Paid Off A Student Loan Or Car Loan

Paying off any loan is an achievement that’s worth celebrating. But the types of credit you have also are considered high impact on your VantageScore® 3.0. This means having a good mix of credit between revolving debt and installment debt . If you pay off the only loan you have, that affects the diversity of your accounts.

Other Reasons Your Credit Score Could Drop After Paying Off Debt

Although the most common reasons for a score drop after paying off debt are listed above, there are a few other possibilities.

Here are some things to keep in mind if you notice a change in your score after paying off debt:

- You paid off an older collections account: In some cases, making payments on an old collections account can lead to the collection agency changing the date of the debt. Since the debt resurfaces as a newer account on your credit report, it may make a larger impact on your score.

- Not enough time has passed since paying off the debt: The credit bureaus may not get information about your debt payment for 30 days or more, so youll want to check your credit report to see whether the account is marked as paid off.

- Your score drop is unrelated to paying off debt: Although your credit score may drop after paying off debt, that may not be the reason your score dropped. Credit scores are a complicated calculation, and there could be many other reasons for a change in your score. For example, you may have applied for a new line of credit, have a missed payment on a different account, or have inaccurate information on your credit report.

In any case, if you notice a credit score drop, youll want to make sure to get a copy of your credit report. After looking at your report for each of the three credit bureausTransUnion®, Experian® and Equifax®youll have a better idea of the information theyre reporting about you.

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

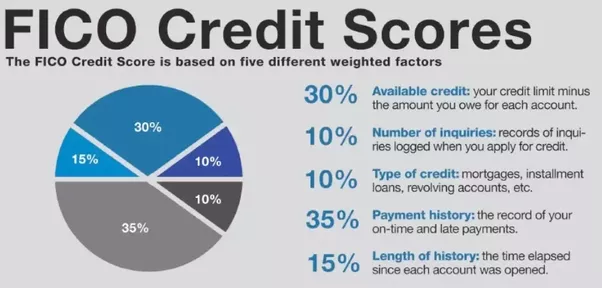

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Recommended Reading: When Do Credit Card Companies Report Balances To Credit Bureaus

Why Did My Credit Score Just Drop 6 Common Reasons

Your three-digit credit score can be the difference between being approved for a new financial product with strong terms versus being stuck with sky-high interest rates or worse, denied altogether. So it can be incredibly frustrating when you think youre doing well financially, only to find that your score has dropped.

that helps lenders and often landlords determine how much risk you pose as a borrower or renter. The better your credit score, the lower your interest rates and larger your credit limits will be, while the opposite is true the lower your score is. But credit scores also frequently change, and sometimes not for any obvious reason.

Scores fluctuate all the time depending on how the information in your credit history is evolving and changing, says Rod Griffin, senior director of consumer education and advocacy at Experian.

Here are the six most common problems that can lower your credit score, according to Griffin:

Pay Your Debts On Time

On-time payments are the single biggest factor affecting your credit score. Paying your bills on time does cause most peoples credit scores to fluctuate. A single missed payment can stay on your credit report for up to seven years.

We recommend you schedule a consistent time for meeting these obligations. Set aside a day each month that works for you, and focus on meeting all of your debt obligations. This ensures that bill/debt paying becomes a habit, decreasing the likelihood you ever miss a payment. It also makes the process easier, because you can get everything done at once.

Related:How to Get Out of Debt

Don’t Miss: 888-826-0598

You Made An Expensive Purchase

Another important factor in your credit score is the amount of available credit you’re using, or your credit utilization ratio. It comes as a surprise to many people but, if you make a big purchase on your credit card one month, you could see a credit score drop even if you pay the balance in full on your due date.

This happens because credit card issuers typically report the as of the last day of the billing cycle. The balance on your credit card statement is often the balance that appears on your credit report.

It’s relatively easy to correct the impact of a high balance. Simply pay down the balance promptly, avoid making other credit card purchases, and wait for the updated balance to show on your credit report. This will help you recover the lost credit score points.

