What Is A Good Credit

Unfortunately, there isnt a straightforward answer. Each insurer decides what a is, so numbers can vary. However, your regular credit score can often give you an idea of how good your insurance score is.

About the author:Kayda Norman is a NerdWallet authority on auto insurance. Her work has been featured in The New York Times, The Washington Post and USA Today.Read more

NerdWallet averaged rates for 40-year-old men and women for all ZIP codes in any of the 50 states and Washington, D.C., in which the insurer was one of the largest insurance companies . Good drivers had no moving violations on record and an insurance credit score considered good by each insurer a good driving discount was included for this profile. Sample drivers had the following coverage limits:

-

$100,000 bodily injury liability coverage per person.

-

$300,000 bodily injury liability coverage per crash.

-

$50,000 property damage liability coverage per crash.

-

$100,000 uninsured motorist bodily injury coverage per person.

-

$300,000 uninsured motorist bodily injury coverage per crash.

-

Collision coverage with $1,000 deductible.

-

Comprehensive coverage with $1,000 deductible.

In states where required, minimum additional coverages were added. We used the same assumptions for all other driver profiles, with the following exceptions:

Check Your Credit Report Regularly

Your credit score could be low due to various reasons payment defaults, multiple credit requests, reports not being updated despite dues being cleared, etc. Regular credit report checks can help you keep track of errors in your credit activity, which can be flagged to the concerned credit bureau for rectification.

Does Income Play A Role In Having A Perfect Fico Score

Income is not a factor in determining your FICO® Score. While access to some credit products can be restricted by your income and financial situation, when it comes to achieving a perfect credit score, income is not a barrier.

In fact, in the fourth quarter of 2018, a little over 38% of perfect FICO® Scores were held by people with an estimated average annual income of $75K or less, according to Experian data.

Obviously, having more money can help you pay your bills, but building a healthy credit score really comes down to the basics of paying your bills on time every month and maintaining low , or the amount of debt you carry compared with total credit available.

Recommended Reading: How Is Your Credit Score Determined

Read Also: Can You Get A Mortgage With A 600 Credit Score

Types Of Accounts That Impact Credit Scores

Typically, credit files contain information about two types of debt: installment loans and revolving credit. Because revolving and installment accounts keep a record of your debt and payment history, they are important for calculating your credit scores.

- Installment credit usually comprises loans where you borrow a fixed amount and agree to make a monthly payment toward the overall balance until the loan is paid off. Student loans, personal loans, and mortgages are examples of installment accounts.

- Revolving credit is typically associated with credit cards but can also include some types of home equity loans. With revolving credit accounts, you have a credit limit and make at least minimum monthly payments according to how much credit you use. Revolving credit can fluctuate and doesn’t typically have a fixed term.

How To Maintain A Solid Credit Score

Although the credit-scoring models vary, theyre often similar enough that your scores will rise or fall in tandem. Knowing what factors impact your credit can help you improve your scores and increase your chances of being approved for credit cards and loans with lower interest rates.

To help keep your credit scores on the up-and-up, be sure to pay your bills on time and in full each month, maintain low balances, avoid closing credit card accounts whenever possible, minimize the amount of new accounts you open and sustain a good variety of credit accounts.

You should also check your credit score often to identify potential fraud, identity theft or legitimate errors, which can all bring down your credit score. You can check your credit score for free at LendingTree.

Recommended Reading: What Credit Score Do You Need For A Discover Card

The Purpose Of A Credit Score

Before we dive deep into the factors that shape your credit score, it helps to understand why companies care about credit scores in the first place. Spoiler alert: Its all about the money.

The FICO Score, used by 90% of top lenders in the United States, analyzes the information on your credit report. Then, it predicts how likely you are to pay a bill 90 days late within the next 24 months.

