What Is Your Credit Score Why Is It Important

Your credit score may be defined as a rating that reflects your creditworthiness. Think of your as a batting average. If your batting average is above 50, then it means that you have a consistent scoring record of 50, and you are a good player. Similarly, when your credit score is high, it shows that you have borrowed and repaid credit responsibly in the past.

Your credit score is important because it showcases how dependable or risky you are as a borrower. Thus, it directly impacts how eligible you are for a loan, what the lender will offer you as a loan amount, and the rate of interest you will be charged. Your credit score allows lenders to judge the potential risk in lending you money. Your credit score is critical when it comes to unsecured or collateral-free loans and can affect your eligibility for personal loans to a great extent.

While you as an individual have a score, even businesses are given credit scores. For a business, the CIBIL score impacts how creditworthy a lender will find the company. A business credit score could also impact its ability to attract investment.

Additional Read: Save 45% on personal loan EMI

The Usefulness Of A Credit Score Is In The Eye Of The Lender

Whats more, if a particular lender considers credit scores, they are free to use whichever score or combination of scores they feel will best help them make a decision. They can also assign whatever weight or significance to a score or scores they would like.

So, generally speaking, whats a good credit score for an applicant? Its a score which, if used by a lender, is high enough to convince that lender to lend to that applicant under favorable terms.

Learn More About Your Credit Score

A 640 FICO® Score is a good starting point for building a better credit score. Boosting your score into the good range could help you gain access to more credit options, lower interest rates, and fewer fees. You can begin by getting your free credit report from Experian and checking your to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Recommended Reading: Synchrony Bank Ppc

Freedomplus: Best For Competitive Interest Rates

Overview: FreedomPlus offers loans of $7,500 to $50,000, with funding in as few as 48 hours.

Why FreedomPlus is the best for competitive interest rates: Whereas its maximum APR is 29.99 percent, some personal loan lenders charge as much as 36 percent.

Perks: While FreedomPlus does not disclose its eligibility requirements, it is possible for borrowers with credit scores in the low- to mid-600 range to be approved.

What to watch out for: The minimum loan amount of $7,500 is a bit high compared with other options on this list. If you need to borrow less, youll need to explore other personal loan options.

| Lender |

|---|

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

You May Like: How Long Does It Take Opensky To Report To Credit Bureaus

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

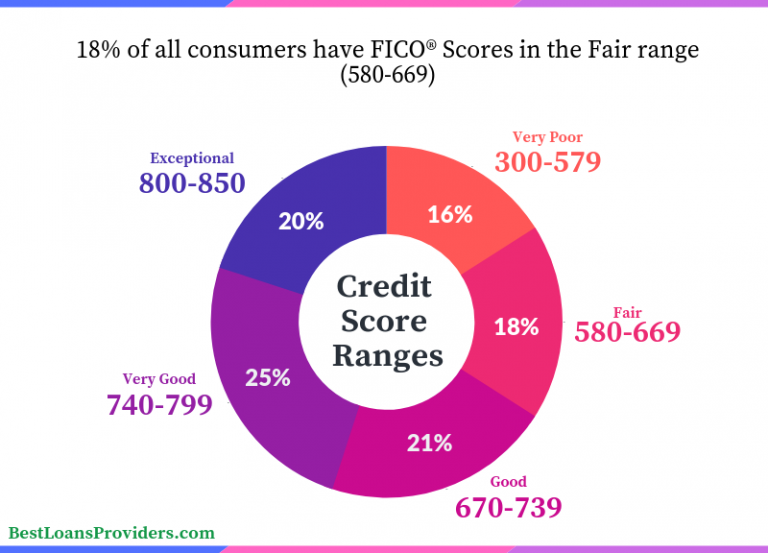

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

Don’t Miss: Who Is Ic Systems

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

Can I Get A Car / Auto Loan W/ A 640 Credit Score

Trying to qualify for an auto loan with a 640 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 640 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

Don’t Miss: Zzounds Financing Review

How To Get A Loan Despite A Poor Credit Score

- Borrow from non-banks:While non-banking financial companies, like Bajaj Finserv, still need you to have a decent credit score, they tend to have relatively simpler eligibility criteria, which may help you raise funds fast and without too much effort.

- Apply with a guarantor or co-signer to your loan account:Adding a co-borrower to your loan application helps distribute the responsibility of repayment between you and the co-borrower. When your co-borrower has a good score, you will be able to borrow a larger loan amount and boost your chances of approval too.

- Try to find a secured loan:When a loan is unsecured, the lender is more stringent with the eligibility criteria by carefully filtering and selecting the most dependable or reliable borrowers. However, if you have collateral to offer, the significance of having a good credit score diminishes.

Additional Read: Get personal loan on bad CIBIL score

A Reason To Dig Deeper

700+ may be considered good, but why stop there when lenders dont? Depending on a range of scores, lenders may grant or deny some credit applications, but theres a whole array of different offers for credit cards and loans available, depending on a persons credit score. The very best offers go to those with the best scores, while those with lesser credit scores get stuck with higher rates or even get refused completely.

Heres a breakdown:

- 300-580 Very Poor

Recommended Reading: Is 611 A Good Credit Score

The Credit Score Needed To Buy A House

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Why Are Good Credit Scores Crucial

This low-interest credit card with double miles from Capital One is available only to those with excellent credit.

