What’s The Benefit Of Joining The Scheme And Why Is My Credit File Important

Making your payments on time could see your credit history improve, therefore making it easier to prove your identity and apply for credit products.

Think of your credit file as your financial CV. It gives potential lenders an insight into your spending history, allowing them to make an informed decision as to whether they want to take you on as a borrower.

Building your credit history through your rental payments will make you more attractive to a lender. Showing you can meet payments on time will improve your credit score, though lenders won’t see this. They’ll have their own scoring system and will take into account your affordability. And as mortgage payments could end up being more affordable than your current rent, you could see yourself on the property ladder far sooner.

See our for full info on what a credit rating is and how to improve it.

How Does Reporting Rental History Help Me

- You may need the information to assist you with future rentals. Some landlords are very skeptical when renting their properties to renters without established rental history. Reporting this information may help you when you try to least a property in the future.

- You are established as worthy of lending credit. When you try to apply for credit, it helps when lenders can see that you have established your creditworthiness.

- It may help you when you look for a job. Many employees check credit to determine whether to employ you. The information on your credit report may help you land your next job.

The next time you decide to rent, you should make sure that your landlord will report your payments to the credit agencies. You can see a major improvement to your credit score when your landlord reports your good payment history to them. Keep reading to learn more about annual credit report questions.

Build Credit History By Paying Your Rent On Time

Why Building Your Credit History Is Important

How Paying Rent On Time Helps Build Your Credit History

Experian incorporates on-time rental payment data reported to Experian RentBureau into Experian credit reports. Your rental payment information will be included as part of your standard credit report and may be incorporated into certain credit scores. The inclusion of positive rental payment history within Experian credit reports allows you to establish or build credit history through timely rental payments.

In the long run, having a two-year excellent credit line for my rental payments will add value by helping me to potentially receive lower interest rates on a mortgage and car and consumer loans. I may even get a better rate on insurance premiums.

B. Scott, Multifamily resident

How Rental Payment Data is Used

Experian RentBureau receives updated rental payment data every 24 hours from property management companies and electronic rent payment services nationwide. This data is accessed by resident screening companies for use during the application process for prospective residents. Continuous on-time rental payment data also may be incorporated within Experian credit reports, which are used by various types of credit-granting institutions, including banks, auto finance companies and telecommunications providers.

How To Make Sure Your Rent Is Reported

To learn more about these services, visit the rental payment service providers working with Experian RentBureau:

Also Check: What Score Do You Need For Care Credit

Does Paying Rent Build My Credit Score

Paying your rent can help build your credit score, but only after you actively report these payments to credit bureaus. Consistent reporting of your rent payments improves your credit score on various scoring models. But remember, you must make payments on time each month.

