Two: Determine Whether You Should Or Shouldnt Dispute

After youve reviewed a recent credit report, consider the following reasons to dispute items on credit report to help you decide if its worth a shot:

- There is incorrect personal information on your credit report, such as your name or Social Security Number

- There is a negative item that is beyond the statute of limitations for reporting

- The report shows that you carry a debt balance which you have already settled

- There is duplicate information shown on your credit report

- You have a duplicate credit report or mixed information for yourself and another person

- There are fraudulent items on your report, like a new credit card or loan that you did not open or apply for

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Errors On Credit Reports Could Include

- Identity-related errors such as a misspelled name, wrong phone number or address, or your information incorrectly merged with another persons credit record

- Incorrectly reported accounts, such as a closed account reported as open or an account wrongly reported as delinquent

- Account balance and credit limit errors

- Reinsertion of inaccurate information after its corrected

Recommended Reading: How Long A Repossession Stay On Your Credit

Why Does Your Score Sometimes Change During A Dispute

During a credit dispute, your score may increase due to a negative item being temporarily ignored. Normally, when your score is calculated, a negative item results in a decreased credit score. However, items that are in an active dispute may not factor into your credit score.

While you are disputing your credit report, an XB code is filed alongside the items you are disputing. This code informs lenders and other agencies that view your report to temporarily ignore the item while it is being reviewed.

This helps to explain various score changes during and after a credit report dispute. If your dispute is unsuccessful, your score may appear to dropbut it may actually just revert to where it was before the XB code was placed. If your dispute is successful, your score may not increase as much as you had hoped if the negative item was already being ignored as your score was calculated during the dispute.

In any case, its generally useful to dispute any inaccurate information, so its helpful to know exactly what information you can dispute.

How To Remove A Dispute From A Credit Report

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013. This article has been viewed 32,804 times.

If you go to a bank for a mortgage, the lender will look at your credit history to check your creditworthiness. A lender may refuse to make a loan to you if any of your creditors have reported your account as being in dispute. You may have “disputed” a particular charge attributed in error to your credit card, for example. Then in order to secure a loan you may want to have that dispute settled and removed from your record. Here’s how to do that.

Also Check: Credit Score Of 611

What Usually Happens After You Dispute Something On Your Credit Report

Once you file your dispute, credit reporting agencies must tell information provider about it. Information providers are required to verify the data in questionor, if its found inaccurate, they must inform all three bureaus and have the data corrected or deleted. The credit bureaus sites offer you links to check on the status of a dispute, and FAQs that describe possible outcomes and next steps.

Once a dispute investigation is complete, credit bureaus are required to inform you of the results in writing and provide a new free report if there are changes. Further, the bureau must provide information on the data furnisher involved. Data furnisher is the legal term for any entity that provides information to a credit reporting agency. You can request that the bureau notify anyone who received your report over the last six months.

If you are unsatisfied with the results, you can:

- Refile your dispute, potentially with additional documentation.

- File a statement of dispute, about 100 words, that will be affixed to your file and any future reports. You can ask the bureau to get the statement to entities that recently obtained your report. A fee may be involved.5

How Do Collection Reports Impact Your Credit Score

While a collection report usually causes serious damage to your credit score, how much it impacts it depends on which credit scoring model you use to calculate your score. It also depends on whether the collection account is paid or unpaid. For example, FICO Score 9the latest version of the FICO credit scoring modeldoesnt report paid collection accounts.

Earlier versions of this credit scoring model, however, do include paid collection accounts. If a lender uses an earlier model to assess the likelihood you can repay a loan, its likely that it will see a lower credit score if you have a paid collection account listed on your credit reports.

You May Like: Remove Payday Loans From Credit Report

How To Dispute Your Credit Report And Win With Donotpay

Instead of chasing down every credit reporting agency and filling out duplicate dispute forms, let DoNotPay help! Don’t sweat typing up letters and handwriting envelopes. Avoid the awful wait times involved with self-disputing efforts and let DoNotHelp do all the heavy lifting for you!

