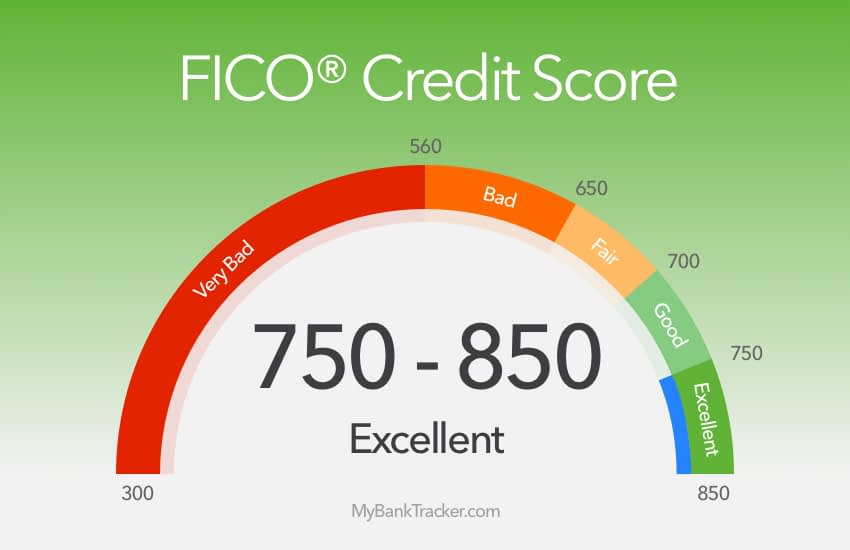

How Do Credit Scores Range

Excellent credit score: 741-900

If your credit score falls in this range, congratulations! An excellent credit score helps you qualify for the best rates and terms on financial products. Youâll have an easier time getting approved for financing on large purchases, such as major appliances, a new car, and your first home. Youâre also more likely to receive promotional rates, rewards, and cashback bonuses on new credit cards.

Good credit score: 713-740

Having a good credit score means lenders see you as a low-risk borrower. Youâll get approved for solid interest rates, but there could be some simple steps you could take to bump up your credit score and access even better rates. With a bit of time, discipline, and patience, your credit score could reach new heights and help you save money on interest in the long run.

Fair credit score: 660-712

Below Average credit score: 575-659

With a below average credit score, youâll have a difficult time getting approved for standard rates and terms on credit cards or loans. You may be able to get a secured loan or a secured credit card, but the interest rate youâll qualify for will be higher than average. To save money in the long run on interest payments, itâs in your best interest to build up your credit score and reach a good or excellent score.

Poor credit score: 300-574

Percent Of Credit Files That Dont Qualify For A Fico Score

The Ascent reports that data released in 2019 found 11 percent of Americans dont qualify for a FICO credit score5.

In order to qualify for a FICO score, you must have:

- At least one credit account that has been open for at least six months

- At least one account that has reported to credit bureaus within the past six months

- No deceased status on your account6

If you share a credit card or other types of credit with someone who has passed, this may account for the deceased status thats preventing you from receiving a FICO score on your credit report. Watch your credit with a credit reporting agency like Experian to report this.

What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

Don’t Miss: What Is The Free Annual Credit Report Website

Making Payments On Time

Keeping up with repayment is essential to achieve the highest possible credit score. According to FICO, payment history accounts for 35% of the overall credit score, and never missing a payment means safely improving your score. If you are more than 30 days late with a payment, creditors will likely contact the credit bureaus, and your credit score will decrease. Late payments can stay on your record for up to seven years. During this time, you may find it challenging to borrow money.

The Importance Of A Top Credit Score

There are several key benefits of having a high credit score. If you are working towards the highest credit score, here are some of the reasons why its important to keep going:

- Lower interest rates and fees for loans and mortgages: If you want to borrow money, you will have access to lower interest rates if you have an excellent credit score.

- More options: With a very good or exceptional credit score, a wider range of lenders and products will be available to you.

- Access to deals and incentives: Some incentives offered by credit card companies, for example, cash back on purchases or 0% offers, are only available to customers with top credit scores.

Lower premiums: In some cases, a good credit score can help you save money on premiums, for example, auto insurance.

Recommended Reading: Does Klarna Help Your Credit Score

Is A 720 Equifax Score Good

A 720 credit score is considered a good credit score by many lenders. Good score range identified based on 2021 Credit Karma data. … It can mean you’re more likely to be approved when you apply for a credit card or loan. Good credit can also help you qualify for lower interest rates and better loan terms.

