How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Alternatives To Credit One Bank Cards

These five alternatives compete with Credit One for consumers who have bad credit. One is a secured card that requires a deposit. If you can swing it, a secured card is often the easiest to obtain, whatever your credit score.

| $35 – $99 | Poor/Bad |

The Milestone® Mastercard® Less Than Perfect Credit Considered is an unsecured card for those with imperfect credit. You should not apply if you have been delinquent with any creditor in the past two months. When you apply for the card, the issuer will consider you for one of its various versions, each with its own annual fee and account-opening fee schedule. You can pre-apply for the card without affecting your credit score. The card waives the cash advance fee for the first year. If you make a late payment, your APR will increase for an indefinite period.

| $0 – $99 | Bad, Poor Credit |

The Indigo® Mastercard® for Less than Perfect Credit lets you prequalify without affecting your credit score. If you dont prequalify, the issuer may refer you to a credit card from another bank. You may qualify for one of three versions of the card, two of which charge an annual fee. The card reports your payments each month to the three national credit bureaus.

How To Build Credit With A Capital One Credit Card

Because Capital One reports to all three major credit bureaus, you can use your credit card to build credit and improve your credit score.

To build credit with your Capital One credit card:

How we get our information

The above details were collected directly from Capital Ones customer service team.

Kari Dearie

Don’t Miss: What Credit Score Is Used To Buy A House

Is Credit One A Good Credit Card

A Credit One credit card may be useful for those with bad credit or no credit. As with any financial product, it has its pros and cons.

On the plus side, its unsecured cards do not require a security deposit and may charge no annual fee. You get free credit scores, $0 fraud liability, free collision damage waiver for car rentals, and travel accident coverage.

Despite all the benefits, you will want to consider potential problems with a card from Credit One, including:

- The Better Business Bureau has received more than 1,200 complaints about Credit One.

- You may not know important parameters until after you apply, including the APR, fees, and grace period.

- The card charges fees for many of its services and may charge an annual fee as well.

To be sure, these policies may help Credit One extend credit to consumers who would otherwise have trouble obtaining a credit card.

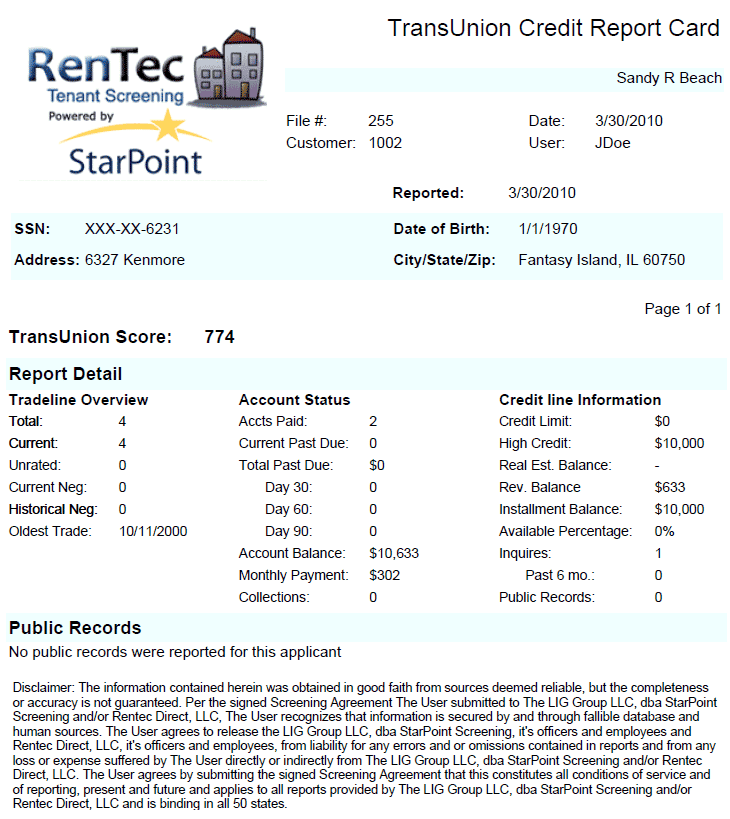

What Does A Tri

A tri-merge credit report includes key financial information about you. This includes a list of your open credit card accounts and how much you owe on them. It also lists your open loan accounts including mortgage, personal, student and car loans and the balances on them.

