Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Review Your Report & Dispute Any Errors

Reading your credit report is one of the most vital steps when it comes to building credit and maintaining it. While reviewing your report, make sure your personal and account information is accurate.

Common credit reporting errors to look for include the following:

- Incorrect name or address

- Paid accounts that are listed as open

- Account balance or credit limit errors

- Accounts that dont belong to you

If you spot an error, dispute it with each credit bureau that lists it on your report or the creditor that reported it. The investigation will typically take 30 days to complete. Once its over, the credit bureau will remove the information if it finds that it is in fact an error.

How To Request Your Credit Report From A Credit Bureau

For basic credit hygiene, getting your three free credit reports from AnnualCreditReport.com is a good start.

However, there may be circumstances where you will need to check your credit report more frequently than whats available for free. For instance, you may be buying a home or starting a new job. Or perhaps youre doing your due diligence to protect against identity theft. Pulling your credit report in all of these cases would be a judicious move. But in some cases, it may come with a fee.

According to the CFPB, the credit bureaus legally can not charge you more than $13 per report. As a reminder, the three major bureaus are allowing you to check their credit reports every week for free until April 20, 2022. After that date or in the meantime if you need to check your credit report more than once per week you can contact the bureaus directly to buy your credit report.

Equifax

To request a credit report directly from Equifax, you can call 1-800-685-1111 toll free. You can also request one online by creating a myEquifax account. Once your profile is set up, you can request a credit report from your account page.

Experian

To get your Experian credit report straight from the company, either call 1-888-397-3742 or go to Experians report-access page, select Request my Credit Report and follow the prompts to determine if you qualify for an additional free credit report or if you are required to purchase one.

TransUnion

You May Like: What Credit Score Is Needed For Amazon Prime Visa Card

What If The Cifas Marker Is There By Mistake

If you think a Cifas warning has been put on your credit file in error, you can contact the lender who put it there to see if theyll remove it.

Be aware that credit rating agencies are unlikely to remove any entry on your report if they believe the reason the marker was put on your credit file was justified. Lenders are legally obliged to report any fraudulent attempt on your account to the credit reference agencies.

Find out more about Cifas markers on the Cifas website

Free Equifax Credit Report In Spanish

Additionally you can receive your Equifax credit report in Spanish. Equifax is the first and only credit bureau to offer a free, translated credit report in Spanish online and by mail.

There are two ways to request your Spanish credit report, online or by phone.

You can visit: www.equifax.com/micredito or call Equifax customer service 888-EQUIFAX and press option 8 to begin requesting your free credit report in Spanish.

Recommended Reading: Does Stoneberry Report To Credit Bureau

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get atAnnualCreditReport.com.

Free Annual Credit Report

Review your credit report often to make sure the information is accurate. If you see something on your report that you didnt do, it could mean youre the victim of identity theft.

You can get one free credit report each year from each of the three nationwide credit bureaus. The website annualcreditreport.com is your portal to your free reports.

Note: when you leave that website and move to the company website to get your free report, the company will probably try to get you to sign up for costly and unnecessary credit monitoring services.

You can also get your credit reports by phone by calling 1-877-322-8228. Under North Carolina law, credit monitoring services are required to tell you how you can get credit reports for free.

To keep track of your credit during the year, request a free report from a different credit bureau every four months. You can also pay for additional copies of your credit report at any time.

Read Also: How To Get An Eviction Off Your Credit Report

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Drivers License

- Birth Certificate Issued in Canada

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

Read Also: How To Find Out Credit Score For Free

Read Your Credit Report Closely For Errors

Once you have received a credit report, it’s crucial to read it closely to verify that all of the following information is accurate:

- Personally identifiable information : Your name, address, SSN, date of birth, and employment information.

- Type of account , the date you opened the account, your or loan amount, the account balance, and your payment history .

- A list of everyone who has accessed your credit report within the last two years, including both soft and hard inquiries. When you apply for a loan, you’re giving the lender authorization to ask for a copy of your credit report.

- Public record and collections: can collect public record information from state and county courts, including bankruptcies. Additionally, if you have any overdue debt that was turned over to a collection agency, this will also appear on your credit report.

While it’s still a good idea to check for errors such as a variation of your name or an old address, personal information like this isn’t used to calculate your and, as such, isn’t as crucial to have corrected. However, if the name or address on your credit report don’t correspond to anything you go by or anywhere you’ve lived, respectively, then that could be a sign of some suspicious activity, such as identity theft.

How Many Free Credit Reports Can You Get Per Year

The number of credit reports you can get for free depends on where you get them from and whether youve placed a fraud alert on your credit reports.

