The Credit Scores Lenders Use

The score you pulled from the or another third-party provider was an educational credit score, provided just to give you a perspective on your credit standing. Theyre not the scores that lenders actually use to approve your application. Services that provide credit scores include this information in their disclaimers.

On top of that, you likely purchased a generic credit score that covers a range of credit products. Creditors and lenders use more specific industry credit scores customized for the type of credit product youre applying for. For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan. Mortgage lenders use a score developed specifically for mortgage loans. Your lender also might also use a proprietary credit score thats developed for use by just that company.

Many lenders use the FICO score, but even the score you receive through myFICO may be different from what your lender sees. Some lenders also use VantageScore, but again, their version is different from yours.

The score the lender pulls might differ from the one you used sometimes by several points, possibly enough to disqualify you from the best interest rate or maybe enough to have your application denied. When you order your credit report and score from myFICO, you’ll receive access to the most widely used FICO industry scores. This will give the best idea of what the lender sees when they check your credit score.

Can Closing An Account Hurt My Credit

Although the act of closing an account is not considered negative, closing a credit card account may increase your overall . Your utilization rate measures the amount of total available credit you are using on your revolving accounts, and is an important factor in most score models. When you close a revolving account, you lose that credit limit, which can cause your utilization rate to increase if you still have balances on other accounts, and in turn hurt your scores.

Thanks for asking.

Is A Fico Score The Same As A Credit Score

As with all credit risk scores, FICO® Scores predict the likelihood that someone will fall 90 days behind on a bill within the next 24 months. FICO® does this using complex algorithms based on information in your from each of the national credit bureaus: Experian, TransUnion and Equifax.

FICO® periodically releases new versions of its scores, and it creates different versions of its scores to work with each bureau’s databases, which is why there are many FICO® Scores. Other companies, including VantageScore®, also create credit risk scores that similarly analyze consumer credit reports to calculate scores.

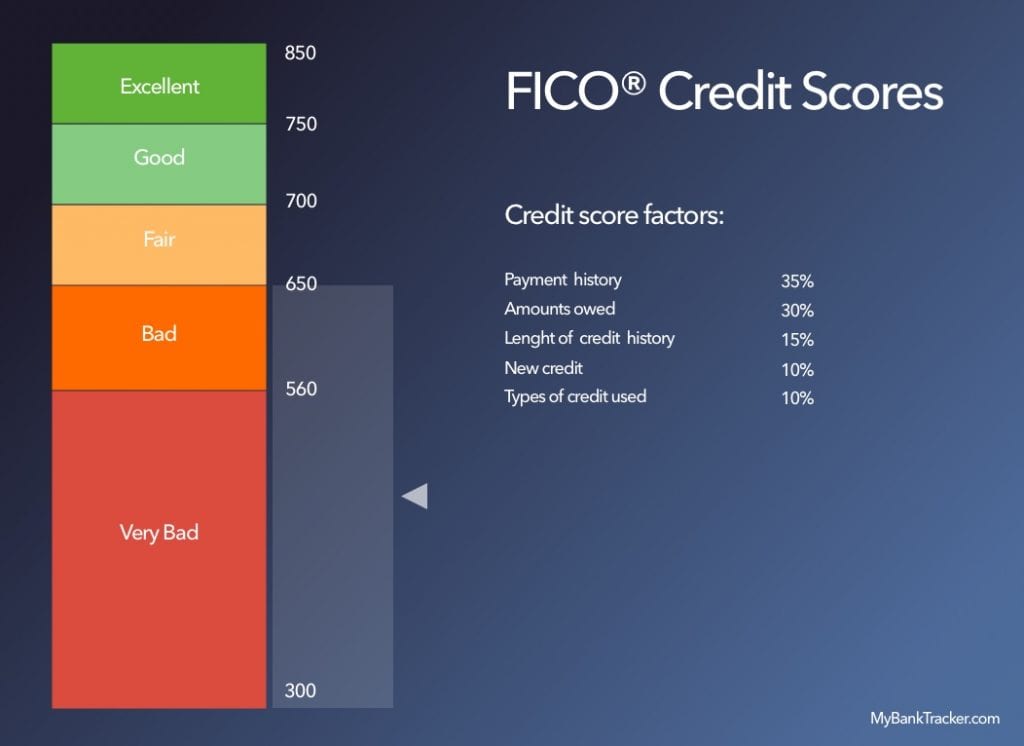

FICO® and VantageScore credit scores range from 300 to 850, and group consumers by . For example, a FICO® Score of 800 to 850 is considered “exceptional.” However, even if they use the same range and information from the same credit report, each scoring model takes a unique approach that may result in a different score.