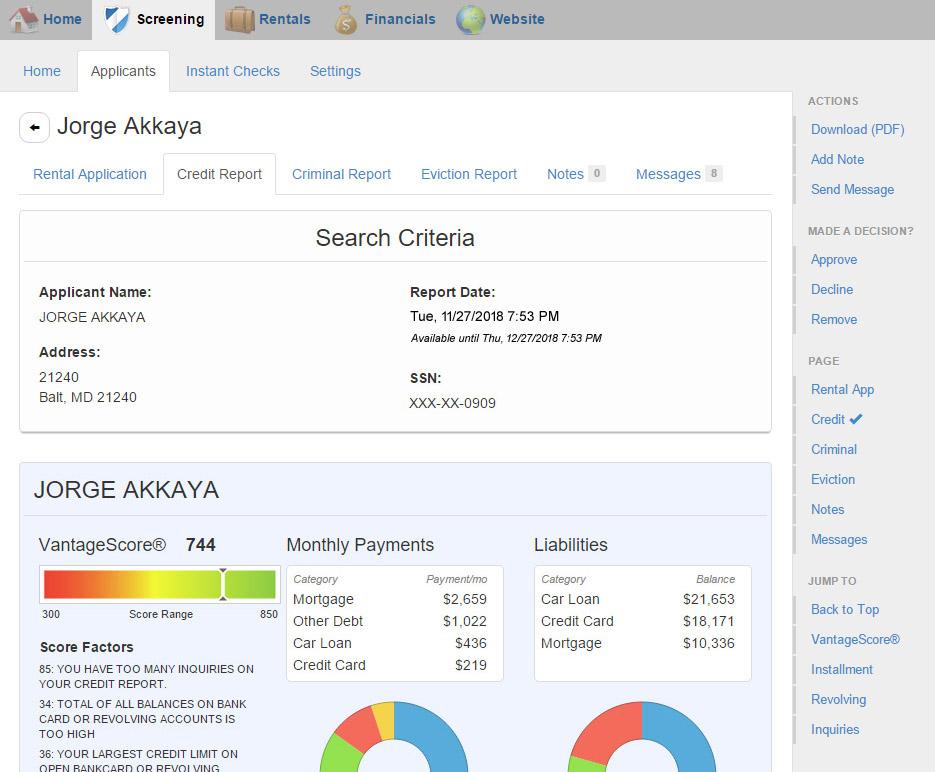

For instance, a study shows that adding your rent payments for two months can increase your VantageScore score by 9 points. Another study by TransUnion shows that credit scores can rise by as much as 16 points after 6 months.

What Is Rental Exchange

The Rental Exchange scheme was launched by credit reference agency Experian and The Big Issue Group in March 2016 as a way of allowing tenants to build up a credit history and ultimately improve their credit rating by paying their rent on time each month.

The scheme uses rental payment data in the same way it would mortgage payment data, so if you’re signed up, your payments will be recorded and added to your credit file.

Before Rental Exchange, some renters were unable to show they could meet regular payments, particularly if they didn’t already have a traditional credit product.

More than 150 social housing providers, local authorities and letting agents are reporting data into the Rental Exchange scheme with more expected to come on board – though you can opt to do it yourself now if yours hasn’t signed up yet. If you rent from a private landlord, you’ll most likely need to ask to join the scheme.

It’s worth noting you can’t add your monthly payment data retrospectively as it’s only collected from the point you sign up and it starts to be shared so the sooner you join the scheme, the better. However, the account will show the start date of your tenancy, which, if you’ve been in the property a while, could show longevity and stability two big positives for lenders.

You May Like: Which Business Credit Cards Do Not Report Personal Credit

Does Paying Rent Improve Your Credit Score

Although landlords and property management companies aren’t required to report payments to the credit bureaus, a perfect payment pattern is still something to strive for. Not only will that information be appealing to anyone reviewing your credit report, adding a well-managed lease to your reports can cause your credit scores to rise.

Payment history is the weightiest scoring factor in both the FICO® Score and VantageScore® models, so the more evidence that you have been paying your bills on time, the better. Bear in mind that only the newest versions of the FICO® Score and VantageScore® models consider rental data, and some lenders still use older versions.

However, for the most current credit scoring systems that do take rental history into account, your on-time rental payments can give your scores a lift, especially if your credit history is young or you’ve had some credit problems in the past. According to Experian’s study, 75% of study participants who were scoreable before rental data was included on their credit files found that adding rental history increased their credit score. On average, those who saw an increase experienced a VantageScore 3.0 increase of 29 points.

Reporting Good Payment History For Renters Can Instantly Boost Their Credit Score

Did you know that if youve been making your rent payments on time that your by more than 40 points if that was reflected on your credit history?

Your landlord likely knows this, as do the credit bureaus.

A credit rent boost is fast becoming a trend. But it has yet to really catch on with the ones who need it most: Renters.

Does paying rent increase your credit score? Yes.

Greg Knotts, Continental Finance Blog

Most people know that building a strong credit history involves showing that they are a good candidate for credit or a loan.

One of the keys to showing this is to make payments on a credit card balance on time.

Other big payments like a mortgage or a car loan are also big indicators on a persons credit report.

But an on-time payment history of your rent is something many people never considered to be an indicator of good credit history.

Thats the thing though, paying rent on time is a great example of what a credit report from all three credit bureaus is looking for.

You can build credit history with rent payments. Ongoing reporting of your on-time payments helps establish your good record.

Chris Parker, executive director of Giv Development, told that rent reporting is a very useful indicator of a persons credit history.

They were the epitome of good credit risks, Parker told Herron.

You May Like: How Long Does Something Stay On Chexsystems

Things To Keep In Mind

While reporting rent on your credit report sounds like a good idea for every payment on time, you can strengthen your score digging into how it actually pans out reveals some interesting caveats.

For example, a string of reddit posts discussing consequences of reporting rent payments reveal exactly how Experian reports them on a credit report. Reddit user flymd claims his credit score dropped 20 points one month after opting to report his rent payments to the bureau.

The only thing different I could find on my report was that it was now categorizing my rental payments as a brand new loan account with an age of < 1 month, which has significantly altered my average age of accounts and hit my score, flymd writes.