For example, the Fair Credit Reporting Act entitles you to receive one free credit report from each major credit bureau a year. This means you can view all your credit reports for free once per year through AnnualCreditReport.com.

In addition, some credit reporting companies and personal finance websites allow you to check one or more of your reports for free. For example, if you sign up for myEquifax, you can get six free Equifax credit reports per year through 2026. Experian also allows you to view your Experian credit report for free 12 times a year.

You can also get an additional free copy of your report from each credit bureau if you suspect fraud and place a fraud alert on your credit reports. To do this, you must contact one of the credit bureaus.

If youve been a victim of identity theft and filed a report, you can get an additional six free credit reports per year, two from each credit bureau.

You May Like: Is 653 A Good Credit Score

Additional Ways To Acquire Your Credit Report

The above strategies are focused on the three major credit bureaus: Equifax, Experian and TransUnion. However, while those three bureaus are nationwide and are likely to have the most comprehensive consumer data on you, they are not the only organizations to compile credit reports.

According to the CFPB, you are also eligible to receive free annual reports from approximately 50 additional specialty credit-reporting agencies. These companies compile consumer data in the following areas:

- Checking and banking accounts

- Low income and subprime credit

- Medical records

- Supplementary credit records

- Tenant and rental records

- Utility payments

While it may be overkill to pull dozens of credit reports from these niche agencies on a regular basis, their reports can come in handy in certain circumstances. If a bank denies your request to open a checking account or if a landlord rejects your rental application, you can pull a report from the corresponding agencies to see if somethings on your consumer record.

View the CFPBs detailed list of credit agencies for contact details of the individual companies and what areas they specialize in. Note that not all of the companies are nationwide, and they might not all have data on you.

Whats The Deal On Free Credit Reports

The Federal Trade Commission is warning about scams in the age of coronavirus. In short, they recommend that you ignore unsolicited pitches for Covid-related items, and robocalls or emails claiming to be from the CDC or World Health Organization. Going down any of those rabbit holes could lead to fraud, identity theft, and damaging information in your credit files.

Fortunately, theres an easy way to check ALL of your credit reports online, for free. Back in December 2003, the Fair and Accurate Credit Transactions Act was signed into law, which gives every U.S. consumer the right to receive a copy of their credit report free of charge once a year.

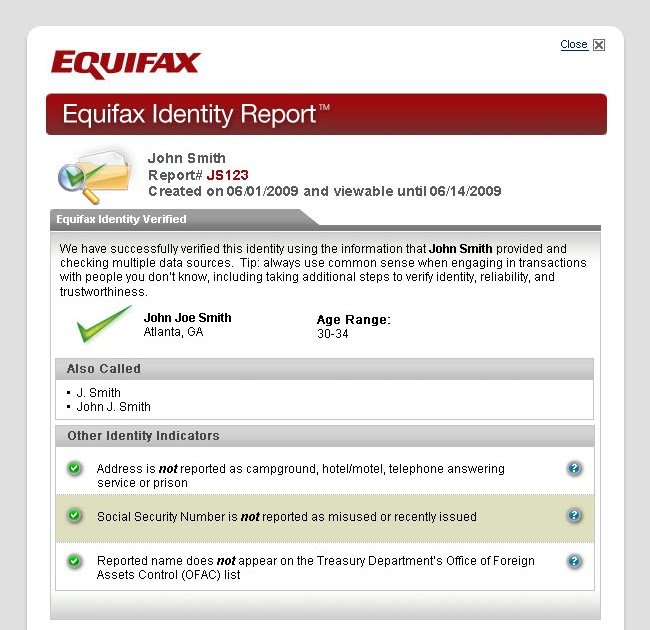

A credit report provides you with all of the information in your credit file, which is maintained by consumer reporting companies Equifax, Experian, Trans Union, and Innovis. This is the information that is provided by them in a consumer report requested by a third party, such as a lender, landlord or insurance company. This information includes mortgage, credit card and loan balances, along with your payment history. A credit report also includes a record of everyone who has received a consumer report about you within a certain period of time.

And thats not the worst of it. If you have items appearing on your credit report that you do not recognize, such as consumer loans and store credit cards, it could indicate that identity theft is taking place.

