Goodys Credit Card Login

Category: Credit 1. Goodys Credit Card Login | Make a Payment Goodys Credit Card Login | Make a Payment You can manage your Goodys Credit Card the easy way by enrolling for Comenity Bank online access. Comenity Bank is Net/Goodys Credit Card Activation. Sign Up: Register Your Goodys Credit Card

Where Can I Get My Credit Score

There are a few main ways to get your credit score, including from a credit card or other loan statement, a non-profit counselor, or for a fee from a credit reporting agency.

You actually have more than one credit score. Credit scores are calculated based on the information in your credit reports. If the information about you in the credit reports of the three large consumer reporting companies is different, your credit score from each of the companies will be different. Lenders also use slightly different credit scores for different types of loans.

There are four main ways to get a credit score:

Check your credit card or other loan statement. Many major credit card companies and some auto loan companies have begun to provide credit scores for all their customers on a monthly basis. The score is usually listed on your monthly statement, or can be found by logging in to your account online.

Talk to a non-profit counselor. Non-profit and HUD-approved housing counselors can often provide you with a free credit report and score and help you review them.

Buy a score. You can buy a score directly from the credit reporting companies. You can buy your FICO credit score at myfico.com. Other services may also offer scores for purchase. If you decide to purchase a credit score, you are not required to purchase credit protection, identity theft monitoring, or other services that may be offered at the same time.

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

Also Check: What Is The Worst Credit Score

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services will notify you after certain updates have been made to your credit report and credit score, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if youve been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services. Some institutions may offer it for free under certain conditions.

Hard Vs Soft Credit Inquiry

A credit inquiry is a request that potential lenders, employers, and landlords send to consumer agencies to check your credit score. Credit inquiries or credit pulls help lenders assess your creditworthiness based on your previous usage of credit.

Not all credit checks affect consumers credit scores. Theres a difference between hard inquiries and soft inquiries.

Read Also: How Does A Charge Off Affect Your Credit Report

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

How To Check Your Credit Scores

There are a few ways to check your credit scores:

Read Also: What Is An Inquiry On A Credit Report

Find Errors In Your Credit Report & Fix Them

No mistake is too small to fix. It is much more applicable for errors made in your credit report. A small mistake in your credit report can dip your credit score immensely.

So, review your credit report every month diligently. In case you have found an error, lodge a complaint and get it rectified immediately.

How To Minimize The Number Of Hard Inquiries You Have

Hard inquiries arent bad to have even if they may cause a slight temporary dip in your credit scores but it can be good practice to know how to minimize the number of inquiries on your credit report.

Below, CNBC Select rounded up some general guidelines to keep track of your hard inquiries:

- Dont apply for several credit cards within a short timeframe. Experts generally recommend only applying for a credit card every six months.

- Only apply for credit cards you would actually benefit from using.

- Make sure you check your credit score beforehand . You can do so for free with most card issuers, using apps such as Discovers Credit Scorecard and Chases Credit Journey .

- Before applying for a credit card, shop around with prequalification tools, which allow you to check your likelihood of qualifying for a card without damaging your credit.

You May Like: What Credit Report Do Apartments Look At

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

How Can The Credit Score Be Improved

since you know the significance of maintaining a good credit score and the factors that are considered for calculating the credit score, listed below are easy ways to improve your credit score:

- make timely payments of your loan EMIs

- pay your bills on time

- do not exhaust the complete credit limit

- clear any outstanding dues or bills

- avoid applying for numerous credit cards or loans

Recommended Reading: What Credit Report Does Target Pull

Free Credit Score Resources

Most credit card issuers provide free credit score access to their cardholders making it easier than ever to check and know your score.

Some issuers, such as Citi and Discover, provide free FICO Scores, while others, such as Chase and Capital One, provide free VantageScores.

You can check your credit score in less than five minutes by logging into your credit card issuer’s site or a free credit score service and navigating to the credit score section. There will typically be a dashboard listing your score and the factors that influence it.

FICO and VantageScore will pull your credit score from one of the three major credit bureaus, Experian, Equifax or TransUnion.

Here are some free credit score resources that you can access, whether you’re a cardholder or not:

Red Flags For The Lender

What creditors dont want to see on your credit history are late or missed payments, mortgage default, and also bankruptcy is some information that makes lenders turn their interest. You may have better chances to get approved with a smaller amount of loan if you have these data on your history. Then, you may walk with some loans on your hands.

Read Also: What Can You Do With A 800 Credit Score

Understanding The Credit Reports Through Key Terms

NA or NH: If you never owned a credit card or took a loan, there are chances that you will see an NA or NH on your credit score. NA or NH indicates that are there no, little, or insufficient credit activity to create a report or to generate a online credit score.