How Does The Average Credit Score Differ By Generation

The following are the average scores by generation:

- Generation Z: 674

American Express reports the following average credit scores by income:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

Low average credit scores may be linked to lower income due to factors like higher-income individuals being able to pay back credit card debts more easily and maintaining a lower credit utilization ratio. The credit limit of those with higher incomes may also be higher than that of those with lower incomes.

However, income is not the most reliable indicator of a score. A persons income is only one factor that affects their credit score. It is still possible to have good credit and a low income. No matter your income level, dont worry. Your credit score is not determined by your income.

Recommended Reading: What Does Charge Off Mean On Your Credit Report

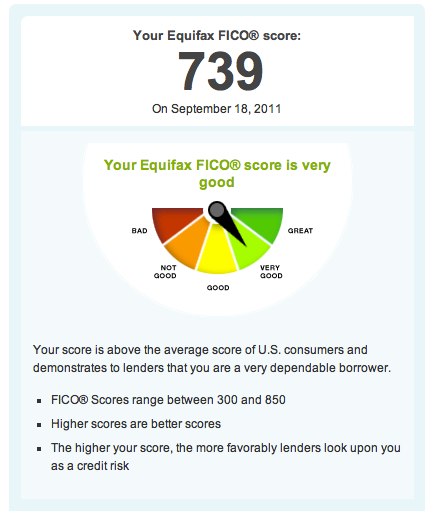

What Is The Equifax Credit Score

Dont confuse any of the scores listed above with the Equifax credit score. The Equifax credit score does not refer to a FICO or VantageScore number using Equifax data.

So, what is the Equifax credit score?

Equifax developed its own scoring model to help educate consumers. The Equifax credit score is not based on the FICO or VantageScore models. You can use data from any of the big credit bureaus to create an Equifax credit score not just Equifax data.

The Equifax credit score is not geared toward underwriting and lenders dont use it. It was created to help consumers estimate their creditworthiness and general financial health.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Does Applying For A Credit Card Hurt Your Credit Score

Is 893 A Good Credit Score

An 893 credit score is excellent. Before you can do anything to increase your 893 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and don’t count towards your score.

How Do You Get A Perfect Credit Score

Income, savings, and investments have no bearing on your credit score. Its simply a measure of your debt management skills. A high credit score can be achieved by showing financial institutions that you are always able to repay your loans on time. Aside from on-time payments and low credit utilization, perfect scores are also distinguished by two other factors, notes the team over at Bungalow.

Perfect credit score holders:

- Have a greater number of credit cards. An average of 6.4 credit cards are owned by people with perfect credit scores, almost twice the national average of 3.8.

- Perfect credit card scores averaged $3,025 in debt. Nationally, the average salary is $6,445.

Recommended Reading: What Is Nctue On Credit Report

Benefits Of High Credit Scores

High credit scores usually come with multiple benefits, including:

- Lower interest rates. When you apply for a personal loan, mortgage, auto loan or student loan, youll have a better chance of qualifying for the best interest rate. This can save you thousands of dollars during your lifetime.

- More lending options. If you have a high score, you shouldnt have much trouble meeting any lenders minimum credit score requirements. This gives you access to lenders who only offer loan products to applicants who have excellent credit profiles.

- . Since some of the best cash back credit cards require excellent credit scores , youll most likely qualify. In addition, youll also be able to qualify for a 0% APR credit card that doesnt charge interest on purchases or balance transfers for up to 21 months.

- Lower car insurance premiums. If you live in a state that allows , you could pay a lower monthly premium.

- Lower security deposit for an apartment. When you purchase an apartment, youll probably pay less of a security deposit than someone who has a low credit score.

How To Get A Good Credit Score

Good credit habits, practiced consistently, will build your score. Heres what you need to do:

-

Pay bills on time. This is important because payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to 7 years.

-

Try to keep your credit card balances well below your credit limits aim for, and lower is better. High utilization dings your score, but the damage will fade when you’re able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

-

Keep credit accounts open unless there is a compelling reason, such as high fees or poor service, to close them. Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Also, closing an account cuts into your overall credit limit, driving up your credit utilization.

-

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up. That’s why it’s important to research credit cards before you apply.

-

Monitor your credit reports and dispute information you believe is incorrect or too old to be included .

