Why Bad Debt Is Removed After 7 Years

There is no limit to how long a creditor can pursue a debt, but there is a limit on the amount of time they have to take you to court to collect it. That limit is between four and six years, depending on the state you live in. There is also a limit on how long the debt can be reported on your credit report. For unpaid or delinquent accounts, the limit is seven years. Debts that are being reported past the limit are often due to misunderstanding or error.

If That Fails Wait For The Collection To Drop Off Your Report

Generally speaking, negative information is removed from your credit report after seven years. The clock starts from the first date your delinquent accounts are reported. This means if you miss one or more payments, then the account is sent to collection, the late payment information will be removed seven years after the first date of delinquency, not when it gets to collections.

Be aware, however, that just because a debt disappears from your credit report doesnt mean you dont have to pay it. If its not past the statute of limitations or the time frame when a creditor can sue you for a debt, then a creditor still has the right to pursue payment and even take you to court to recoup it.

Each state has its own laws that govern the statute of limitation on debt. Make sure you understand your responsibility to pay old debts based on your states laws. If necessary, seek counsel from a lawyer to make sure you are compliant with your debt obligations and will not end up paying more than required.

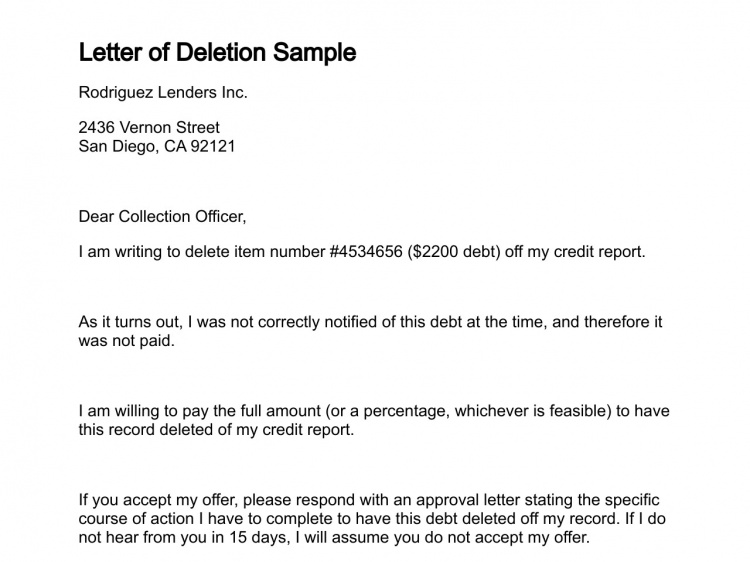

Should you negotiate a pay-for-delete agreement?

In some cases, you can negotiate what is called a pay-for-delete arrangement. With pay-for-delete, you pay all or a portion of the debt in exchange for the collection agency removing the account from your credit report.

Dispute Any Inconsistencies To A Credit Bureau

The first step to closing a settled account on your credit report is to dispute it.

You must study the loan or account closely and see if there is any inaccurate information.

If there is, then you can dispute inaccurate information.

This information can include personal details like your name and address to inconsistencies in repayments.

For example, you have kept track of making payments and when comparing your data to the records on the account it appears that they didnt receive or track a payment.

This is something you should dispute.

To dispute, you must contact one of the three credit bureaus.

Equifax, Experian, and TransUnion allow anyone to file a dispute online or by mail.

When filing your dispute you must provide your name, number of the account you are disputing, why youre disputing it, and supporting information and documents to prove that the dispute is valid and accurate.

After providing the credit bureau with your dispute and supporting information they must look into it.

They have a timeline of 30 days to begin the investigation process.

If the credit bureau finds anything, they will inform you in writing through the mail.

If the settled account was faulty, it will then be removed from your account.

The only way it will appear again is if the creditor proves it was accurate.

This is a great way to not have the account affect your score negatively but in most cases, it will still remain on your report.

You May Like: Why Wont Equifax Give Me My Credit Report Online 2017

Dispute After 7 Years

According to the Fair Credit Reporting Act , past-due accounts can only remain on your credit report for seven years from the first date of delinquency. Sneaky collectors often try to re-age a debt, making it look like the account became delinquent later than it did. This re-aging keeps the debt on your credit report longer.

If the seven-year reporting period is up , dispute the debt from your credit report. Any proof you have regarding the first date of delinquency will strengthen your dispute.

How To Remove Collections From Credit Report

Having collections on your credit report hurts your score. There are 3 ways you can remove collections from your credit report without paying. 1) sending a Goodwill letter asking for forgiveness 2) disputing the collections yourself 3) working with a credit repair company like Credit Glory that can dispute it for you.

