You Have A High Balance On One Or More Credit Cards

Its not enough to pay on time. You also need to think about the balance you carry on each card.

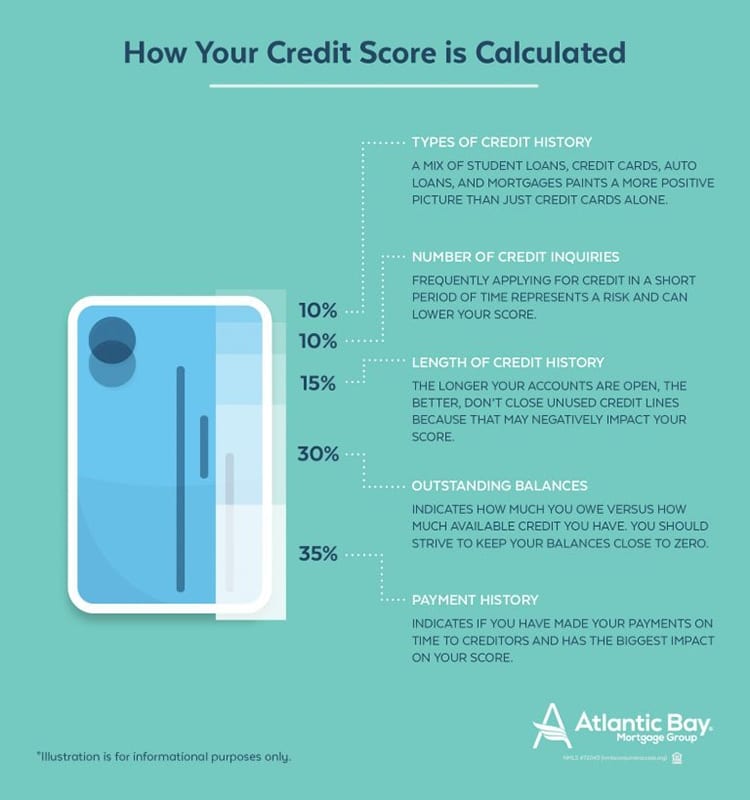

Your the portion of your credit limit you actually use influences your credit score more than any other factor except paying on time. Its figured on both an overall and per-card basis. Aim to use no more than 30% of your credit limit on any card the best scores go to those who use less than that.

Say you have a relatively low limit on a card and you use it to buy a new refrigerator. If you dont pay it down enough before the next month, your score can suffer.

However, credit card issuers typically report to the credit bureaus every month. As soon as a lower balance is reported to the credit bureaus, that past high balance will cease to hurt your credit.

What Is A Bad Or Poor Fico Score

A FICO credit score is a number between 300 and 850 designed to indicate the likelihood that a consumer will repay a loan on time. The higher number, the greater the consumer’s creditworthiness. This number is created from account and payment information on a user’s credit report. A score between 300 and 579 is considered to be very poor, while one that’s between 580 and 669 is considered fair.

| Very Poor | 16% | ||

| 580-669 | Applicants with scores in this range are considered to be subprime borrowers. | ||

| 670-739 | Good | 21% | Only 8% of applicants in this score range are likely to become seriously delinquent in the future. |

| 740-799 | Applicants with scores here are likely to receive better than average rates from lenders. | ||

| 800-850 | Exceptional | 20% | Applicants with scores in this range are at the top of the list for the best rates from lenders. |

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Recommended Reading: Can Hard Inquiries Be Removed From Credit Report

Why Having Good Credit Is Important

Having good credit can help you in many ways. The most obvious is by helping you qualify for better interest rates on loans.

According to May 2020 data from myFICO, increasing your credit score from a range of 620639 to 760850 could lower your monthly payment by nearly $200. Thats a big deal!

But even if you arent planning to apply for a mortgage or another form of financing, your credit scores can still affect your life. Your credit report information could affect your home and car insurance rates, your eligibility for rental housing, and depending on where you live, it may potentially affect your job applications.

With so many ways that your credit report and scores can influence your life, its important to keep close tabs on both and take quick action when you notice credit file mistakes.

Closing Old Credit Cards

Another component of your credit score, 15 percent, is the length of your credit historylonger credit histories are better. Closing old credit cards, especially your oldest card, makes your credit history seem shorter than it actually is. Even if you don’t use the card anymore, if there’s no annual fee, you should keep the card open because you have nothing to lose.

Recommended Reading: How To Get A Free Credit Score Report

How A High Credit Score Could Save You Money

Lets say, for example, you plan to get a 30-year fixed-rate mortgage for $300,000. Heres what your loan could look like if you had a credit rating in the 760 to 850 range, compared with one in the 620 to 639 range. Not only would your monthly payment be lower, but you could save $95,680 on interest over the life of the loan.

| 760-850 credit score |

|---|

1 APRs are based on national averages and do not reflect Bank of Americas rates. Source: myFICO.com, October 2021.

This example is provided for comparison purposes only and does not constitute a commitment to lend nor is intended to guarantee that you currently qualify for the example APRs above.

