Phase One: Establish Business Credit

When youre building business credit whether you have a new business or a well-established one its tough to know which lenders may potentially help build business credit. These tips may help:

- Consider starting with a business credit card account. Most small business credit cards report to at least one of the major business credit reporting agencies.

- Vendor accounts that report to the business credit bureaus can be a good option for business credit newcomers. Often called tradelines these typically offer net- 30, net-60, and/or net-90 vendors. Most dont check personal credit.

- Navs Business Boost account helps build business credit with tradeline reporting.

Other Credit Bureaus To Take Note Of

Any organization that collects information about consumers and sells it to others is known as a consumer reporting agency. While this largely includes Experian, TransUnion and Equifax, there are other credit bureaus to be aware of. Here are some others you may want to know about:

- ChexSystems: Collects and reports information on closed checking and savings accounts.

- LexisNexis: Provides reports to lenders with information that Experian, TransUnion and Equifax dont collect.

- C.L.U.E. Inc.: Collects insurance-related information and creates consumer auto and personal property reports.

- CoreLogic: Supplies tenant screening reports to landlords. These reports may include any history of evictions and a background check.

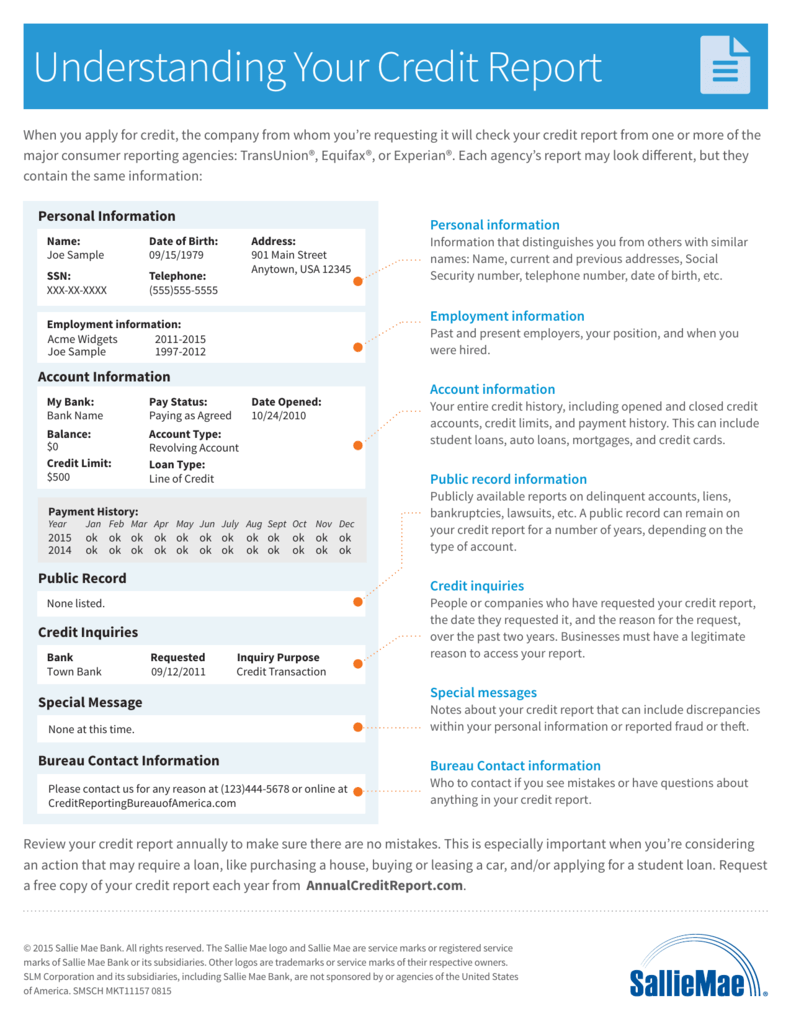

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Also Check: What Does A Credit Report Look Like