Having a good credit score generally makes peoples personal finance lives a lot easier. A good score can mean the difference between being approved or rejected for things like credit cards, mortgages and apartment rentals. It can also mean a huge difference in how much people pay for credit through interest rates, because those with poor credit get stuck with higher rates.

Since financial institutions dont have the luxury of knowing all their potential customers on a personal basis, they need some way of judging whether someone is likely to repay any money lent to them. Thats where credit scores come in.

Equifax, TransUnion and Experian are the three credit bureaus that create consumer credit scores.

The formulas that the credit reporting bureaus use are each a little different from each other and the exact ins-and-outs of them are proprietary. While the credit bureaus methodologies may vary, they generally judge how consumers use credit and how they pay it back. Paying bills late, maxing out credit cards and having accounts in collections are all signals that a consumer is unlikely to pay back lenders on time reliably. Having several credit accounts in good standing, low balances on credit cards and a history of consistently paying back lenders on time are all signs that a consumer is very likely to handle a new loan or line of credit responsibly.

Read Also: Old Credit Report

The Minimum Credit Score Needed To Purchase A Home Can Be Anywhere From 580 To 640 Depending On The Type Of Mortgage

Your credit score is one factor that can make or break your house hunt since it plays a big role in a lenders decision-making process.

In addition to dictating the types of loans youre eligible for, your credit score is also one factor that helps lenders determine your interest rate and other fees related to the loan. This is why its important to take a look at your credit score and understand all of the ways it will impact the purchase of your future home.

Weve updated this guide for 2021 to make sure you understand what you need during your search this year. Our guide identifies the ideal credit scores for different types of loans and explains both how your credit score influences the home-buying process and what you can do to improve your credit score.

Trust The Processthe World Of Credit Moves Slowly

Or, if you are feeling confident, continue to do your own research using articles such as this one on how to raise your credit score. Whichever you decide to do, try to be as patient as possible. No matter how low you are currently sitting at, know that it is never impossible to climb out of your economic hole. You can make credit utilization work to your advantage if you are savvy about it!

Founder of Credit Repair Partner. I worked in the credit repair industry for about 10 years. I love, helping people become smarter about their credit and finances.

Read Also: Nfcu Pre Approval Mortgage

Annual Percentage Rate Apr

Do you know how credit cards typically advertise wide interest rate spreads, like 14.99% to 24.99%? With a credit score between 600 and 649, youre much more likely to pay 24.99%.

This is a primary reason why we recommend throughout this guide that you keep your credit card balance to an absolute minimum. Its possible to use a credit card to increase your credit score and to do so at a very low cost. But if you carry a balance, the interest cost will be substantial.

Auto Loan Rates For Fair Credit

Theres no single minimum credit score needed for a car loan. But generally speaking, credit scores in the fair range may limit your options to loans with higher rates and less favorable terms.

Building your credit over time is a good way to potentially get access to better terms, but thats not an overnight process. If youre on a shorter time frame, there are a few things you can do to help.

Compare car loans on Credit Karma to see your options.

Read Also: How To Notify Credit Bureau Of Death

How To Raise Your Credit Score

A higher credit score can help you qualify for a home loan and lower interest rate, potentially saving you thousands of dollars over the life of the loan.

If youve been monitoring your credit and determined it needs some work, here are some ways to improve your credit scores:

- Become an authorized user on a friend or family members credit card account.

- Pay down some or all of your debts.

- Set monthly reminders so you never forget to schedule a payment.

- Only open credit accounts that you need.

- If some of your accounts are delinquent or youre not sure where to start, consider contacting a credit counseling agency.

Credit Score Mortgage Loan

Keep in mind that only a few lenders give loans to borrowers with fair credit. This is because many lenders see it as a greater risk. Nonetheless, there are numerous lenders who will accept scores in the low 600s. Note that the interest rates charged will probably be higher. Before you apply, identify lenders that will work with fair credit scores. There is no point in applying for a mortgage if you know your score is below the Lenders credit threshold.

Don’t Miss: Remove Hard Inquiries Fast

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

How To Get Your Credit Score Above 640

If you are finding that you do not like what you are seeing in terms of a 640 credit score mortgage or FHA loan, you are not out of luck. There are things you can do to bump your number, decrease the interest rates you would be paying, and save yourself some money down the road. This can be done via DIY methods if you have the time or craft to do so. Or, you can seek professional assistance. Check out the methods below for the best ways of how to increase a credit score from 640.

Recommended Reading: Aargon Agency Las Vegas

How To Increase A Credit Score Of 640

Dispute Negative Accounts: If you have evidence that your credit reports negative information is false , you can challenge the record and get it removed or corrected.

Pay Off Collections Accounts: This can possibly improve your scores but always try to have the creditor provide a Deletion Letter that will allow the account to be completely removed if the account is paid off.

Reduce Utilization: Each month, strive to utilize no more than 30% of the credit available on your credit card accounts. This is a significant factor in determining your score. Some things you can do to decrease credit utilization include paying several times per month, making bigger payments and spending less.

Pay On Time: The most vital credit score element is payment history. Not delaying monthly payments provides the borrower with a good track record and shows responsibility on their part. Late payments will negatively affect your credit score in a substantial way.