Supercharge Your Future & Credit Score Today

Reclaim your financial freedom and speak with a live credit specialist for your free consultation, right now

Copyright © 2022 Credit Glory LLC. All rights reserved. 1887 Whitney Mesa Dr Ste 2089, Henderson, NV 89014. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Credit Glory does not provide legal advice and is not a substitute for legal services. If you are dealing with credit and debt issues you should always contact a local attorney for legal advice regardless of your use of any other service. Credit Glory does not guarantee the permanent removal of verifiable tradelines or make promise of any particular outcome whatsoever. Credit Glory requires active participation from its clientele regarding requested documents and information, including investigation results, for the sought-after outcome of a healthy, accurate credit report. Individual results may vary.

Can I Get A Mortgage & Home Loan W/ A 805 Credit Score

Getting a mortgage and home loan with a 805 credit score should be extremely easy. Your current score is the highest credit rating that exists. You’ll have no issues getting a mortgage or home loan.

The #1 way to get a home loan with a 805 score is just to apply for that loan and wait for approval!

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

Consider Consolidating Your Debts

You can consolidate your debts by taking out a debt consolidation loan and using the loan to pay off your other debts. The primary purpose of debt consolidation is to reduce the number of payments and amount you pay each month.

With an 805 credit score, you can make the most of this approach because youll qualify for loans with low interest rates. If you have primarily revolving debt, this approach could further strengthen your credit by reducing your credit utilization and improving your credit mix. It also reduces the risk of late payments because you have fewer accounts to manage.

However, there are some potential downsides to think about. For example, if the loan term is long, then you may end up paying more overall in interest, even if your monthly payment is lower. If you do consolidate your debts, make sure to keep your old accounts open so that you dont reduce the amount of available credit you have.

Also Check: How To Add A Tradeline To Credit Report

What Does Not Count Towards Your 805 Credit Score

There are many things that people assume go into their 805 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

What Affects 805 Credit Score Negatively

When dealing with a credit score, any negative information will cause it to get lowered. This is not ideal for anyone. However, there are many ways that a person can work to boost their credit score and make it more positive. Even though you are at a 805 FICO credit score, you can still maintain or even grow that score by following some credit-worthy tips.

Dispute any negative reports that are on your credit report that you did not make or that are untrue. Disputing these and then having them cleared from the report helps.

Always make on time payments to uphold the credit score that you have.

Keep the credit usage to around 30% of what you currently have available. You can go a small amount above this, but make sure to pay it off so that it is below the 30% mark.

Take out loans responsibly to make sure that you are able to afford the payments that come with them.

Keep accounts open, the longer the account is open, the better it will have an impact on the credit score in a positive way.

Refrain from opening up many new accounts over the years, as the newer ones can negatively impact a credit score.

Keep the amount of times that your credit is hard checked in balance. Hard inquiries on your score can cause it to go down a few points.

Have a good mix of debt loans, vehicles, mortgage, credit cards and other credit. Having a mix shows youre good and responsible with all types of debt.

You May Like: How To Get Official Credit Report

Auto Loans You Can Get With An 805 Credit Score

Getting an auto loan is easy with a credit score of 805. Youll qualify for all the best interest rates, and youll even be eligible for 0% APR car loans that some new car dealers offer.

According to a 2020 quarterly report by Experian, people with credit scores of 781850 received average interest rates of 3.80% on used car loans and 2.65% on new car loans, whereas people with credit scores in the range of 501600 had much higher average interest rates, at 16.56% for used car loans and 10.58% for new car loans. 7

Depending on the loan term and how much youre borrowing, this difference could amount to hundreds or thousands of dollars in savings. If youre thinking about buying a car, then you might want to start looking around now while your score is high.

Steering Clear Of Bankruptcy

Bankruptcy is a highly feared word in the world of finances. Its something that we all hope we will never have to endure the mere thought or possibility of it is enough to make us quiver in fear.

Bankruptcy is definitely not something that should be underestimated. It will be one of the biggest blows not only to your finances, but to your state of mind and well-being as well. Plain and simple, a bankruptcy is something that you want to avoid at all costs. And as you may have guessed, a bankruptcy is not going to look good on your credit report .

But while it is universally acknowledged that bankruptcy is something that you should try to avoid at all costs, there are still many mistaken beliefs that surround how to avoid it, too. A bankruptcy will immediately lead to a huge drop in your credit rating and will be visible on your report for over ten years at least. This means that if your credit score has already fallen thanks to late/missed payments or defaults, with a bankruptcy, things arent exactly going to look so sunny.

What if you are forced to file for bankruptcy? Is it still possible to rebuild your credit?

Yes, it still is. Even though your bankruptcy will be listed on your report for ten years, you can still slowly but steadily rebuild your credit by paying each of your bills when you need to. In this scenario, however, its vitally important that you repay each of those bills without exception.