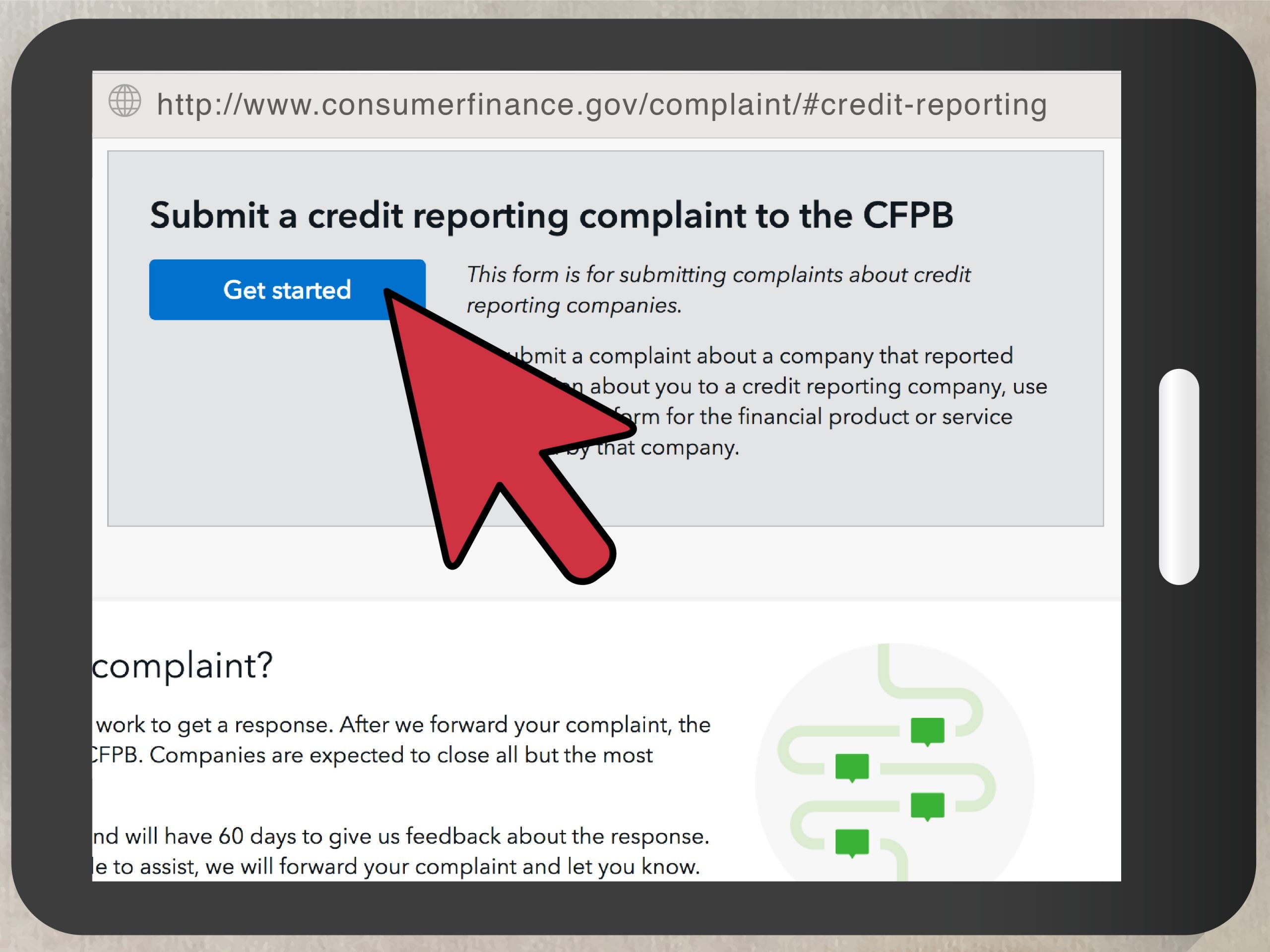

Who Oversees The Credit Reporting Agencies

Since 2012, the Consumer Financial Protection Bureau has been tasked with supervising the largest agencies at a federal level. The CFPB conducts exams to monitor how the credit reporting agencies screen for accuracy, investigate consumer complaints, and other procedures.

