How Does A Derogatory Account Affect My Credit

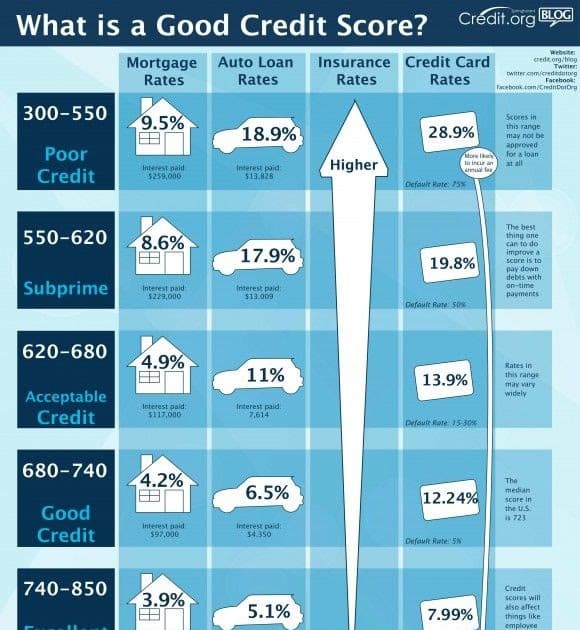

Your payment history is the most important factor in your credit scores, so even a single late payment can hurt your scores. However, a seriously delinquent or derogatory account, such as a charge off or collection account, will be harder to recover from than just one or two missed payments. While some lenders still may be willing to extend credit to someone with derogatory items on their report, they may do so with less than favorable terms, such as higher interest rates or fees.

Derogatory accounts or items such as collection accounts and bankruptcy may also prevent you from qualifying for an apartment. You may also have to pay hefty security deposits to open a cellphone or other service account.

Accounts with derogatory payment history can remain on your credit report for seven years from the original delinquency date. A Chapter 13 bankruptcy remains on the report for seven years from the date it was filed, while a Chapter 7 bankruptcy may remain part of your credit history for 10 years from the date filed.

You could simply not pay the debt.

As I explained earlier, if you havent made a payment in a long time, by not paying, the debt is purged from your credit report earlier than if you pay the collection agency.

First, will a collection agency sue you? If the debt is small, likely not. It costs money in legal fees to make an application to the court for a judgment and getting a garnishment order.

Negative Information From Late Payments

- Late Payments: You must be at least 30 days late on a payment for it to show up on your credit report. Information about payments that are late by 30 days or more will remain on your credit file for 7 years from the date creditors report them to the credit bureaus. People often get concerned that a payment thats just a few days late will be noted on their credit reports, but thats not the case.

- Charged-Off Account: When you are 120 days behind on a loan payment or 180 days late on a credit card, your lender will be required to write the debt off its books , and your account will be classified as Not Paid as Agreed on your credit reports. This information will remain on file for 7 years, starting from when the delinquency that led to the charge-off is first reported to the credit bureaus.

For example, if your account was reported as late to the credit bureaus in September 2020 and it charged-off in December 2020, the late payments and charge-off record would stay on your credit report until September 2027.

You can read more in our Q& A about how long late payments stay on your credit report.

Sydney Garth Credit Cards Moderator

@sydneygarth06/08/20 This answer was first published on 06/08/20. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Paid collections stay on your credit report for 7 years. After you pay the account in collections, you can reach out to the collection agency and see if they will accept a goodwill adjustment. This is a request to remove a negative item from your credit report, or at least reclassify its status to benefit you, but the collection agency has no obligation to honor it. If the collection agency does not accept a goodwill adjustment, your credit report will still reflect your account as paid, which will look better to creditors than if you had not attempted payment.

