Multiple Collection Agencies Same Debt

If your credit report looks as Experian describes, with the old collection accounts accurately reporting as closed, there may not be much you can do besides wait seven years for the collections to fall off your credit report.

However, if the original creditor and/or multiple collection agencies report the same debt as if they are all separate open collection accounts, that may be an error that you need to dispute with the credit bureaus.

What Does This All Mean

You may have noticed that this discussion feels short on specifics. For example, it doesnt say that an account with a reported date of more than 36 months ago will be bypassed by some of the score calculations. And theres a reason for this lack of specificity: credit score models vary. They all have their own rules and nuances, so generalizing isnt particularly helpful.

What is true, however, is that the dates on your credit reports are key to an accurate report and accurate credit score. Review your credit report carefully you can get free annual credit reports at AnnualCreditReport.com. If you are having trouble understanding it, this guide to understanding credit reports can help.If you believe a date listed is wrong, dont hesitate to contact the credit reporting agency or the company furnishing the information for clarification, and to dispute it if necessary.

When Negative Information Comes Off Your Credit Reports

Delinquent accounts may be reported for seven years after the date of the last scheduled payment before the account became delinquent. Accounts sent to collection , accounts charged off, or any other similar action may be reported from the date of the last activity on the account for up to seven years plus 180 days after the delinquency that led to the collection activity or charge-off.

What Is a Tradeline?

Also Check: What Is The Highest Credit Score Number

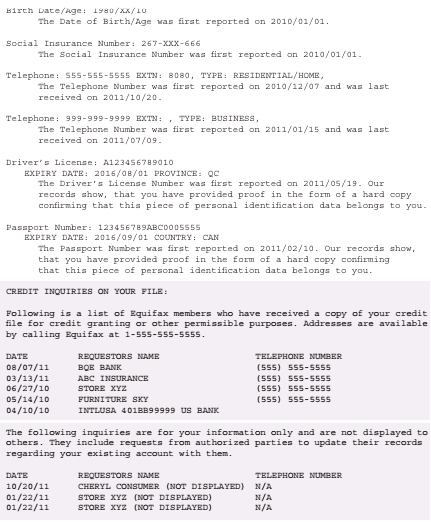

Inquiry Date/date Of Request

Dates that someone reviewed your credit information may be important, depending on the type of inquiry. Inquiries fall into two categories: those that affect your credit scores and those that dont . All are reported for 24 months. And since soft inquiries dont impact your scores, they arent important on that front. But for hard inquiries, the date of inquiry is important because most credit scoring models will ignore those that are more than 12 months old.

And in case youre wondering, hard inquiries in the past 12 months generally have the same impact regardless of whether they are one month old or 11 months old.

Student Loan Delinquency Or Default

Late student loan payments can start to hurt your credit after 30 days for private student loans and 90 days for federal student loans, and those delinquencies stay on your credit report for seven years.

Federal student loans go into default if you dont make a payment for 270 days. And the government has strong debt-collection powers: It can garnish your wages, Social Security benefits or tax refunds. With private student loans, your lender can term you in default as soon as youre late, but it has to take you to court before it can force repayment.

What to do: If youve paid late but havent defaulted, consider switching to an income-driven repayment plan, putting your loan in deferment or forbearance, or asking your lender for a modified payment plan.

If youve defaulted on your federal student loans, the government offers three options: Repayment, rehabilitation and consolidation.

How long bankruptcy stays on your credit report depends on which type you file.

There are two common types of personal bankruptcy. A Chapter 7 bankruptcy will stay on your reports for 10 years. Chapter 13 bankruptcy sticks around for seven years.

What to do: Begin to re-establish credit. A secured credit card or a credit-builder loan can help people build credit when they can’t qualify for unsecured credit. And note that credit scores can rebound from bankruptcy sooner than you may think.

You May Like: What Credit Score For Fha Loan

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently at the very least annually, if not more often to catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major once a year. However, because of the pandemic, all three bureaus are offering free weekly reports through the end of 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to check your reports from all three bureaus since each one can include different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service

P.O. Box 105281

Other ways to get your credit report

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance or employment in the past 60 days based on your credit

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- You’re a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

To request additional copies, contact the bureaus directly. Heres how to do it:

For a more detailed guide on how to request copies, make sure to read our article on how to check your credit report.

How Credit Reports Work

Credit reports also list credit inquiries and details of accounts turned over to credit agencies, such as information about liens and wage garnishments. Generally, credit reports retain negative information for seven years, while bankruptcy filings typically stay on credit reports for about 10 years.

