Can Someone Run A Credit Report Without Me Knowing

It depends. Like we said earlier, there are soft inquiries and hard inquiries. Soft inquiries happen all the time without you even knowinga company might check your credit score if theyre planning on mailing you a promotional offer. These inquiries dont affect your credit score at all.

But hard inquiries require your actual consent before they can happen. These impact your credit score and cant legally be done without you knowing, so breathe easy. If you notice a hard inquiry you didnt authorize, youll need to dispute it with the credit agency.

How Does Information Get On My Credit Report And Is It Updated On A Regular Basis

When you have an account with a lender, theyll typically submit account updates to at least one of the three major credit reporting agencies TransUnion, Equifax and Experian. Since lenders dont always report to all three agencies, the information on your credit reports may vary.

Its also important to note that lenders report at different times of the month, so you might see slight differences in your reports, and therefore your credit scores, at any given time.

Your Name And Variations

Your could contain different versions, and maybe even misspellings, of your name. For example, your first and last name might appear along with your first and last name with your middle initial.

Your credit report is compiled using information from the;creditors and lenders you do business with.;The name you put on your applications is the name that appears on your credit report, so be consistent. Also, if creditors have misspelled your name, that misspelling will appear on your credit report.

You May Like: What Credit Report Does Comenity Bank Pull

Hard Pulls Vs Soft Pulls

When you apply for credit of any kind, you effectively authorize a business or individual to do what is called a hard pull or hard inquiry on your credit report. There likely will be a negative effect on your credit score from hard pulls, especially if several occur over a short period of time.

Hard pulls are another issue. Hard pulls are viewed as an indication that you need financial help to complete whatever transaction you are making, thus it has a negative effect on your credit score. The effect usually is slight, maybe 5-to-7 points, but if your credit score is on the borderline, it may drop to the wrong side of that line after a hard pull and affect the interest rate you are charged.

This should not discourage you from shopping at several lenders for auto or home loans. Fair Isaac Corporation calls this rate shopping, and allows a 45-day window where the numerous hard inquiries are treated as just one.

Will All Delinquent Bills Be Reported To A Credit Bureau

Most of them will eventually make it to your credit reports if you refuse to or cannot make your payments. It goes without saying that most of your traditional credit goes on your credit reports; auto loans, mortgages, credit cards, student loans and retail store cards. The following are somenon traditional types of credit that dont make it to your credit reports: utilities, cellular phone service and doctors bills. These credit items generally wont show up on your credit reports unless you stop paying them. Once you stop paying them theyll likely be sold off to third party collection agencies that will most definitely report them on your credit files. It may take a while, but eventually most will end up on your credit reports.

No Credit Card Required. FREE updates every 30 days.

Read Also: What Is Cbcinnovis On My Credit Report

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

The Business Doesnt Report To Any Credit Bureau

In the credit reporting world, businesses decide which of the three credit bureaus theyre going to subscribe to, if not all three. Your account will not appear on your credit report if the business doesnt subscribe to a particular credit bureau. This explains why you may see an account on just one of your credit reports but not the other two.

The account may not be a traditional credit account. Accounts like utilities, cable services, telephone, water, etc. fall into this category. Depending on the company and the state, some utilities may report to the credit bureaus, but theyre not required to do so.

Unfortunately, delinquent accounts may be reported even when regular, timely payments are not. So its important to pay on time even if you dont see the account on your credit report.

Many rent payments dont appear on renters credit reports, especially if youre renting from a smaller landlord who doesn’t subscribe to a credit bureau. Accounts with larger property management companies are more likely to appear on either your Experian or TransUnion credit report.

Historically, rent payments havent shown up on credit reportsexcept in cases of severe delinquencyso dont be surprised if your rental history isnt on your credit report.

Some third-party services will work with your landlord or property management company to report rent on your behalf, but you’ll have to subscribe to the service.

Read Also: Removing Hard Inquiries From Your Credit Report

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report.;An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life;

- disability insurance applications.