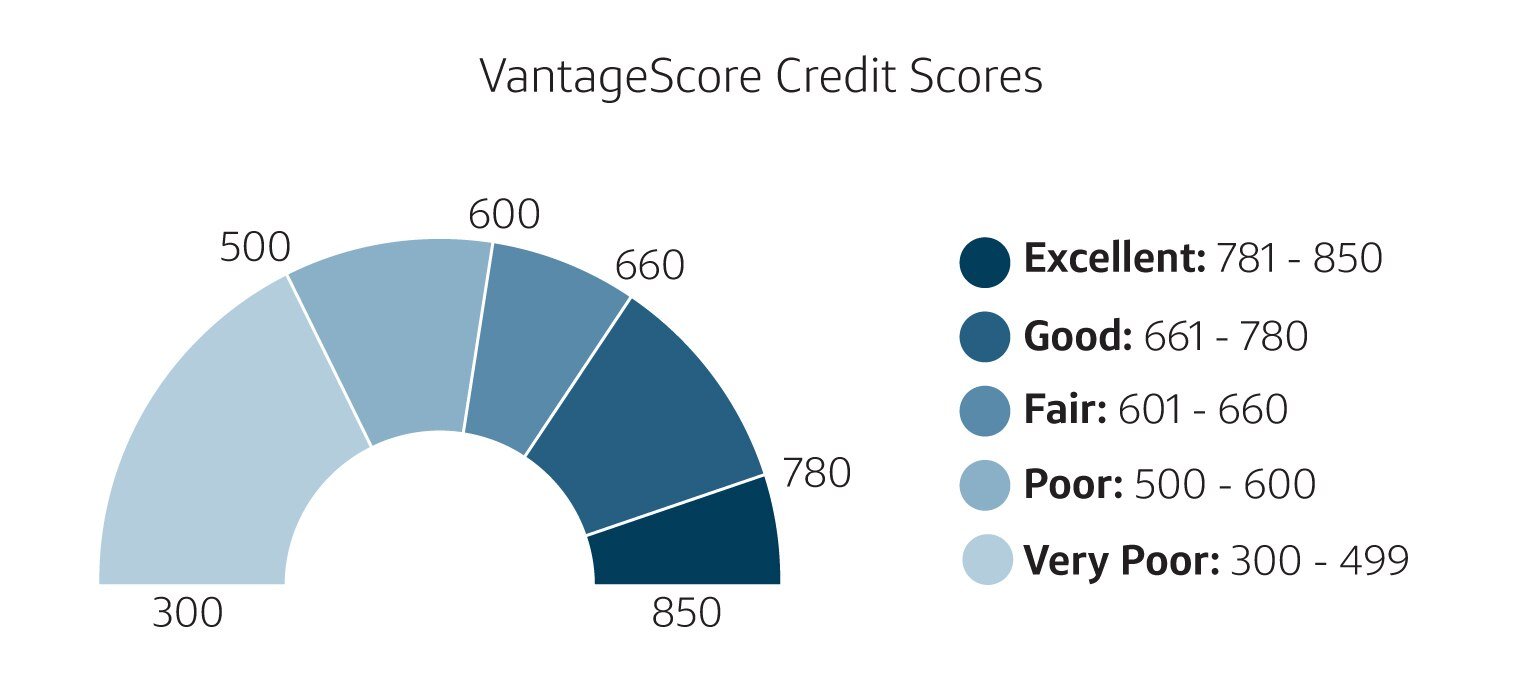

FICO scoring models rank-order credit reports on a scale of 300 to 850. If your score falls on the higher end of that range, you have a good credit score. That higher score tells lenders youre less likely to fall seriously behind on credit obligations. If your score is low, the lender knows that the risk of you paying late is greater.

Related: How To Improve Your Credit Score

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Recommended Reading: How Often Can You Request A Credit Report

