Ways To Reduce Your Auto Loan Interest Rate

With a credit score between 730 and 739, you are going to qualify for prime loans at a higher interest rate than if you were able to increase your credit score to 780+.

Because you are so close to receiving super prime credit score rates it may make sense to consider spending 30, 60, or 90 days building your credit.

The time and money spent would put you in a lower risk bracket and open the doors to much more financial freedom and better opportunities.

Another option to get a vehicle loan with a lower interest rate would be to ask a family member to co-sign on the loan.

The co-signer would become the primary borrower and you would be the secondary borrower.

They would be responsible for making the payments on the loan if you failed to do so, but you would qualify for an auto loan based on their credit score and not yours.

If you know someone with a good credit score, it may not hurt to ask them to be your co-signer.

Additional Auto Loan Resources

How Can Bankruptcy Help My Credit Score

If you find yourself in a situation where you need to file for bankruptcy, your credit score is less significant than the grounds for filing. A looming paycheck garnishment or mortgage foreclosure is more urgent than getting a new loan or credit card. However, once youve been granted bankruptcy relief, you could discover that the bankruptcy really helps your credit. Even though your bankruptcy will appear on your credit report for up to 10 years, this is true. In fact, bankruptcy has both short-term and long-term positive effects on your credit. We list these below.

Ology: How We Chose The Best Credit Cards For Good Credit

Methodology: We analyzed 1,478 of the top credit cards on the market to narrow down a selection of the best choices. Core criteria we considered in our analysis include:

- Base rewards program: The best cards in this category for cash back, points or miles offer competitive rewards rates, helpful spending categories and straightforward redemption policies.

- : APR is the interest charges you pay if you carry a balance. The top credit cards offer reasonable APRs, especially for those who have good credit scores.

- Sign-up bonus: Sign-up bonuses give you the opportunity to earn cash back, points, statement credits and other types of rewards for meeting a spending requirement within a specified time. Bonuses with a good ratio of spending-to-value are rated highly.

- Annual fee: Is a cards annual fee worth it? We measure the annual fee against each cards features and benefits to rate its holistic value.

Read Also: How Do I Get A Repo Off My Credit

Inaccurate Credit Histories Are Common

Many people in this situation discover they have a few negative entries on their credit reports that are not accurate.

When you discover inaccurate credit information on your credit report, youll want to get that negative entry removed as soon as possible so your credit score can be all that it can be.

Unfortunately, when you apply for credit, credit card issuers and other lenders wont care whether your credit score doesnt really reflect your actual credit risk. No matter how well you explain things, the lender will rely on what myfico says.

The terms of your new car loan or personal loan will reflect this reported credit risk. In other words, youll pay higher interest rates because of your inaccurately low score.

When you have worked hard to establish a long history of on-time payments and responsible credit utilization, these kinds of lending decisions are beyond frustrating!

So removing inaccurate credit information from your credit history is a must. Doing this should restore your credit history within a couple months.

There are a couple ways to go about it:

- Do It Yourself Credit Repair: You can call the lender who reported incorrect credit information and ask that they correct the inaccurate data. I always recommend handling this in writing.

- Professional Credit Repair: If youre the type of person who would rather pay a professional handle it and just be done with the whole thing, I suggest you check out Lexington Law.

Capital One Walmart Rewards Mastercard: Best For Walmart Rewards

Why we picked it: This card comes with a whole lot of cash back. Earn 5% on Walmart.com purchases , 2% on in-store Walmart purchases and Walmart fuel stations, 2% on restaurants and travel purchases and 1% cash back elsewhere.

Pros: As a sign-up bonus, youll get 5% cash back on any Walmart purchase you make in-store when using Walmart Pay for the first 12 months. Also, theres no minimum to redeem rewards, no foreign transaction fee and your rewards dont expire. And to ease the application process, you can get instant approval via the Walmart App.

Cons: The card carries a high APR range at 17.99% to 26.99% variable. Also, theres no spend-related sign-up bonus or introductory APR.

Who should apply? If Walmart is your go-to for groceries, gas or any other need, this card can pack a punch with its high-yielding cash back offers for no annual fee.

Who should skip? Unless your typical shopping routine consists of trips to Walmart, youd better benefit from another cash back option, such as the Blue Cash Everyday.

Read our Capital One Walmart Rewards® Mastercard® review.