How To Keep An Eye On Credit Score Fluctuations

Keeping a sharp eye on your credit report and score is the most effective way to know whats going on with your creditworthiness. Although your credit score isnt included on your credit report, you can get a free credit report from each of the three credit bureaus once a year and inspect for errors or suspicious activity.

Theres also the option of paying for a credit monitoring service that alerts you whenever theres any activity related to your credit report so you can know exactly whats going on at all times.

Also Check: Thb Cbna

Reasons For Your Credit Score Drop

by Lyle Daly | Updated July 17, 2021 – First published on March 18, 2019

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

If your credit score took a dive, we’re going to show you how to bring it back up.

So you’ve just had the unpleasant experience of seeing that your credit score dropped.

Since no one likes to go backwards, a dip in your credit score is both frustrating and stressful. It can have a serious impact on your life, as you may have a harder time qualifying for the top credit cards or obtaining the best personal loan rates.

That’s why it’s crucial that you figure out what happened to your credit and how to correct the issue. Here are all the possible problems that could have caused your credit score drop, plus how you can fix each one.

You Closed A Credit Card Account

It may seem intuitive to close an old credit card account you dont use much, but this can actually cause your credit score to drop. Why? Because maintaining old accounts shows lenders not only how long youve been using credit, but how long youve been using it responsibly. In addition, closing an old account lowers your total amount of credit, thereby raising your credit utilization.

Don’t Miss: Comenity Bank Credit Bureau

Your Credit Utilization Rate Is Too High

Your credit utilization rate is the ratio between how much credit you use vs. how much you have available. The standard goal is to keep your credit utilization rate below 30%. You might have an excellent track record of making payments on time and in full, but if you only have one credit card and youre using 90% of the total amount, your credit score is still going to suffer.

Griffin advises that borrowers in this situation open up another account and split your usage between the two because if youre using your credit well and can keep utilization low on both cards, youll likely see scores improve over time.

But keep in mind that this strategy can also backfire if you cant keep the utilization low on both cards. Then, youll likely end up lowering your credit score because youve maxed out your cards and are carrying a high balance each month, leading to a high utilization rate. Thats where making just the minimum payments on your cards may not be enough. Youll need to pay off more than the minimum amount if you want to lower your utilization rate in order to raise your overall score.

Should I Apply For Another Loan

If you have paid off a debt and are looking to keep up your credit score, you may be wondering what you can do. If you close a loan, it may seem like opening another loan will keep your credit score points high. However, applying for another loan may only help your credit score in certain scenarios.

If the loan you closed was held for a while, meaning you had a long credit history with that loan, opening a new loan wont help with any credit score points lost. A new account wont bring you any wins with credit history length.

However, if paying off a loan means you lose some diversity in your credit portfolio, applying for certain types of loans could help your score. You get some points for having different types of credit . If the loan you pay off is the only one you have of its kind, you could gain some points back by opening a new type of loan. For example, if you pay off your car loan and are left with only credit cards, consider applying for a different type of loan.

A bigger contributing factor than credit mix for your credit score is whether you can make payments on time. If applying for a new loan will impact your ability to make any payments on time, you shouldnt risk applying for the new loan.

Don’t Miss: Credit Score For Carmax Financing

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Should You Worry About Your Credit Score Dropping

Changes in your credit score are completely normal, so theres no need to worry about small fluctuations! That being said, its good to check your credit report at least once a month so you can monitor these changes when they occur.

You may want to take note of large changes in your score as they could be an indication that something bigger is happening for example, if you have unauthorized accounts opened in your name, or youve been a victim of identity theft.

Don’t Miss: Can I Get A Repossession Off My Credit

What Do Lenders Report To The Credit Bureaus

Experian, Equifax and TransUnion receive positive and negative information from lenders every month about millions of Americans. However, not every credit provider reports to all of the credit reporting agencies lenders pick and choose which and how many bureaus they report to.

Data reported to the credit bureaus are:

- Account activity. If your account is open and in good standing, closed, delinquent, default, charged off or sent to collections.

- Payment history. On time, late or missed payments. Late payments will be reported in days 30, 60, 90, 120, 150 days late.

- Account balance. How much your current balance is compared to your credit limit this is your credit utilization ratio.

- Credit card and loan applications, requests to change your credit limit, or anything else thats registers a hard pull of your credit will be reported.

- If you have an authorized user on your credit card account, any activity on the account from their usage will be reported on your credit report since youre the account owner.

Why Does A Hard Inquiry Affect Your Credit Score

If you spot a hard inquiry on your credit report, dont sweat it too much. Its there because your credit was pulled by an issuer or lender when you applied for a credit card or loan. And if your credit score does get dinged from it, its OK. It can bounce back in a few months if you use your card responsibly.

How many points does a hard inquiry affect credit score?

A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably wont be that significant. As FICO explains: For most people, one additional credit inquiry will take less than five points off their FICO Scores.

Why does a hard inquiry a negative effect on your credit score? Lenders and credit scoring models consider how many hard inquiries you have on your credit reports because applications for new credit increase the risk a borrower poses. One or two hard inquiries accrued during the normal course of applying for loans or credit cards can have an almost negligible effect on your credit.

How long does it take for credit score to go up after a hard inquiry?

Hard inquiries on your credit the kind that happen when you apply for a loan or credit card can stay on your credit report for about 24 months. However, a hard inquiry wont affect your score after 12 months, if it affects your score at all.

Don’t Miss: Credit Score For Affirm Approval

Why Is My Credit Score Going Down If I Pay Everything On Time

If youre making on-time payments that are being reported to the credit bureau, your payment history is probably not the cause of a drop in your score. Look at the other factors that may cause a drop in your credit score that could be going on. For example, if youre using up more of your available credit and revolving a balance, your credit utilization ratio could be going up.

Reasons Why Credit Scores Drop

Credit scores are calculated using lots of information from your credit report about your finances. This includes factors like your payment history, the amount you currently owe, your and how many accounts you have open. So when thereâs a drop in your score, itâs likely that thereâs been a change in one of these or one of the many other factors that go into credit scores.

Read on for some reasons your credit score might drop and what you can do about them.

1. New Credit Applications

A new credit application could have an impact on your credit score. Thatâs because a new credit application creates a âhard inquiry,â which can stay on your credit report for up to two years. And multiple credit applications in a short period of time may raise a red flag to lenders. Those applications could be seen as a sign your financial situation has changed, and it could put a dent in your score.

What you can do: Try to keep new credit applications to a minimum by only applying for the credit you need. And when you do apply for a new credit card, you could first check with the lender to see if they can tell you whether you may be pre-qualified or pre-approved for one of their cards. Pre-qualification and pre-approval use whatâs known as a âsoft inquiryâ to check your credit, which wonât hurt your score.

2. High Credit Utilization

3. Payment History

4. Derogatory Remarks on Your Credit Report

You May Like: Does Klarna Affect Credit

How Can I Get Rid Of Hard Inquiries On My Credit Report Fast

One way is to go directly to the creditor by sending them a certified letter in the mail. In your letter, be sure to point out which inquiry were not authorized, and then request that those inquiries be removed. You could also contact the 3 big credit bureaus where the unauthorized inquiry has shown up.

Ask For Late Payment Forgiveness

Paying on time constitutes 35% of your FICO Score, making it the most important action you can take to maintain a good credit score. But if youve been a good and steady customer who accidentally missed a payment one month, then pick up the phone and call your issuer immediately.

Be ready to pay up when you ask the customer rep to please forgive this mistake and not to report the late payment to the credit bureaus. Note that you wont be able to do this repeatedly requesting late payment forgiveness is likely to work just once or twice.

You have 30 days before youre reported late to the credit bureaus, and some lenders even allow as long as 60 days. Once you have a late payment on your credit reports, it will stay there for seven years, so if this is a one-time thing, many issuers will give you a pass the first time youre late.

How much will this action impact your credit score?

If youre a day or two late on a credit card payment, you might get hit with a late fee and a penalty APR, but it shouldnt affect your credit score yet. However, if you miss a payment by a whole billing cycle, it could drop your credit score by as many as 90 to 110 points.

Recommended Reading: Aargon Agency Settlement