Also Check: Do Closed Accounts Affect Your Credit Score

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

How Accurate Is The Equifax Credit Score

The accuracy of any credit score depends on the completeness and correctness of the data being analyzed. Credit scoring models have more similarities than differences, and if you apply all scoring models to the same set of data, your scores should be similar.

You tend to see greater differences among scores when scoring models are applied to different databases. For instance, FICO 5 works with data from Equifax, while FICO 2 pulls in data from Experian and FICO 4 uses TransUnions database. The results from FICO 5, 4, and 2 may vary because all creditors dont necessarily report to all three bureaus. TransUnion might have information about a late payment when Experian doesnt.

Another reason that scores might vary is that creditors dont always report to each bureau at the same time. So each bureau might show a different balance on the same account, and that can impact your credit utilization and your credit score.

The Equifax credit score is an educational credit score. Educational credit scores have been shown to differ significantly from those that lenders use to make underwriting decisions. According to the Consumer Financial Protection Bureau , educational credit scores sold by credit bureaus to consumers differ from those used by lenders by a meaningful amount about 20% of the time. Meaningful means the two scores would have resulted in different underwriting decisions or loan pricing.

You May Like: Does A Judgement Show Up On Your Credit Report

What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

Get Your Credit Score For Free

Banks know your credit score, so why don’t you? Get your free score and monthly updates with the Finder app. Pop in your phone number below to get your download link.

Equifax is the largest credit score provider in Australia and has helped of 20 million people get their . We’ll run through what services they offer, how to read their credit reports, and the pros and cons of Equifax.

Also Check: How To Put A Fraud Alert On Your Credit Report

Fannie Mae & Freddie Mac Send Out Warning

Equifax started to publicly disclose the coding errors in May to an industry publication called National Mortgage Professional. Since then, huge mortgage institutions such as Fannie Mae and Freddie Mac have sent out warnings to lenders:

Any lender that received credit report data directly from Equifax online or via a third-party consumer reporting agency/reseller over this period may be affected by this incident.

The Main Factors That Affect Your Scores: Fico Vs Vantagescore

While VantageScore and FICO scoring models have differences, both make it clear that some factors are more influential than others.

For both models, payment history is the most important factor, followed by the total amount of credit you owe .

FICO uses percentages to indicate the importance of each factor to your credit scores.

| FICO |

|---|

|

Less influential |

Don’t Miss: What Does Cls Mean On Experian Credit Report

Perfect Score Vs Average Score: Credit Profiles

People with perfect FICO® Scores carry debtthey just do it differently from those further down the scoring scale. U.S. consumers with perfect scores have more tradelines, or credit products, but less average debt than those with the average FICO® Score, which in the fourth quarter of 2018 was 701.

People with FICO® Scores of 850 carried an average 6.4 credit cards compared with the national average of 3.8 credit cards. When it came to credit card debt, however, Americans with perfect FICO® Scores owed less than half the U.S. average: an average $3,025 compared with the national average of $6,445.

In every other debt category except mortgage and personal loan, people with perfect scores had more open tradelines but less debt than their counterparts with average scoresunderscoring the value of being able to manage debt while having numerous credit accounts.

Does It Help To Have The Highest Credit Score

Having a high credit rank is definitely good. However, the highest credit score does not guarantee people of receiving exclusive benefits that people with credit scores in the higher end of the credit range cannot hope to receive. In other words, as long as a personâs credit score lies in the higher end of the and he/she is classified as a prime borrower, the person can hope to receive all the advantages that people with a FICO score of 850 can avail. Considering this, the following discussion on the advantages of a high credit rate assumes relevance.

You May Like: Which Information Can Be Found On A Person’s Credit Report

How Does Credit Scoring Work

To get any credit score, a lender needs two things a source of credit data and a credit scoring model. Equifax, TransUnion, and Experian all maintain extensive collections of consumer credit data. Each bureau compiles its data into credit reports. However, a credit report is not a credit score. To get a credit score, a lender runs credit bureau data through a credit scoring model.

The most widely used credit scoring system is the FICO score created by the Fair Isaac Corporation. FICO comes in several versions that are still in use, including FICO 2, 4, 5, which mortgage lenders use, and FICO 8, 9, and 10, which are for general use. There is also the VantageScore, a popular alternative created by all three credit bureaus working together. Finally, there are industry-specific versions of scores geared toward credit card issuers, for instance, or auto financing.

A consumer can have dozens of credit scores because there are so many combinations of data sources and credit scoring models. Here are some of the most common scores used by creditors to make lending decisions: