What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

How To Get An Excellent Credit Score

If your credit score falls within the good, fair or bad ranges and you want to get an excellent credit score, follow these tips to help raise your credit score.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Autopay is a great way to ensure on-time payments, or you can set up reminders in your calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate. .

- Don’t open too many accounts at once. Each time you apply for credit, whether it’s a credit card or loan, and regardless if you’re denied or approved, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score about five points, though they bounce back within a few months. Try to limit applications and shop around with prequalification tools that don’t hurt your credit score.

What Is The Lowest Credit Score

According to the FICO credit score range, the lowest credit score a person can have is 300. But luckily, most people dont have a score as low as this.

But a score below 540 is considered bad credit, thus a lot of people are denied loans and credits based on this FICO score. Moreover, the average score that people have in the US is 704.

Don’t Miss: Which Credit Report Do Car Dealers Use

Dont Cancel Cards Needlessly

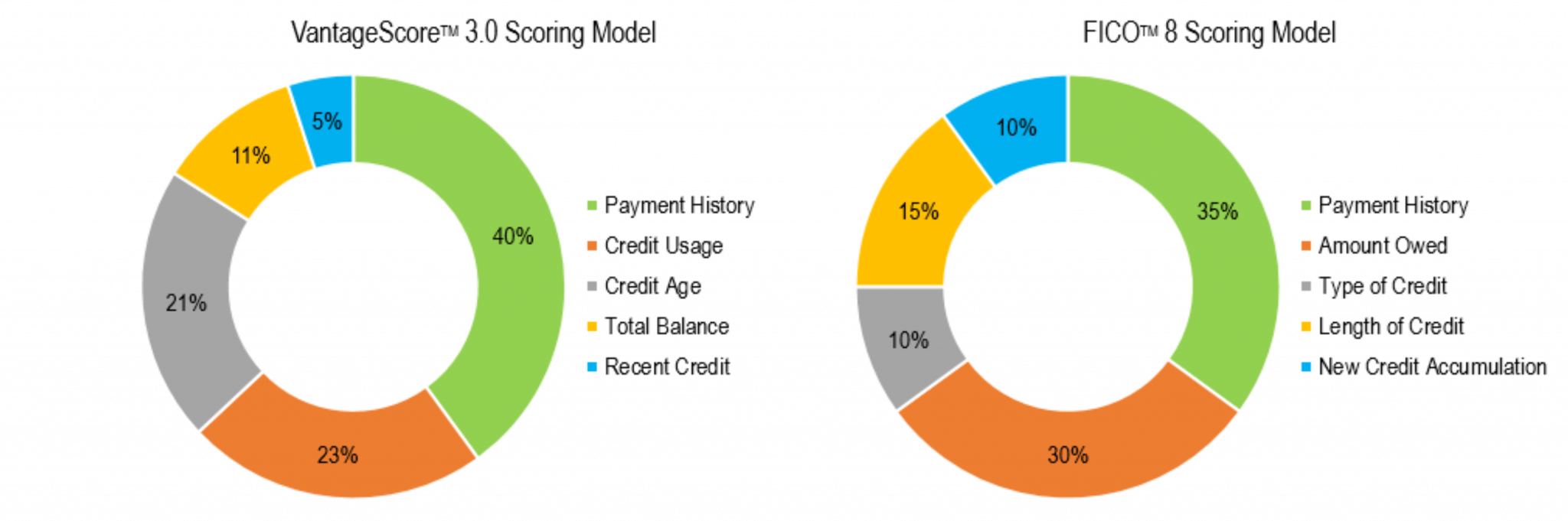

As you can see, both models look favorably on consumers who have longer credit histories and lower credit utilization ratios.

Unfortunately, you cant magically create 10 years of credit history. What you can do is choose one or two credit cards to keep active and never cancel. Not only will this help you build a longer credit history, but it can also help you keep your credit utilization rate low, since more active credit cards in your name means more available credit.

Paying Down Your Debt

Paying down your debt is one of the best ways to boost your credit score. Too much debt shows lenders and creditors that you may spend more than your means. How much debt you have in relation to how much credit you have weighs heavily on your score.