How Do I Get A Copy Of My Credit Report

Everyone is entitled to one free credit report per bureau per year by federal law. You can access yours at AnnualCreditReport.com. You’ll have to answer some security questions to verify your identity and then you can view your reports. You have the choice to view all three reports at the same time or to space them out throughout the year.

If you’ve already used your annual free credit reports for the year, you can purchase additional credit reports from the credit bureaus themselves. Some credit monitoring companies may also offer credit reports to customers who sign up for their services.;

Recommended Reading: What Credit Report Does Paypal Pull

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.;

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

What If The Cifas Marker Is There By Mistake

If you think a Cifas warning has been put on your credit file in error, you can contact the lender who put it there to see if theyll remove it.

Be aware that credit rating agencies are unlikely to remove any entry on your report if they believe the reason the marker was put on your credit file was justified. Lenders are legally obliged to report any fraudulent attempt on your account to the credit reference agencies.

Find out more about Cifas markers on the;Cifas website

Recommended Reading: Is 524 A Good Credit Score

Poor Credit Score: Under 580

An individual with a score between 300 and 579 has a;significantly damaged credit history. This may be the result of multiple defaults on different credit products from several different lenders. However, a poor score may also be the result of a bankruptcy, which will remain on a credit record for seven years for Chapter 13 and 10 years for Chapter 11.

Borrowers with credit scores that fall in this range have very little chance of obtaining new credit. If your score falls in it, talk to a financial professional about steps to take to repair your credit. Additionally, so long as you can afford to pay a monthly fee, one of the best credit repair companies may be able to get the negative marks on your credit score removed for you. If you attempt to obtain an unsecured loan with this score, be sure to compare every lender youre considering in order to determine the least risky options.

Doing things such as paying down debt, making timely payments, and maintaining a zero balance on credit accounts can help improve your score over time.

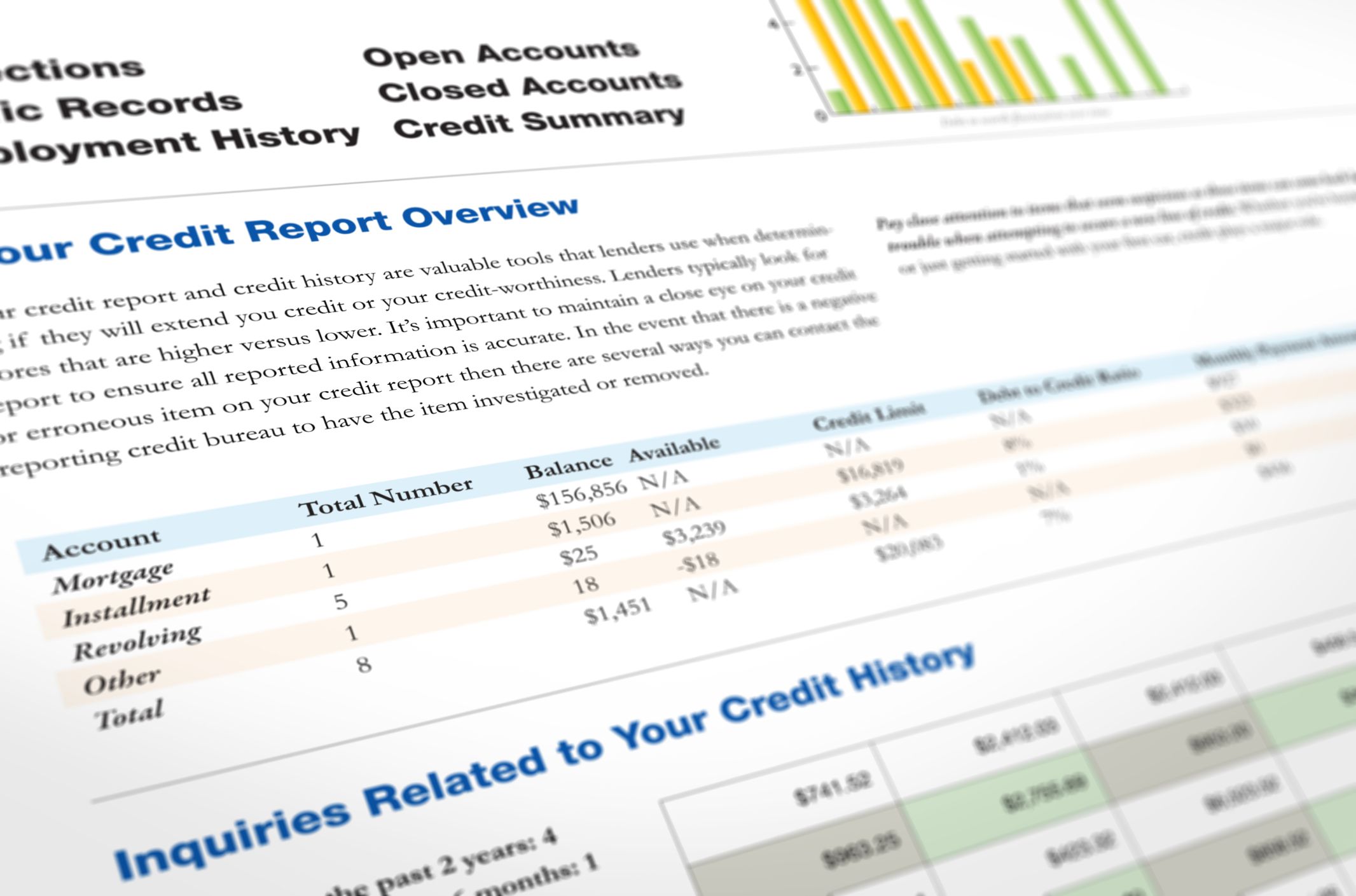

What’s In Your Credit Report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO Scores to inform future lenders about your creditworthiness.

Although each of the credit bureausExperian, Equifax and TransUnionformat and report your information differently, all credit reports contain basically the same categories of information.These four categories are: identifying information, credit accounts, credit inquiries and public records.

You May Like: Is 779 A Good Credit Score

Requirements For Employment Credit Checks

The best way to prepare for a credit check is to get a copy of your credit report as soon as possible. You are legally entitled to one free copy of your credit report every year from each of the three nationwide credit reporting companies. This way, you can check for any issues or errors and dispute them before an employer sees them.

You can also add a brief statement of dispute to your credit report to explain why an issue occurred. For example, you might explain that you were late on a car payment due to an emergency medical issue.

Since the employer needs your written permission to run a credit check, you’ll know whether you need to address any issues. Prepare a brief explanation of potential issues the employer might see and explain what you’ve done to rectify the situation.

Employers do understand that applicants experience financial challenges like unemployment, so past credit issues don’t necessarily mean you won’t be hired.;

When Does Info On Credit Reports Get Updated

We regularly get questions from readers who are curious about when a new account will show up on their credit reports and how often lenders report information to the bureaus.; As a result, we reached out to a selection of the largest credit card issuers for answers.; You can find information about their policies below.

| Within 30 days of approval | Monthly |

Don’t Miss: Zzounds Financing Review

Where Can I Get My Credit Report

Your credit report is available in a few different places and formats. The federal FACT Act entitles you to one free copy of your credit report from each of the three major credit reporting agencies TransUnion, Equifax and Experian every 12 months. It also entitles you to additional free credit reports if you were recently denied credit, employment or insurance or if youre a victim of fraud, unemployed or on public welfare assistance.

As part of TransUnions commitment to supporting all Americans during and after the COVID-19 health crisis, were pleased to offer you free weekly credit reports through April 20th, 2022 at the same place you would go for your free annual reports: annualcreditreport.com.

