Reasons Why Outstanding Debt Spells Bad News For Your Credit Score:

1. It maximises your credit utilisation ratio:

- A good credit utilisation ratio is 30% or lower.

- A high ratio means you are using too much credit and can, as a result, reduce your credit score

2. It makes repayment of future loans difficult:

- If you have outstanding debts, it means that you could already be paying high EMIs.

- Borrowing more loans in the future with outstanding debts can create a major repayment burden and even cause bankruptcy.

Benefits Of High Credit Scores

High credit scores usually come with multiple benefits, including:

- Lower interest rates. When you apply for a personal loan, mortgage, auto loan or student loan, youll have a better chance of qualifying for the best interest rate. This can save you thousands of dollars during your lifetime.

- More lending options. If you have a high score, you shouldnt have much trouble meeting any lenders minimum credit score requirements. This gives you access to lenders who only offer loan products to applicants who have excellent credit profiles.

- . Since some of the best cash back credit cards require excellent credit scores , youll most likely qualify. In addition, youll also be able to qualify for a 0% APR credit card that doesnt charge interest on purchases or balance transfers for up to 21 months.

- Lower car insurance premiums. If you live in a state that allows , you could pay a lower monthly premium.

- Lower security deposit for an apartment. When you purchase an apartment, youll probably pay less of a security deposit than someone who has a low credit score.

List Of Countries By Credit Rating

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

This is a list of countries by credit rating, showing long-term foreign currency for sovereign bonds as reported by the largest three major credit rating agencies: Standard & Poor’s, Fitch, and Moody’s. The list also includes all country subdivisions not issuing sovereign bonds, but it excludes regions, provinces and municipalities issuing sub-sovereign bonds.

Read Also: 8773922016

An Excellent Credit Score Is Good Enough

You don’t need a perfect credit score to get the best deals. A score of 720 or higher is generally considered excellent. And scoring 800 or above qualifies you for the best terms offered.

Thats pretty great news if you aspire to get into the group of people who have top-tier credit but you dont want to obsess over every single point in an effort to get the highest score possible.

What Is The Highest Credit Rating For You

Your highest ranking is the one you reach by being consistently responsible with your loans, mortgages, and credit cards. No one is perfect, but if you work at your FICO score, you should be able to reach the golden land of 760 and above. And that score is as high as you really need to go.

About the Author

Jeff Hindenach

Jeff Hindenach is the co-founder of Simple. Thrifty. Living. He graduated from Bowling Green State University with a Bachelor’s Degree in Journalism. He has a long history of financial journalism, with a background writing for newspapers such as the San Jose Mercury News and San Francisco Examiner, as well as writing on personal finance for The Huffington Post, New York Times, Business Insider, CNBC, Newsday and The Street. He believes in giving readers the tools they need to get out of debt.

You May Like: What Is Syncb Ntwk On Credit Report

Canadian Credit Score Ranges

In Canada, from 300 to 900, with the higher the score the better. Having a healthy credit score can open financial doors and make sure you have access to credit products and loans in the future when you need them.

Its important to keep in mind that while a healthy credit score is important, its never a good idea to become obsessed with having a perfect score. Its very hard to get a perfect score. What you should do is focus on the overall health of your finances and your credit score will reflect that.

Find out how to increase your credit score without increasing your debt.

What Is The Average Credit Score In Canada

While credit scores in Canada range from 300 – 900, the average is around 650, according to TransUnion, though it varies from province to province. Once you’ve reached a credit score of 650 or higher, you’ll be able to qualify for more financial products. A credit score below 650 is going to make it hard to qualify for new credit, and anything you are approved for will likely come with very high-interest rates.

Do you know your credit score? You can use Borrowell to get your credit score in Canada for free. With Borrowell, you’ll get weekly credit score updates, see exactly what’s impacting your credit score, and get personalized tips on how to improve your score. You can also find your free credit score here.

Check out this infographic that shows the average credit scores in Canada:

Don’t Miss: How To Remove Repossession From Credit Report

Benefits Of Knowing The Maximum Credit Score

As we mentioned before, knowing the maximum credit score is important because it gives you a framework for whats possible and it helps you understand how much improvement you need to make in order to break into that Excellent threshold.

If youre like most of the U.S. population, you have some room for improvement. Lets look at some of the ways you can improve your credit score.

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

You May Like: Unlock My Experian Credit Report

Become An Authorized User

If you dont have a lengthy credit history, ask a family member who has excellent credit to add you as on their oldest credit cards. Your score can increase if the credit card issuer reports information to the credit bureaus for authorized users. However, the downside is that your score can decrease if the primary cardholder misses a payment and its reported on your credit report.

What Is A Good Credit Score In Canada

Your credit score is used by lenders to determine what kind of borrower you are. It can affect your eligibility for certain loans or credit cards as well as the interest rate you get.

In Canada, your credit score ranges from 300 to 900, 900 being a perfect score. If you have a score between 780 and 900, thats excellent. If your score is between 700 and 780, thats considered a strong score and you shouldnt have too much trouble getting approved with a great rate. When you start hitting 625 and below, your score is getting low and youll start finding it more and more difficult to qualify for a loan.