Ideally, you want as little debt as possible. Lets say you have a credit limit of $5,000. If your credit card bill is up to $4,500, you have a high level of debt in relation to your available credit. A credit card bill of $100 shows youre using very little of your available credit.

Having low credit usage is one of the best ways to increase your credit score. Instead of closing your accounts, keep your cards open and use them sparingly to keep this ratio low. Closing too many accounts doesnt actually increase your score.

The next best thing you can do for your credit score is to pay down more of your debts. Start with your smallest debts first. If youre having trouble coming up with the money to pay off your debt, we have loan options that can help get you out of the cycle of debt.

Read Also: Does Credit Karma Hurt Your Score

Get Your Credit Utilization In Check

Amounts owed makes up the next largest chunk of your credit score at 30%, and your is a significant piece of this puzzle. By paying your credit cards and lines of credit down to below a 30% credit utilization rate, you can boost your credit score.

Using the debt avalanche or debt snowball method, you can pay off your credit card debt as quickly as possible without straining your monthly budget. Once you get a low credit utilization rate, you may start seeing your credit score tick upward.

Making Your Payments On Time

Another factor that goes into calculating your credit is how you pay your bills. Making your payments on time will help to boost your score. The longer history you have of on-time payments the better.

The length of your credit history is another major component to calculating your score. When you have an account thats been open for several years with on-time payments, your credit score will go up. To help boost your score, keep your accounts open and keep up with your payments.

You May Like: What Credit Score Do You Need For Paypal Credit

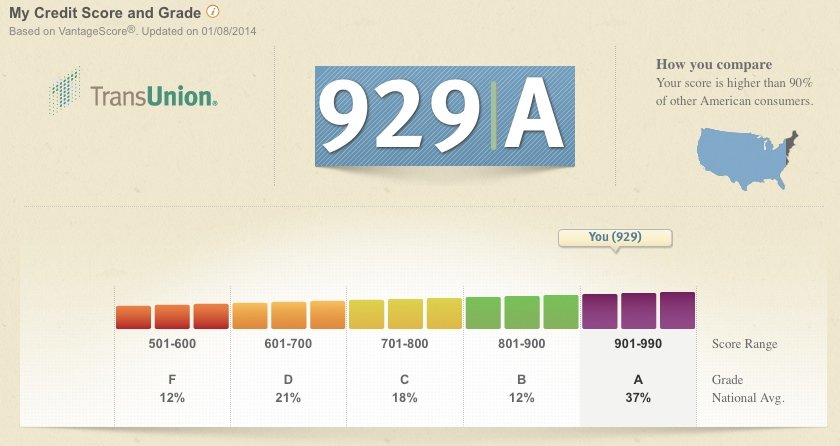

Is It Possible To Have A 900 Credit Score

Technically, the answer is yes but you would have to be very specific about which industry. FICO Auto Scores range from 250-900 and the Bankcard Score ranges between 300-850. There are many different versions of scoring models though so if your desired industry isnt one listed above then we can take this into consideration for our appraisal process.

What People Who Score 800 Or Higher Do

According to FICO, those who achieve ultra-high credit scores pay on time, use credit lightly, have a long credit history and rarely open a new account. Heres what they tend to have in common:

-

A of about 25 years.

-

Owes less than $3,500 on credit cards.

-

Uses only 7% of credit limit.

-

No late payments on credit reports .

Read Also: What Information Is Not Found On Your Credit Report

What Is The Perfect Credit Score

Want to have a perfect credit score?

We will tell you everything related to credit score. And will show you the ways through which you can get the perfect score.