STD: Applicable to an individual’s credit report where the payments are made with the due dates.

SMA: Applicable on a credit report when the borrower has delayed the repayments.

DBT: This indicates a doubtful situation where the credit information has been inactive for over 12 months.

LSS: A credit report can be remarked as LSS if a lender reported the loan/credit card account as loss or if the account remains as a defaulter for a longer period of time.

DPD: Days past due indicates the number of days that the account has not received a payment. In a situation where the borrower could not make the repayment but came to an agreement with the lender for either a repayment plan or a settlement will indicate a written off or settle status.

Protect Yourself When Getting Your Credit Report Or Score

Make sure you do your research before providing a company with your personal information. Carefully read the terms of use and privacy policy to know how your information will be used and stored.

For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit reports or credit scores to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Read Also: How Does Credit Score Work

What Do I Do With My Credit Report

Read it carefully. Make sure the information is correct:

- Personal information are the name and address correct?

- Accounts do you recognize them?

- Is the information correct?

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Read Also: What Affects My Credit Score

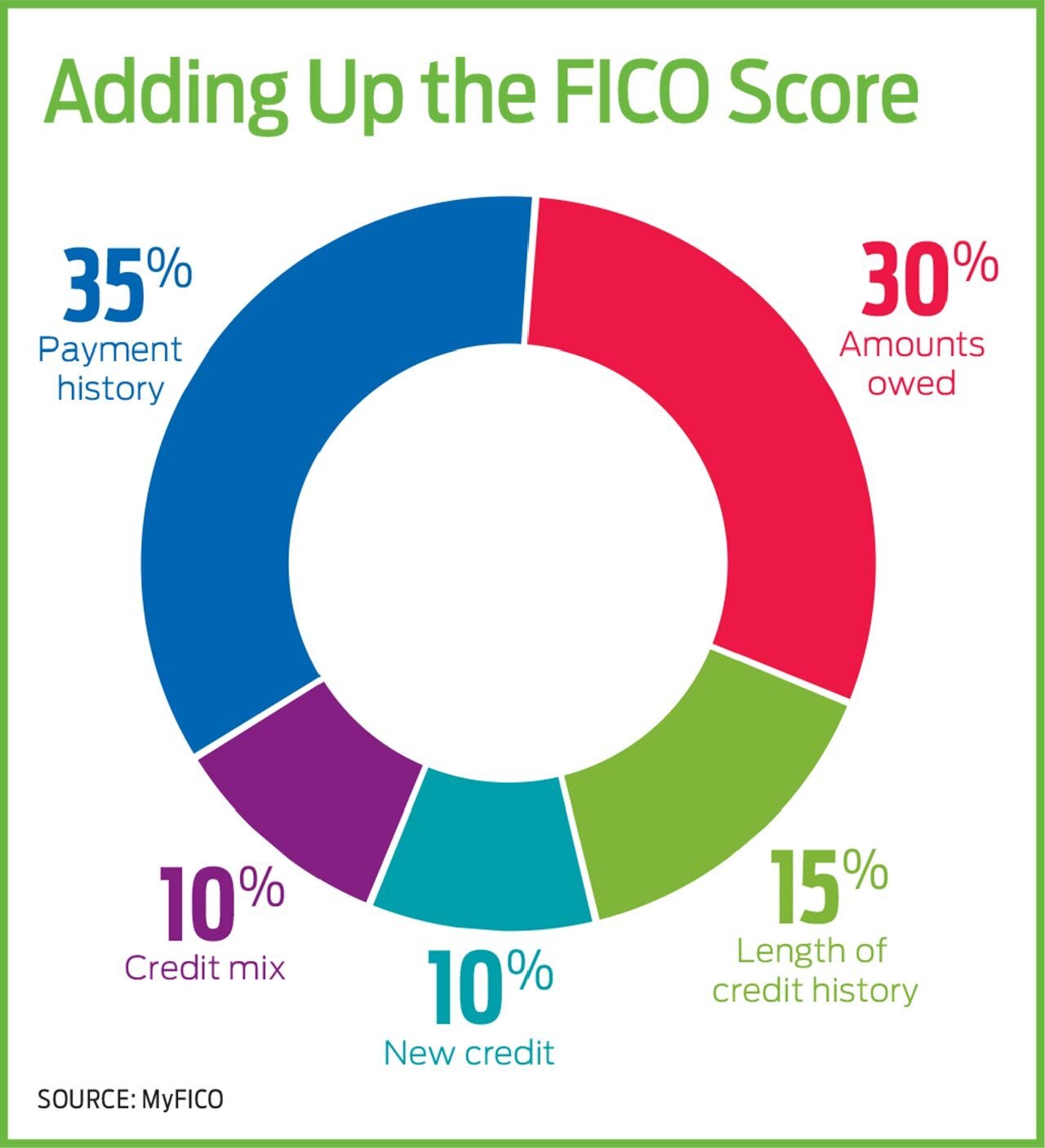