If you have a complaint with one of them, you can contact the CFPB, the FTC, and your state attorney general. It may seem like many steps, but its best to cover your bases and get as many regulators involved as possible if theres any potential wrongdoing.

What Consumer Information Do The Credit Bureaus Collect

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Laws editorial disclosure for more information.

The credit bureaus collect financial information on all consumers to create credit reports for each individual. The information in these credit reports determines your credit score, which can impact what kinds of financial opportunities you get access to. If youre prioritizing your credit, you should know what affects your score, and that includes learning what information the credit bureaus collect. This can help you improve and maintain a high credit score and secure a solid financial future.

You May Like: How To Get Student Loans Off Credit Report

What Information Do The Credit Bureaus Collect

The credit bureaus include an array of information that helps them determine your creditworthiness and assign you a credit score. Information they compile typically includes identifying information, like your name, addresses , Social Security number and date of birth, as well as information on the accounts you have had, balances you owe and payments you have made. They also collect the following information:

- Current and past credit accounts

- Payment history

- Negative information such as missed payment, collections, bankruptcies, repossessions and foreclosures

- Hard inquiries

The Credit Bureaus Must Follow Federal And State Laws

You may find it frustrating that the credit bureaus are allowed to collect sensitive financial information without your permission. Yet even though these companies can gather your information and sell it to others, there are some rules in place to protect you.

At the federal level, the credit bureaus must follow the Fair Credit Reporting Act . The FCRA exists to protect consumers and regulates what consumer reporting agencies are required to do when it comes to your information. The full text of the FCRA fills out over 100 pages, but some of the most important provisions of the act include:

In addition to the FCRA, the credit bureaus have state laws to comply with as well. For example, on top of the free annual credit reports provided by the FCRA, state law might require the credit bureaus to give you more free reports. Furthermore, in certain states, employers arent allowed to review your credit information as part of a background check.

Read Also: How To Remove Old Late Payments From Credit Report

How Does The Fcra Regulate Credit Reporting Agencies

In addition to ongoing government oversight, credit reporting agencies must also comply with the FCRA. This federal law helps to protect consumers by requiring the agencies to investigate all disputes within 30 days.

While this does not mean the credit bureaus now make sure your credit reports are accurate, it does give you recourse when they unfairly report your credit history. You also have a right to a free yearly copy of your credit reports.

Why Are Credit Scores Different

Also, note that the type of credit score a credit bureau assigns may be different ,and that you may get a FICO credit score from one and a VantageScore from another, for example. If you have your credit scores pulled at different times, you may also see varying scores due to the passage of time and more information being added to your credit reports.

You May Like: How To Dispute Collections On Credit Report

How To Dispute Errors On Your Credit Report

When you read your credit reports, its important to take a close look at them as there may be inaccuracies or errors. You may find errors such as:

- Identity errors: Your name may be misspelled or your address may be incorrect.

- Duplication errors: One of your debts is listed several times.

- Balance errors: The amount on your balance or credit limit is incorrect.

- Account errors: Your account may be reported as open when its actually closed or vice versa.

To report wrong info on your credit report, you can file a dispute. Its entirely free to file a dispute. Remember, if theres wrong info from all three bureaus, youll need to file a separate dispute with each bureau. If its just one report that has incorrect information, the dispute only needs to be filed with that particular credit bureau.

And when you file a dispute, under the Fair Credit Reporting Act, the credit bureau has 30 days to review and respond.

You can get started with the process by contacting the credit bureau directly:

TransUnion:

How To Dispute Incorrect Information

Its a good idea to regularly review your credit reports. You can get a free copy once a year from each of the credit bureausEquifax, Experian and TransUnion. Fortunately, you can do this online and for free using the website AnnualCreditReport.com.

While its smart to look over your credit reports to make sure you have a solid understanding of your debt obligations and your overall payment history, federal regulators note you should also check for errors. This is mainly due to the fact that incorrect information on credit reports is fairly prevalent, and it could even lead you to early signs of identity theft. You may also find a simple mistake on your credit reports that should be fixed, such as an account you paid off and closed that is still listed as open, or the same debt listed twice.