What’s In My Fico Scores

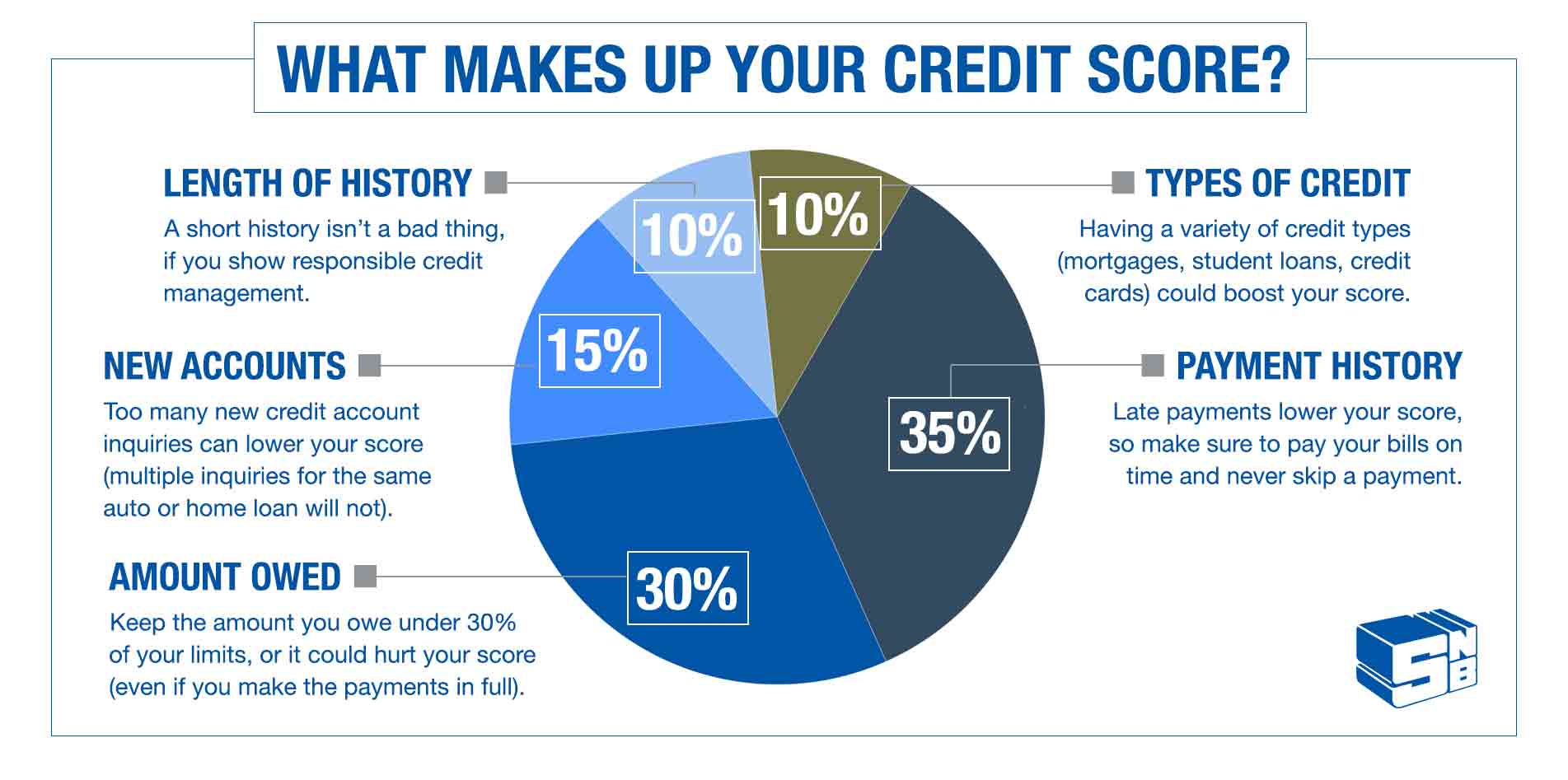

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix .

Your FICO Scores consider both positive and negative information in your credit report. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The importance of these categories may vary from one person to anotherwe’ll cover that in the next section.

Why Does Your Credit Score Matter When Applying For A Personal Loan

Youll need a few things before you apply for a personal loan, but the first thing you should do is take a look at your and review your credit reports. Equifax, Experian and TransUnion, the three main credit bureaus, each report a different score based off of different scoring models.

Your are important because they provide lenders with clues to determine whether they think youll be a responsible borrower who will pay back the loan on time and in full.

Lenders want to ask themselves, if I lend you money, will you pay me back?’ said Jim Droske, the president of Illinois Credit Services.

Plus, the better your credit, the more likely you are to get favorable terms like lower interest rates on your loan. You can use a number of services to check your Equifax and TransUnion scores, which use the VantageScore model, or use Experian to check your score based on the FICO 8 model. Note, the FICO 8 model gets used in about 90% of lending decisions in the U.S.

Read Also: What Credit Report Does Capital One Use

What Goes Into A Credit Score

While there are various credit scores, 90% of top lenders use FICO® Credit Scores, including Discover.1 While the exact FICO® Score formula is proprietary, FICO breaks down the general categories and weight additionally. According to FICO, these percentages refer to the general population, but may vary from one person to anotherfor instance, the relative importance of the categories may be different for consumers who have not been using credit long.

Hire A Credit Repair Company

You can correct your credit reports yourself, but many consumers hire a credit repair agency to do the work on their behalf.

The credit repair agency will typically lodge a specified number of challenges each month. The goal is to have a bureau and/or lender or merchant validate or remove the disputed data. Below are our top-three recommended credit repair companies:

| $79 | 9.5/10 |

Credit repair companies work on a monthly subscription basis, usually for about six months, although you can cancel at any time. Weve found that the agencies we evaluate charge reasonable fees for the work they do.