You May Like: What Is Jpmcb Card On My Credit Report

What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

Credit Score: Personal Loan Options

With a score this high, you wont face any problems securing a loan. Your personal loan interest rates for credit score 805 and above should range from 13% to 15% on average, but lower rates are definitely available. Shopping around will be in your best interest, because youll qualify for nearly every loan. However, be sure to do your shopping in a brief period of time so your credit score doesnt take a dip.

You May Like: How To Remove Derogatory Items From Credit Report

How Good Is A Credit Score Of 750

Youre still well above the average with a 750 credit score, and you wont have trouble opening a credit card or getting a loan. Most lenders consider a 750 credit score to be in the very good range, which is a single step below exceptional.

A 750 score isnt something to worry about, but you may want to work on pushing your score into the 800s. Borrowers with scores in the 800s get the absolute best interest rates and credit card offers. It can be worth the extra effort to improve your score if you want the best of the best. Its usually not difficult to boost your score from 750 to 800. Keep making your payments on time, manage your bills and youll see results.

Percent Of Adults Who Never Check Their Scores

One study conducted by Javelin Strategy & Research and sponsored by TransUnion revealed that 54 percent of adults never check their credit scores8.

Checking your credit score is a crucial aspect of reaching your financial goals and correcting any mistakes in your credit report.

Whether you regularly use a credit card or are paying back loans like student loans, always check your score on a regular basis, whether its through a third-party application or using an established credit reporting company like Experian.

You May Like: What Number Is An Excellent Credit Score

What An 805 Credit Score Means Wallethub

An 805 credit score is a perfect credit score, believe it or not. Despite being just shy of the highest credit score possible , a credit score of 805

An 805 credit score is considered a very good or excellent credit score by many lenders. Heres what it means to have excellent credit,

People with a credit score of 805 or higher are said to belong to the 800 Club. Even though the highest score you can get is an 850, an 805 is

How To Check Your Credit Report For Identity Theft

Category: Credit 1. Free Credit Reports | FTC Consumer Information How do I order my free annual credit reports? · Visit AnnualCreditReport.com · Call 1-877-322-8228 · Complete the Annual Credit Report Request Form and mail it to:.About Credit Reports · How To Get Your Free Annual Credit Reports How can

Recommended Reading: What Does Closed Derogatory Mean On Credit Report

Is It Possible To Get A Credit Score Of 850

Its possible to achieve an 850 FICO® Score. However, its very difficult to get your score this high. An 850 credit score means that you have nearly perfect credit management. Very few people actually hold a perfect 850 credit score. Consumers with this score are incredibly unlikely to default on their loan obligations. If you can achieve an 850 credit score, youll have access to nearly any type of loan or card.

No lender will expect you to have an 850 credit score, no matter what youre applying for. Its possible to buy a home, go back to school and get a personal loan even if you have less-than-ideal credit. However, if youre still determined to make it into the perfect credit club, you can use these tips to start your journey toward an 850-point score.

Why Experts Say 760 Is The Best Credit Score To Aim For

It might be exciting for some to aim to achieve the highest credit score of 850. However, it comes with no additional benefits that you likely won’t already get with a 760 score.

“The best published interest rates for auto loans are 720+ and for mortgages 760+,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells Select. “As such, I always tell people, shoot for 760 or better. That way, they’re safe for all loan types and cards.”

For Jim Droske, president of the credit counseling company Illinois Credit Services , the threshold is 760 as well. But he says aiming for 780 is even better to be “the safest” in any type of lending situation. Anything higher, though, won’t be more beneficial, nor would it get you a better offer with more favorable terms.

“If you’re above 760, or 780, certainly you’re already getting the best you can get,” Droske tells Select. “You’re already hitting that pinnacle of what care about.” A high enough credit score shows lenders and credit card issuers that you are less of a risk and more likely to pay back the loan, versus if you had a lower credit score.

“Anything above that is really just maybe a little pride,” says Droske. “When you have already reached the summit, no need to look for a ladder.”

Also Check: How Do You Find Out What’s On Your Credit Report

What Are The Average 805 Credit Score Car Loan Rates In 2022

For those that have excellent credit scores, they can ensure that they will qualify for just about any type of loan that they wish to take out, whether it is an auto loan or a mortgage. Personal loans are also something that are easier for them to borrow with such a high credit score. It is important to provide proof of your income when applying for any loan, though.

| FICO Credit Score |

|---|

| 3.34% |

All the calculation and examples below are just an estimation*.Individuals with a 805 FICO credit score pay a normal 3.4% interest rate for a 60-month new auto loan beginning in August 2017, while individuals with low FICO scores were charged 14.8% in interest over a similar term.

So, if a vehicle is going for $18,000, it will cost individuals with excellent credit $326 a month for a sum of $19569 for more than five years at 3.4% interest. In the meantime, somebody with a lower credit score paying 14.8% interest rate without an upfront installment will spend $426 a month and wind up burning through $25584 for a similar auto. That is in excess of a $6015 distinction.