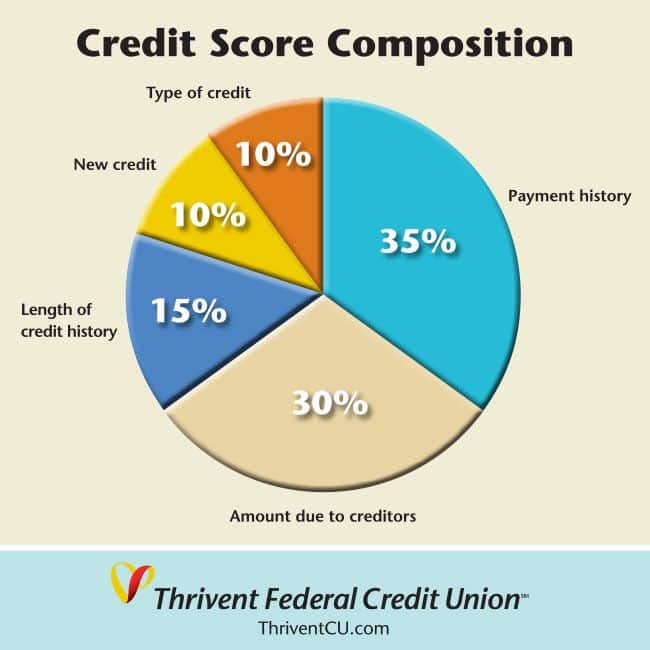

How Is The Credit Score Calculated

a credit score is calculated differently by the various credit information bureaus. general factors on the basis of which your credit score is calculated are mentioned below:

payment history – 35% of your credit score is calculated on the basis of your payment history. your payment history shows how timely youve made the payments, how many times you’ve missed on the payments or how many days past the due date youve paid your bills. so you can score high if you have a higher proportion of on-time payments. make sure you never miss out on payments as this would leave a negative impact on your score.

how much you owe – about 30% of your credit score depends upon how much you owe on loans and credit cards. if you have a high balance and have reached the limit of your credit card then this would lead to a drop in your credit score. while small balances and timely payments would help in increasing the score.

the length of your credit history is accountable for 15% of your credit score. if your history of on-time payments is long then definitely you would have a higher credit score. having said that, at some point, you must apply for a credit card or loan rather than avoiding it so that you also have a credit history for banks review.

how many products you have – the products that you have is responsible for the 10% of your credit score. having a mix of various products like installment loans, home loans, and credit cards help in increasing your credit score.