Recommended Reading: Do Credit Checks Affect Your Credit Score

Why Is My Account In Collections Not Showing Up On My Credit Report

There can be multiple reasons why your account in collections is not showing up on your credit report. Below are some potential reasons:

- Past The Statute of Limitations Accounts in collections disappear from your credit reports after 6 years.

- System Error Sometimes technological errors or glitches can cause disturbances to your credit report. These are typically temporary and your collections account will likely reappear.

- Its In Transition If your debt was recently sold to a collection agency, it may be in the transitionary period where the debt is being moved from the original creditor to the collection agency.

- Its Paid Off If you or a loved one has paid off your collections account, the account will not disappear but may look different. It should appear as satisfied.

Step Four: Lodging Complaints Against The Collection Agency

If the steps above do not bring about a deletion then you can lodge complaints against the collection agency with the Consumer Financial Protection Bureau here. Anyone or a combination of the potential violations below can be used to file the complaint and demand a deletion:

1. Collection agency failed to provide you with validation for the debt

2. Collection agency failed to mark the debt as disputed on the credit report

3. Collection agency reported the debt with an incorrect date of last activity on your credit report

4. The collection agency is reporting an account that is 7 years old

5. The collection agency is reporting a paid debt as an unpaid one.

6. The collection agency sent you a collection notice for a debt that was past the statute of limitations for your state and failed to specify that they cannot sue you.

Read Also: What Is Included In A Credit Report

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

If You Find An Error In The Report Dispute The Collection

Errors on your credit report can be removed or corrected. In most cases, you have to initiate this process. For incorrect information, you can file a dispute with the credit bureaus to have the accounts investigated. Your dispute letter should include:

- Your contact information: Complete name, address, and telephone number

- A clear list of each mistake with account numbers

- An explanation as to why and how the information is incorrect

- An explicit request for the information to be removed or corrected

- A copy of your credit report with the erroneous items highlighted

- Supporting documentation proving how the information should be reported

There are many ways you can contact and dispute items on your credit report. The Consumer Protection Bureaus guide on disputing credit report errors contains the following directory of each the credit reporting agency and where to send disputes:

According to the Fair Credit Reporting Act , credit reporting agencies and furnishers must investigate and respond to disputes within 30, and sometimes up to 45, days of receiving your . If the information is found to be correct, then it will remain on your report. Otherwise, it will be removed or updated.

Also Check: Does Asking For A Lower Interest Rate Affect Credit Score

The Pay For Delete Alternative

If you havenât yet paid off the account you hope to delete from your credit history, you may benefit from a âPay for Deleteâ arrangement. This is the term used when a borrower pays a debt in full, and – in exchange – the debt collections agency agrees to remove the item from the borrowerâs credit report.

Many debt collection agencies will not remove paid-off delinquent accounts because they have contracts with the credit bureaus that require them to keep accurate information on your credit report for as long as possible. The contracts have this clause written into them because the customers of the major credit bureaus want to see these items. This way, they can make more informed decisions about whether to offer credit or a loan to a given borrower. If a paid-off collections account shows up on the borrowerâs credit history, the lender may charge the borrower a higher rate of interest or even decline to extend credit, in some cases. This is permissible under the Fair Debt Collection Practices Act.

If a debt collection agency or debt collector was to violate its contract with the credit bureaus by removing an accurate paid-off account from a borrowerâs credit history, then it could lose its contract with the bureaus and thus go out of business.

Can Paid Collections Be Removed From A Credit Report

If you dont want to wait seven years for the paid collection to drop off your credit report, you may be wondering how to remove paid collections from a credit report.

When a debt is said to be sent to collection it means that the lender has given up on trying to get that money from you. Instead, they have employed a debt collections company to pursue the debt. This is bad for your credit report because it reflects badly on you as a debtor.

Accounts that get to the collection stage are considered seriously delinquent. It means that someone lent you money but you didnt repay it even after they did everything in their power to get you to pay it back. They had to send a debt collections company to try to collect money from you. Lenders dont want to give money to someone that has a bad record of repaying their debts. A collection will have a significant, negative impact on your credit score.

The problem is that, even if you then pay off this debt through the debt collection company, the collection still remains on your credit report. So even if you no longer owe the lender money, your credit score will still be negatively affected.

Luckily, there are some strategies you can employ to get paid collections removed from your credit report.

Don’t Miss: How Do You Get A 800 Credit Score

Offer Pay For Removal

Pay for removal is when you request that the debt collector removes a collection entry from your credit bureau for payment. Theres nothing that requires the debt collector to agree to this. Whether a debt collector agrees to this usually depends on the debts age and the amount, and your previous account history.

Before you request this, make sure youre aware that by offering pay for removal, youre agreeing to pay the full amount owing to the debt collector, plus any interest and fees. If you were in the position to do this, you probably wouldnt have ended up in collections in the first place, so this isnt always feasible.

