Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

What Is A Credit Score

A credit score is a numeric value, primarily a 3-digit number, which is used by lenders and lending institutions to assess an individuals creditworthiness. Based on this score, the bank or lending party decides whether or not the individual can repay the loan and whether they should be provided with a loan in the first place.

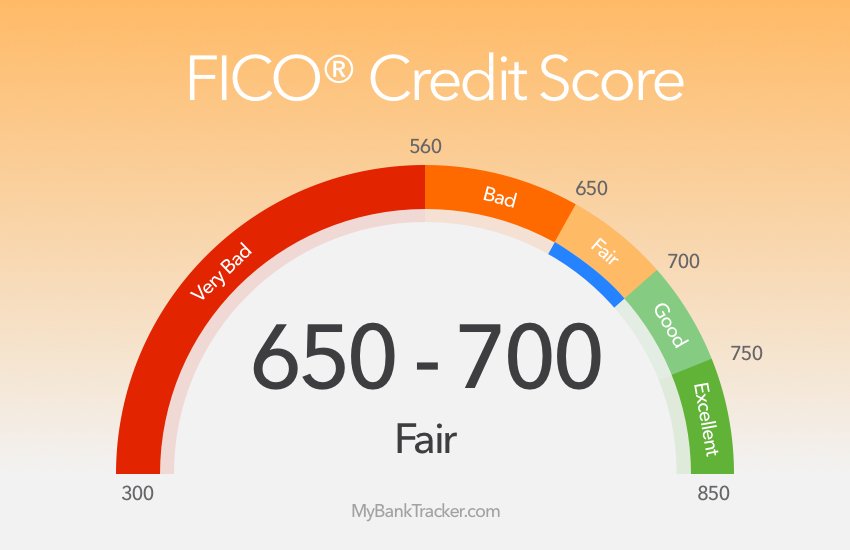

FICO score is the most commonly used score which ranges from 300 to 850, where 300 is considered poor, and 850 is the optimal score that gets you the best deals. A higher score also improves your chances of getting loan approvals and vice versa.

Manage Debt In A Responsible Manner

Following from the previous point, you can manage your debt more efficiently by doing the following:

- Go for planned purchases rather than succumbing to impulse buying.

- Use credit cards only when you really need to, utilizing cash otherwise.

- Set up automatic payments as soon as you have sufficient cash, for instance, right after payday.

- Consolidate your debt with a balance transfer offer.

Don’t Miss: What Credit Report Does Paypal Pull

Who Or What Decides If I Can Get A Loan

This decision is usually made by banks, credit card companies, auto dealers, retail stores, and other such lenders. Credit card companies can summarize a consumers credit history and decide whether or not to lend money. However, this decision may be made with the help of a credit score issued by the credit reporting agency. A credit reporting agency can never make this decision.

What Can I Do With A 700 Credit Score

The wonderful thing about having a credit score of 700 is that you can probably do almost anything you need to do . Whether 700 is at the high end of your credit range or the low end of your credit range, there are options. Keep in mind that in the 700 hundred range a person will not likely get the best interest rates. Some people choose to wait to buy a home or car until they have improved their scored to ensure better interest rates. So although you may qualify for any type of loan, it may not be the best time to. What you can do with a 700 hundred credit score is try to continue to improve it. As stated above, it may be best to keep just a few credit card with low balances and always make payments on time or early. Continue in this trend, and it is probably best to only use your credit on items that you absolutely must finance. If you can pay cash for a car? All the better. Likely you cant pay cash for a home, so continuing to build your credit score for when you do purchase a home may be a great financial choice to try to set yourself up for future financial success.

Learn more about your credit score and ways to improve it!

Don’t Miss: Does Klarna Build Credit

Watch Out For The Balance Transfer Trap

A 0% introductory APR is an outstanding benefit to have, but only if you use it the right way. And the right way is to pay off any balance transferred before the 0% APR introductory term ends.

To do otherwise is to put yourself in a potential trap.

Heres why

- Balance transfer fees. Credit cards routinely charge an upfront fee of between 3%-5% of the balance transferred. If you transfer $10,000, that will be $300 to $500, paid up front.

- The 0% introductory APR could convince you to keep the balance outstandingafter all, it wont be costing you any money.

- The 0% introductory APR will end, and then youll be subject to the regular interest rate. Its possible that rate will be higher than the one youre paying on the card you transferred the balance from.

If you wont be able to pay the balance in full within the introductory term you might want to avoid a balance transfer entirely. In that situation, itll just be moving debt from one credit line to anotherwith an interest rate reprieve in the middle.

What Credit Cards Can You Get With A 700 Credit Score

Although the prestige credit cards with rewards creeping up to 6 percent are probably still out of reach, a 700 score will put you into a better rewards bracket than those with a 600 score who qualify only for credit builder cards with minimal rewards, Rossman said.