FICO® also creates other types of scores that are based in part, or entirely, on your credit reports. For example, FICO® offers and bankruptcy scores, which try to predict the chance you’ll file an insurance claim or declare bankruptcy, respectively.

Read Also: Is 611 A Good Credit Score

What To Know About Fico Score Vs Credit Score

Credit scores are numbers that banks use to evaluate your creditworthiness. They can affect your ability to get approved for a credit card, mortgage, or personal loan, as well as the interest rates youll pay on those loans.

When you have high credit scores, youre an attractive borrower to financial institutions when you have low scores, those institutions view you as more of a credit risk.

Credit scores usually range from 300 to 850, and contrary to popular belief, you dont have just one. In fact, you probably have hundreds of credit scores.

Thats because lenders can report your behavior to any of the major credit bureaus Equifax, Experian, and TransUnion so each might have different information about you in their . Credit scores are based on these individual credit reports, so each report can generate different scores.

Plus, there are also different companies that offer credit scoring models, one of which is called FICO.

What Are Inquiries And How Do They Impact Fico Scores

Inquiries may or may not affect FICO® Scores. Credit inquiries are classified as either hard inquiries or soft inquiriesonly hard inquiries have an effect on FICO® Scores.

Soft inquiries are all credit inquiries where your credit is NOT being reviewed by a prospective lender. FICO® Scores do not take into account any involuntary inquiries made by businesses with which you did not apply for credit, inquiries from employers, or your own requests to see your credit report. Soft inquiries also include inquiries from businesses checking your credit to offer you goods or services and credit checks from businesses with which you already have a credit account. If you are receiving FICO® Scores for free from a business with which you already have a credit account, there is no additional inquiry made on your credit report. FICO® Scores take into account only voluntary inquiries that result from your application for credit. Hard inquiries include credit checks when youve applied for an auto loan, mortgage, credit card or other types of loans. Each of these types of credit checks count as a single inquiry. Inquiries may have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk.

Recommended Reading: What Credit Card Is Syncb Ppc

Why Is My Credit Score Lower For A Mortgage

Have you checked your credit score recently? We always advise that you check your credit score before making a big purchase that requires that you borrow money. But, often times there will be a credit score gap, which happens when the credit score you receive doesnt match the score your lender pulled during the loan approval process. This happens quite often when applying for a mortgage. So, why is your credit score lower for a mortgage? And, which FICO credit scores do mortgage lenders use? Read on and well explain the difference between your mortgage credit score vs. your consumer credit score.

How Credit Karma Makes Money

Credit Karma’s business model is not entirely altruistic. It is a for-profit business that makes money by giving you a free credit score in exchange for learning more about your spending habits and charging companies to serve you .

Credit Karma places advertisements in front of its users, hoping that they will respond to them by clicking on them. Many of these advertisers are lenders, and Credit Karma may earn a fee if you apply through one of its links.

Your personal data is valuable stuff to advertisers, and they pay more to target it. With more than 100 million users, this is a healthy revenue model for Credit Karma.

Read Also: Is Paypal Credit Reported To The Credit Bureaus

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

I Opted In But It Says No Score Is Available Why

The most common reasons a score may not be available:

- The credit report may not have enough information to generate a FICO® Score

- The credit bureau wasnt able to completely match your identity to your Wells Fargo Online® information. To keep your information current, sign on to Wells Fargo Online®, visit the Profile and Settings menu, select My Profile and then Update Contact Information. Make sure your email addresses, phone numbers, and mailing addresses are current.