Read Also: What Is Syncb Ntwk On Credit Report

Also Check: What Is A Good Credit Score In California

Getting A Free Credit Report

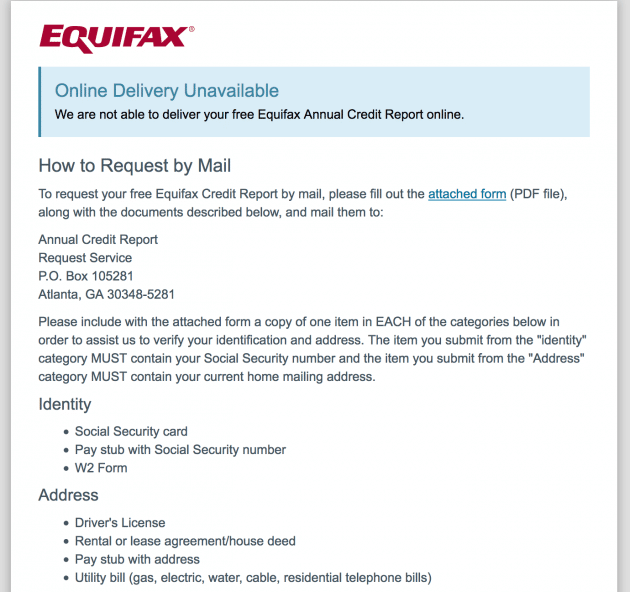

According to the Fair Credit Reporting Act, you are entitled to get one free credit report per year from each of the credit reporting agencies. You can ask for them all at the same time or you can choose to spread them out over the entire year, asking for a different one every four months. To request your free credit report by mail, fill out the Annual Credit Report Request Form and mail it to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-528. According to the Federal Trade Commission, this is the only authorized source for free credit reports.

One Survey On Credit Reporting:

- 17 per cent of Canadian adults had checked their credit reports in the prior three years

- Of those who checked, 18 per cent found inaccuracies in their credit reports

- 10 per cent believed they were denied access to financial services because of report inaccuracies

Some credit bureau watchers estimate that there are errors in 10 to 33 per cent of credit files. Some of those mistakes can be serious enough to hurt your credit status. That hit to your credit score can result in a denied loan or a higher interest rate. Across Canada, provincial consumer agencies collectively get hundreds of complaints annually about credit bureaus.

If you find something in your file that you dispute, you can write the credit agency in question and tell them you think theres an error. The credit reporting agency usually sends along the form you need when it sends you the credit report. Use it to spell out the details of any information you dispute. The dispute forms are online, too.

Be sure to send along any documents that support your version of the matter in dispute. The reporting agency then contacts whoever submitted the information youre disputing.

If the file is changed, you will be sent a copy of your new report and any company thats requested your credit file in the previous two months will also be sent the corrected file.

You can also file a complaint with your provincial consumer agency.

Don’t Miss: Does Phone Bill Affect Credit Score

How Do I Get A Copy Of My Equifax Credit Report

You have a Right to a Copy of Your Equifax Credit Report

The federal Fair Credit Reporting Act gives consumers the right to receive free copies of their Equifax consumer reports and to dispute any inaccuracies. Equifax is a “consumer reporting agency” under the FCRA and is required to give a free copy of your report every year. You have the right to receive that credit report on an annual basis and to dispute any errors that you find that Equifax made. There are a number of reasons allowing your to get a free copy of your credit report. If you don’t know whether your are entitled to a free copy, you can email us through this site or call 400-CREDIT | 400-2733 to get help.

Order by Mail

Even though it may seem more convenient and quicker to order over the web, you should only order your Equifax report by mail. Consumers who order over the web are subject to risks that mail requests don’t have. Most importantly, when you order by mail, you should use a delivery verification services like “registered mail” or “return receipt request” so that you have proof of mailing to request to Equifax and that Equifax received a copy of the request. This will insure that you have proof of the request if Equifax refuses to send the report. If you need help with your mail request for your Equifax credit report, you can email us through this site or call 400-CREDIT | 400-2733 to get help.

Include Proper IdentificationKeep a Copy of Your Request to EquifaxWhat if They Don’t Send the Report

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Read Also: How To Get Credit Report From Credit Bureau

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

-

Data from one or two credit bureaus

-

A recent history of your credit use

-

Additional information about building and protecting your credit

AnnualCreditReport.com is authorized by federal law and safe to use as long as you ensure you’re on the correct site.

Double-check the URL when you type it, to be sure you have not made a typo. Some other sites have similar-sounding names, so check that the URL matches and the site looks as expected.

Be aware that your credit reports are free, but credit bureaus also use the AnnualCreditReport.com site to sell credit scores and promote paid services, such as . However, monitoring doesnt keep your identity from being stolen it just alerts you after the fact. For best protection, use a

Just get your free credit report. Dont get suckered by the upsell, says Ed Mierzwinski, consumer program director for the U.S. Public Interest Research Group.

AnnualCreditReport.com