Different Scores At Each Credit Bureau

Because each credit bureau could have different information on file about you, your credit scores will most likely differ for each of the three credit bureaus: Equifax, TransUnion and Experian.

Sometimes the difference is just a few points. Other times, the difference in your credit scores from each bureau can be vast due to an error or mistake in your credit report. These differences can cost you thousands over the life of a loan. Be sure to check your reports regularly or sign up for alerts to be notified when your score changes.

What Fico Says About Having The Perfect Credit Score

Even a representative at FICO the scoring model most lenders use to check applicants’ creditworthiness says that having a credit score in the top 2% of the U.S. population won’t further benefit you, so there’s no need to stress.

“The reality is that, from the standpoint of qualifying for credit, it doesn’t matter whether you have a perfect 850 or a score just below that,” Ethan Dornhelm, VP of FICO scores and predictive analytics, tells CNBC Select. “To lenders, a consumer with a score in the 800s is a sparkling applicant.”

The Minimum Required To Calculate A Credit Score

For a credit score to be calculated, your credit report must contain enough informationand enough recent informationon which to base a credit score.Generally, that means you must have at least one account that has been open for six months or longer, and at least one account that has been reported to the credit bureau within the last six months. What are the minimum requirements to have a FICO Score?

Read Also: Leasingdesk Screening Reviews

Why Students Would Want To Have A Good Credit Score

A good credit score can help students who are planning to leave school or those who are currently in school get their first credit card, finance their school expenses, rent an apartment or buy their first car.

Lenders use your credit score to determine if you are a good borrower. Those with stellar credit scores are usually offered the best interest rates, which can help them save more money in the long run.

Remember that theres more to your credit than your credit score. It may be tempting to work to obtain the best credit score you can. However, now is also the best time to learn the skills needed to keep a good score over time and develop responsible financial habits.

Most students have used student loans to support their schooling, and it can be an excellent place to start when it comes to establishing responsible financial habits. Just make sure to pay your student loan on time to refrain from getting any late fees.

Keep Old Accounts Open And Deal With Delinquencies

The age-of-credit portion of your credit score looks at how long youve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts that youre not using, dont close them. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time. That wont erase the late payments but can improve your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the creditor a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsand bankruptcies for 10 years.

Read Also: How To Self Report Utilities To Credit Bureaus

What Is A Good Vantagescore

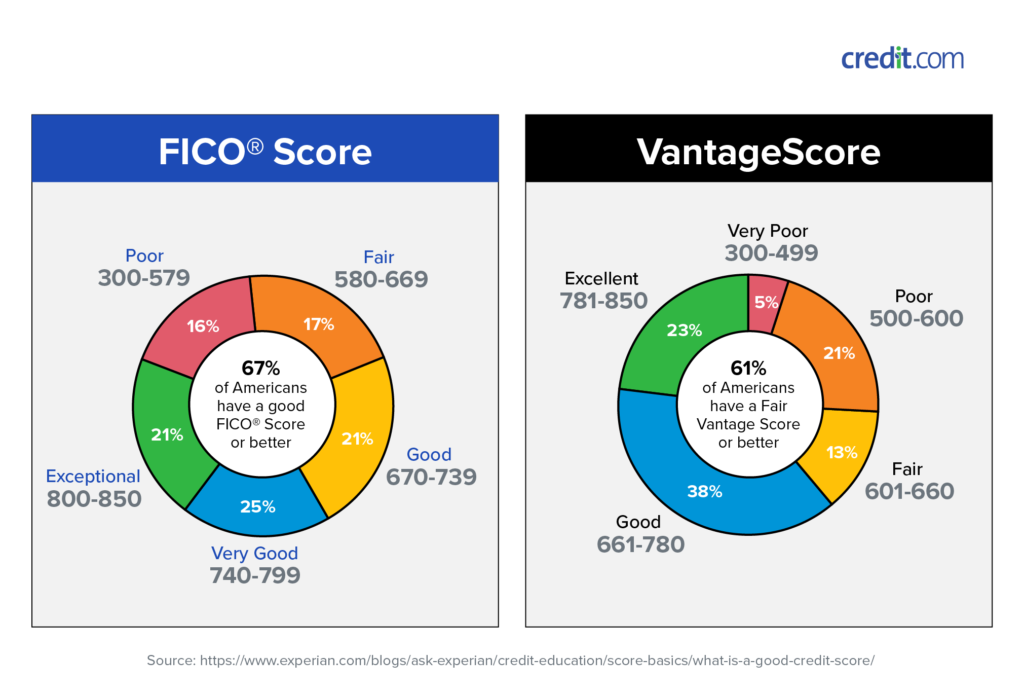

FICO’s competitor, VantageScore produces a similar score using the same credit report data from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores above 780 are considered “superprime” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in July 2021 was 693.

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

Also Check: Does Paypal Credit Report To The Credit Bureaus 2019

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

A Good Credit Score Is In The Eye Of The Beholder

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

Don’t Miss: Credit Score Of 524

Who Cares About Your Credit Score

Heres a list of who is legally allowed to access your credit reports and scores:

Insider tip

If you discover mistakes on your credit reports, you have the right to dispute them with the appropriate credit reporting agency. Credit errors might lower your credit scores. So, you should be sure to address any inaccuracies you find on your credit reports.

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Recommended Reading: Is 694 A Good Fico Score

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

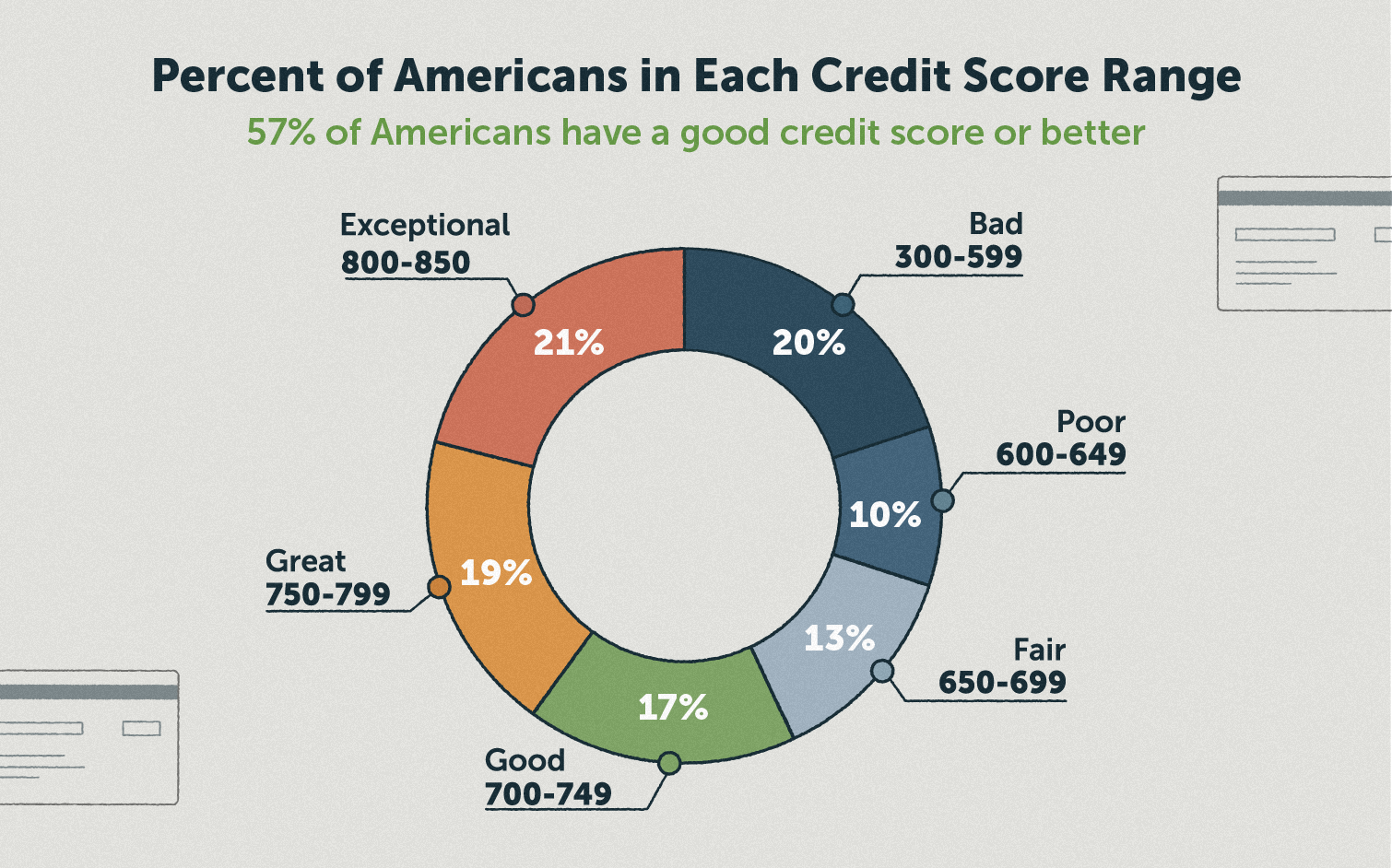

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

The Differences In The Bureaus

Conceptualizing the difference in scoring systems at each credit bureau can be difficult without more direct comparisons.

FICO is one type of credit score that provides a credit score based on payment habits and the amount of debt the individual currently has on their credit lines. Experian, Equifax, and TransUnion all use VantageScore credit scores, which use the same factors, but a different formula.

While a FICO score is just a number, the credit reports issued by Experian, Equifax, and TransUnion all include more detailed information as well.

The exact information you get from any report will be dependent on where the report comes from, what credit scoring model is used, and what information you request.

Recommended Reading: Transunion Account Locked

How Credit Scores Work

A credit score can significantly affect your financial life. It plays a key role in a lender’s decision to offer you credit. People with credit scores below 640, for example, are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage in order to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or above is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO score range is often used.

- Excellent: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit you take out.

A persons credit score may also determine the size of an initial deposit required to obtain a smartphone, cable service or utilities, or to rent an apartment. And lenders frequently review borrowers’ scores, especially when deciding whether to change an interest rate or credit limit on a credit card.

What Is A Credit Score?

How To Earn A Good Credit Score:

If you currently have a credit score below the “good”rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Read Also: Does Carvana Report To Credit Bureaus

Whats A Good Credit Score

A good credit range depends on where a score comes from and whoâs judging it. And there are different scoring companies, so you can have more than one credit score. As the Consumer Financial Protection Bureau puts it, âBased on your credit reports, you will be given a credit score by the credit-reporting companies. You donât just have one credit scoreâeach company does their own.â

FICO®, which is one credit-scoring company, says scores between 670 and 739 qualify as good. For VantageScore®, another credit-scoring company, scores between 661 and 780 might be considered good. Scores can also be considered very good, excellent and exceptional.

It may also help to know that credit scores are based on information in your . Scores are calculated by credit-scoring companies, like FICO and VantageScore, using complex formulas called scoring models.

Hereâs how FICO and VantageScore define credit score ranges:

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you are doing so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

Recommended Reading: Remove Credit Inquiries In 24 Hours

Tip : Never Miss A Payment

If theres one thing you can control when it comes to credit building, its payment history. Payment history accounts for at least 35% of most credit scores. And you can avoid forgetting to pay your bill by setting up automatic monthly payments from a bank account. You just need to make sure theres enough cash available in the account every month to cover the payments.

With that in mind, its wise to contribute to an emergency fund on a monthly basis as well. With a solid stash of cash backing you up, you will be less susceptible to missing bill payments and incurring credit-score damage if youre ever met with a significant, unexpected emergency expense. Your goal should be to save about a years worth of take-home pay for this purpose, but even a few months pay will go a very long way.

Why Does A Good Credit Score Matter

A good or excellent credit score will save most people hundreds of thousands of dollars over the course of their lifetime. Someone with excellent credit gets better rates on mortgages, auto loans, and everything that involves financing. Individuals with better credit ratings are considered lower-risk borrowers, with more banks competing for their business and offering better rates, fees, and perks. Conversely, those with poor credit ratings are considered higher-risk borrowers, with fewer lenders competing for them and more businesses getting away with criminally high annual percentage rates because of it. Additionally, a poor credit score can affect your ability to find rental housing, rent a car, and even get life insurance because your credit score affects your insurance score.

You May Like: How To Check Your Credit Score Chase

Average Tenant Credit Score Ranges

What is the average number you can expect to see when checking into what should be considered an acceptable credit score for renting?

Here at RentPrep, we run a lot of for the landlords who use our services. This gives us some insight into what you might see from renters. We are not the only ones who have insight into acceptable credit scores, however.

These are some of the most popular numbers used as a measure of what is an average credit score for tenants in America.

649

This is the exact average score we have seen in one year of data among all of the reports weve completed. This means if the score is lower than 649, it should be at least a little concerning. According to Experian, an acceptable credit score to rent an apartment is around 638.

These numbers are based on the data we have here at RentPrep. We run thousands of credit checks every month and this is a result of our findings. Understand that this is not based on all renters, but it is based on renters of landlords who run background checks.

673 699

According to an article from ValuePenguin, the average credit score of Americans in a 2021 report was 688 for the Vantage scoring model and 711 for a FICO model. Keep in mind that this is not industry-specific it takes into account everybody and not just renters. Renters statistically have a lower credit score than homeowners.

662