- If you’ve frozen your credit with the credit bureau, you may not immediately receive a credit score. A score should become available for you to view after the next monthly update. Contact Experian® with further questions.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Why Your Credit Score Is Different Depending On Where You Look

Modified date: Aug. 18, 2021

What are the three numbers that have a huge effect on your life, from your ability to get a car loan or a mortgage to your chances of being denied rental housing or a job?

Im talking about your .

If you havent given your credit score much thought until now, you need to start tracking your score. After all, there are plenty of tools for doing so. And most of these apps can help you improve your score.

First, lets talk about what exactly a credit score is.

Whats Ahead:

Is Fico Better Than Transunion

Its considered to be one of the more balanced bureaus since it assigns weight fairly evenly across the standard risk categories. TransUnion ranges from a low of 300 to a high of 850. FICO scoring is more holistic, which allows more Americans to qualify for loans and mortgages than most traditional bureaus scores.

Read Also: Remove Repo From Credit

Important Disclosures And Information

Bank of America credit cards are issued and administered by Bank of America, N.A. Better Money Habits, Merrill Lynch, U.S. Trust, Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation. All other company and product names and logos are the property of their respective owners.

Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

Fico Vs Experian Vs Equifax: An Overview

Three major compile information about consumers’ borrowing habits and use that information to create detailed credit reports for lenders. Another organization, Fair Isaac Corporation , developed a proprietary algorithm that scores borrowers numerically from 300 to 850 on their creditworthiness. Some lenders make credit decisions strictly based on a borrower’s FICO score, while others examine the data contained in one or more of the borrower’s credit bureau reports.

When seeking a loan, it is helpful for borrowers to know their FICO score, as well as what is on their credit bureau reports, such as those from Experian, Equifax, and TransUnion. A borrower who appears stronger under a particular scoring or reporting model should seek out lenders that use that model. Given the crucial role a good credit score and credit reports play in securing a loan, one of the best credit monitoring services could be a worthy investment to ensure this information stays safe.

You May Like: Is 672 A Good Credit Score

Fico Is About To Change Credit Scores Here’s Why It Matters

- EmbedEmbed

Roughly 40 million Americans are likely to see their credit scores drop by 20 points or more. An equal number should go up by as much.hide caption

toggle caption

Roughly 40 million Americans are likely to see their credit scores drop by 20 points or more. An equal number should go up by as much.

Your credit score can determine whether you can buy a car, get certain jobs or rent an apartment. It’s a big deal. And so is this: Credit scores for many Americans are about to change even if they don’t do anything.

The changes will be extensive. About 40 million Americans are likely to see their credit scores drop by 20 points or more, and an equal number should go up by as much, according to Joanne Gaskin, vice president of scores and analytics at FICO, the company at the heart of the credit scoring system.

Every five years or so, FICO updates the way it determines credit scores. This time, the biggest change is in how it treats personal loans, Gaskin says.

Maxing Out Your Credit Cards Each Month

Lets say you pay your bills early every single month and never miss a payment, but you cant help but rack up balances that continue growing every month. This can be a huge problem for your credit since the amounts you owe in relation to your credit limits, called , make up 30% of your FICO score.

Whats the problem? According to myFICO.com, credit score formulas see borrowers who constantly max out their cards as a potential risk. Thats why its a good idea to keep low credit card balances and not overextend your credit utilization, they report.

Whats the best utilization rule? Credit reporting agency Experian says you should strive to keep your credit balances below 25% to 30% of your limits to achieve the best results. This means that, if your total credit limit across all your is $10,000, you should never owe more than $2,500 to $3,000. If you maintain balances higher than that in relation to your credit limits, you should fully expect your credit score to take a hit.

Also Check: What Is Cbcinnovis On My Credit Report

How Are Credit Scores Determined

A few factors determine your credit score. Three major credit bureausTransUnion, Experian, and Equifaxcreate credit reports and designate your credit score based on your borrowing habits and payment history. FICO scores are calculated using a proprietary algorithm.

Today, many people use websites, like or Credit Sesame, to keep track of their credit score. Credit card companies, such as Discover and Capital One, can also give you updates on your FICO score.

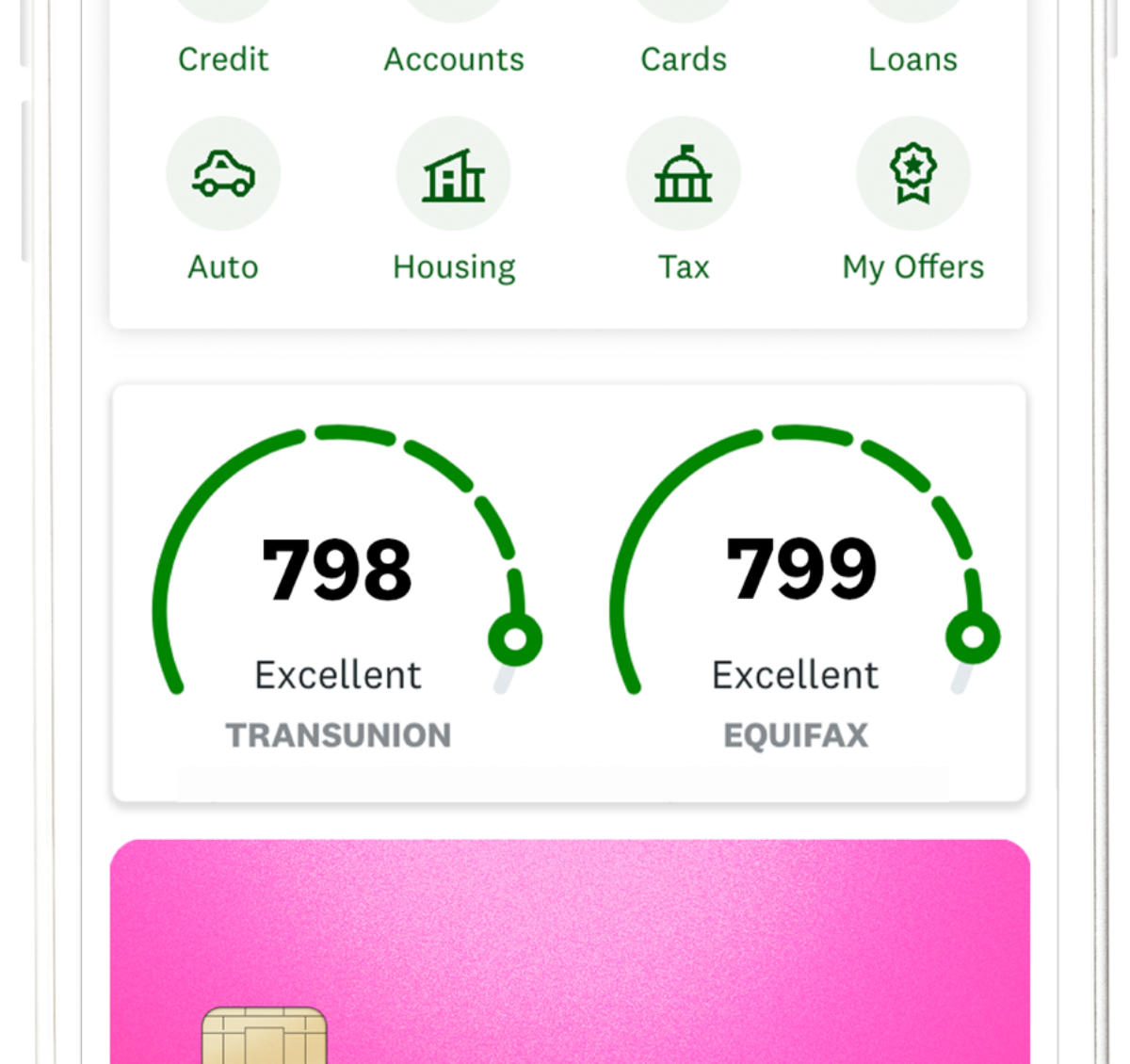

Tracking your credit score can be confusing because it can differ depending on the credit monitoring system. For example, you may have a credit score of 702 with TransUnion, 720 with Equifax, and 707 with FICO.