Here’s how anyone can clean up their credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps:

You’ll likely want to explore some of our many other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more!

Dispute Your Credit Reports Errors

Under the Fair Credit Reporting Act, both the credit reporting bureau and the company that reports the information about you to the credit bureau are required to accept disputes from consumers and correct any inaccurate or incomplete information about you in that report.

The U.S. Federal Trade Commission recommends taking these actions:

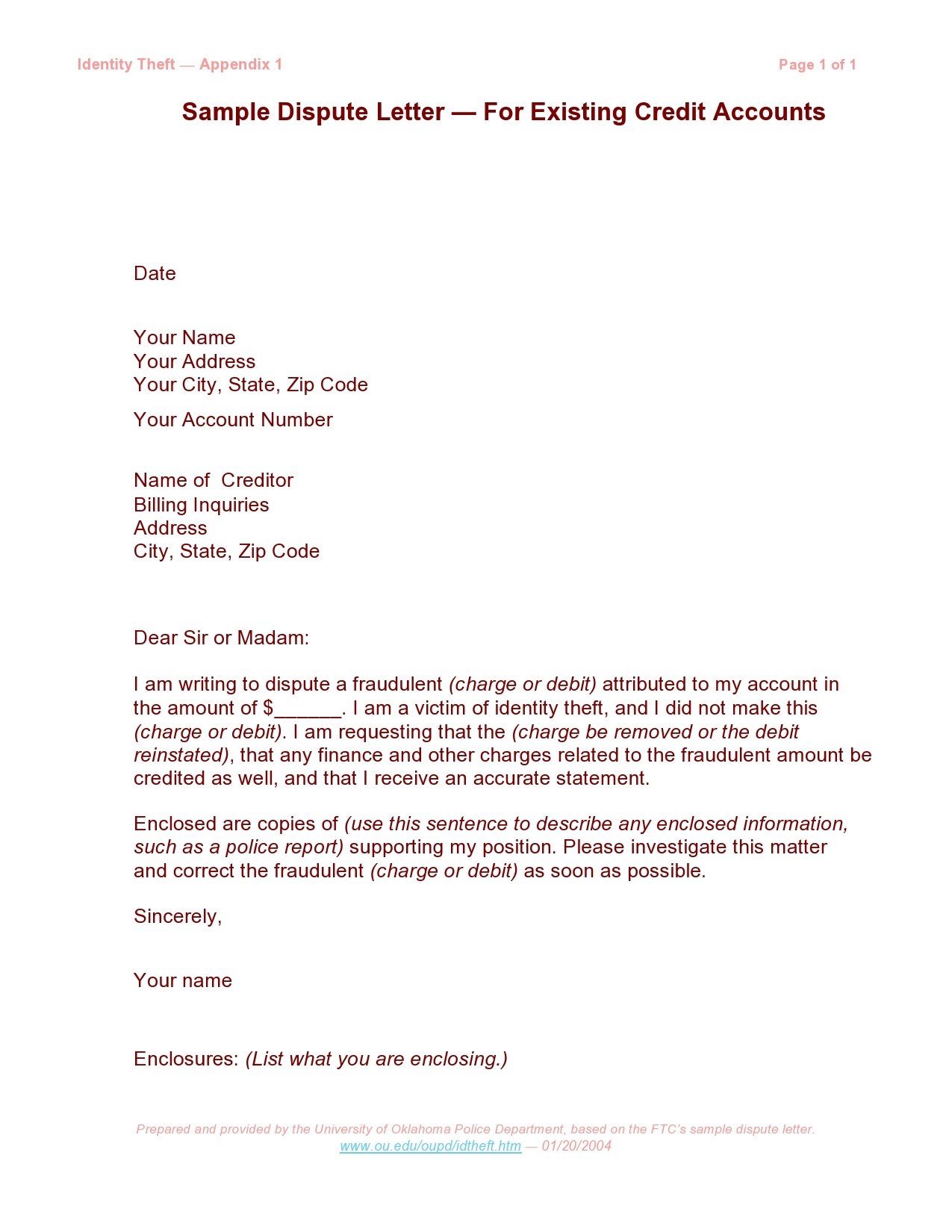

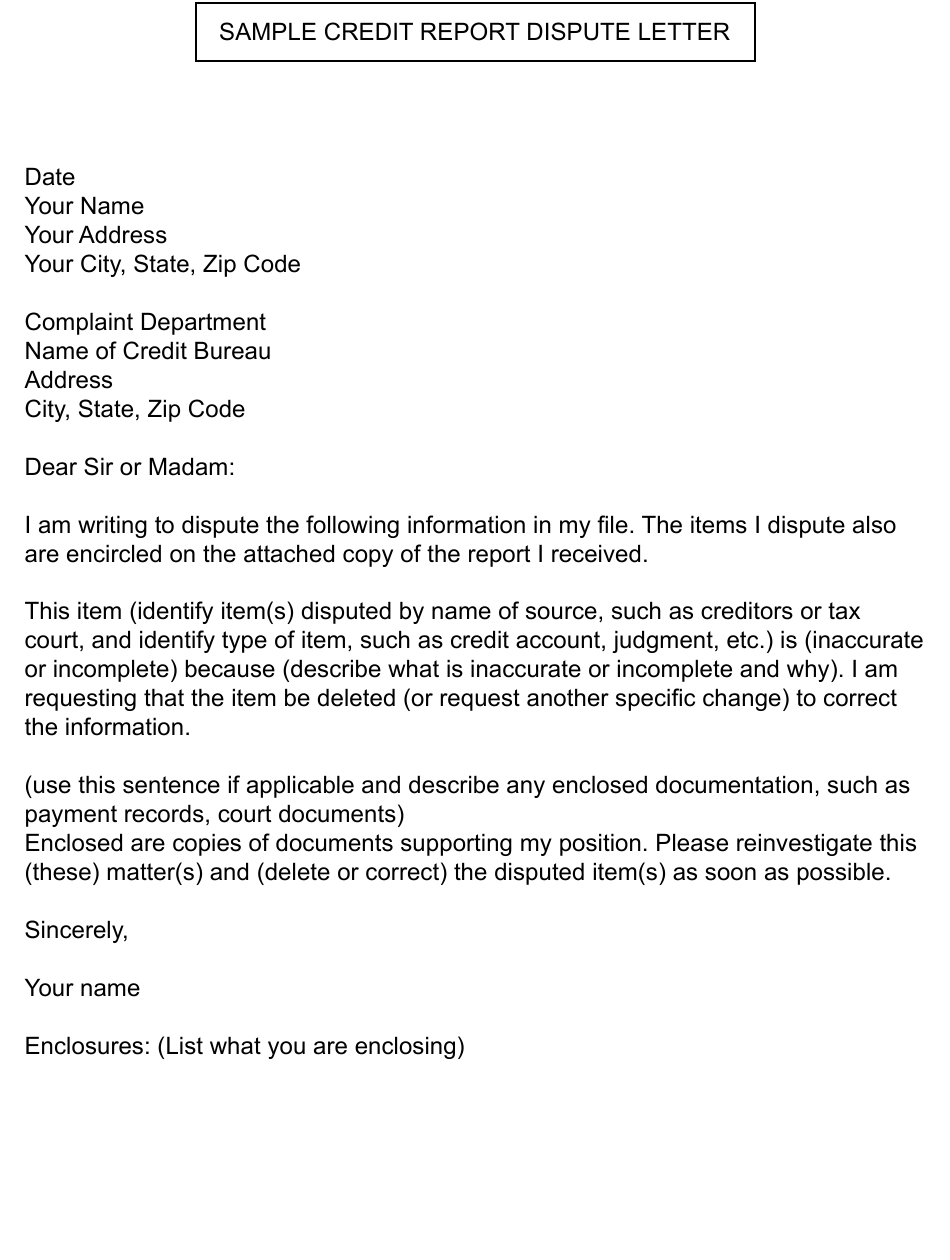

- Tell the credit bureau, in writing, what information you think is inaccurate. The Federal Trade Commission provides a sample dispute letter that makes this step easier. The letter outlines what information to include, from presenting the facts to requesting that the error be removed or corrected.