Remove Debt Collections From Your Credit Report

The Balance / Daniel Fishel

Many creditors send your account to a debt collector if you have left it unpaid for several months. The debt collector will then have the job of pursuing you for payment by calling you and sending letters, sometimes even making an offer to settle on the debt.

Once the debt collector has been assigned or the account sold, part of their practice is to list the account on your credit report showing that you have an outstanding debt. Because it indicates severe delinquency, having a debt collection on your hurts your credit score. Even though a collection will affect your credit less as it gets older, the entry will remain on your credit report for seven years for future creditors and lenders to see and scrutinize. The best option for dealing with collection accounts is to have them removed from your report.

You May Like: How To Get Hard Copy Of Credit Report

Will Making Payments Change The Timeline Or Keep A Collection From Falling Off Your Credit Reports

In general, making payments on a debt in collection should not affect the time it stays on your credit reports.

As the Consumer Financial Protection Bureau notes, however, in some states a partial payment can restart the time period for how long the negative information appears on your credit reports.

A partial payment can also restart the statute of limitations, or period of legal liability, for the debt. If the debt is still within the statute of limitations, a debt collection agency may choose to sue you for your unpaid debt. Each state has its own statute of limitations that determines how much time a debt collection agency has to take legal action, but for many states it ranges from three to six years.

If you do pay off an account in collections, the collection agency may be able to contact the credit bureaus and remove the collection account from your credit reports before the seven-year mark.

You may have to do some extra pushing to make this happen.

Before paying off an account in collection, get on the phone with an agent from the debt collection agency and confirm that the agency will update your credit reports. If the agent cant or wont agree to remove the paid account from your credit reports, ask if the account can be updated as paid as agreed upon once your payment/s are received.

How To Remove Collections From A Credit Report Canada

Note that the tips included here assume that a collections account assigned to you is accurate. If you find a collection account on your Canadian credit report that isnt yours or that has incorrect information, youll want to dispute it with the credit bureau thats reporting the information before doing anything else.

If you want to remove accurate collections from your credit report in Canada, follow these steps:

- Ask for debt validation. Once you are contacted by a debt collector, send them a letter requesting that they validate the debt. Ask them to verify the name of the original creditor, the amount owed and whether the debt is still within the statute of limitations for your province. Debts that are outside the statute of limitations are no longer considered collectable.

- Request pay for delete. Pay for delete is essentially an agreement in which you ask the debt collector to remove a collection account from your credit report in exchange for payment. Whether they agree to this usually depends on how old the debt is, how much is owed and your past account history. Keep in mind that if youre asking for pay for delete, its with the expectation that youll pay the full amount owed, including the original balance as well as interest and any fees charged by the collection agency.

Don’t Miss: How Does Leasing A Car Affect Credit Score

How Many Points Will My Score Increase When A Collection Is Removed

Your credit score is always a moving target. Positive and negative events may constantly be added or subtracted from it, though most likely, theyll be added before being removed.

The latest scoring models, FICO 9 and VantageScore 4.0, mostly ignore paid collections. The accounts will still be on your credit report, but they wont hurt a score as much as not paying the account would.

Many creditors, however, may still be using older versions of FICO. FICO 8 ignores collections under $100, but the one used by mortgage lenders still counts all collection accounts. You can ask your lender which credit scoring model it uses before applying.

Its difficult to say how much a credit score can increase when a collection is removed. If you check your score regularly and know what it was before the collection was listed on your report, then you can compare it to what it was before the collection was deleted.

If your score fell 50 points when a collection was added, then it should increase by 50 when its deleted. Your lender may be able to give you an idea of what to expect.

There are reports of credit scores rising by more than 100 points within 45 days of paying off collection accounts.

When it comes to removing collections from credit reports, time is on your side.

How To Remove Collections From Credit Report: Dispute It

Your first shot at removing debt collections accounts from your credit report is to dispute the debt. One scenario happens when the account is not your debt at all. Again, you should catch and dispute this within 30 days. Doing so will make your life easier, but if you miss the deadline, you have other options.

Simply put, you cant be held responsible for a debt that isnt yours. You will have to submit a credit report dispute. This dispute goes to the three credit bureaus, Experian, Equifax and TransUnion, who can then remove the debt from your report.

You can also submit a dispute when your debt collection has been sold from one collector to another. When this happens, the account information on your report often ends up outdated. Then you can send in a dispute to have the older account removed.

Lastly, you may dispute the debt collection account after seven years. But isnt the account automatically removed from the report after seven years? Typically, yes. However, some collectors may try to re-age a debt to keep it on your report even longer. So if you notice that a debt collection account remains on your report after seven years, be sure to dispute it immediately. Providing the bureaus with proof of your original overdue account dates will help.

Don’t Miss: Is 730 A Good Credit Score