Another way to access your credit report information is through a subscription based credit monitoring product such as TransUnion Credit Monitoring. and become a member to get instant online access to your credit report and score with updates available daily. Youll also get interactive tools, key information and alerts to help you understand and stay on top of critical credit report changes and protect your report with just a click.

Exceptional Credit Score: 800 To 850

Consumers with a credit score in the range of 740 to 850 are considered consistently responsible when it comes to managing their borrowing and are prime candidates to qualify for the lowest interest rates. However, the best scores are in the range of 800 to 850.

People with this score;have a long history of no late payments, as well as low balances on credit cards. Consumers with excellent credit scores may receive lower interest rates on mortgages, credit cards, loans, and lines of credit, because they are deemed to be at low risk for defaulting on their agreements. Having an excellent credit score is particularly useful for qualifying for a personal loan, as it typically more than makes up for a lack of collateral.

Don’t Miss: Does Opensky Report To Credit Bureaus

How To Check Your Credit Report

It’s easy to check your credit report:

- Request your free credit report from Experian at any time.

- Check your at any time

- Visit annualcreditreport.com to request one free credit report from each of the 3 major credit reporting agencies every 12 months.

Who Can Check My Credit Report?

The Fair Credit Reporting Act limits who can view your credit report and for what reasons. Generally, the following people and organizations can view your credit report:

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and; include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.;

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.;

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

You May Like: Does Paypal Credit Report To Credit Bureaus

How Can I Get My Chexsystems Report

The Fair Credit Reporting Act requires ChexSystems to provide you with one free copy of your checking account report each year. See your options for submitting a request here.

You also have the right to pull a free copy of a ChexSystems report used in a decision to deny your application for a new account. After youve been denied, the bank or credit union is required to give you an adverse action notice, which will include contact information for the company that provided the report.

Whats Included In A Credit Report

A credit report normally includes your personal information, information about your credit accounts, any credit inquiries, and public record/collections information.

Personal information can include your name, address, social security number, date of birth, and place of employment.

are made anytime someone asks for a copy of your credit report. In this section, your credit report shows anyone who ever made an inquiry within the last two years, including yourself. Soft inquiries can take place without you knowing. For example, a credit issuer will check your credit report so they can send you a pre-approved card in the mail. A hard inquiry, on the other hand, requires your consent.

Account information will detail your credit history. It will likely include a list of all loans youve taken out, the balance left on those loans, what type of loans they are , and your payment history .

Public records listed in your credit report include information from state or county courts and collection agencies. The report will show any time youve been sued, declared bankruptcy, or foreclosed on a home, as well as any liens, wage attachments, judgments, or overdue debt.

You May Like: Does Speedy Cash Report To Credit Bureaus

Credit Cards That Check Transunion Credit Card

What exactly is what does transunion credit report show?

Fellas! Will you be Functioning as being a secretary in a business or Firm? Certain, you’ll get in cost in all letters issues. And yes, a what does transunion credit report show concern is one of a factor you ought to be master in. Even You’re not an staff, a what does transunion credit report show is vital for virtually any applications if you need to send a proposal to other Firm, enterprise or simply your Trainer. Figuring out how essential what does transunion credit report show applications are, we have an interest to discuss it today. Please continue to be tuned and luxuriate in looking through!A what does transunion credit report show is a proper and Experienced doc which is published by personalized, organization or corporation to its clients, stakeholder, organization, Group and plenty of more. This letter applications to deliver any facts, ask for, permission and a lot of extra professionally with The essential and common templates amongst people all over the entire world. Both a personal correspondent and firm need to build the Develop excellent by way of your what does transunion credit report show in sake of exhibiting your professional organization. Then how to really make it? Right here we go.

What Must Contain in what does transunion credit report show?Well, it’s the vital pieces you ought to mention inside your what does transunion credit report show. And, here the sections are:

| Title |

|---|

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.;

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Recommended Reading: Does Paypal Credit Do A Hard Pull