Read Also: Does Zzounds Do A Credit Check

So Can I Lease A Car With A 736 Credit Score

There are two kind of leasing deals namely the normal deal and the promotional deal. A promotional car lease deal is one offered via auto makers and their merchants temporal period . The arrangements are vigorously promoted and can be seen on car organization sites.

As a rule, these extraordinary arrangements depend on lessened costs, and helped lease-end residual value. Besides, there might be mileage confinements and up-front installment to be required. When you will try to lease a car with 736 credit score, keep in mind that only people with good or excellent score point are entitled to this promotion the reason being that most car companies go on loss because some people do not fulfill the lease agreement most of the time.

Auto Loans For Good Credit

The best rates for auto loans are typically available to people with good-to-excellent credit, but what good credit means to auto lenders can vary. Beyond the base credit-scoring models like FICO and VantageScore, there are also industry-specific scores that lenders could check, such as FICO® Auto Scores.

Even though you may not know which specific score a lender will use, its still a good idea to have an understanding of your overall credit health when shopping around. You can check your credit from Equifax and TransUnion for free on . You can also periodically get a free credit report from each of the three main consumer credit bureaus from annualcreditreport.com.

And yes, its important to shop around! Take some time to compare offers to find the best terms that could be available to you. In particular, the rates offered at car dealerships may be higher than rates you might be able to find at a bank or credit union, or with an online lender.

If youre shopping around for auto loan rates, consider getting preapproved to boost your negotiating power when youre at the dealership. A preapproval letter can be a great way to show car dealers youve done your homework and wont accept a subpar financing offer. Just be aware that it can result in a hard inquiry, which can temporarily ding your credit.

And if you already have a car loan but youve improved your credit since you first got it, you might be able to find a better rate by refinancing.

You May Like: What Is Syncb Ntwk On Credit Report

Is 730 A Good Credit Score

A 730 credit score is right on the edge between a good and excellent credit score. Typically, a credit score ranging from 660 to 719 is considered a good credit score, while the 720 to 850 credit range is considered Excellent. But usually, it does not work like this in practice.

A lot of U.S. lenders will consider applicants with Good Credit Scores Acceptable. This means that the lenders will consider their application eligible for various credit products but may not offer the lowest-available interest rates to these applicants.

If you do not have a good credit score right now, fortunately, you can improve it quickly by reducing your Credit Utilization. A good Credit Score will provide you the access to a wide variety of home loans and credit card products. And if you consider improving your credit score further, it will get you the home loans at much lower interest rates and affordable mortgage terms.

A Credit Score of 730 is on the lower range of good credit score, therefore, you would probably want to improve it further before applying for a home loan. To improve your Credit Score, you need to work on all the factors collectively that contribute to your total FICO score.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Don’t Miss: How Accurate Is Creditwise Credit Score

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

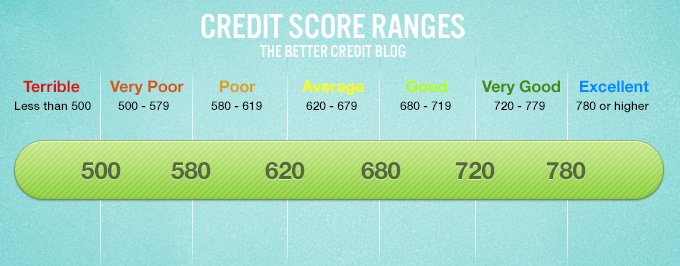

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.

Recommended Reading: How Long Foreclosure On Credit Report

Use Your Credit Card But Never Max It Out

Im not the type of person who buys everything on my credit card. I do use one of my credit cards a lot, however.

Ive found I need to use the credit card a lot to get the highest FICO score possible. The caveat is that you should never max out the card. In fact, I recommend you pay it down every month and never get even close to the credit limit.

As a general rule, you should try to keep your . In other words, if you have a credit card with a total credit limit of $1,000, never rack up more than $250 worth of charges on the card.

This is why its also important to have a credit card with a high limit. For example, my main credit card has a credit limit of $30,000, and I never get even close to 25% utilization.

If you dont have a card with a high enough limit to keep you comfortably under 25% utilization, give the creditor a call and request that they up the credit limit.