Ok But What About My Other Credit Scores

FICO Scores are just the tip of the iceberg. You may have dozens of other credit scores youre not aware of.

The other main scoring model youll run into is the VantageScore. The three major credit-reporting agencies Equifax®, Experian® and TransUnion® teamed up in 2006 to create the independently managed firm VantageScore Solutions, which just released the fourth and latest version of its credit scoring model, the VantageScore 4.0.

We know this is a lot to take in, but dont panic. While each of these credit-reporting agencies calculates your credit scores differently, they all focus on how responsible you are with the money you borrow.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How Do Fico Scores Consider Loan Shopping

In general, if you are loan shopping – meaning that you are applying for the same type of loan with similar amounts with multiple lenders in a short period of time – your FICO® Score will consider your shopping as a single credit inquiry on your score if the shopping occurs within a short time period depending on which FICO® Score version is used by your lenders.

How To Check Your Credit Scores

Now that weve made all this fuss about FICO scores, you probably want to know what yours are, right?

These ranges are somewhat subjective, since lenders base their decisions on more than just credit scores.

To see where you fall, try the Discover Credit Scorecard, which gives a free FICO score to anyone who signs up for an account.

Or, for more options, heres a list of all the places you can get your FICO scores for free. It also includes websites where you can get other free credit scores, like your VantageScores.

Insider tip

While youre at it, you should probably check your credit reports. Theyre what your credit scores are based on, so if theyre not correct, your credit scores wont be either. You can get one free credit report per year, per bureau at AnnualCreditReport.com. You can also use services like to monitor two of your VantageScore 3.0 credit scores on a regular basis.

Don’t Miss: Syncb Inquiry

Top 3 Reasons You Should Choose Fico Scores Over Non

“For years, there has been a lot of confusion among consumers over which credit scores matter. While there are many types of credit scores, FICO Scores matter the most because the majority of lenders use these scores to decide whether to approve loan applicants and at what interest rates.” The Wall Street Journal1

So why choose FICO Scores over other scores? Here are just a few reasons:

2.You can make more informed financial decisions. With FICO Scores, you’re better prepared to know when to apply for credit because you’re viewing the scores used by 90% of the top lenders.

Remember, non-FICO credit scores can differ by as much as 100 points. Other credit scores may vary from your FICO Score by several points. This variance could cause you to overestimate your likelihood of getting approved. According to a recent Consumers Union report, “score discrepancies can give consumers the false hope that they qualify for credit or low-interest rates when they do not. Consumers can face higher interest rates than expected, or be denied credit.”2

On the flip side, non-FICO credit scores can lead you to underestimate your creditworthiness, keeping you from purchasing a much-needed family car or refinancing a mortgage that could save you thousands in interest.

Why Is My Credit Score Different When Lenders Check My Credit

The credit score you see and the one your lender uses may be different for several reasons.

To start, it’s important to understand that credit scores are based on the information found in credit reports maintained by the three major credit bureaus. If those reports differ, a credit score based on one report may not be identical to a score based on another.

Another reason the scores differ might be because there’s more than one credit scoring model, and there’s no guarantee the one you’re using to check your own credit is the same one your lender relies on. Plus, each model regularly releases updated versions of the scores it producesand there are score versions that are specific to certain industries. For example, when you check your for free, you might receive a score calculated using the VantageScore® 3.0 model, but your mortgage lender might use the FICO® Score 2 to assess your credit.

We’ll explain more about the differences between credit scoring models below, as well as other reasons your score may differ. What’s important to remember, though, is that the same positive behaviorpaying bills on time, limiting credit card debt, maintaining a long credit historywill typically lead to a good or excellent credit score across the different models and versions and credit bureaus.

Here’s what you need to know about the various credit scores you have, and which are most important to keep an eye on when you’re seeking new credit.

Read Also: What Is Syncb Ntwk On Credit Report