Keep Your Credit Card Balances Low

To improve your score, keep your the amount of credit you use in comparison to your credit limitslow. The general rule of thumb is to keep your credit utilization rate below 30%. This means if your credit card limit is $1,000, try not to borrow more than $300 at a time.

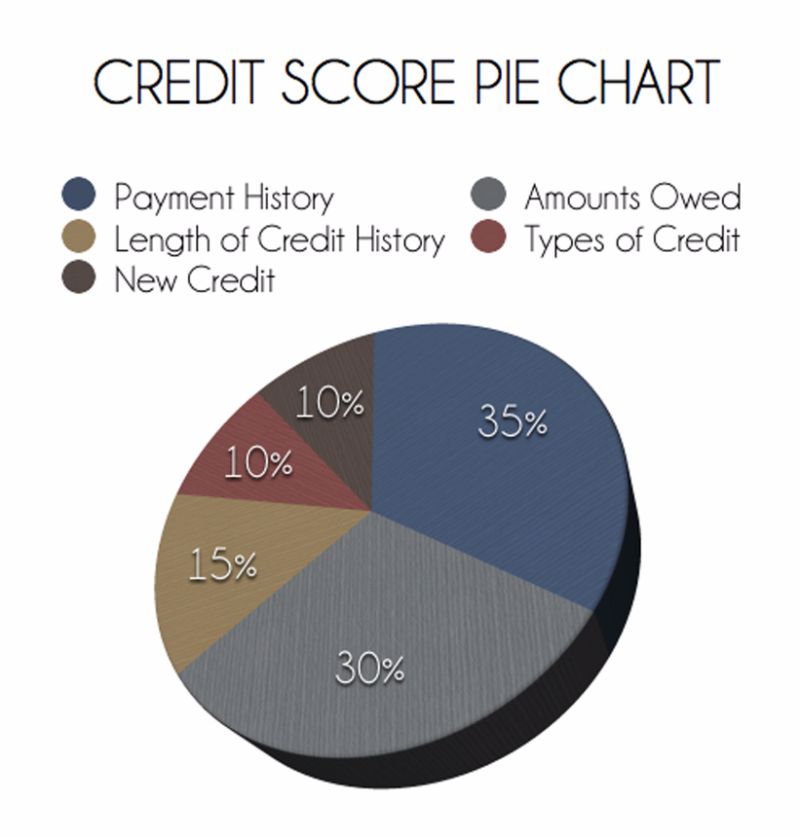

If your credit utilization becomes too high, this can negatively impact your credit score because the amount you owe accounts for 30% of your score.

Why You Should Establish Credit

If you’ve always paid with cash or checks to make purchases and haven’t used credit, it’s a good idea to start. And if youve had credit problems in the past, its important to re-establish your credit history for a few key reasons:

- You may need good credit for such routine matters, such as having utilities connected to your home.

- Good credit is important to secure financing when buying furniture, a computer, a car, or even a new home.

- Employers may check the credit rating of prospective employees.

- Renting an apartment may be easier, as a good credit rating tells landlords that you are a person who’s more likely to pay the rent on time each month.

- If you need a loan, banks may look more favorably upon you if you have a good credit history.

Strategies That Will Quickly Get You A Better Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

If you would like to boost your credit score, there are a number of quick, simple things that you can do. While it might take a few months to see an improvement in your credit score, you can start working toward a better score in just a few hours.

Also Check: How Do You Remove Inquiries Off Your Credit Report

Is A 700 Credit Score Good

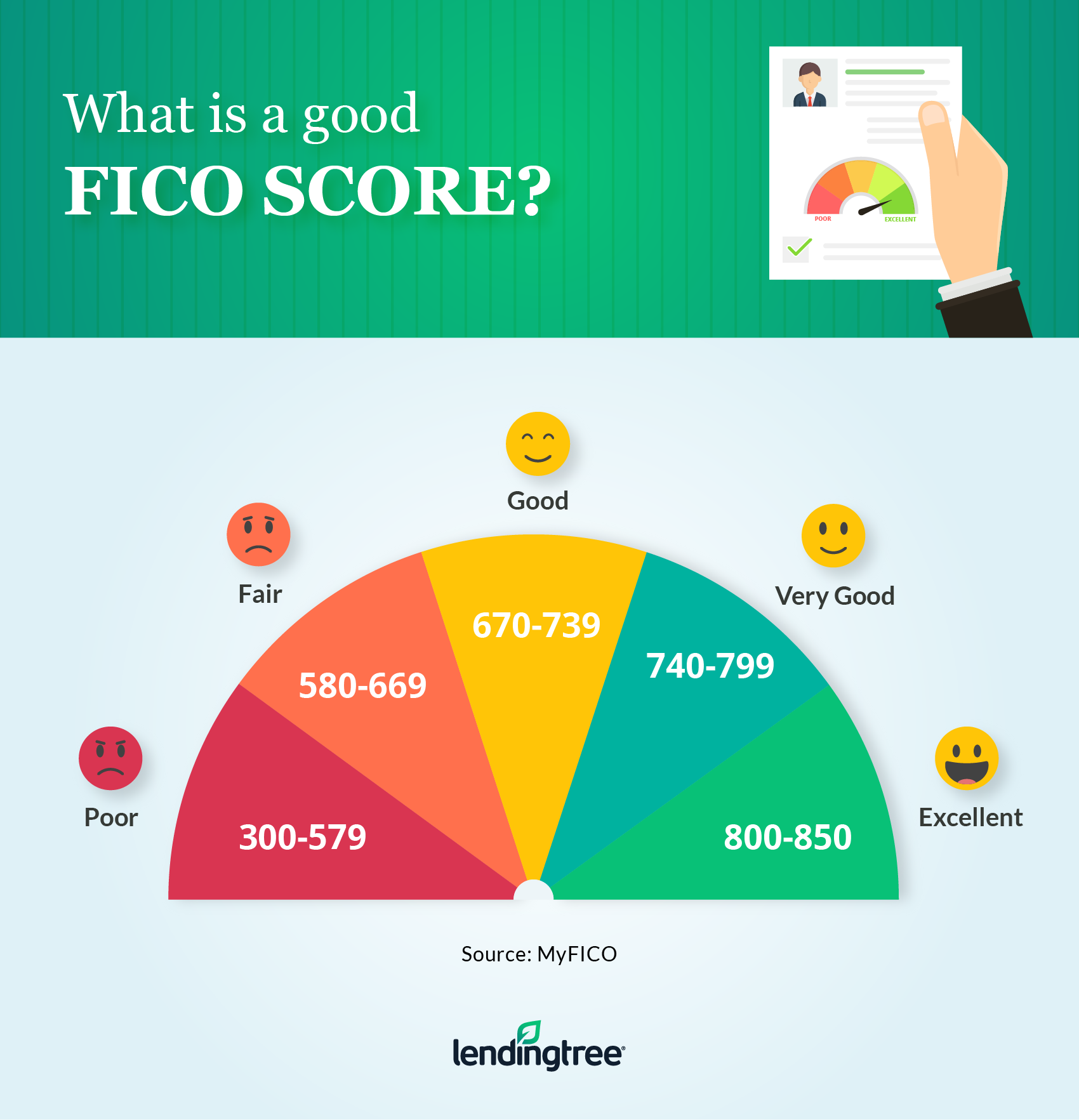

FICO credit scores, the industry standard for sizing up credit risk, range from 300 to a perfect 850with 670 to 739 labeled good, 740-799 very good and 800 to 850 exceptional. A 700 score places you right in the middle of the good range, but still slightly below the average credit score of 711.

If Youve Split Up Ensure You Financially De

If you split up with someone youve had joint finances with , once your finances are no longer linked, write to the credit reference agencies and ask for a notice of disassociation. You can also call up or find the forms online.

This will stop their credit history affecting yours in the future. However, the agencies say they cant do this if you still have a joint account open with the ex. The accountll need to be closed or transferred to an individual account before you can do it. For example, a joint loan would have to be paid off before a notice be given.

Tip Email

You May Like: How To Remove Negative Off Credit Report

What Is An Excellent Credit Score

You probably already know that your credit score is a three-digit number based on the information in your credit report, which includes items like your loan payment history and credit card balances. Multiple companies have models that calculate credit scoresFICO and VantageScore, for example, which both operate on a scale from 300 to 850.

Generally speaking, a higher credit score can translate to cost savings, perks and more. Your credit score is a key factor considered by lenders, so a better score can help you get more credit at attractive interest rates . Landlords and employers can also check your credit score as part of their due diligence process. And some of the best reward credit cards are only available to those with the highest scores.

So how high should you aim? Getting a perfect score is extremely difficult, so many credit overachievers strive for a score in the high 700s or 800+. That puts you squarely in the highest range for most credit scoring models .

If youre nowhere close, dont worrythe tips below will still help you improve your credit score over time. You can actually reap many of the benefits listed above with a score thats considered good. But if good doesnt cut it, read on for your roadmap to excellent credit.

What Credit Score Do You Start With

You don’t start with any credit score, and you won’t get a score until you open a credit account that reports to the credit bureaus. Once you open an account, you will receive a score based on that account. It probably won’t be the best score since you don’t have a long enough credit history, but it won’t be the worst score, either.

Don’t Miss: How To Get Comcast Collection Removed From Credit Report

Seek Out A Secured Credit Card

Another option for building credit is to get a secured credit card. It requires a cash deposit, typically around $200, which becomes your credit limit . You can then use the credit card as you would any other, and the deposit protects the issuer from the possibility that you won’t pay off your balance. If you use a secured card responsibly, your card issuer could upgrade you to a traditional unsecured card in the future.

The Best Ways To Establish Credit

If the question What does your credit score start at? is at the top of your mind, here are some suggestions that can help you establish a strong FICO® Score and set you on the path to excellent credit:

- A secured credit card can be a great way to establish credit. Secured cards work just like regular credit cards and report your payment record to the three credit bureaus, but they do require a refundable security deposit. I used a secured credit card to help establish my own credit, and highly recommend this route.

- Alternatively, being added as an authorized user to a parent or guardians account can help you establish a FICO® Score. Just be sure the person who adds you uses their card responsibly — otherwise, it could have the opposite effect.

- Pay your card in full and before the due date every month. If you absolutely must carry a balance, be sure to make at least the minimum required payment to keep your account in good standing.

- Keep your credit card debt balances below 30% of your available credit. Experts generally agree that credit utilization above 30% can hurt your credit score.

- Apply for new credit sparingly. A flurry of new credit accounts and applications all at once can be a big negative for your score, especially if you have a limited credit history.

Also Check: Is 594 A Good Credit Score

Limit New Lines Of Credit

When you apply for a new credit card or loan, a hard inquiry will appear on your credit report, possibly leading to a brief dip in your score. Plan to apply only for the credit you truly need, after you’ve done enough research to understand which accounts you’ll likely qualify forand avoid new loans you may have difficulty payingso you can help your credit improve.

Set Up Automatic Payments

Once you have a credit card you must make your payments on time. Missing a credit card payment can result in extra fees, a ding to your credit score, or even worse, it could end up going to collections.

You can through your bank. You decide how much money you want to come out of your checking account each month to be put onto your credit card balance.

Read Also: What Is 11 Sprint On Credit Report

Apply For A Credit Builder Card

Once youâve been managing your finances responsibly and paying your bills on time for a while, itâs time to apply for your first credit card – a credit builder card. You should be ready for this step after about six months.

are designed specifically for people with little or no credit history. They usually have very high interest rates , and rarely have any perks.

However, theyâre a powerful way to improve your credit score. And if you handle them responsibly, your provider will increase your credit limit and decrease your interest rate over time.

-

Use an eligibility checker before you apply. An eligibility checker lets you find out your chances of being accepted without affecting your .

-

Search for Triple Lock guaranteed offers. Cards and loans with a Triple Lock guarantee will give you a guaranteed credit limit, guaranteed interest rates. And youâll even be pre-approved, so you can be 100% certain youâll be accepted.

-

Make small, regular purchases. A good rule of thumb is to never use more than 50% of your available credit limit. This shows your credit card provider you can manage credit responsibly.

-

Always pay your statement balance on time and in full. You can pay just part of your balance, the âminimum paymentâ, without damaging your credit score. However, the remainder will attract interest. Credit builder cards have high interest rates. So, if youâre not careful, your debt can quickly spiral out of control.

Handle Your Starter Credit Cards Diligently

When 18-year-olds seek access to credit, they’re in the spotlight when it comes to handling their starter credit cards.

Card providers will be watching to see if you pay your monthly card debt on time and that you keep your spending credit card balance low

Adhere to those standards and you’re on your way to a stronger credit score and better access to loans and credit.

Don’t Miss: What’s A Perfect Credit Score

Factors In Your Credit Score

Now that youre working to build your credit history, keep in mind that there are several factors that contribute to your credit score. For the purposes of this article, were going to look at the factors that contribute to your FICO score, since it is the most commonly known and widely used scoring method. Your FICO score is based on the following factors:

Heres a breakdown of how these factors stack up to each other:

FICO scoring model calculation factors

| 10% |

Now that you know what goes into a credit score and how to build your best score, lets look at how to maintain your score.

Keep Unused Accounts Open

At some point, you may have credit accounts with no balance that you arent actively using. And you may think its a good idea to close those accounts. But its not at least not when it comes to building your credit.

Why? Because keeping those accounts open will help your credit history continue to grow. And, as we mentioned earlier, a long credit history positively contributes to your overall credit score.

Just remember: there is a difference between keeping them open and actually using them. If you find yourself getting tempted by the bank offering new cards or increased credit limits, it might be better to just close the account. They can be costly if not managed correctly.

You May Like: Does Closing Credit Card Hurt Score

Take Out A Credit Builder Loan

A credit builder loan, available from a bank or credit union, allows you to borrow money that sits in a savings account, which you will have access to at the end of your loan term. You will need to be able to show an income as proof that you can afford the payments, so consider choosing a small loan. As you make your payments on time toward your loan, the bank will report your activity to the credit bureaus. Not only will you end up with better credit in the long run, youll also end up with nice savings and who couldnt use that?

Building credit with a credit building loan

| Good FICO Score |

How Can I Establish First

There are many ways to build credit. But there are some important things to keep in mind with any path you choose: Remember to use credit responsibly, spend within your means and pay bills on time. Together, these habits can help you build credit from scratch.

Need access to credit? Here are four ways to get started.

1. Apply for a Credit Card

Lack of credit history could make it difficult to get a traditional unsecured credit card. But thereâs another option called a secured credit card. With a secured card, you make an initial deposit, just like when you move into a new apartment. As you make payments on the card, you start to build a positive credit history. It could also help you transition to your first traditional credit card.

2. Become an Authorized User

If a friend or loved one trusts you and is willing, they could make you an authorized user on their card. Becoming an allows you to make purchases. But the primary account holder is ultimately responsible for payments.

Being an authorized user could allow you to benefit from the primary account holderâs credit history. But negative actions could also be reported, which could affect the primary account holderâs credit and your credit, too.

Be sure to check with the card issuer to see how they handle reporting authorized users to credit agencies.

3. Set Up a Joint Account or Get a Loan With a Co-Signer

4. Take Out a Credit-Builder Loan

Recommended Reading: How To Check My Experian Credit Score

Keep Old Accounts Open

Even if you no longer use an old credit card, it’s typically best to keep the account open. That’s because your credit scores benefit from a long credit history and a high total credit limit. Closing established accounts will shorten the average age of your accounts and lower your total credit limit.

It will take years before an account closed in good standing drops off your credit report, but the effects on your credit utilization rate are immediate. If a credit card comes with a high annual fee you can’t afford, closing the account could be a good optionor ask your issuer to downgrade the card to a no-fee version if possible.

Why You Should Consider Building Your Credit With An Unsecured Credit Card

An unsecured credit card is a regular credit card. An unsecured credit card comes with some additional benefits but is more difficult for someone without any credit to obtain.

The main difference between a secured and unsecured credit card is that an unsecured credit card does not require any collateral. You dont have to provide a deposit to obtain it. However, this means there is more risk involved for lenders. As a result, it can be more difficult for someone with no credit or poor credit to get an unsecured credit card, and the credit cards can be less favorable .

There are several benefits associated with using an unsecured credit card to build your credit including:

- More credit card options. An unsecured credit card simply offers more options than a secured credit card.

- More reward options. With more credit card options come more rewards options.

- Higher credit limit. A higher credit limit can be a double-edged sword. More credit helps to fund bigger purchases however, this can get you into trouble if you arent a responsible credit user. The benefit of a larger limit is that it can reduce your credit utilization ratio.

- Lower APR. To get an unsecured credit card, you have to have a positive credit history and a fair credit score. The higher your score, the better your interest rate. Secured credit cards have high APRs because lenders are taking a risk giving money to someone without any credit history.

Recommended Reading: How To Get Collections Off Credit Report

Make Payments On Time

Ensuring your payments are always on-time is the best way to boost your credit. Since your payment history makes up 35 percent of your credit score, it is crucial to pay your bills on time. Not only do you avoid any cash penalties or APR increases, but you show the pattern of financial consistency that credit agencies want to see.

What Is The Average Credit Score For Young Adults

There are two main models to score your credit: FICO and VantageScore. Under both models, the highest credit score you can get is 850. But, as a beginner building credit, no one expects you to have a perfect credit score!

According to Value Penguin, the average credit score for people aged 18-23 is 674. This would be considered a Good credit score on the FICO model:

- 800 to 850 Exceptional

- 580 to 669 Fair

- 300 to 579 Very Poor

If youve never opened a line of credit and your starting score falls in the Fair or Very Poor range, speak with a financial professional. There could be an error on your credit report or you might be a victim of .

Also Check: How Long For Chapter 7 To Come Off Credit Report

Maintain A Low Credit Utilization

When you open your credit accounts youll have a combined maximum credit limit across all of your different accounts. But you want to make sure youre only using what you need. This will help you maintain a low credit utilization, which, as you may remember, accounts for 30% of your credit score.

Keeping your credit utilization low helps to build credit because it shows lenders that you can responsibly manage your available credit. If there are accounts with high balances, try transferring some of the balance to lower interest rate cards. This will help you work on paying the principal balance down a lot quicker.