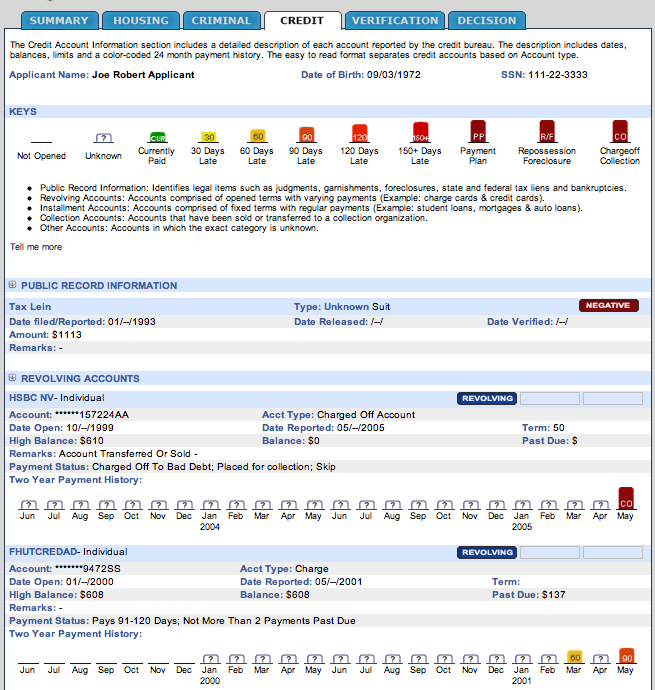

In a statement provided to Forbes, TransUnion explained exactly how rental payment histories are recorded on credit reports.

Rental payments are reported as portfolio type Open and account type Rental Agreement.. They show up in the tradelines section among all the other tradeline types . It will show up as a new account if it was not previously reported but may not be a new loan as rental agreements could have been open previously and are just now being reported on.

Emily Christiansen, director of Experian Rent Bureau, adds that a diversified credit report will benefit consumers in the long run, regardless of the initial dip.

Is Rent Reporting Really Worth It

It’s unlikely that timely rent payments will help obtain any of the major forms of credit cards, mortgages, auto loans without a lender willing to work with higher risk borrowers. Yet many landlords still look at the actual credit report along with the score. So, for prospective renters with some questionable ‘established’ credit and a favorable reported rental history, adding positive credit in this way could help their chances, Paperno says.

Unfortunately, however, other than in this specific example there really isn’t much upside to paying for positive rental data, Paperno concludes.

Also Check: Creditwise Score Accuracy

Where Rentreporters Falls Short

Because the company reports only to TransUnion and Equifax, its reach is limited. The company says it also plans to add a customer portal, but for now, clients receive status updates via emails or by calling the company.

Also note that the companys user satisfaction guarantee about your initial score bump has a time limit. Once RentReporters adds rent payments to your credit report and emails your new score, you have only 48 hours to cancel the service and get a refund. RentReporters then removes the rental history, which in turn shifts your credit score back to what it would have been without the service.

Read RentReporters educational materials and advice with the understanding that it wants you to buy its services. It sometimes overemphasizes the role of rent reporting in a broader credit-building strategy.

How Rental Kharma Works

Rent appears as a tradeline on your credit report it might appear classed as a “rental agreement” or open account, depending on which credit bureau supplies the information. That differs from the revolving and installment tradelines traditionally used to calculate credit scores.

Cullen Canazares, co-founder and CEO of Rental Kharma, says that the addition of rental data can establish a credit score for a previously unscorable consumer within a couple of weeks.

The company can report a payment history, looking backward, of up to two years if youve moved around, leases will appear as multiple tradelines. Canazares says the addition of back rent payments increases the average age of accounts, which is factored into your credit score.

The company helps its users leverage their new credit scores by pointing out which credit card issuers accept the scores that show rental history. Applying for those credit cards and using them responsibly can further build a credit score.

Canazares says his company has helped about 5,000 customers to qualify for major purchases, such as cars and homes.

You May Like: Does Speedy Cash Report To Credit Bureaus

What Can I Do If The Information On My Rental History Is Wrong

Once you get a copy of your rental history report, check it carefully to make sure its accurate. And dont let anything slip byincorrect dates for even one apartment could jeopardize your chances for a new place, because it could erroneously show late rent payments. If any information on the report is wrong, you can dispute it. Supply the company with supporting information, and theyll review the issue and fix any problems.

How To Get Your Rental History To Show On Your Credit Reports

I recently applied for a mortgage and was denied because my credit score was under 600. I was surprised to hear this because I have no debt beyond my car payment which has never been late in the 4+ years that I have been making car payments. I got rid of all my credit cards and paid them off 8 or 9 years ago. The mortgage company said that THAT was the problem. I don’t have ENOUGH established credit and they suggested that I get 3 or 4 cards. Not an easy thing to do when your credit score is so low. Talk about a “Catch-22”!

