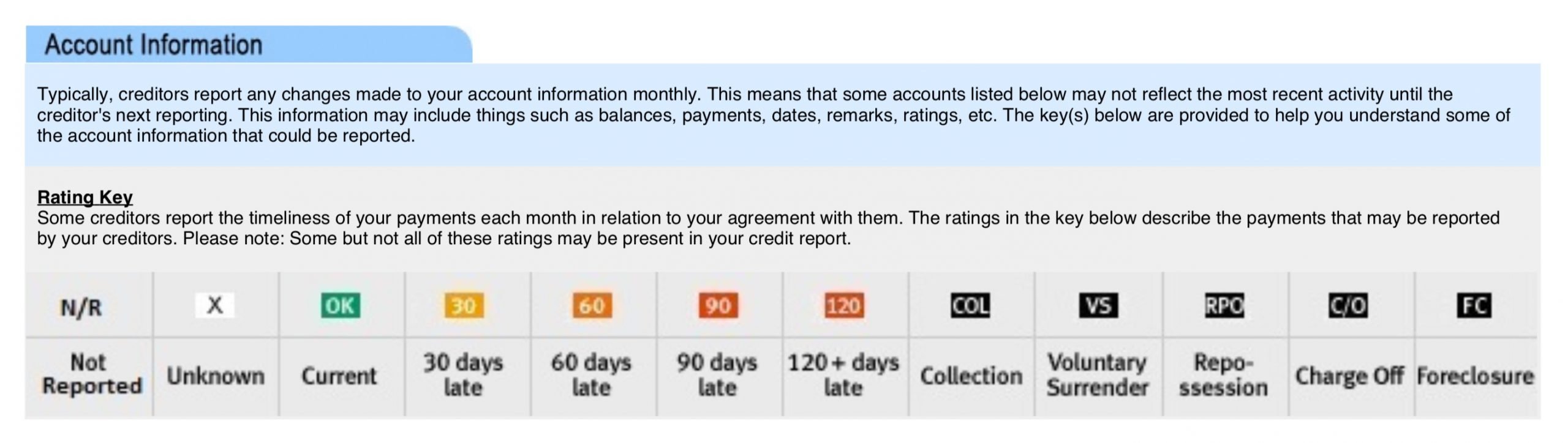

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Recommended Reading: When Does Opensky Report To Credit Bureaus

How Long Does Positive Information Remain On Your Credit Reports

The Fair Credit Reporting Act is the federal statute that defines consumer rights as they pertain to credit reports. Among other consumer protections, the FCRA defines how long certain information may legally remain on your credit reports.

There is no requirement in the FCRA for credit reporting agencies to remove positive information such as on-time credit paymentsthey can remain on your credit reports indefinitely. Even after a positive account has been closed or paid off, it will still remain on your credit reports for as long as 10 years.

The credit bureaus keep a record of your accounts in good standing even after they’ve been closed because it’s important for credit scoring systems to see their proper management. As such, credit scoring systems such as FICO and VantageScore® still consider closed accounts that appear on your credit report when calculating your scores.

Tax Lien: Once Indefinitely Now Zero Years

Paid tax liens, like civil judgments, used to be part of your credit report for seven years. Unpaid liens could remain on your credit report indefinitely in almost every case. As of April 2018, all three major credit agencies removed all tax liens from credit reports due to inaccurate reporting.

Limit the damage: Check your credit report to ensure that it does not contain information about tax liens. If it does, dispute through the credit agency to have it removed.

You May Like: Unlock Transunion Credit Report

How To Read Your Credit Report: Red Flags And Errors You Should Dispute

Your personal credit can play a critical role in your livelihood, as it may impact how creditors, landlords, insurers, and employers view you. Knowing how to read a credit report, detect any red flags, as well as dispute and correct inaccuracies, can help you stay on top of your finances, keep your credit score in good shape, and know what changes to make to reach your financial goals faster.

A credit report is an ever-evolving history of your financial past. Heres what you need to know to dig into yours.

What Is A Good Credit Score

Credit scores commonly range from 300 up to 850. A score in the mid-600s or above may be considered a good score, however, higher scores may make it easier to get approved for a new loan or line of credit with favorable terms. Regardless of your score, creditors will also take into account the underlying information in your credit report to make their determination on whether or not to lend.