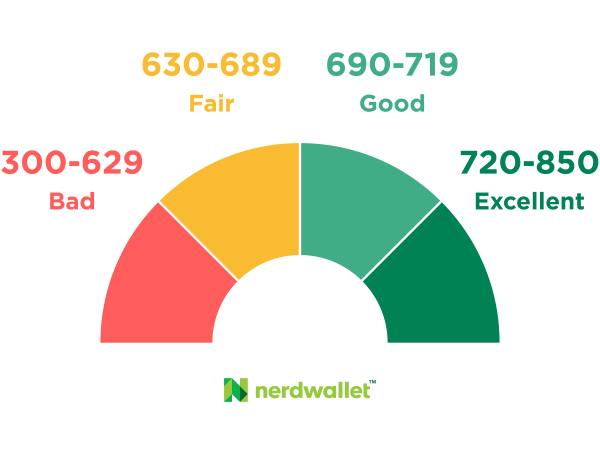

The highest credit score you can have is 850. At some places, you can see that score is 900 as well. Commonly the credit score ranges from 300 to 850. FICO and Vantage Scores are the most common versions of valuing credit scores. Any score above 670 is considered to be a great score.

According to researches, only 1.6% of U.S. citizens had a perfect Fico score. Credit scores are important for you to have. It determines your creditworthiness. Having a decent score can get you good rates from lenders for taking credit.

You May Also Like: Does checking credit score lower it?

Is It Possible To Raise Credit Score 200 Points In A Year

While its possible to make some progress in a year, it would be very difficult to raise your credit score by 200 points in that timeframe. A more realistic goal would be to focus on increasing your score by 100 points or so over the course of a year. This can be done by making on-time payments, keeping your credit utilization low, and maintaining a good mix of different types of credit accounts.

You May Like: What Should My Credit Score Be To Buy A Car

What’s The Highest Possible Credit Score

Ninety percent of all U.S. lenders use FICO® scores when determining creditworthiness, making it the most common scoring model. And the FICO 8 scoring model is the most popular among the FICO scores.

The FICO 8 scoring model has a credit score range of 300 to 850, making an 850 credit score the highest you can attain.

How To Get An 800 Credit Score And Above

You don’t need a perfect credit score, but if you’re looking to achieve an 800 credit score or higher, there are some concrete actions you can start taking now. Keep in mind, though, that it takes a long credit history and no derogatory marks on a credit report to establish and maintain a high credit score.

As you work toward improving your credit, here are some tips to help you get started:

Recommended Reading: How Do You Get Your Credit Score Up

Learn About The Highest Credit Score And Just How Perfect Your Credit Score Needs To Be

If youâve ever wondered what the highest credit score you can have is, itâs 850. Thatâs at the top end of the most common FICO® and VantageScore® credit scores. And these two companies provide some of the most popular in America.

But do you need a perfect credit score? Not necessarily. According to credit bureau Experian娉s research, a score above 760 could qualify you for the best interest rates.

What Factors Determine Your High Credit Score

It turns out that there are several key factors that go into determining your credit score. Heres a look at some of the most important:

1. Payment History One of the biggest factors impacting your credit score is your payment history. Lenders want to see that youve been consistent in making payments on time, and a history of late or missed payments can have a major negative impact on your score.

2. Credit Utilization Another important factor is your credit utilization ratio, which is the amount of debt you have relative to your credit limit. A high credit utilization ratio can indicate to lenders that youre struggling to manage your debt, which could make them hesitant to extend new credit to you.

3. Credit History The length of your credit history is also a factor, as a longer history can give lenders a better idea of your repayment patterns.

4. Types of Credit The mix of different types of credit accounts you have (such as installment loans, revolving lines of credit, etc.

Read Also: What Credit Score Is Needed For A Conventional Loan

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Can You Attain An 850 Credit Score With Bad Credit Or No Credit

If you had a late payment or other negative information added to your credit report, you may think that a perfect credit score is unattainable. Luckily, credit is self-healing with time and some effort on your end.

Most negative information on your credit history remains there for seven years, but Chapter 7 bankruptcy is an exception at up to 10 years. So if all you had was a late payment or collections account, you could attain that 850 by maintaining good credit habits and waiting for that seven- to 10-year clock to run out.

Suppose your credit score is less than 850 because of an issue you can control, such as credit utilization ratios or credit mix . In that case, you may be able to reach that perfect score even earlier by lowering your debt or getting a better mix of revolving and installment debt.