Today, a 700 credit score has you in the ballpark, Rossman said. But other factors are going to tip the balance as to whether you get approved or not.

Lenders will take a hard look at your income, your debt-to-income ratio, late payments and recent debt.

Somebody who has opened a bunch of credit cards is going to look risky, Rossman said, as is somebody who has run up a bunch of debt.

Rossman said a consumer likely would qualify for a card like the Capital One Quicksilver Cash Rewards Credit Card, with 1.5 percent cash back and no annual fee, and the Citi® Double Cash Card, which offers 1 percent cash back when you spend and 1 percent back when you pay for your purchases.

Overall, Citibank and Bank of America tend to be a little more lenient in issuing premium cards, Rossman said, compared to American Express, Chase and Discover.

Factors in your favor include your relationship with the issuing bankif you have a checking account or mortgage at that bank, for instance.

Read Also: Carmax Approve Bad Credit

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

Reasons People With 700+ Credit Scores Still Get Rejected

Just because you have an excellent credit score doesn’t mean you will get approved for a credit card or loan. Your credit score is just one part of the credit underwriting process. Here are five reasons why you might get rejected, even though you have a great score.

1. You are a “gamer.”

As the bonuses have become richer, more people have become what the credit card industry calls “gamers.” These are individuals who move from one sign-on bonus to another, costing the credit card companies big money. Credit card companies are becoming more sophisticated in their efforts to block gamers. If you have taken advantage of multiple bonus offers in the past, don’t be surprised if a credit card company declines you in the future – even if you have an excellent credit score.

2. You have insufficient income.

Your credit score does not measure how much money you make. Most credit scores focus on your payment history, your total credit card debt and the history of your credit file. But the credit reporting agencies do not know your income.

Imagine the following borrower profile:

- Total credit card limits of $100,000

- No collection items

This is an excellent borrower profile. However, the lender does not know the applicant’s income. If the borrower only makes $30,000 a year, the $20,000 of credit card debt is a big warning sign. However, if the borrower makes $300,000 a year, the $20,000 of credit card debt is a lot less worrisome.

Shutterstock

Read Also: Is 586 A Good Credit Score

What Affects Your Credit Score

Whether you have a good credit score on its way to very good or excellent, or have a less-than-good score that youd like to improve, the factors that affect your credit score are generally the same.

Since your credit score depends in part on the credit scoring model used to generate it, how these factors are used can vary. But Equifax offers some useful guidance on what factors are considered and how important they are.

Blue Cash Preferred Card From American Express

Earn up to 6% cash back on everyday expenses with the Blue Cash Preferred® Card. Right now, the card offers 6% cash back on groceries and streaming services, 3% cash back on transportation expenses and gas and 1% cash back on other purchases. Along with that, the card has an intro APR of 0% for the first 12 months and users can earn a $300 statement credit if they spend $3,000 in purchases in the first 6 months. After the first year, users must pay an annual fee of $95. To get this credit card, youll need to have a credit score of about 700 or higher.

You May Like: Check Credit Score Without Social Security Number

Setting Up Automatic Payments

Assuming youre prone to overspending- despite successfully reaching a good credit score, we will let you rethink this.However, this is one of the easiest and ideal ways of keeping your scores above average.

This process allows banks or lenders to pull out money from your account so you wont have to worry about failing to meet your deadline. Through this, you will not only save time but also money, because you will avoid extra charges for returning money promptly.

You can consult with your lending company on how to make your payments automatic. Meanwhile, if you arent comfortable with this approach, simply jotting down reminders about the upcoming bills you have to pay could be an option. Your phone calendar or memos app would work well for this.

Why You Want A Score Above 700

A credit score above 700 essentially puts you in the prime category and opens up opportunities that arent available to consumers with lower scores, including:

- When you buy a home, you should get competitive mortgage interest rates

- When you buy a car, you may qualify for any 0% financing deals from manufacturers

- When you apply for a credit card, you may qualify for the best bonus and introductory offers

- When you apply for auto insurance, you will be considered more responsible and could get better rates

- When you apply for a job that requires a credit check, you could easily pass screening

You May Like: What Is Syncb/ppc

Frequent Credit Card Use Is Required To Take Full Advantage Of Rewards

Depending on the rewards offer, earning them can be a bit complicated. It may be easy in the first year, due to a generous sign-on bonus. But the ongoing rewards arent always so easy.

Take travel rewards, for example. If a travel rewards card offers two points for every $1 you spend, youll have to spend $1,000 per month to earn 2,000 points. In one years time, you can earn 24,000 points spending at that level, equal to $240 in travel purchases.