Read Also: How To Unlock My Experian Account

How Long Does Negative Information Stay On Your Credit Report

A Tea Reader: Living Life One Cup at a Time

The length of time negative information can remain on your credit report is governed by a federal law known as the Fair Credit Reporting Act . Most negative information must be taken off after seven years. Some, such as a bankruptcy, remains for up to 10 years. When it comes to the specifics of derogatory credit information, the law and time limits are more nuanced. Following are eight types of negative information and how you might be able to avoid any damage each might cause.

How Long Do Accounts Remain On My Credit Report

The time limits listed below apply to federal law. State laws may vary.

Accounts:

In most cases, accounts that contain adverse information may remain on your credit report for up to seven years from the date of first delinquency on the account. If accounts do not contain adverse information, TransUnion normally reports the information for up to 10 years from the last activity on the account. Adverse information is defined as anything that a potential creditor may consider to be negative when making a credit-granting decision.

Bankruptcies:

Generally, bankruptcy and dismissed bankruptcy actions remain on file for up to 10 years from the date filed. A completed or dismissed Chapter 13 remains on file for up to seven years from the date filed. A voluntarily dismissed bankruptcy remains on your file for up to seven years from the date it was filed. The actual accounts included in bankruptcy remain on file for up to seven years from the date of closing/last activity regardless of the chapter pursuant to which you filed.

Inquiries:

Under law, we are required to keep a record of inquiries for a minimum of two years if related to employment and for one year if not employment related. It is TransUnion’s policy to keep a record of all inquiries for a period of two years.

Foreclosure public record:

Generally, foreclosures, both paid and unpaid, remain on file up to seven years from the date filed.

Forcible detainer:

Garnishment and attachment:

Read Also: How Are Account Numbers Displayed In A Credit Report

Types Of Derogatory Credit Items

Different derogatory items affect your credit score in different wayssome items are given more importance than others. For example, a single late payment will hurt your credit score, but not as much as bankruptcy, which impacts your credit score almost more than anything else. Multiple derogatory items will also cause your credit score to drop.

These are the types of derogatory credit items that can appear on your credit report:

- Late payments, resulting from credit card and loan payments that are more than 30 days late

- Charge-offs, resulting from debts that have fallen more than 180 days past due and have been written off as uncollectible

- Debt collections, resulting from debts that have been sold or assigned to a third-party debt collector

- Foreclosure, resulting from delinquent mortgage payments

- Repossession, resulting from delinquent auto loan payments

- Debt settlement, resulting from an agreement between you and a creditor to reduce the outstanding balance and cancel the remainder

- Bankruptcy, resulting from the legal process of having your debts discharged in court

How Long Does An Eviction Stay On Your Record

An eviction can stay on your public record for at leastseven years. After this period, evictions fall off your public records,including your credit report and rental history.

Evictions can impact your credit score and yourability to rent, but there are ways to improve your chances of renting after aneviction.

Take a look at our guide to learn how to do just that.

You May Like: How Long Does Repossession Stay On Your Credit

Derogatory Mark: Account Charge

If you dont or cannot pay your debt as agreed, your lender may eventually charge the account off. The charge-off will appear on your credit reports for seven years.

What to do: Try to pay off the debt or negotiate a settlement. While this wont get the charge-off removed from your credit reports, it’ll remove the risk that youll be sued over the debt.

How Do I Build A Good Credit History

Establishing a good credit history takes time. If you have steady income and have used the same mailing address for at least one year, you may wish to apply for credit with a local business or department store, or for a secured loan or credit card through a financial institution. Paying credit obligations on time will help you develop a good credit history and may enable you to obtain additional credit in the future.

When filling out credit applications, it is important to use complete and accurate personal information, including your formal or legal name. You may also wish to see if the company reports account information to a credit reporting company. Companies are not required to report account information, but most do.

Each creditor has different requirements for issuing credit. If you are denied credit, contact the creditor to find out why. You may be denied credit for various reasons, including not meeting the creditor’s minimum income requirement or not being at your address or job for the required amount of time. You can overcome these obstacles with time.

Read Also: How To Get Car Repossession Off Credit Report

How To Remove Derogatory Items From Your Credit Report

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

* * *