A tri-merge report will also list any late payments youve made on these accounts during the last seven years. A payment is reported as late if youve made it 30 days or more past your due date.

Other negative financial information is included in these reports, including bankruptcy filings youve made in the last 7 or 10 years and foreclosures youve suffered in the last 7 years.

The more negative information in the reports, the less likely lenders are to approve you for a mortgage. Lenders dont want to see high balances on your credit card accounts or late payments on any of your accounts.

One thing this report wont include? Your . Thats because credit scores are never included in credit reports. The most important credit score, the FICO® Score, is maintained and created by the Fair Isaac Company. This company says that more than 90% of lenders use FICO® Scores when making lending decisions. Lenders will pull this score when you apply for a mortgage, but it wont be included in either your individual credit reports or your tri-merge credit report.

Dont Miss: Free Tri Merge Credit Report With Scores

Read Also: When Does A Bankruptcy Fall Off Your Credit Report

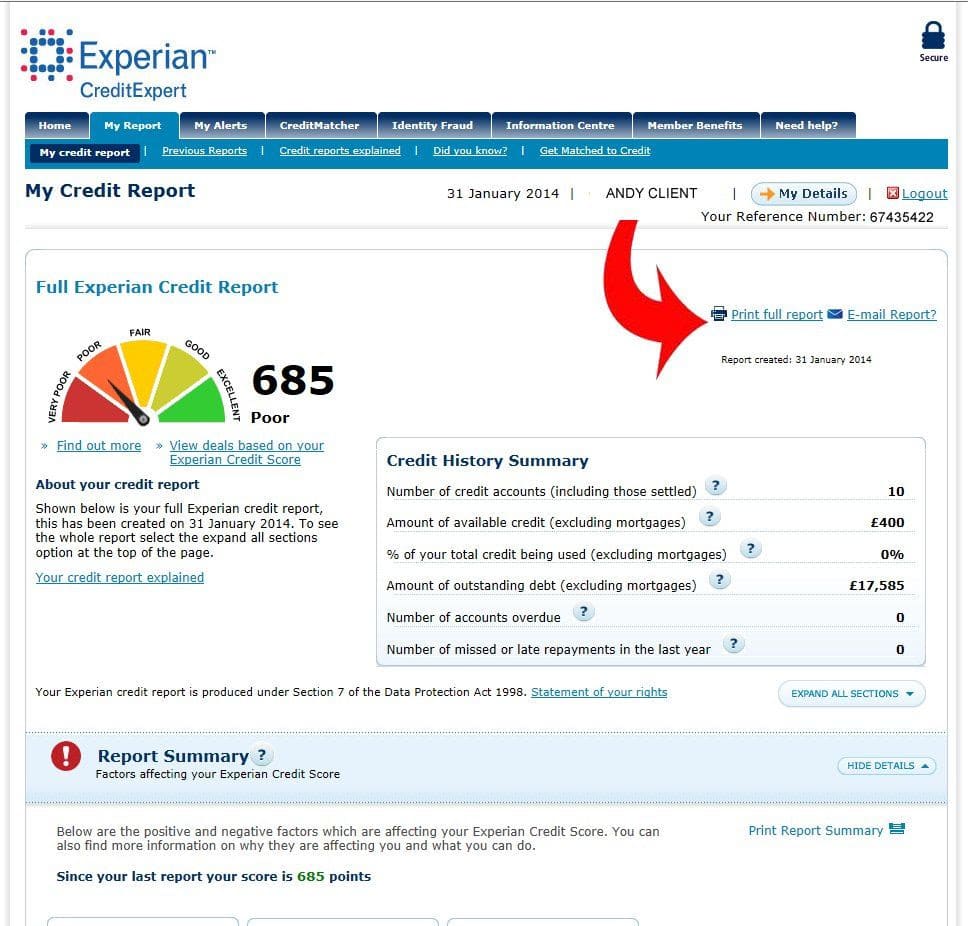

Did You Know Its Not Just The Score That Counts

Lenders will look at your credit score when dealing with an application for credit. But their lending decision wont be made on the score alone. They will scrutinise the whole report to get an overall picture of the kind of borrower they are considering.

This is a good reason for making sure you have actioned a financial disassociation from any ex-partners you may have held a mortgage or any other kind of credit with.

Read Also: Which Credit Score Is Used Most

What To Do Before You Ask For A Credit Limit Increase

Before you ask for a Credit One Bank credit line increase, you should make sure that your credit score is in good standing. Fortunately, there are plenty of ways to check your credit score online for free. Taking a look at your credit score can help you gauge your ability to qualify for a Credit One credit increase.

Other steps you can take right away include ensuring your bills are paid early or on time and paying down debt if you can. Keep in mind that credit card issuers may believe youre a higher risk if you max out your available credit limits and ask for more. As a general rule of thumb, most experts recommend keeping your below 30 percent for the best results.

Also, take the time to check your credit reports for incorrect information that could be hurting your score. If you find mistakes on your credit report with any of the three credit bureaus, you can dispute them.

Don’t Miss: How Long Foreclosure On Credit Report

Clearer Terms And Conditions

When reviewing credit card options, Capital One terms and conditions are much clearer for its cards compared with Credit One. Although both card issuers comply with federal law that requires a uniform disclosure statement, Capital One provides more details on its individual credit card pages. This makes it easier for an applicant to decide if a card makes sense for their wallet.

How Do You Know Which Card Bureau An Issuer Uses

All of the major card issuers claim to use all three credit bureaus when checking an applicants credit report. However, they may use individual bureaus more than others, and they typically pull only one credit report when you apply for a card. Credit card issuers also consider this kind of data proprietary information, so they wont disclose any specific information.

Also note that you find out which bureau a card issuer used after you apply, but only if youre denied. If a card issuer approves your application, the company isnt legally obligated to inform you which credit bureau it used. However, if the issuer rejects your application, youll find out the identity of the bureau used to make the decision when you receive the issuers adverse action notice. According to the Consumer Financial Protection Bureau , this notice must also include the reason your credit card application was denied.

This means that, if a credit card issuer pulls your Experian credit report and denies your application due to your payment history, youll get a notice that explains it in detail.

Don’t Miss: When Does Your Credit Score Update

Which Credit Bureau Is Most Accurate

Three major credit bureaus dominate consumer credit reporting in the U.S.: Equifax, TransUnion and Experian. These companies provide consumer credit reports to companies or other authorized parties who use the information to predict riskâwhether it be money lending or property and auto leasing. The industry turns a hefty profit each year from selling credit information, which is normally provided to agencies by banks and other lenders.

No reports on the same individual pulled from different bureaus are likely to be the same. Reports are different for a variety of reasons. For these reasons, itâs nearly impossible to determine which credit bureau is the most accurate. Most credit bureaus will rate your credit based on a standardized FICO credit score system. Major U.S. lenders are likely to use this score to assess your credit and base lending decisions on it.

Since each score falls within a rangeâfor example, a score between 670 and 739 is considered a good credit scoreâextreme differences between FICO scores issued by credit bureaus are unlikely. Minor differences may occur due to differences in the way the score is tabulated.

Which Credit Cards Help Authorized Users Build Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Adding someone to your credit card as an is a simple way to potentially buoy their credit scores, assuming youve paid the account on time and havent used too much of your available credit. But to make this strategy actually work, youll want to be sure that information about that account is included on their credit reports. Otherwise, adding someone to your card whether its a child, partner or parent wont do a thing for their scores.

Getting that same account to appear as a “tradeline” on your authorized users credit reports will depend on two major factors:

-

The issuers policy. All major issuers NerdWallet surveyed reported authorized user activity to the three major credit bureaus Equifax, Experian and TransUnion in some form. But some noted that they dont report information if the primary account includes negative information or if the authorized user is under a certain age.

-

The credit bureaus policy. Even when issuers report an authorized user account, the credit bureaus might not include it in the authorized users credit report if it includes negative information or if the authorized user is under a certain age, depending on their policy.

Also Check: How Is Credit Score Determined

How Does A Mortgage Affect Your Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

When it comes time to buy a house, few people can afford to pay entirely in cash.

Most opt for a mortgage, or a home loan. Like all major lines of credit, a mortgage will appear on your credit report. This is probably a good thing: A mortgage can help build your credit in the long run, provided you pay as agreed. Heres why.

Also Check: How To Get An Eviction Off Your Credit

How To Time Your Credit Card Payment To Boost Your Credit Score

The good news is that once you know the date your credit card company reports to the credit bureaus, you can use that information to boost your credit score.

As we mentioned, your credit utilization is an important factor that makes up your credit score. And generally speaking, the lower your credit utilization, the better. As a result, its in your best interest to have as low a balance as possible on your statement closing date since thats when Discover will report your balance.

Example:

Lets say you have a credit card limit of $5,000. Throughout the month, you use your credit card for all of your expenses, adding up to about $2,500. As a result, Discover reports a $2,500 balance to the credit bureaus, which shows a credit utilization of 50%.

To improve your credit utilization and, therefore, your credit score you can simply change the day you make your credit card payment. Instead of making your payment on the due date, make your payment just before your statement closing date. That way, youll have as low of a balance as possible when Discover reports to the credit bureaus.

Read Also: What Day Of The Month Does Your Credit Score Update

Bottom Line On The Best Credit One Credit Card For Your Wallet

Youve got several options if youre interested in a new Credit One card, including cashback cards and no annual fee cards. Credit One also provides a few options if you need help rebuilding your credit.

Overall, Credit One offers a wide range of cards to choose from. To find the right card for you, look over our list of Credit One Bank cards to see which card can help with your financial needs. Consider your lifestyle and spending habits as you review each card.

Unsecured Credit for Poor or No Credit History

Do Not Use More Than 30% Of Your Credit To Avoid Problems

The information to the credit bureaus usually arrives three days after the closing statement from Capital One. If it is common for you to be late on your payments or recurrently over your credit limit, reporting the information is done regularly.

There are three nationally recognized consumer credit bureaus nationwide, Experian, TransUnion, and Equifax. Their percentage calculations are not done out of thin air and use the information provided by Capital One regarding your credit cards.

Don’t Miss: Who Uses Credit History To Determine Credit Score

What Goes Into A Credit Score

Your credit score is determined by credit scoring models like FICO and VantageScore. Although the actual formula used to figure out your score is top secret, you should keep some general guidelines in mind when trying to make a change.

Your on-time payment history accounts for about 35% of your credit score. Make sure youâre paying all of your bills on time from month to month. You can even try to get your rent and utility bill payments reported to the credit bureaus if you know youâll always stay on top of those. A missed payment can stay on your credit report for seven years, so weâre begging you, please stay on top of this. Humans make mistakes so setting up automatic payments can keep your mind at ease.

Your accounts for about 30% of your credit score. Try to pay off some of your debts and keep your credit card balances low to ensure your overall credit utilization ratio is in a good place. If you drastically improve your utilization, youâll see a change in your credit score the next time itâs updated.

Your length of credit history makes up 15% of your score. If youâre fresh to financial independence, there isnât much you can do but start off strong.

Your recent credit applications account for 10% of your credit score. A credit application generally requires that a lender checks your credit score to see if you qualify. When lenders check your credit reports, itâs typically classified as a hard inquiry, which can hurt your score.

Types Of Credit Score Updates

There are two types of credit score updates: soft inquiries and hard inquiries.

Soft inquiries occur when you or your creditors check your credit score. These do not affect your credit score.

Hard inquiries occur when you apply for new credit, such as a loan or credit card. These will cause your credit score to drop a few points, but the effect is generally temporary.

Read Also: Does Free Credit Report Work

Don’t Miss: Can You Remove Late Payments From Credit Report

How To Dispute Information On Your Credit Report

You can open a dispute in the event you find an error on your credit report. Prepare your personal information and sufficient documentation of the error before you submit a dispute. You can dispute errors with each credit bureau online, by mail or by phone. The bureau you file a dispute with should investigate your claim and release its findings after about 30 to 45 days.

If the results lead to a change in your credit report, you should receive a free, updated copy of your reportâbut this may take another 45 days. If unhappy with the results of the dispute, you can resubmit your dispute with any additional supporting information to help your case.