The vast majority wont fall in the highest or lowest class, so heres a breakdown of how an extensive variety of FICO scores can influence the aggregate sum paid through the span of a five-year loan:

| FICO Range | |

|---|---|

| $7,582 | $25,584 |

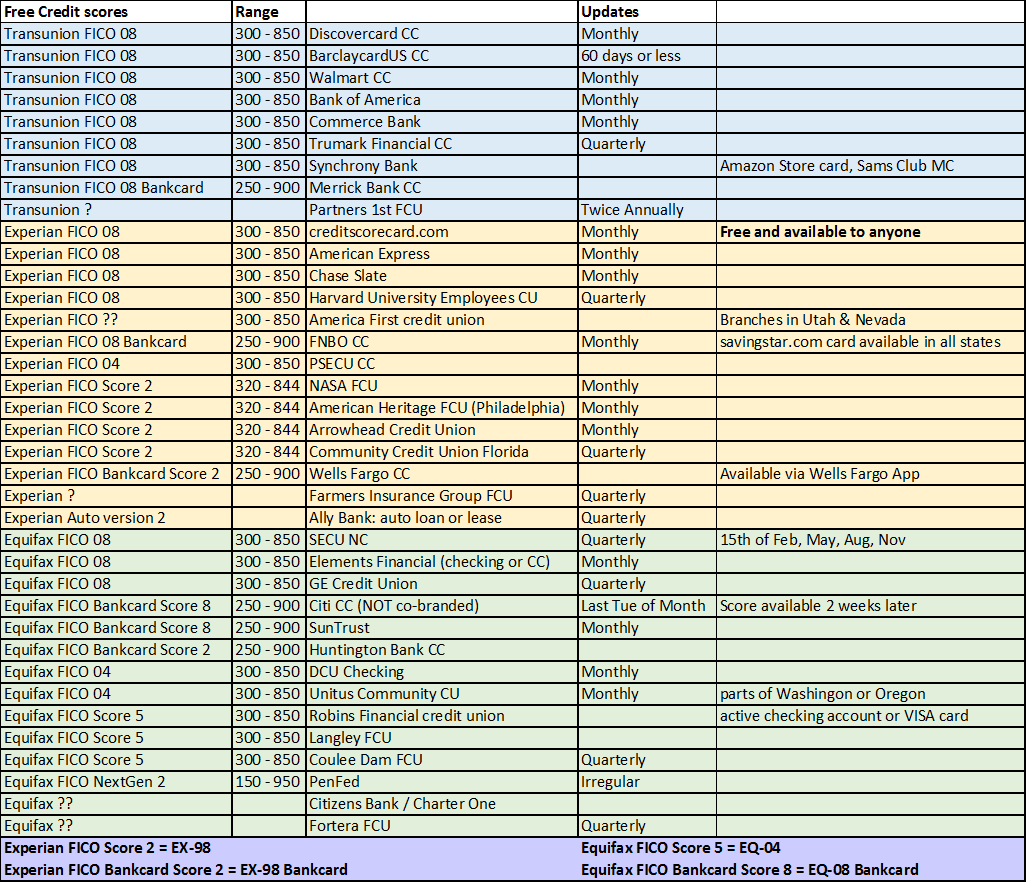

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 805 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Read Also: Is 720 A Good Credit Score

Whats A Good Credit Score Range

A good credit-score range depends on where a score comes from, who calculates the credit score and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine . That means that what FICO, VantageScore or anyone else considers good may not be the same.

However, there are some general guidelines for how being within a score range can impact your choices:

- A poor to fair score means you may find it difficult to qualify for many credit cards or loans. You might need to start with a secured credit card or credit-builder loan to build or rebuild your credit. And if you do qualify for an account, you may have to pay high fees and interest rates if you don’t pay your balance in full each month.

- A fair to good score means you may be able to qualify for more options, but you wonât necessarily receive the best rates or terms. You also might find you can qualify for a traditional unsecured but have a harder time qualifying for a premium card.

- A very good or excellent score means you may be able to qualify for the best products with the lowest advertised rates. While creditors consider other factors too when determining your eligibility and rates, your credit score probably wonât be holding you back.

Whatâs a Good FICO Credit Score Range?

FICO scores that range between 670 and 739 qualify as good scores. Scores in that range are near or slightly above the U.S. average. In total, FICO breaks its scores into five categories:

Cibil Assigns You A Score From 300 To 900 Based On Factors Like

- Your timeliness with repaying credit in the form of EMIs or credit card bills

- Your credit utilisation ratio, when it comes to your credit card limit or loan vs. income

- The number of times you have applied for credit in the recent past and been rejected or approved

Heres how your credit score defines your financial habits and how you can proceed from one category to the next.

Read Also: Is 621 A Good Credit Score