Delta Skymiles Gold American Express Card: Best For Delta Airlines

Why we picked it: Anyone frequently flying with Delta should take a long look at where this card can take you. Earn 2X miles on Delta purchases, at restaurants worldwide and at U.S. supermarkets.

Pros: In addition to Delta, travelers have its large network of airline partners to choose from, plus no blackout dates and miles dont expire. Earn 40,000 miles after spending $1,000 in purchases on your new in your first three months and a $50 statement credit for eligible purchases at U.S. restaurants within your first three months.

Cons: Theres a $25 fee for booking travel over the phone and a $35 fee for Ticket Office bookings. You also cant book flights with layovers and theres a $99 annual fee .

Who should apply? This card offers a lot to Delta flyers. They can boost their SkyMiles through common-purchase categories while also saving on Delta flights, checked bags, and lounge access.

Who should skip? If you dont often fly Delta or if youre not a frequent traveler in general, there are better choices for you.

Read our Delta SkyMiles Gold American Express Card review.

Recommended Reading: Cbcinnovis Hard Inquiry

You Need A Mortgage Loan

You definitely dont need a mortgage loan to have good credit. However, if you want to max out your credit score, having a mortgage loan with good payment history is a must.

Since a mortgage loan is usually a relatively large loan and more difficult to get than other installment loans such as an auto loan, a mortgage shows creditors you have been responsible enough with your credit to get the mortgage in the first place.

Fair Isaac Corporation, which provides the FICO score, recommends you have a mix of different types of credit accounts. So along with credit cards and installment loans, a mortgage loan is the last piece of the pie to round off your credit mix.

I also want to note I didnt start seeing my credit score go up because of the mortgage loan until about a year later, so it definitely takes some time.

You obviously shouldnt take out a mortgage loan just to get a perfect credit score. But a mortgage loan is normally considered to be good debt, in that interest rates are relatively low and youre financing something that usually appreciates in value.

If you dont already have a mortgage, be sure to fix up your credit report before applying for a mortgage assuming youre ready for homeownership.

How Your Credit Scores Are Set

Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion.

They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history, how much debt you have and how long youve been using credit.

Pro Tip: You can view sample credit scores summaries from each bureau to get a sense of what to expect.

You May Like: Credit Score 766 Means

Citi Double Cash Card: Best For Cash Back

Why we picked it: The Citi Double Cash offers 2% cash back in a unique way: 1% on general purchases and then an additional 1% cash back as you pay off those purchases. With no annual fee, the card boasts one of the most competitive rewards rates of all cash back cards in an affordable way.

Pros: Theres no category restrictions or rules to follow, so earning cash back is simple and easy to track. Plus, your rewards can be converted to ThankYou points, which can be redeemed for travel purchases, gift cards and more for a rate of $1 cash back to 100 ThankYou points. Theres also a lengthy 18-month 0% introductory APR on balance transfers .

Cons: If you decide to take advantage of the balance transfer opportunity, theres a fee of 3% or $5, whichever is greater. Also, theres no sign-up bonus available.

Who should apply? Thanks to its simplicity, this cash back card is a good fit for someone who values freedom and flexibility, particularly for existing Citi customers already familiar with earning ThankYou points. And if you have credit card debt to combat, the intro APR window on balance transfers could be a godsend.

Who should skip? Its one of the best credit cards on the market, but anyone on the hunt for bonus rewards, whether they be high-rate categories or a spend-based welcome bonus, should look elsewhere.

Read our Citi® Double Cash Card review.

How Is Credit Score Calculated

Your credit score is more than just a number. It indicates your likelihood of repaying a debt. There are five distinct elements that contribute to determining your score. We list these below.

- Payment history: This indicates if you make timely payments on all of your accounts. Your payment history accounts for 35% of your credit score.

- This covers the majority of your available credit that has been utilized. If at all feasible, keep your overall credit limit to 30% or less. Your credit score is determined by 30% of your credit use.

- Credit age indicates the length of time youve had credit and the age of each of your accounts. Close older accounts only if they include a lot of bad material. Credit age accounts for 15% of your credit score.

- This refers to the many sorts of credit accounts you have, such as revolving and fixed-payment credit cards. Lenders like a credit combination that is diversified. This component is responsible for 10% of your credit score.

- This shows how many times in the previous several months or years youve applied for additional credit. Your credit score is made up of 10% new credit applications.

You May Like: Does Klarna Report To Credit