Costs Associated With Rental Reporting

If a renter opts in to rent reporting, landlords can charge them $10 a month or the actual cost of reporting the rent payment, whichever is less. If the tenant fails to pay the rent reporting fee, the landlord cannot use it as a reason to terminate the lease, nor can they deduct the unpaid fee from the security deposit. If the fee remains unpaid for more than 30 days, the landlord can stop reporting and the tenant will not qualify for rent reporting again for a minimum of six months. The renter can choose to stop the reporting at any time during the lease, but they must do so in writing.

Whats The Benefit Of Joining The Scheme And Why Is My Credit File Important

Making your payments on time could see your credit history improve, therefore making it easier to prove your identity and apply for credit products.

Think of your credit file as your financial CV. It gives potential lenders an insight into your spending history, allowing them to make an informed decision as to whether they want to take you on as a borrower.

Building your credit history through your rental payments will make you more attractive to a lender. Showing you can meet payments on time will improve your credit score, though lenders wont see this. Theyll have their own scoring system and will take into account your affordability. And as mortgage payments could end up being more affordable than your current rent, you could see yourself on the property ladder far sooner.

See our for full info on what a credit rating is and how to improve it.

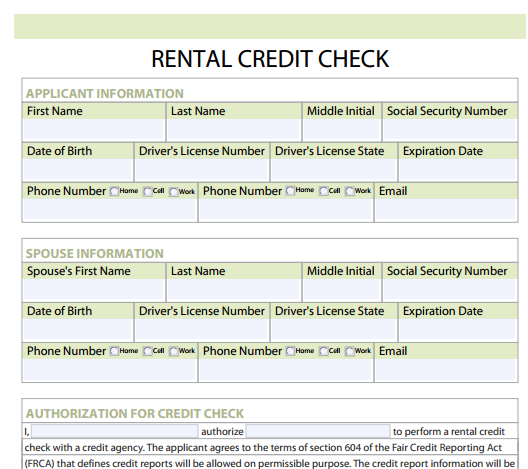

How To Report Rent Payments To A Credit Bureau

Charlene Rhinehart is an expert in accounting, banking, investing, real estate, and personal finance. She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting. She is the founder of Wealth Women Daily and an author.

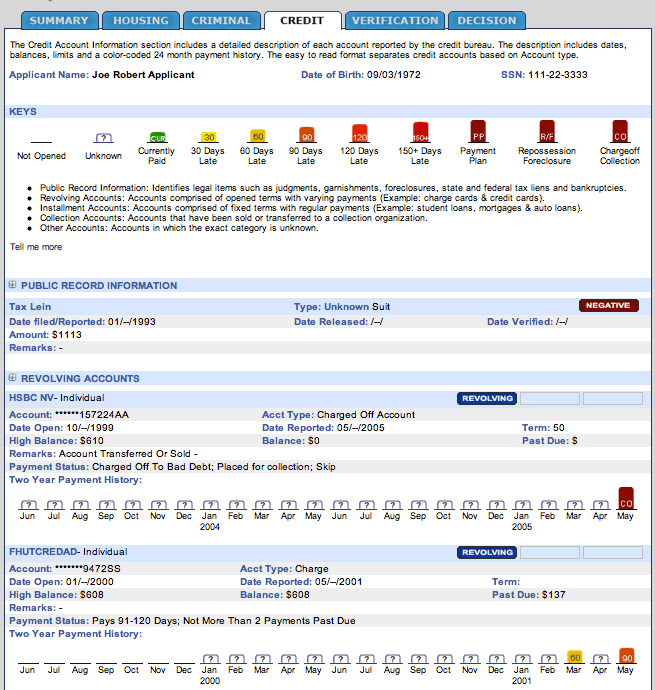

Rent payments are not always included in credit scores because they are not routinely reported to credit bureaus. However, rent is the largest monthly expense for many people. Approximately 25% of renters spend more than half of their income on rent, and nearly 50% spend more than 30% of their income on rent.

If you pay your rent on time each month, you could stand to gain from rent payment reporting, especially since 35% of your is based on your payment history. If youre looking for a way to boost your credit score or just want credit for making your rent payments on time, there are some options for reporting rent payments to the credit bureaus.

You May Like: What Factors Affect A Credit Score

Maybe: If Enrolled With A Rent

If you and your landlord have enrolled with a rent-reporting service, your monthly rental payments will be reported to credit bureaus and appear on your credit report.

But just because your rental payments are reported to credit bureaus and exist on your credit report doesn’t mean that your credit score will immediately increase. To understand why, let’s talk about how on-time payments are used to generate credit scores.