The decision to eliminate my credit card debt has come back to bite me in the butt. The only other payment that I make every month is my rent. I have a good, strong solid rental history of 6 years with my current landlord and I can also throw in the 2 landlords before this one. Unfortunately, my rental payments don’t get reported to the credit bureaus, so it does nothing to benefit my credit. I have found several web sites that, for a montly fee, claim to report rent payments to Experian and Trans Union, and that this has the POTENTIAL of raising my credit score substantially.

Is reporting my rent to any of the three companies listed a legitimate and beneficial way to get my rent payments added to my credit score?

DDB

Recommended Reading: How Long Does It Take Opensky To Report To Credit Bureaus

Best Rent Reporting Services In 2021

Summary: Not all rent reporting services are created equal. We review ten rent reporting options and how to choose the right one for you.

Many people do not realize that their rent payments are not usually reported to the three major credit bureaus. This is unfortunate because the reporting of your monthly payments could have a positive influence on your credit score.

You can fix this problem.

You can pay a Rent Reporting service to report your monthly payments. For an additional fee, many services will report 24 months of previous rental payments. Thats a quick way to establish a credit history.

When choosing a rent reporting service, the two most important factors to consider are their reputation, the number of credit bureaus that they report to,and their initial cost, including the reporting of 24 months of previous rental payments.

In this post:

What If I Dont Currently Pay Rent Online

Create a free Avail account and invite your landlord to Avail to start accepting rent payments online so that you can start building credit with rent. Online rent payments offer plenty of incentives for landlords, including quick direct deposit, automated rent receipts, and easy tracking and reporting for tax time.

You May Like: How To Remove Child Support From Credit Report

How To Check Your Rental History

Checking your rental history report gives you the opportunity to review what landlords are likely to see when they check your file. It could also help you spot any inaccuracies that may appear and have them corrected. There are multiple companies that provide this type of report, so you may want to find out which reporting agency your prospective landlord uses if you think it’s important to see the exact report they’re accessing.

You can request a copy of your Experian RentBureau report by completing a request form and mailing it in, or by calling 877-704-4519. The other major companies that provide tenant history reports are LexisNexis, CoreLogic and Tenant Data.

Building Off Of Your Thin Credit History

Lets start with the fact that your mortgage company is recommending the 3-4 credit cards. Im sure youre as leery as I am about that suggestion. If youre anything like me, then you feel great about being debt-free, and probably dont want to reopen that can of worms, but maybe we can meet them halfway.

Secured Credit Cards are a Great Option. This is only a catch-22 if you have bad credit. Im assuming that you have little to no negatives on your credit report, based on what you said above. Your problem is credit history. Good credit history and are the two most important things in determining your credit score. The history is self-explanatory, and by definition, we are going to need time to be on our side. Utilization, on the other hand, is the amount of credit you utilize in comparison to whats available to you. In other words, your debt. Credit utilization should be ridiculously low, as low as you can make it, but above zero. Banks want to know that you can use credit responsibility, but that you dont really need it.

Based on the information you provided, you should be able to qualify for a secured card, and I would start with a securedMasterCard through Capital One. This credit card is specifically for building or rebuilding credit, and has no annual fees . The security deposit minimum is $49, which gives you a credit limit of $200, and if you deposit more, you can get your limit up to as much as $3,000 .

Recommended Reading: What Credit Score Does Carmax Use

Why Report Rent Payments

Good credit is the cornerstone of financial health.

All of that is about to change. The major credit bureaus now accept rent payment history from landlords and include that history on the individual renters consumer credit report. This means you can now add rent to credit reports. This is a game-changer for tenants, who can now see improvement in their credit reports. That unlocks a multitude of savings and benefits, allowing access to the best financing rates and the best amenities. It is no wonder that 68% of renters surveyed would choose a landlord who reports rent payments.

Landlords Who Report Rent See Fewer Delinquencies

Good credit builds over time and requires a mixture of credit accounts. The traditional way to build credit is to take out a credit card, springboard that into a car loan, and eventually take the step of securing a long-term mortgage. As credit matures, consumers benefit by qualifying for the best interest rates and financing terms, making it easier to build wealth.

But more tenants today are staying in the rental market, either as a lifestyle choice or because mortgages are more difficult to obtain and housing is becoming more expensive. Over time, those renters fall behind homeowners who benefit from making monthly mortgage payments, forcing tenants into a downward spiral of spending more of their income on interest and fees to access credit lines.