Read Also: How To Send A Credit Report By Email

When And How To Remove Delinquency From My Credit Report

If you have a delinquent credit card debt that has not yet been charged off or sent to collections, making timely debt payments is the best way to reduce the impact of the delinquency on your credit score. Your credit report will still show that you missed a few payments, but a strong history of on-time payments can overcome a brief period of delinquency.

If your debt has been delinquent for so long that it has become derogatory, you can expect that derogatory mark to remain on your credit report for seven years. If old debt has not fallen off your credit report after seven years, contact the three major credit bureaus and request that they remove the delinquent debt from your credit report.

You may also have a delinquent debt on your credit report that is not actually yours. Believe it or not, one in five consumers discover errors on their credit reports which is why it is important to request copies of your credit reports regularly and dispute any errors you find. If your credit report includes a delinquent debt that you dont recognize, get the debt removed as quickly as possible. That way, you can maintain the credit report and credit score that you deserve.

Also Check: 611 Credit Score Mortgage

Collection Accounts And Your Credit Scores

Reading time: 3 minutes

Highlights:

- If you fall behind on payments, your credit account may be sent to a collection agency or sold to a debt buyer

- You are still legally obligated to pay debts that are in collections

- Collections accounts can have a negative impact on credit scores

Past-due accounts that have been sent to a collection agency can be a source of confusion when it comes to your credit reports and credit scores. What does that mean? And if you pay off the accounts, can they be removed from your credit reports? Weve broken down what you need to know.

What is a collection account? If you fall behind on payments, the lender or creditor may transfer your account to a collection agency or sell it to a debt buyer. This generally occurs a few months after you become delinquent, or the date you begin missing payments or not paying the full minimum payment.

Typically, lenders and creditors will send you letters or call you regarding the debt before it is sent to a collection agency. You may not be notified if your account is being sold to a debt buyer, however. The collection agency or debt buyer will then attempt to collect the debt from you.

If your debt is sold to a debt buyer or placed for collection with a collection agency, you are still legally obligated to pay it. You may end up making payments directly to the collection agency or debt buyer instead of the original lender.

Don’t Miss: How To Handle A Charge Off On Credit Report

How Can I Avoid Delinquency

Delinquent accounts can be bad for your credit scores and your bank account. Its smart to do everything in your power to avoid them.

That being said, most people dont just wake up one morning and think, Today feels like a great day to skip my credit card payment. No, delinquencies generally happen because of an underlying problem.

A job loss or a reduction in income, for example, can make it difficult to keep up with your bills. An illness or emergency expense could also cause financial problems. Sometimes delinquencies happen because you dont have a good plan for how to spend your money.

Whatever the reason youre making late payments, the following tips might help you get back on track.

Recommended Reading: How To Remove Evictions From Your Credit Report

What’s In A Credit Report

Your credit report can include information that is needed to identify you: name birth date current and two previous addresses current or last known employers name drivers licence number .

Your credit report may also have information about your credit history that is, how youve dealt with other debts. This is very important information as it tells the new credit provider how youve treated those debts, which gives an indication about how youre likely to treat the new debt.

Whats included in your credit report can be a bit technical. To help you understand, weve set out an explanation below:

Recommended Reading: What Business Credit Cards Report To Credit Bureaus

Understanding Your Credit Report

More than half of consumers never checked their scores in 2019, according to a report in USA Today. This likely means they never checked their credit reports as well. One reason for that could be that credit reports can seem difficult to understand.

While your credit report may appear complicated at first, after you break it down section by section it will become much easier to understand. Well go over the sections of your credit report with in-depth descriptions.

Additionally, credit reports have codes along with identifying information for both you and the companies you have done business with. When you read over your report, youll want to understand what those codes mean and how they are used to record your credit history. You can also find a guide to those codes below.

Understanding your credit report is the first step to repairing your credit. When you understand and monitor your credit reports, you can increase your credit rating. In fact, 34% of subprime consumers who followed their credit raised their score to near-prime or above credit risk.

How Long Do Collections Stay On Your Credit Report

If a creditors information regarding an accounts delinquency is valid, the collections record will exist for seven years starting on the date it is filed.

Heres how it typically works: When a creditor considers an account neglected, the account may be handed over to an internal collection department. Sometimes, however, the accounts debt is sold to an outside debt collection agency. This often happens when you are about six months behind on payments.

Around 180 days after the original due date of the payment, the creditor might sell the debt to a collections agency, says Sean Fox, co-president of Freedom Debt Relief. This step indicates that the creditor has decided to give up on getting payment on its own. Selling to the collections agency is a way to minimize the creditors loss.

At that point, you will start to hear from a debt collector, who now has the right to collect the payment. Depending on the type of debt you have, a variety of countermeasures exist on behalf of creditors to prevent major financial losses.