What Is The Impact Of Rent Reporting On Your Credit Score

While testing their new credit rent reporting program Goldman Sachs found the average score of their participants increased by 42 points, going from a credit score of 616 to 658.

This increase put many on the cusp or over the line of being considered a prime borrower. That opened up a lot of credit options.

Whats most interesting about the GS program is that the boost was immediate.

Compared to other strategies, this rent reporting program was happening instantly while other strategies could take months to show an impact.

How did the program generate near instant results? It had to do with the amount of payments added to a persons credit history.

The Goldman Sachs program added up to 24 months of rental payment history to a persons credit history. This historical data obtained a big boost very quickly.

Previous programs run by Credit Builders Alliance, the company Goldman Sachs partnered with to test their credit report rent program, showed a 23-point average increase among renters.

You May Like: What Credit Score Is Needed For An American Express Card

Im Glad I Gave Them A Shot Its Worth It

05/28/2019

I paid for the service and it took about 2 months to get the ball rolling because I was in transitional housing and that was a new situation for them but it finally went through and my credit score went up about 35 points immediately and every other month it?s going up a point. I?m glad I gave them a shot it?s worth it.

04/05/2019

Dylan Mclvor was so helpful and this company is awesome. I?m so excited to see my credit score go up.

Raymond D

04/03/2019

I?ve seen a significant increase in my credit in a short time. Credit Boost is a great service, with excellent customer service!..

Brett Q

Reporting Rent For Credit: Does It Happen Automatically

While well get into what you need to know to add rent to credit reports soon, its important to understand that this is never something that occurs automatically.

In most cases, tenants pay their rent each month by check or directly through their bank account. Because credit bureaus dont look at your checking account balance or payments processed there, your rent wont directly affect your credit score.

Don’t Miss: How To Have A Perfect Credit Score

Talk To Your Landlord

Another option is talking to your landlord or other creditor directly and asking them to start reporting your payments to the bureaus. Remember, theres a fee for them to do so, so they might not be interested. You could offer to paybut if youre paying, youre probably better off signing up for an account that you can regularly access.