Recommended Reading: What Have You Heard About Building Your Credit Score

Don’t Miss: How To Get Irs Lien Off Credit Report

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, the best way to help improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows that you can responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services will notify you after certain updates have been made to your credit report and credit score, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if youve been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services. Some institutions may offer it for free under certain conditions.

Read Also: Is 717 A Good Credit Score

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

What Is A Credit Score

A credit score is a number from 300 to 850 that depicts a consumers . The higher the score, the better a borrower looks to potential lenders.

A credit score is based on : number of open accounts, total levels of debt, repayment history, and other factors. Lenders use credit scores to evaluate the probability that an individual will repay loans in a timely manner.

There are several different credit bureaus in the United States, but only three that are of major national significance: Equifax, Experian, and TransUnion. This trio dominates the market for collecting, analyzing, and disbursing information about consumers in the credit markets.

Also Check: What Is The Free Annual Credit Report Website

What Does Your Credit Score Start At

It all depends on how you start using credit. Some people wonder whether the starting credit score is zero, for example, or whether we all start with a credit score of 300 . The truth is that theres no such thing as a starting credit score. We each build our own unique credit score based on the way we use credit.

If you havent started using credit yet, you wont have a credit score. You begin to build your credit score after you open your first line of credit, such as a credit card or a student loan. At that point, your credit score is determined by the way you use that initial credit account. As lenders report your credit activity to the three major credit bureaus , youll begin to build a credit file that will be used to determine your starting credit score.

According to FICO, the minimum scoring criteria is as follows:

It is important to note that you can meet these requirements with just one account or several.

What is the starting credit score? Thats the wrong question to ask, since the answer doesnt technically exist. Instead, ask yourself how you can build the best credit score possible.

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Also Check: How To Self Report To Credit Agencies

Increase Your Credit Mix

If you don’t have access to a personal loan, or you donât have many credit cards, your score is probably low and you have no real way to increase it fast. Thatâs why some people are taking to a new option that adds monthly payments you already make to your credit report.

Experian has trademarked this process, calling it Boost , and it does provide instant results for many people. The process is relatively simple, and it works like this:

- You ask your rental management company, utility company, or a third party like Experian to start reporting your monthly payments this gets added to your credit report as âpayment historyâ when this payment history is recalculated against your credit usage and total outstanding balances, your score goes up.

You can even request something called a âlook backâ where they pull your total payment history and they add that into the calculation. This is an excellent option for people with great payment histories , but who donât have a lot of cash or credit usage.

Speed Impact: Immediate

What Is A Credit Report

A is a summary of how you pay your financial obligations. It contains information based on what you have done in the past. Lenders use it to verify information about you, see your borrowing activity and find out about your repayment history. Some of the information on your credit report is used to determine your credit score.

Recommended Reading: How To Remove Serious Delinquency On Credit Report

What Affects Your Fico Score

While FICO doesnt reveal its scoring formula, it gives useful guidelines about the factors that matter for scores. As you can see, paying on time and keeping balances low account for about two-thirds of your score:

-

Payment history : Late payments can really hurt your score, as can accounts in collections or a bankruptcy.

-

Amount of debt relative to credit limits : This is how much of your available credit you are using the less, the better for your score.

-

Age of credit : This refers to how long youve had credit and the average age of your credit accounts.

-

Recent applications for credit : A so-called hard inquiry when you apply for new credit can nick your score for up to six months. That’s why it’s important to research credit card offerings and eligibility requirements before applying to one.

-

Whether you have more than one type of credit : Having both installment loans and revolving credit can help your score.

How Is A Credit Score Calculated

Although credit-scoring algorithms are industry secrets, credit-scoring companies do reveal the basics of what factors impact a score and how a credit score is calculated and it all starts with your credit reports.

There are generally three places to find your consumer credit report: Experian, Equifax and TransUnion. These are the three main credit bureaus that collect consumer credit information in the U.S. Each credit report contains information, such as your history of payments on credit accounts, whether you have an account in collections and other personal identifying data and public records, such as bankruptcies.

turn the information in your credit report into an easy-to-use number. Think of them like your grade point average in school all your exams are included on your credit report, and the credit score is your final GPA.

Your credit reports arent necessarily identical, and your credit score may vary depending on which credit report the score is based on. Additionally, there are many different credit-scoring models and each may calculate your score in a different way.

Recommended Reading: Do Payday Loans Show On Credit Report Australia