If youve never used credit or just havent used it in many years, chances are you have no credit score at all. In this case, building an 850 credit score is possible by managing the FICO Score variables you can control and waiting for your score to increase over time.

Don’t Miss: What Is China’s Credit Rating

Vantagescore And Fico Are The Two Main Credit

But even if you have pretty good credit habits, dont be surprised if you check your scores and find that youre below 850.

Perfect credit scores can seem to be inexplicably out of reach. Out of 200 million consumers with credit scores, the average FICO score is 704. And FICO says that as of April 2019, just 1.6% of Americans with credit scores had perfect FICO scores.

Pay Your Bills On Time Every Month

Paying your bills on time every month is a must if you want to maintain a good credit score. If youre struggling to make on-time payments, you may need to evaluate your budget and see whether there is anything you need to cut out to make room for more cash flow. You can also consider setting up automatic payments, so you know youre never late on a payment.

Read Also: How To Clear A Judgement On Your Credit Report

Characteristics Of Consumers With Excellent Credit

According to a report by FICO, users with the highest credit scores generally have a few things in common, like: 2

- An average credit account age of 11 years

- A below 6%

- Below $3,000 in debt across their revolving accounts

FICOs report also noted that:

- Less than 35% had applied for new credit in the past year

- 96% had never missed a payment

As one would expect, the two biggest takeaways are that perfect scorers make on-time payments and borrow responsibly. For example, their low credit utilization rates indicate that they dont max out their credit cards.

Review Your Credit Reports

Credit report errors happen. If a creditor reports negative information thats inaccurate or incomplete to the credit bureaus, it can damage your credit score. To catch and fix reporting errors, review your credit reports at least once a year.

You can view all three of your credit reports for free by visiting AnnualCreditReport.com. Normally, you can only view them for free once per year. However, due to the Covid-19 pandemic, you can receive free weekly reports until April 20, 2022.

You May Like: Does Arrowhead Advance Report To Credit Bureaus

How Missed Mortgage Payments Or A Foreclosure Affects Your Credit Score

Missed mortgage payments and a subsequent foreclosure will damage your credit score. Lenders report missed payments as 30 days late, 60 days late, and 90+ days late to the credit reporting agencies. According to FICO, a person’s credit score drops about 50 to 100 points when the lender reports the account as 30 days past due, and each subsequent delinquency lowers the score further.

After a foreclosure, your score will likely go down by at least 100 points. How much the score will fall depends, to some extent, on your score before the foreclosure started. Someone with a higher score before foreclosure generally loses more points than someone who already has a low score. Short sales and deeds in lieu of foreclosure have a similar effect on credit scores.

Beware of Credit Repair Scams

Avoid credit repair organizations that charge a fee to improve or repair your credit you can take steps to improve your credit yourself.

How To Get Your Credit Score For Free

You might be able to get your score for free from your credit card issuer. Getting a FICO score is more useful than a VantageScore because lenders use that score more frequently. Experian will also provide you with a free score based on the FICO Score 8 model, though you’ll have to create an account with the company to get it.

Also Check: How To Improve Your Company Credit Rating

How Many People Have Perfect Credit Scores

Now that you know what a perfect credit score is, you may be wondering how many people have actually achieved this feat.

FICO® credit scores range from 300 850. According to data from FICO®, about 1.6% of the U.S. population has a credit score of 850. This figure is up from 0.98% in April 2014 and 0.85% in April 2009.

For many people, reaching an 850 credit score can seem like a daunting task. However, when you look at the lifestyle and financial habits of those who have an 850 credit score, youll notice many commonalities.

This starts with where consumers live, as youll see in the chart below. The following five states contain the highest number of individuals with an 850 credit score:

How An Excellent Credit Score Can Help You

An excellent credit score can help you receive the best from lenders and give you a higher chance of being approved for credit cards and loans.

Many of the best cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers cardholders the chance to earn 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets but you’ll need good or excellent credit. Terms apply.

And if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you’ll also need good or excellent credit.

Take note that even if your credit score falls within the excellent range, it’s not a guarantee you’ll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Check out Select’s best credit cards for excellent credit.

Read Also: How To Remove Something From Credit Report