Fortunately, there is a formal process you can use to dispute incorrect information on your credit reports. Specifically, you will need to mail a letter to each of the credit bureaus with the incorrect information, as well as the company that provided the incorrect information. In your letter, youll need to include the following information:

- Your name and contact information

- An explanation of mistakes on your credit report

- A copy of your credit report with the mistakes highlighted or circled

- Supporting information that shows why the information is wrong

- A request for the information to be updated or removed

| Experian |

|---|

|

Chester, PA 19016-2000 |

Recommended Reading: How To Get Something Removed From Credit Report

Changes In Credit Reports From Bureau To Bureau

Your credit scores can vary depending on the bureau you check with. This can happen because of the possible differences in data that make up each report. For instance, creditors are not required to report information to credit bureaus. While many choose to do so, some may send your information to only a few of the main bureaus.2 This leads to variations in scores and reports across the board.

Bureaus also have a tendency to use independent scoring models that take different approaches when evaluating your credit reports. This can also result in different credit scores, even if the same report from the same bureau is being used.2

Fico Scores For Small Business

In some ways, business credit scores are a lot like personal credit scores. For example, you dont have just one credit score. You have many. Weve already mentioned scores from the major commercial credit bureaus. In addition, FICO produces a credit score specifically for small businesses called the FICO SBSS Score. This score can analyze data from the business credit report, the owners personal credit reports as well as financial and application data to produce the FICO SBSS Score.

Also Check: What’s The Highest Your Credit Score Can Go

What Are Credit Reporting Agencies

A credit reporting agency collects and records the credit information of both individual consumers and businesses.

In the United States, the industry is dominated by the largest three credit reporting agencies: Equifax, Experian, and TransUnion. They are three separate companies in competition with each other and, consequently, dont share information back and forth. So, its not uncommon to see different information from each credit reporting agency.

What Do I Do If My Reports Have An Error

According to a 2021 Consumer Reports survey, approximately 34 percent of participants had a mistake on one of their credit reports. That means even you may have an error on one of your credit reports. Youre legally entitled to a fair and accurate credit report, so you can file a dispute with the credit bureau in question if you do find an error.

You should always file a dispute if you find incorrect information on your credit report. Something as small as an incorrect spelling of your name or birth date could result in someone elses debts being added to your report. Other common mistakes are debts being reported twice or marked as owing even though theyre current, which can lower your credit score.

While you can file on your own, many people opt for credit repair services. Credit repair consultants will review your report for you, find any errors and file disputes on your behalf. The credit repair consultants at Lexington Law Firm can help you get back on track toward a path of strong credit and new financial opportunities.

Reviewed By

Recommended Reading: How To Clear Bankruptcy From Credit Report

Who Requests Credit Reports And Scores

A surprising number of businesses are interested in your credit report and score. Good credit scores are viewed as indicators of reliable and responsible financial behavior.

When a business does a credit check, they can make a soft pull or a hard pull on your credit report. Soft pulls are involuntary inquiries during a background check. They dont affect your credit score.

Hard pulls are considered voluntary inquiries, things like when you apply for a credit card, mortgage or auto loan.

Unauthorized hard pulls by a business can negatively impact your credit score. But you can ask the credit bureaus to remove it because the inquiry was made without your consent.

The credit-card industry has the most interest in your credit report because it supplies a temporary loan each time you use on its cards. The other obvious businesses interest in your score are mortgage brokers, auto dealerships and banks.

Some of the less-obvious businesses include insurance companies, employers, landlords, utility companies, licensing agencies, collection agencies and child support enforcement agencies. Each of them can file negative reports with credit bureaus if you fail to make timely payments on your accounts.

The insurance industry says there is statistical proof of a direct correlation between drivers with low credit scores and frequency/severity of accidents .

Why Check Your Credit Report

Your credit report is a record of how well you manage credit. Errors on your credit report can give lenders the wrong impression. If there’s an error on your credit report, a lender may turn you down for credit cards or loans, or charge you a higher interest rate. You may also not be able to rent a house or apartment or get a job.

Errors can also be a sign that someone is trying to steal your identity. They may be trying to open credit cards, mortgages or other loans under your name.

Take a close look at your credit report at least once a year to see if there are any errors.

Read Also: How To Find Out Your Credit Score

The Fair Credit Reporting Act Regulates Credit Bureaus

Federal and state laws govern what can and cannot appear in your credit reports and who can request a copy of your credit report.

The Fair Credit Reporting Act , which was passed in 1970 and has been amended several times, is one of the most important federal credit reporting laws. Some of its major rules include:

- Consumers can request a free copy of their credit report from each once every 12 months.

- Negative information, such as late payments, generally must be removed from credit reports after seven years, although certain bankruptcies can remain for 10 years.

- A person or company must have a “permissible purpose” to request a copy of a consumer’s credit report. These include the consumer’s permission or to make a lending decision after receiving an application.

- Consumers have the right to dispute information in their credit reports. The credit bureau must investigate non-frivolous disputes and verify, correct or delete the disputed information.

The FCRA applies to all consumer reporting agencies, not just the big three.

The Three Major Consumer Credit Bureaus Are Equifax Experian And Transunion

A credit bureau is a company that gathers and stores various types of information about you and your financial accounts and history. It draws on this information to create your credit reports, which in turn form the basis for your credit scores.

The three major credit bureaus are often grouped together. But theyre separate companies that compete for the business of , who may use the credit reports and scores from these bureaus to help them make lending decisions. And theyre not the only three bureaus out there.

Keep reading to learn about the data the credit bureaus collect, how credit bureaus get the information they use to create your reports and scores, and how you can contact them if you think somethings wrong.

Recommended Reading: What Is Experian Credit Score

Is Your Business Credit Report Accurate

Ultimately, only you the business owner can review your credit reports to determine whether they are correct. Thats just one reason why its good to review your business credit reports to make sure they dont contain mistakes. If you find inaccurate information, you will need to dispute it with the business credit reporting company that is reporting the mistake.

When Does The Credit Bureau Update Your Credit Score

Credit bureaus update your credit score whenever they receive new information. If there’s a change that hasn’t been reflected in your credit score , it’s probably because the company hasn’t reported that information to the credit bureau yet. If there is inaccurate or outdated information in your credit report, you are entitled to dispute it.

You May Like: When Does Kohls Report To Credit Bureau

Resources To Take Action

Under the federal Fair Credit Reporting Act , all consumer reporting companies are required to provide you a copy of the information in your report if you request it.

You are also entitled to a free credit report every 12 months from each of the three nationwide consumer reporting companiesEquifax, TransUnion, and Experian. You can request a copy through AnnualCreditReport.com.

As a result of a 2019 settlement, all U.S. consumers may also request up to six free copies of their Equifax credit report during any twelve-month period through December 2026. These free copies will be provided to you in addition to any free reports to which you are entitled under federal law.

Types Of Information Credit Bureaus Collect

There are numerous credit bureaus, and each one works differently. However, most big lending decisions are based on information stored at the three major credit reporting companies: Equifax, TransUnion, and Experian.

1. Personal Information

Personal information helps the credit reporting companies to identify you and distinguish you from other borrowers. That usually includes:

- Name, address, Social Security Number, date of birth

- Previous addresses

- Employment history

2. Public Records

Bankruptcies are the only public record to appear in credit reports, as of spring 2020. To comply with stricter reporting standards under the National Consumer Assistance Plan, by April 2018 the credit reporting companies purged all tax liens and civil judgments, including foreclosures, evictions, and wage garnishments.

3. Inquiries

Every time somebody asks the credit reporting companies about your credit, they make a record of it. These inquiries stay on your credit report for about two years. They may lower your credit score by a few points at first, but that usually only lasts for less than a year.

4. Tradelines

Tradelines are records of your loans and lines of credit, which is perhaps the most significant information collected by the credit reporting companies.

They detail the vital characteristics of each loan. They may go by a variety of names depending on the credit reporting company, but the general characteristics are:

- Type of loan

Read Also: Does Paypal Credit Report To Credit Bureaus