Potential Strain On Personal Relationships

Your credit score and overall credit profile can put tremendous strain on your personal life, including the relationships that matter most to you. Although your credit profile doesnt actually merge with your spouses after marriage, his or her credit can affect your ability to qualify for or afford new loans, such as auto or home loans, that youre applying for together.

For instance, say you have excellent credit and your spouses is just so-so. When you apply for a mortgage, the lender looks at both profiles and assesses your households overall credit risk. Even if your risk is low enough to meet the lenders qualification standards, youre likely to pay a higher interest rate or larger down payment together than you would were it just you applying for the loan.

Even worse, if your spouse cant qualify for a new credit card or loan on his or her own, he or she could apply for a joint card or loan using your Social Security number and other information thats commonly shared between spouses. If your spouse subsequently falls behind on payments, both of your credit profiles suffer the consequences.

Situations like these can lead to tension and acrimony. In the worst case, they can threaten a relationships long-term viability.

Read Also: Is 570 A Bad Credit Score

Why Is My Credit Score Low If I Have No Debt

It was about a year after getting my first credit card. After using the card to make small, necessary purchases , I had dutifully paid off my balances before my bill was due each month.

I never carried a balance and Id never had a cent worth of debt to my name. I was proud to build my credit and establish myself as a financially responsible, creditworthy adult, and fully expected it to reflect in my credit score.

But when I saw my credit score for the first time, I was disappointed. It was lower than I thought it would be. Why was my credit score low if I had no debt?

The most obvious answer was that my credit history was just not long enough.

This wasnt, however, the only reason my credit score was much lower than I expected.

You Delay Building Wealth And Even Retiring

Bad credit can also have a long-term impact on your financial life. If you have high-interest credit card debt, you’re not able to put any money away for the future at least not enough to balance out your APR fees.

As long as your interest rates are high, you’re putting less money into equity and assets and more money into servicing debt. And debt has no return on investment the money you pay in interest is cash that you will never see again.

In some cases, qualifying consumers should consider a balance transfer credit card with limited-time 0% APR, such as the Aspire Platinum Mastercard®. A balance transfer card can help knock out some interest payments if you have existing debt to pay off. As you lower your debt-to-credit ratio, your credit score should improve, and then it might be worth refinancing your mortgage or auto loans to see if you can earn a better APR, shave some of that interest off and put it aside for retirement savings.

See: How do 0% APR cards work and how to make the most of your balance transfer.

You May Like: What Is A Closed Account On Credit Report

Improve Your Credit Score For The Future

It is possible to improve a poor credit score. The bad marks can go away after seven years for delinquencies and ten years for Chapter 7 bankruptcy.

With time, your credit score can go up organically as you refrain from adding more debt and pay your bills on time. At the very least, making the minimum payment each month will help improve your history of on-time payments and lower your debt-to-credit ratio.

In the meantime, you can learn about the most common credit card mistakes so that you feel confident using one again and understand exactly how to abide by your terms and agreements.

“Many times, people fall into the trap of assuming that if they pay nearly enough to cover the minimum payment, or miss the due date by only a few days, that this should somehow count and they shouldn’t be penalized,” Ulzheimer explains.

“But if you can snap out of this kind of thinking, you are going to wake up one day and see a better score. You are usually no more than seven years away from great credit I promise you that.”

Learn more:

Only Paying The Minimum Each Month

It might be tempting to only repay the minimum amount on your credit card each month, but paying more than the minimum can mean youll spend less on interest and potentially improve your credit score. Try our Repayment Calculator to see just how much you could save in time and interest by paying just a little more each month.

Read Also: What Information Can Help Your Credit Rating

Difficulty Starting A Business

Sometimes it takes money to make money. If youre starting a business and need funds to make that happen, a low credit score can make it harder to obtain a business loan or a business credit card at good rates. Even if you can get your hands on a business loan that accepts a low credit score, chances are youll receive a lower loan amount and higher interest rates than youd get with a higher credit score.

Your Loans May Have Higher Interest Rates

If you can get a car loan or home loan with poor credit, your loan terms may not be as desirable as you wish. You may be stuck signing a loan with a higher interest rate. That means you’ll pay more in interest charges throughout the life of your loan. Because of the high interest rates of some loans, having poor credit can be very expensive.

Also Check: How To Build Credit Rating

Learn More Aboutcredit Management

See the online credit card applications for details about the terms and conditions of an offer. Reasonable efforts are made to maintain accurate information. However, all credit card information is presented without warranty. When you click on the “Apply Now” button, you can review the credit card terms and conditions on the issuer’s web site.

As seen on:

Credit Report And Score Websites

Federal law entitles you to one free credit report but not score per year from each of the three major credit reporting bureaus. These reports are available at AnnualCreditReport.com.