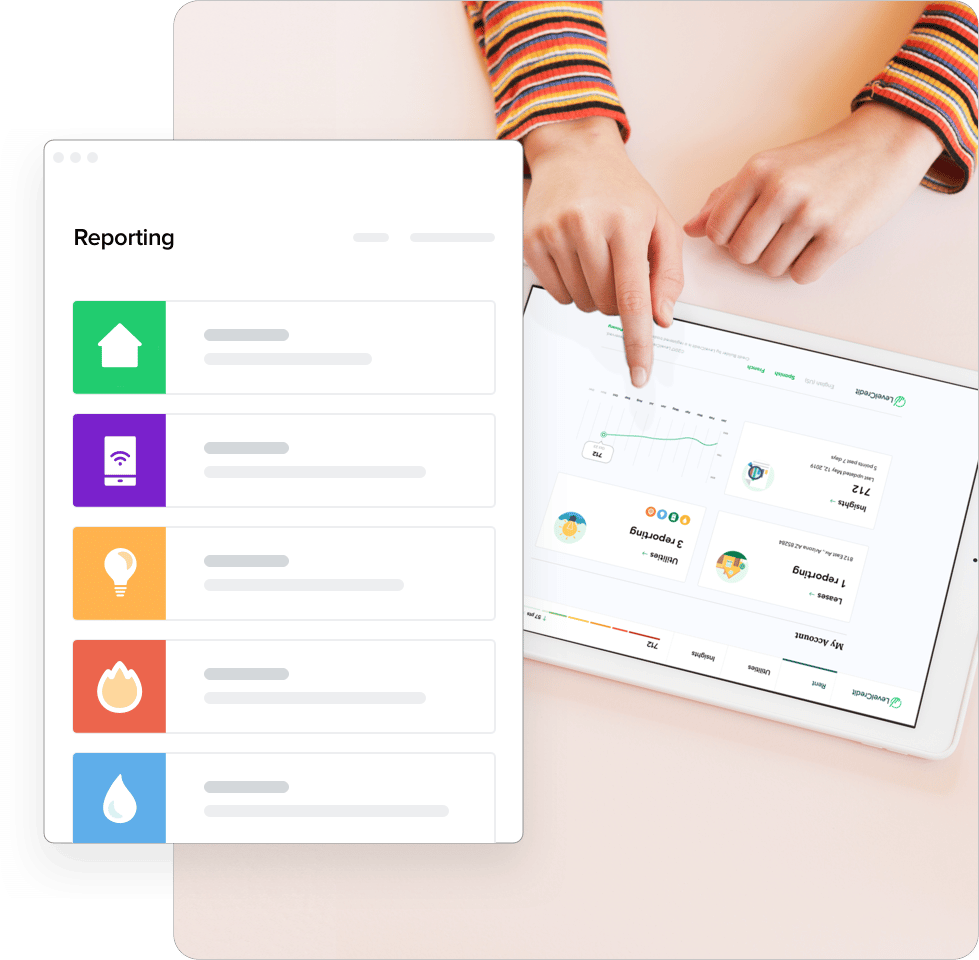

How Do You Evaluate A Service

First, be sure adding alternative data to your credit reports is going to be valuable to you. It’s important to know that not every credit score uses the information. The most recent versions of FICO credit scores FICO 9 and 10 factor in alternative data if it’s reported, as does FICO’s competitor VantageScore. But FICO 8, the scoring model in widest use, does not.

Then, compare the six- or 12-month cost of rent reporting versus that of getting a secured credit card or credit-builder loan. Those products generally report to all three credit bureaus. LevelCredit reports rent to all three major credit bureaus, but reports utilities only to TransUnion.

Some of the LevelCredit features, such as access to credit scores, credit report information and personalized tips, are offered for free from credit cards and personal finance websites, including NerdWallet.

Finally, ask these questions of any rental or utility reporting service you’re considering:

-

What would my total costs be for a year of service, including any setup fees or fees for previous payment history?

-

How do you protect my personal data?

-

Which of the major credit bureaus do you report to?

-

Do you provide free access to credit scores, and if so, which score?

-

How soon should I expect the information to appear on my credit report?

-

How can I cancel the service?

Recommended Reading: Does Checking Your Credit Score Make It Go Down

Best Rent Reporting Services In 2021

Summary: Not all rent reporting services are created equal. We review ten rent reporting options and how to choose the right one for you.

Many people do not realize that their rent payments are not usually reported to the three major credit bureaus. This is unfortunate because the reporting of your monthly payments could have a positive influence on your credit score.

You can fix this problem.

You can pay a Rent Reporting service to report your monthly payments. For an additional fee, many services will report 24 months of previous rental payments. Thats a quick way to establish a credit history.

When choosing a rent reporting service, the two most important factors to consider are their reputation, the number of credit bureaus that they report to,and their initial cost, including the reporting of 24 months of previous rental payments.

In this post:

Can I Add Rental History To My Credit Report

Can you add rental history to your credit report?

Have you ever tried to apply for credit only to find out that your credit is bad or that you do not have enough established credit? This is the story of many people who were denied credit. There are many ways that you can raise your credit score so that you can be extended credit. One of those ways is to report you rental history to the credit bureaus. Many people do not know that this is possible. Being a good renter can help you improve your credit score.

Read Also: When Do Credit Cards Report To Agencies

Questions For Rent Reporting Services

Rent reporting services are becoming more popular, so its a good idea to do some research and find the right fit for you. Ask these questions of any rental reporting agency you’re considering:

-

What would my total costs be for a year of service, including any setup fees or fees for previous rental history?

-

How do you protect my personal data?

-

Which of the major credit bureaus do you report to?

-

Do you provide free access to credit scores, and if so, which score?

-

How soon should I expect the information to appear on my credit report?

-

How can I cancel the service?

About the authors:Bev O’Shea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Amanda Barroso covers consumer credit and debt at NerdWallet. She previously worked at the Pew Research Center and earned a doctorate at The Ohio State University. Read more

Yes: Your Landlord Reports Your Rent Payment As Delinquent

A landlord can report any missed payment to a credit bureau, which will land on your credit report. That missed rental payment will act as a negative mark on your payment history and as payment history is one of the most important factors in calculating your credit score, your score will likely go down.

Also Check: What Does It Mean When Your Credit Score Is 0

What About Those Options To Report Rental Payment To Credit Bureaus

There has been a push in the credit score industry to get more people on board with adding rental payment history.

- The benefits to the renter are clear and high impact.

- The benefits to property managers are also vivid they can make more informed decisions about their properties.

- The benefits to credit bureaus, credit card companies, and lenders are also clear having more data helps makes it easier to reduce risk.

So why isnt this everywhere already?

Property management companies and landlords are the biggest bottleneck to widespread use of this strategy.

Currently the various apps and programs that do this most conveniently for renters put all of the onus on landlords.

Companies like Goldman Sachs and Experian with their own initiatives like RentBureau are trying to make this as seamless and easy for both property managers and residents.

But its difficult to get rent reporting to be convenient.

Experian and the Experian product RentBureau have options for residents and landlords.

But product and company have had a hard time getting widespread acceptance and mentioned herein are the property managers Experian marks as prime targets of the service who are slow to adopt.

Experian report rent tools are still looking to lead the way, however, and TransUnion is following suit with its own initiatives.