Recommended Reading: What Credit Report Does Paypal Pull

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

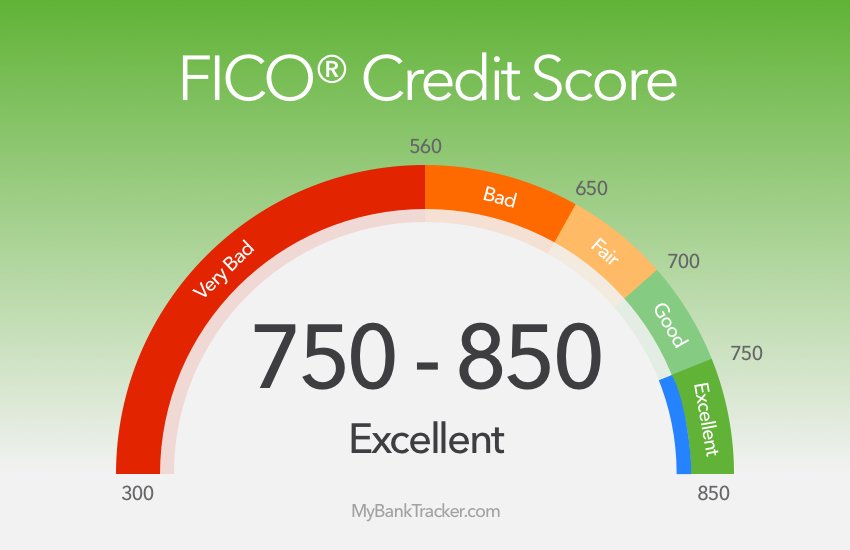

What Does Your Credit Score Mean

News media often coined the term FICO score. it means. Fair Isaac Corporation. It is the most well-known software development company that tables the credit scores of all borrowers. Someones FICO score is a table of various factors related to how they have managed their money. It is not always easy to know everything that comes in this score, but we know that the score itself is important.

Credit scores sometimes called FICO scores. Fair Isaac Corporation, Who created the scoring system range between 300 and 850 Generally, however, credit scores above 720 are considered good, while scores in the range of 760 and above are considered very good or excellent. The higher your credit score, the better your chances of getting a loan, but also a reasonable interest rate. Lenders use your credit score to determine your creditworthiness.

The federal government considers it so important for a persons life that they have access to their credit score that there is a law that states that an individual is entitled to a free credit report from the Credit Reporting Bureau every year. There are three major credit reporting bureaus, and this means that anyone can access their report for free once every four months. More often than not, access to it may require payment, but everyone should be aware of the fact that they are entitled to these free reports.

Debt relief begins here.

To start

Don’t Miss: What Is Syncb Ntwk On Credit Report

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

How Is A Canadian Credit Score Calculated

While we dont know the exact formula for how each of the two Canadian credit bureaus calculates your credit score, we do know the five most important factors that affect it.

- History of payments. Do you make all your credit and loan payments on time all the time?

- Debt level. How much debt do you carry month to month? Are you using up more than 30% of your total limit?

- How long have you been a credit user? The longer the better for the health of your credit.

- New inquiries. Every time a potential lender or your score drops a few points. Too many pulls within a short period of time is a bad sign.

- Diversity. Are you responsibly using more than one type of credit account?

You May Like: How To Get Credit Report With Itin Number

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Don’t Miss: Capital One Rapid Rescore

Vantagescore Credit Score Ranges

VantageScores are also between 300 to 850. The ratings are as follows:

- Very Poor credit 300 to 499

- Poor credit 500 to 600

- Fair credit 601 to 660

- Good credit 661 to 780

- Excellent credit 781 to 850

Heres how VantageScores are computed:

- Overall credit usage, available credit and outstanding balances Extremely influential

- Payment history Moderately influential

- Age of credit history Less influential

- New accounts Less influential

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

Read Also: Does Lending Club Affect Your Credit Score

How Does Outstanding Debt Affect Your Credit Score

The amount of outstanding debt impacts your credit score. Lenders normally check this in the form of the credit utilisation ratio. This refers to the amount of money you are using out of the total credit available to you. The higher the ratio, the lower your credit score. However, this doesnt mean debt is bad for you. In fact, you will be able to build your credit score only when you take on debt. The key is to pay it off in a timely fashion and not going over the limit of your credit cards or bank accounts.

How Credit Scores Affect Your Interest Rate

A high credit score when you apply for a mortgage could save you thousands of dollars in interest over the life of your loan.

Your represents your overall credit history. Its based on information in your , which includes whether you pay your bills on time and the total debt you carry. Lenders consider your score an indicator of how likely you are to repay your mortgage.

Also Check: Business Credit Cards That Don T Report To Personal Credit

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Don’t Miss: Does Speedy Cash Check Credit

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Pay All Of Your Bills On Time

The most important habit to adopt when building credit is timely paymentsyour payment history accounts for 35% of your FICO score. Repaying your debt on time adds positive payment history to your credit reports, which can boost your credit score. However, if any of your bills become 30 days past due, a creditor can report it to the three major credit bureausEquifax, Experian or TransUnion.

Once a late payment is reported, it can cause serious damage to your credit. And it can remain on your credit report for up to seven years, but its impact lessens over time.

Recommended Reading: Speedy Cash Collection Agency