You May Like: How To Report To Credit Bureau

What If Your Bankruptcy Has Been Discharged But Is Still Showing Up On Your Credit Report

Credit bureaus are required to stop showing a bankruptcy seven years after the filing date for Chapter 13 and 10 years after the filing date for Chapter 7. If you notice that your bankruptcy hasn’t been removed from the public records area of your credit reports, you should treat this like any other reporting error and dispute it with the credit bureaus. The credit bureaus are required to respond within 30 days.

As for the accounts included in your bankruptcy? They wont be erased at your filing day, either, according to the three major credit bureaus Experian, Equifax and TransUnion. You can expect closed accounts with delinquencies to be deleted from your credit history about seven years after the account went delinquent and was never brought current. Closed accounts without a negative payment history can stay on your reports for up to 10 years.

What Can Be Done About A Paid

Your chances of getting a paid collection account off your credit report depend on whether the account information is accurate. If the account is inaccurate, your chances of getting the collection account off your credit report are high. If the information is accurate, you can try writing a goodwill letter or you may just have to wait it out.

Dispute Inaccurate Information

Information on your credit report may be inaccurate for several reasons. For one, the item may have been on your credit report longer than the allowed seven years. Or accounts could be listed that arenât yours. This may be a sign of identity theft or of a mixed credit report.

Mixed reports are credit reports with two or more people erroneously included in the same report. This is caused by the creditors or credit bureaus not sufficiently matching identities. This has happened due to not matching all nine digits of the social security numbers. Sometimes, it happens due to people having the same or similar names.

If an item on your report is inaccurate, it must be removed by law. To have it removed, you can send a dispute letter to the credit bureaus. Your dispute letter should state in detail which account has the error and what the error is. You should also provide any supporting documentation to the credit bureau. Send your dispute via certified mail to the credit bureau.

Wait it Out and Do Credit Repair

You May Like: How To Dispute Things On Credit Report

Positive Information From Accounts In Good Standing

Your credit report will always show any open loans and lines of credit, which is good news for your credit score. As long as you keep your accounts in good standing, this positive information will boost your credit score throughout the lives of the accounts. To help keep your accounts in good standing, we recommend that you check out our guide on tips for never missing a due date.

Once you close an account that was in good standing, it will remain on your credit report for 10 years. While it may be frustrating to see an account that benefits your credit score disappear, you can easily balance out the credit score impact by having more than one credit account. You can read more about the benefits of multiple credit cards in our guide about how many credit cards you should have.

How Long A Closed Account Stays On Your Credit Report

The length of time a closed credit card stays on your credit report depends on whether the account was closed in good standing. A negative closed account, like a charged-off credit card, will remain on your credit report for seven years. That’s the maximum amount of time most negative information can be included on your credit report.

If your account was closed in good standing, there is no law requiring it to be removed from your credit report in a certain time period. It could stay on your credit report indefinitely, but will likely be removed ten years after it was closed based on the credit bureau’s guidelines for reporting closed accounts.

It’s not a bad thing that a closed account still remains on your credit report, depending on how the balance and status of the account. Closed accounts generally only hurt your credit score when you have a negative account status or a high credit card balance. An account closed in good standing, however, may have a positive impact on your credit score for as long as the account is included on your credit report.

You might want to scrub your credit report of all closed accounts, but you can only have inaccurate or outdated information removed from your credit report. If this is true for any of your closed accounts, submit a dispute with the credit bureaus to have the account removed from your credit report.

You May Like: What Are Remarks On Your Credit Report

What Is A Credit Report And How Do I Access Mine

Institutions that have issued you credit cards and loans send regular updates about your accounts to , also known as credit reporting agencies. Credit bureaus collect all the data and combine it into a single file, known as your credit report. When you apply for new credit, the financial institution pulls your to determine whether you meet the qualifications.