- Include copies, not originals, of materials that support your position.

- Consider enclosing a copy of your credit report with the errors circled or highlighted.

- Send your letter by certified mail with return receipt requested to ensure the letter is delivered. Keep your post office receipt.

- Keep copies of everything you send.

Also Check: Affirm Credit Score Needed

One: Obtain A Recent Copy Of Your Credit Report

In order to dispute an item on your credit report, youll need to prove to the powers that be that your credit report is inaccurate. To do so, youll want to have a copy of your credit report handy. Consumers are entitled to one free credit report each year from each of the three main credit reporting agencies, which you can access through AnnualCreditReport.com. Or if youre a Mint user, you can easily view your credit score in the Mint app whenever you please!

Once youve got your credit report in front of you, pull out that red pen of yours and notate any items on the report that are inaccurate or with which you do not agree.

Look For Inaccurate Information On Your Credit Reports

If you havent already, request your credit reports from the major credit reporting bureaus: Experian, TransUnion, and Equifax. Youre entitled to one free report from each bureau once per year . You can access all three reports online at AnnualCreditReport.com or call 200-6020 to request hard copies.

Next, carefully review each report for errors and take note of which credit bureaus have reported inaccurate information.

Read Also: 672 Credit Score Auto Loan

The Creditor’s Obligations When You Dispute Information

Under the federal Fair Credit Reporting Act , a creditor who furnishes information to credit reporting agencies must:

- reinvestigate when you dispute reported information

- not report incorrect information once it learns or has a reasonable basis to believe that the information is, in fact, incorrect

- promptly provide credit reporting agencies with correct, complete information when it learns that the information it has been reporting is incorrect or incomplete

- notify credit reporting agencies when a consumer disputes information

- note when accounts are “closed by the consumer”

- provide credit reporting agencies with the month and year of the delinquency of all accounts placed for collection, charged off, or similarly treated, and

- finish its investigation of a consumer dispute within the 30- or 45-day periods in which the credit reporting agency must complete its investigation.

Learn more about your rights under the Fair Credit Reporting Act.

Check All Three Credit Reports For Errors

![50 Best Credit Dispute Letters Templates [Free] á? TemplateLab](https://www.knowyourcreditscore.net/wp-content/uploads/50-best-credit-dispute-letters-templates-free-a-templatelab.jpeg)

Through April 2022, youre entitled to free weekly credit reports from the three major credit reporting bureaus: Experian, Equifax and TransUnion. Request them by using AnnualCreditReport.com.

There may be small differences among your reports, because some creditors dont report your account activity to all three bureaus. But if negative information has popped up on one report, its wise to see whether its also on the other two.

There is no cost to dispute credit report errors, and you can dispute as many items as you like. Filing a dispute does not hurt your credit score, but the result of the dispute may have an effect on your score.

Don’t Miss: Does Apple Card Affect Credit Score

What To Expect During The Dispute Process

Once youve filled out the necessary forms and provided all the information the credit reporting bureaus need, the issue is out of your hands. The credit reporting bureaus will now verify the information that youve disputed. Typically, you can expect the following:

- First, the credit reporting bureau will double check their own information that they have on file.

- Next, if this does not resolve the issue, they will contact the company that the information has come from.

- If the company verifies that the information is incorrect, the credit reporting bureau will update your credit report.

- If the company confirms that the information your credit reporting bureau has, is in fact, correct, no changes will be made to your credit report.

Depending on which credit bureau youre dealing with and how you submitted your dispute, you can expect the process to be completed within 30 days. Once the disputed information has either been confirmed or changed, you will receive a written letter from the credit bureau to inform you of the results of your dispute.

Can I Dispute Errors Caused By Identity Fraud

If you believe the errors on your report are the result of identity fraud, you should definitely send a dispute letter. You should also take additional steps to protect yourself in case the investigation confirms your identity has been stolen.

- TRANSUNION

- Allen, TX 750131.888.397.3742

Recommended Reading: Repo On Credit Report

Before Disputing Review Your Credit Reports

Start by getting a highlighter and a pen out and go through your credit report item by item, page by page highlight the items that are reporting incorrectly and make a note next to the item to help you in the dispute process following these guidelines:

- Incorrect personal information Name, addresses, social security numbers, date of birth reporting incorrectly.

- Negative items that are beyond the statute of limitations for reporting There are specific reporting laws with regard to how long a negative item must report on a consumers credit report.*See below the Statute of Limitations for Reporting

- Inaccurate reporting of account or other information for example, a collection was paid 2 years ago, but it still shows a balance. Or an account was included in a Chapter 7 bankruptcy but it is reporting as a charge off account with a balance still owing.

- Mixed or split credit files for example a father and son have the same name, Sr. and Jr. Or credit from someone who has the same name is on your credit report.

- Duplicate reporting of an item for example two collections for the same debt.

- Fraud or Identity Theft information where you may see inquiries, accounts or collections you never applied for.

How Do You Write A Simple Dispute Letter

Your dispute letter should include the following information:

You May Like: Bp/syncb

Hardest Items To Remove From Your Credit Report

Some things are easier to remove from your credit report than others because these items are easier to verify. Items that are a matter of public record are more difficult to remove. This includes bankruptcy, foreclosure, repossession, lawsuit judgments, and loan default, especially student loan default. Sometimes its hard to get these removed even when theyre legitimately inaccurate.

If you have inaccurate public records on your credit report, try to work directly with the court or agency that has the item listed on your report. Once theyve updated their records to show whats accurate, it will be much easier to work with the credit bureau to clear things up. Creditors and other businesses that report to the credit bureaus have the same obligation to investigate and clear up errors.

How Disputing Impacts Credit

Filing a dispute with one or all of the credit bureaus has no direct impact on your credit scores. But once the dispute process is completed, any changes to your credit reports could lead to changes in your credit scores.

Whether your score goes up, down or remains the same depends on what you’re disputing and the outcome of the dispute. Removal of mistakenly reported negative information, such as late payments or unpaid collections accounts, could lead to credit score improvements. On the other hand, corrections to your personal information, while important to maintaining accurate credit tracking, have no impact on credit scores.

Don’t Miss: How Can I Raise My Credit Score 50 Points Fast

What Should I Expect After Filing A Dispute

Investigation of your dispute

When reviewing your dispute, if we are able to make changes to your credit report based on the information you provided, we will do so. Otherwise, we will contact the company that reported the information to us to verify the accuracy of the information you’re disputing.

Your dispute will be processed in approximately 10-15 days for electronic submission and 15-20 days for postal mail

After our investigation is complete, a confirmation letter or email will be sent to you with the results and outcome of the investigation. If we require additional information in order to complete our investigation, we will notify you. If you submitted your dispute electronically, we will notify you by email. If you mailed in your completed form and documents, we will send you a letter. Due to COVID-19, we are experiencing longer than normal processing times. We appreciate your patience.

How To Track Your Dispute Status

Once you’ve submitted your dispute, Experian will send you alerts via email whenever there is a status update. If you already have an account with Experian, you can also view your dispute alerts in the main Alerts section of your Experian account. Alerts you’ll receive while Experian processes your dispute include:

- Open: This indicates the dispute process has been initiated.

- Update: Your dispute investigation has been completed and your credit report is being updated with the results.

- Dispute results ready: Your credit report has been updated with the results of the dispute investigation.

You May Like: How To Get A Public Record Removed