Although its nice to be able to source a free credit report from these reputable providers, a handful of credit reports per year isnt enough to provide a comprehensive, up-to-date picture of your personal credit. This is particularly true if youre trying to build credit ahead of applying for a major loan, such as an auto loan or mortgage, and want to see how your credit changes from month to month, week to week, or even day to day.

Other sites, such as , specialize in providing free credit scores. Credit Karma relies on TransUnion and Equifax to provide a weekly VantageScore, a type of comprehensive credit score.

Although Credit Karma has some onsite tracking tools, its not ideal if you want to really dig down into your credit profile. It also doesnt offer access to Experian scores or reports.

You May Like: Is Experian Credit Score Accurate

Why Is My Credit Score Low Even Though I Pay My Bills On Time

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If your credit score is lower than you thought it would be, you probably want to know why and what it will take to fix it.

It can be especially perplexing if you thought you always paid on time and expected to have a good credit score. Here are five reasons you may be in a lower credit score range than expected.

Your Credit May Impact Your Ability To Get A Mortgage

If you’re hoping to take out a mortgage, you’ll need to be in good financial standing. For starters, mortgage lenders want to see that you have enough income to pay off your loan. They will also look at your credit report and credit score to make sure you’re ready for this life-changing financial decision.

Your credit score and credit situation will determine if you’re approved for a home loan. Plus, it will impact the type of loan and terms you can get. If you’re thinking of buying a home in the future, now is a good time to start working on improving your credit.

Also Check: Does Ginny’s Report To Credit

Security Deposits For Utilities

Your utility providers take your credit report, and particularly your payment history, into consideration when setting up your account. If you have a poor payment history, chances are you will have to provide the utility company with a deposit in order to get service.

Although the FTC outlines that any utility companies requiring deposits must require them for all new customers or none, many providers waive deposits as long as you meet their credit criteria. This means that the poorer your credit, the more likely you are to be charged a deposit when setting up an account. Some utility providers may also accept a letter of guarantee, which is a letter from someone who has agreed to pay your bill on your behalf if you cant make the payment.

Be Patient After Foreclosure/repossession

Having a home foreclosed or other property repossessed to cover unpaid balances on underlying loans can take your credit score from excellent to bad. For example, someone with a credit score of 780 could expect to see his or her score fall to 620-640, according to FICO. And an individual with a 720 credit score would likely see that score fall to 570-590.

Repossession and foreclosure are unlikely to be the lone negative marks on your credit report, considering they come after numerous missed payments and may be accompanied by collections accounts. And all of that negative information wont fall off your credit report for seven years. So theres no quick fix.

Rather, you need to slowly rebuild your credit reputation by establishing a pattern of on-time payments on any loans or lines of credit you have open. You should at least have one credit card account, for the chance to add positive information to your credit reports every month.

Also Check: What Is A Good Credit Score To Rent A House

What Is The Lowest Possible Credit Score

Both FICO and VantageScore use ranges of 300 to 850 to determine your creditworthiness.

If your FICO Score is between 300 and 579, it is considered poor. According to Experian, 17% of consumers have a score in this range. If you find yourself in this category, you may be denied credit or required to pay additional fees or deposits. When it comes to VantageScores, just under 17% of people fall into the 300-549 range, with applicants unlikely be approved for credit.

Though scores can drop as low as 300, most credit scores tend to range from 600 to 750. If your credit score falls in the poor range, its likely that you have a history of delinquent payments, bankruptcies or loan defaults.

Getting a rock-bottom score of 300 is nearly impossible, said credit expert John Ulzheimer, formerly of FICO and Equifax. To get a score that low you have to be doing everything wrong. Multiple, severe and frequent derogatory entries, maxed out credit cards and excessive inquiries you almost have to make a concerted effort to trash your scores that badly, he said.

If youre wondering why FICO Scores start at 300 rather than zero, Ulzheimer said its because Fair Isaac Corp. used to build custom scores for individual lenders, which ranged from 1 to 299. So, 300 to 850 was chosen to ensure nobody got confused between a custom score versus a credit bureau score, he said.

Credit Cards With Credit Tracking Features

Its increasingly easy to find credit cards that periodically provide you with your credit score or report. Some issuers attach these features to specific cards, while others offer the same features across an entire family of cards. Policies vary by issuer, but its now standard practice for major credit card companies and banks Discover, Capital One, and Bank of America, to name a few to offer free FICO credit scores and credit education tools as a perk of membership.

The fact that more and more credit card companies are offering credit reports, scores, and tracking tools is a great win for consumers. On the other hand, these tools do require you to apply for a credit card or bank account.

If you dont already have good credit when you apply for a new credit card, youre less likely to be approved. And even if you are approved, youre liable for any periodic card fees or interest on unpaid balances. In other words, these ostensibly free tools arent necessarily free.

Recommended Reading: Is Noddle Credit Report Any Good