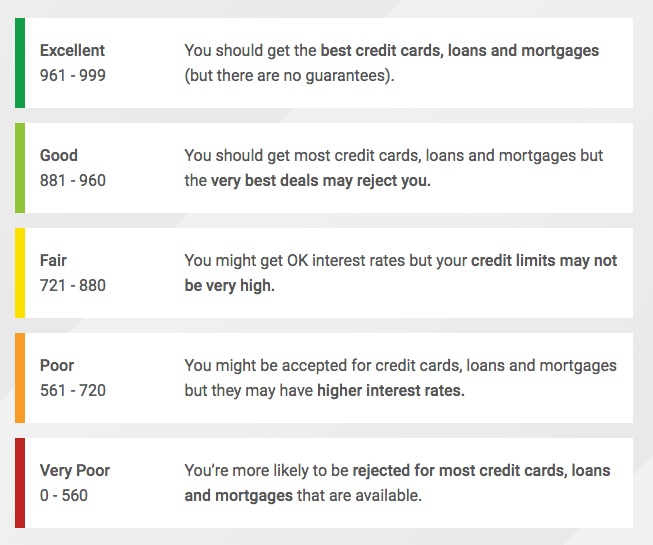

To quickly figure out the likelihood that youll repay a loan on time, creditors may instead use your , a three-digit numerical summary of your credit report information at a given point in time.

Its important to check your credit report periodically to make sure the information it contains is accurate, complete, and within the allowed reporting time limit. You can access your credit report online from any of the credit bureaus, but there may be a fee. Youre also entitled to a free credit report each year from the major credit bureaus.

You can get one free credit report per week from Equifax, TransUnion, and Experian through December 2023 at AnnualCreditReport.com.

As you read through your credit report, reference this guide to better understand some of the abbreviations you see. Different credit bureaus and credit report providers may use slightly different codes, and some codes may only appear on the reports issued to lenders. Well clarify as much as possible.

Write A Goodwill Letter

A goodwill letter is a formal request to a creditor asking for a negative item to be removed.

Although creditors are not required to remove negative items upon request, they may be willing to do so if you have a long history with them or if there were special hardships that led to the negative item.

However, goodwill letters are generally useful only for late or missed payments rather than collections, repossessions or other more significant negative items.

In addition to goodwill letters, you can also request that an account is removed using a pay for delete letter. These letters can lead to an agreement with a collection agency to remove an account in exchange for a set payment. That said, the collection agency may decide not to remove the account, and the original account that went to collections may remain on your report.

Don’t Miss: What Are The 5 Factors That Affect Your Credit Score

Hard Inquiry: Two Years

A hard inquiry, also known as a hard pull, is not necessarily negative information. However, a request that includes your full credit report does deduct a few points from your . Too many hard inquiries can add up. Fortunately, they only remain on your credit report for two years following the inquiry date.

Limit the damage: Bunch up hard inquiries, such as mortgage and car loan applications, in a two-week period so they count as one inquiry.

Derogatory Mark: Account Charge

If you dont or cannot pay your debt as agreed, your lender may eventually charge the account off. The charge-off will appear on your credit reports for seven years.

What to do: Try to pay off the debt or negotiate a settlement. While this wont get the charge-off removed from your credit reports, it’ll remove the risk that youll be sued over the debt.

You May Like: What Is The Minimum Credit Score For A Va Loan

How Long Does A Collection Entry Remain On Your Credit Bureau

Regardless of whether you paid the collection amount owing or not, the collection entry will stay on your credit report for seven years. As a result of this, for seven years, the collection entry will impact your chances of applying for new credit.

The unfortunate part is that even if they approve your credit, youre almost always going to pay a higher interest rate. As the collection entry gets older, it will affect your credit score less and less.

How Long Does Debt Stay On Your Credit Report

How long a collection stays on your credit report depends on the type of loan you have. Derogatory items may stay on your credit reports for seven to 10 years or more, according to the Fair Credit Reporting Act.