But the critical connection is being able to spend at that level every month. If you dont normally use a credit card, you may not accumulate a meaningful number of points.

What A 700 Credit Score Can Get You

As we have raised earlier, the higher your scores are the better. This suggests that a credit score of 700 instantly guarantees you into the good credit range.

Here is where you can get cheaper rates on more financial products, such as broader dealswith all sorts of loans. Because lenders consider people with scores like yours as solid business prospects, most banks would be willing to extend credit with good credit holders.

Note that a 700 credit score will also be good enough to purchase a house. You can find lenders who will consider you for higher value homes requiring jumbo mortgages.

It is understood that the good credit range begins at 690. This may help you get an unsecured credit card with a decent interest rates or balance-transfer card. A car loan and an emergency fund can also be offered. Meanwhile, an excellent credit score can immediately get you the bigger deals at the best rates.

Also Check: 524 Credit Score Good Or Bad

If I Close My Credit Card What Impact Will It Have On My Credit Score

Even once the account is closed, FICO formula will incorporate this account into the calculation of the utilization rate, which means that as soon as you have paid the outstanding balance in the account, your utilization rate and credit score will improve. However, as soon as the balance is paid in full, it will not be included in the calculation, thereby causing a nil effect on the credit score. In short, your credit score is impacted if a credit card is closed under the following conditions:

- It has an outstanding balance

- It has available credit

What Does A 700 Credit Score Mean And How It Affects Your Life

Having a 700 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to buy a car, you will be in a very strong position when applying for a mortgage and you will be able to get a large monthly limit on any credit cards.

However, you probably will not have access to the most exclusive offers and lowest cost finance rates which would be reserved for those in the excellent credit score group. They would not only be able to obtain cheaper finance, but also take out that finance over a longer period which reduces the size of the monthly payment that needs to be made.

Therefore, if you have a credit score of 700 it is worth trying to push it higher. Financial institutions use computer programs to make lending decisions. Moving your credit score higher means that the automated decision making in place will allow the credit professional you are dealing with to advance you more credit at a lower rate.

Financial institutions have a fixed amount of money they can lend to borrowers in each credit score category. This is known as their Risk Appetite. The limits and measures here are approved by the lenders Board of Directors so these limits are firm and cannot be changed easily.

The lending limits are generally higher the better the credit score of the borrower, so someone wishing to borrow a large amount had better have the best credit score possible.

You May Like: What Is Aargon Agency

Dispute Any Errors Promptly

If there are any errors on your report, you need to dispute them immediately. Contact the creditor, open a dispute, and provide documentation supporting your claim. Have the creditor provide written confirmation of the error, then ask them to report the corrected information to all three credit bureaus.

Wait 30 days and pull your credit again. If the error still appears, write a letter to each of the three credit bureaus, and include a copy of the creditors letter acknowledging the error. Based on that letter, the credit bureaus can remove the error and fix your credit report.

Good Credit Score Range For Auto Loans

When determining the interest rates for an auto loan, financial institutions typically rely on FICO® Auto Score 2, 4, 5, or 8. These scores range between 250 and 900. The higher the number the better the score. If youre shooting for the lowest possible APR on your auto loan your Auto credit score should be above 740.

We sampled auto loan interest rates from Unitus Community Credit Union to see how interest varied on a new car loan across a range of credit scores. The results can be seen in the table below.

New Auto Loans: Model Years 2014 and Newer

| 15.24% | N/A |

As with mortgages, the length of the loan also plays a huge impact in your rates. The longer the term on your auto loan, the higher interest you’ll pay. Having a good credit score can mitigate this negative effect.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Track Your Credit With Moneylion

It can help to sign up with a credit monitoring system like MoneyLions Credit Tracker. MoneyLions credit tracking service keeps tabs on your credit, alerting you whenever a new item appears on one of your reports. This can help you keep your inquiries in check and spot identity theft fast.

Credit builder helps to monitor your credit and track your progress, along with 0% APR Instacash to cover everyday expenses. This means youll have cash when you need it so you dont fall behind. You can even check your score without lowering it through the app for free.

Is A 700 Credit Score Good

As you can see from the credit score range chart, FICO views a 700 as right between good/average credit and actually good credit. So technically a 700 would be a good score. Remember though, that one score of 700 does not automatically mean you have good credit. Person A in the story above has more average credit based on the 3 numbers, while person B has good credit. The issue however, is that everyone is always hoping to have better credit. So even though person B has good credit even with their low score being 700, they also had a score of 750, which made them hope that they could fall into the excellent credit category and get excellent interest rates. This is why it is important not to compare to others . In comparison to person A, person B should be happy, but if person B doesnt settle for the good range then person B can work on raising their credit score averages to an even higher level.

Read Also: Does Klarna Affect Your Credit Score