A study by TransUnion recently showed that only 17% of property managers report rent to the three major credit bureaus.

When To Contact The Credit Bureaus

After youve contacted your creditor, youll want to confirm that each of the three major credit reporting agencies has added the positive credit accounts to your credit report. Wait a couple of weeks, and then check your report. If you still see errors, send a letter to the credit bureau asking them to correct the information.

Once you send a request to each of the three major credit bureaus, they are required to open an investigation and resolve the matter within 30 days. This process is beneficial if one of your creditors is hard to reach or unresponsive.

Recommended Reading: Is 688 A Good Credit Score

How Would A Rent Report Change My Score

Its hard to say exactly how much you might benefit from including your rental payment history in your credit report. In 2019, Goldman Sachs completed a pilot program that focused on residents in an affordable housing program. Participants in the pilot saw their scores increase by an average of 42 points, which is a significant gain, though the sample size of the program was small, with 32 residents participating.

Many of the available rent reporting services out there will add the previous two years worth of rental payment to your history, providing a quick boost to your score .

Under the right circumstances, adding your rental history to your credit report could potentially boost your score especially if the rest of your credit history is fairly vacant.

Use A Rent Reporting Service

There are several companies that will report rent payments on your behalf. Monthly fees vary between services, and some charge an initial enrollment fee to get started. In some cases, your landlord may have to verify your rent payments for them to be included in your credit report. Note that even when rent payments are included in your credit report, they may not be included in your credit score calculation.

Also Check: Is 795 A Good Credit Score

How The Credit Bureaus Handle Rent Payments

By default, your rent payment history is not included in credit reporting or credit scores. However, if the major credit bureaus Experian, Equifax, and TransUnion receive this information, they will include it in your credit report. The trick is figuring out how to get your rental payment information to them.

Unfortunately, just because the credit bureaus will include this information in your report doesnt guarantee it will impact your credit score when a lender pulls your credit. One of the most common credit-scoring models, FICO 8, does not include rent payment history when calculating your score. However, some of the newer FICO score models and VantageScore do include your rent history in their reports and scores. So depending on which report your potential creditor pulls, a positive history of rent payments might result in a higher .

On top of that, reporting your rental history to the credit bureaus might be a double-edged sword. Late payments, missed payments, and other derogatory information can also be reported. But, while you may incur a late fee from your landlord for making a late rent payment, that may not be reported to the credit bureaus. Typically, late payments are reported only if they are late 30 days or more. If this happens, your credit score could be negatively impacted.

Should You Add Your Rental History To Your Credit Report

The following is presented for informational purposes only and is not intended as credit repair.

Your credit score is a crucial part of your overall financial health. A strong score makes it easier to access loans and additional credit at desirable terms.

But to build strong credit you also need to use creditand that can be tricky, especially when youre first starting out. It can be difficult to show that youre creditworthy when you have no credit history, which can put otherwise responsible borrowers at a disadvantage.

One solution thats started to gain popularity recently is rent reporting, which adds your monthly rent payment history to your credit report and becomes a factor in your credit score. For someone who hasnt used much credit, but has successfully paid their rent on time each month, this could be a great way to boost your score. But is it right for you? Heres what you need to know.

You May Like: When Do Credit Card Companies Report To Bureaus

What Is Landlord Credit Bureau

Landlord Credit Bureau specializes in reporting rent payments. Rent payment history provided to LCB each month is associated with the tenants consumer credit report with Equifax. By providing a turnkey, user-friendly platform specially designed for landlords, LCB makes the process of reporting rent both seamless and affordable. LCB is committed to helping landlords minimize income loss while rewarding responsible tenants by assisting them in gaining the credit they deserve.

Best Rent Reporting Services In 2022

Alison Kimberly is a freelance content writer with a Sustainable MBA, uniquely qualified to help individuals and businesses achieve the triple bottom line of environmental, social, and financial profitability.

Steve Rogers has been a professional writer and editor for over 30 years, specializing in personal finance, investment, and the impact of political trends on financial markets and personal finances.

Summary: Not all rent reporting services are created equal. We review ten rent reporting options and how to choose the right one for you.

On-time rent payments can boost your credit score, but only if you take action to place them on your credit report. Rent reporting companies can help you do that.

All three credit bureaus will include rental payments in credit reports if they receive that information. They usually wont get it from your landlord. Credit bureaus charge a fee for reporting information, and landlords dont want to pay it.

A rent reporting service can record your on-time payments and boost your credit score. Many will report up to two years of previous payments. You will pay a fee for this service, but if you have a thin credit file and youre trying to establish credit, it may be worth the cost.

Recommended Reading: When Does Navy Federal Report To Credit Bureau