Heres how long you can expect derogatory marks to stay on your credit reports:

| Hard inquiries | |

| Money owed to or guaranteed by the government | 7 years |

| 7 years or until the state statute of limitations expires, whichever is longer | |

| Unpaid taxes | Indefinitely, or 7 years from the last date paid |

| Unpaid student loans | Indefinitely, or 7 years from the last date paid |

| Chapter 7 bankruptcies | 10 years |

You May Like: How Often Does Discover Report To Credit Bureaus

What Is Considered A Late Payment And When Does The Seven

Theres no set rule that applies to all lenders frustrating, we know. Each lender decides what is considered a late payment and when to report it to a credit bureau.

In most cases, if your payment is more than 30 days late, the major credit bureaus are notified, meaning the late payment will show up on your credit reports.

A late payment, also known as a delinquency, will typically fall off your credit reports seven years from the original delinquency date. For example: If you had a 30-day late payment reported in June 2017 and bring the account current in July 2017, the late payment would drop off your reports in June 2024.

The same generally applies if you miss two payments in a row. If you had a 60-day late payment reported in June 2017 and bring the account current in August 2017, both late payments would be removed in June 2024.

How Do Collection Reports Impact Your Credit Score

While a collection report usually causes serious damage to your credit score, how much it impacts it depends on which credit scoring model you use to calculate your score. It also depends on whether the collection account is paid or unpaid. For example, FICO Score 9the latest version of the FICO credit scoring modeldoesnt report paid collection accounts.

Earlier versions of this credit scoring model, however, do include paid collection accounts. If a lender uses an earlier model to assess the likelihood you can repay a loan, its likely that it will see a lower credit score if you have a paid collection account listed on your credit reports.

Also Check: Aargon Agency Hawaii

Read Also: How To Fix A Bad Credit Score

How Will Filing For Bankruptcy Impact Your Credit Score

You’ll likely see your credit scores quickly start to recover in the months following a successful filing, according to a 2014 study by the Federal Reserve Bank of Philadelphia. The study also found it takes about a year and a half after discharge for credit scores to return to their pre-bankruptcy level.

While a bankruptcy erases previous debt, it doesnt eliminate challenges to securing credit in the future. The same Philadelphia Fed study found that most bankruptcy filers experience reduced access to credit long after their bankruptcy is discharged.

Ultimately, once your bankruptcy falls off, there are plenty of potential outcomes and they tend to depend on what else is on your credit report. If bankruptcy is the worst thing on your credit report, and youve worked to reestablish your credit, youre likely to see a pretty dramatic uptick in your credit score. But if you still have some negative marks on your credit report like for missed payments or using too much of your credit limits then your credit score might not rise much.

How Long Does A Collection Account Stay On A Credit Report

The Fair Credit Reporting Act lays out that the collection has to stay on your credit report for up to seven years from the date of default on the original account. This is to give lenders a clear picture of your financial behaviour so they know the risks of lending you money.

However, on a credit report, a paid collection can still stay on your credit report for up to seven years, regardless of whether the account has a $0 balance.

After seven years, the paid collection will automatically drop off your credit report.

Read Also: When Are Bankruptcies Removed From Credit Report

What Does It Mean For Debt To Go Into Collections

If you dont pay back a debt on time, it can eventually go into debt collection. This phase of debt repayment is when a collection agency reaches out to the people that co-signed the debt for the money that the client is owed.

Debt collection agencies are third parties that operate outside of the borrower and lender relationship. A collection agencys job is to find a way to reach the borrower and either collect the money for the overdue debt or find a way for the borrower to start repaying their debt to the lender.

Debt collection agencies receive payment from the lender when they collect on the debt owed. Usually, the collection agency receives a percentage of the debt as their service fee. However, some collection agencies instead buy out the debt for a fraction of the total amount and then go after the original borrower for payment.

Several different debts can go into collections, such as:

- Car and auto loan debts

- Unpaid utility bills, such as electricity or water

In summary, having a debt go into collection is not great. In addition to the credit score troubles it can cause, having a debt go into collections means that you now have a third party hounding you for money. Its stressful, unpleasant, and could be making a bad situation worse.