Unsecured debts, like credit card debt and personal loans, are generally sent to a collections agency, or can even be handled internally. If you fail to pay a secured debt, like an auto loan or a mortgage, foreclosure and repossession are the most common approaches for creditors to begin regaining losses.

You May Like: How Often Does Wells Fargo Report To The Credit Bureaus

Potential Changes To Current Credit Report Laws

There are two potential major changes to how credit is reported and used that are being discussed by the federal government. Neither has been made into law yet, but if they are they could have a huge impact on consumer credit reporting.

The National Credit Reporting Agency Act would replace or supplement the three major credit bureaus with a government credit registry, which the Consumer Financial Protection Bureau would run. Other ideas being considered as part of the law would:

- ban the use of credit scores for most employment screenings

- lower the time negative information stays on your report from seven years down to four years

- delay medical debt recording

- allow for extra protections for COVID-19 victims

The Protecting Your Credit Score Act plans to make it easier for people to review their credit scores with a main website where they can access their scores along with their reports. They could also quickly freeze their accounts or dispute mistakes through the one website.

Proponents of this type of change are being heard in Congress. Chi Chi Wu, an attorney with the National Consumer Law Center and an advocate for changing the current system, spoke recently to the House Committee on Financial Services. He stated, While public agencies are not perfect, at least they would not have profit-making as their top priority.

The Chair of the Committee Maxine Waters , added, Good credit is a gateway to wealth.

Determine The Accounts Legitimacy

Is the collection account legitimate a past-due debt that you actually owe? If it is, youre going to have a tough time getting it removed from your credit reports. However, if the account is actually incorrect, or should have been removed from your reports by now, then you may be able to get it removed through the dispute process.

Also Check: What Does A Judgement Mean On Your Credit Report

Recommended Reading: What Kind Of Credit Score To Buy A Car

How Long Will A Paid

It can take one or two billing cycles for a loan or credit card to appear as closed or paid off. Thats because lenders typically report monthly. Once it has been reported, it can be reflected in your credit score.

You can check your free credit report on NerdWallet to see when an account is reported as being closed.

About the authors:Bev O’Shea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Lindsay Konsko is a former staff writer covering credit cards and consumer credit for NerdWallet.Read more

Choose Your Plan Of Action

There are a few ways to handle a collection account on your credit reports:

- If the collection account is inaccurate, dispute it with each credit bureau thats reporting it. The consumer credit bureaus let you file disputes online for convenience. You can also dispute inaccuracies with debt collectors and creditors themselves, though these disputes will typically have to be by phone or mail. In this case, consider sending a 609 dispute letter via certified mail.

- If the account is legitimate but has been paid, contact the collection agency to request a goodwill deletion. This literally involves asking for the account to be removed because you paid it. Its probably not going to work, but its worth a shot. A goodwill adjustment may be more viable if you havent made any other credit blunders in the past.

- Just wait. A collection can usually remain on your reports for about seven years after the account was declared delinquent, even if its unpaid, and its impact on your scores will dissipate over time.

Don’t Miss: Can You Remove Charge Off From Credit Report

Derogatory Mark: Account Charge

If you dont or cannot pay your debt as agreed, your lender may eventually charge the account off. The charge-off will appear on your credit reports for seven years.

What to do: Try to pay off the debt or negotiate a settlement. While this wont get the charge-off removed from your credit reports, it’ll remove the risk that youll be sued over the debt.

Open And Closed Accounts

Open and closed accounts will both appear on your credit report, with the exception of negative, closed accounts that are older than seven years. Those accounts have passed the credit reporting time limit. Accounts that were closed in good standing remain on your credit report about 10 years after the account has been closed, or whatever period the credit bureau has specified.

Don’t Miss: Which Credit Score Is Used

Not Reported Status On Credit Report

Hello everyone,

I have a quick question. I posted this in Credit Cards and didn’t get a response. I figured I’d put my post in the wrong topic. I managed to dispute a defaulted credit card debt and it now shows as Not Reported. So it shows all the previous good history and the charge off and for this month it show NR. Does this mean that if I try to get something that it will still show up? That was the only thing left I had to correct so the bank would approve my mortgage. Does anyone know if I go back to the bank now they will see it as a good thing, a bad thing, or something that no longer matters? If it’s a good thing, then I’m going to have to dispute it on the other two credit reporting agencies, but that is a great problem to have really. =)

I’m not an expert on CO reporting however, NR simply means they didn’t get an update from the reporting agency when they reasonably expected to get one is my understanding of it based on my own credit reporting vagaries.

Open collection I had: assigned, NR, NR, NR…. CLS when I paid it as an example, am guessing the CO still has a balance and isn’t satisfied on the credit report?

I went ahead and removed your duplicate post.