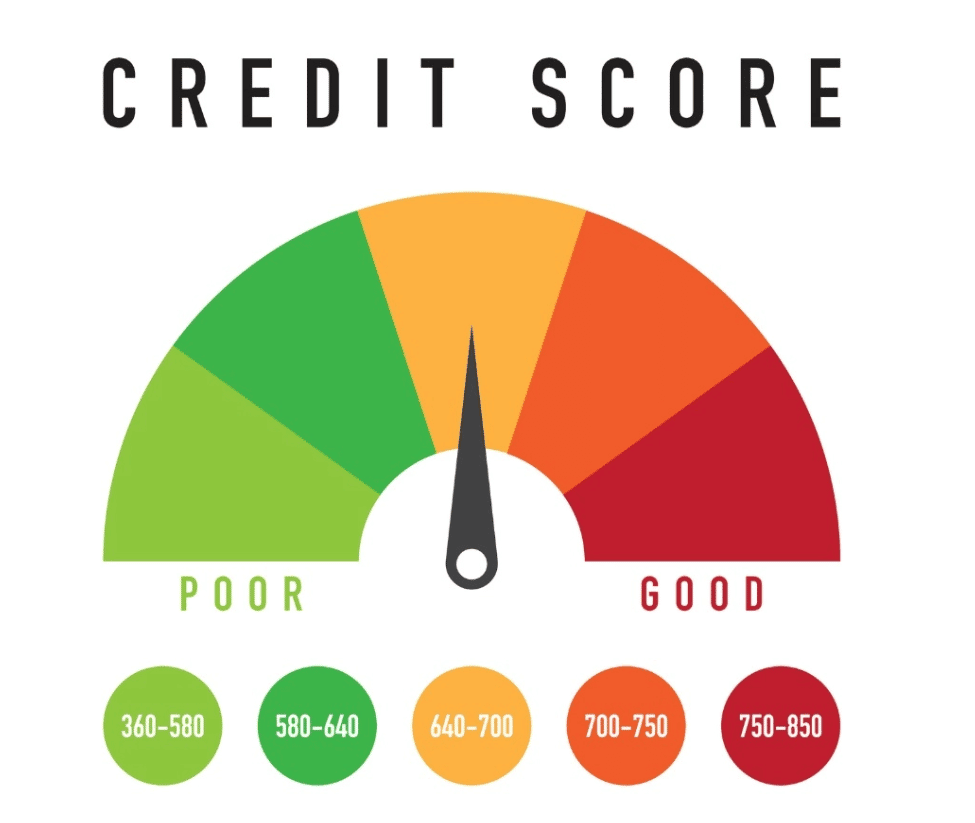

What Is Credit Score

In simple words, a credit score is a three-digit number that measures a person’s ability to pay back borrowed money. It shows a money lender your creditworthiness. Credit score ranges from 300-900.

Your credit score directly impacts your financial health. The higher you are on this scale, the better your credit score is. Alternatively, you are in deep waters if your score dips below 750.

If you have a low credit score, you may not get approved for loans, be unqualified for many lucrative credit card benefits, or may have to pay higher interest if you manage to get credit.

In short, the state of your credit score can impact your short-term and long-term fiscal goals and even your financial future.

Highlight: Most money lending companies or individuals recognize 850 as a good credit score. However, the minimum requirement for availing loan, EMI, or credit card is 750. Anything below 750 gets automatically rejected.

Read Also: Is Your Fico Score Your Credit Score

Do You Know Your Credit Score

Do you want the home of your dreams? Would you like a nice dependable car? If the answer is yes, you may want to take a look at your credit score before applying for credit to purchase these and other items. What IS a credit score? A credit score is a three-digit number that banks, lenders, and other creditors use to determine risk and the percentage rate at which money will be loaned to a potential borrower. The higher the credit score, the lower the risk to the creditor. The lower the credit score, the higher the risk to the creditor. We earn our terms depending on how well we manage our credit.

The Fair Isaac Corporation developed the most widely used credit score model. The FICO® score ranges from 300 850. The credit reporting agencies Equifax and TransUnion both use their version of the FICO® scoring model. Equifax uses the privately labeled Beacon and TransUnion uses the FICO® Risk Score Classic. Experian has discontinued using the FICO® scoring model as of February 14, 2009, and instead uses its own scoring model called Vantage ScoreSM. The score ranges from 330 830. The Vantage Score was developed by the three national credit reporting agencies- Experian, TransUnion and Equifax.

Your credit score is calculated and based on these top five factors:

- 35% Payment History

- 30% Outstanding Debt

- 15% Length of Credit

- 10% New Credit

- 10% Types of Credit Used

About The Author

Most Recent

What Is A Fico Score

Reading time: 1 minute

Highlights:

-

FICO scores are used by some lenders to help determine your likelihood of paying bills on time

-

FICO has many different scoring models

-

FICO scores are calculated using information in your credit reports

Fair Isaac Corporation created FICO scores. There are many different versions of the FICO score based on different scoring models. FICO scores use information in your credit report to help determine your likelihood of paying bills on time. Lenders often use FICO scores to help decide if they will extend credit to consumers.

FICO scores, as well as credit scores other companies calculate using different models, can predict similar types of risk. It’s important to remember that because different FICO scores and other credit scores were created using different scoring models, the scores may not be identical. Different credit score models have different formulas and calculations that use data differently to help predict a persons likelihood to repay bills on time.

Although FICO has many different scoring models, it uses relative percentage weights to help determine how much impact certain factors will have in helping determine a FICO credit score. The main categories considered are a persons payment history , amounts owed , length of credit history , new credit accounts , and types of credit used .

You May Like: How Do You Get Your Credit Score

Pay Your Bills In A Timely Manner

This is the golden rule for improving your credit score. Avoid missing your credit card payment due date.

Thus, you won’t have to be burdened with late fees and high-interest rates.

Even if you are in the middle of a financial crisis, do not put off loan repayment. It will only make your situation worse.

If you are incapable of paying a high-interest rate, contact your credit card issuer and arrange a payment plan that suits you.

From them, maintain responsible .

To know interesting hacks to ward off paying penalties, don’t miss our beginner’s guide on avoiding credit card penalties.

How Are Credit Scores Calculated

Reading time: 4 minutes

-

You dont have just one credit score

-

Payment history, the number and type of credit accounts, your used vs. available credit and the length of your credit history are factors frequently used to calculate credit scores

Many people are surprised to find out they dont have just one . Credit scores will vary for several reasons, including the company providing the score, the data on which the score is based, and the method of calculating the score.

Credit scores provided by the three major credit bureaus — Equifax, Experian and TransUnion — may also vary because not all lenders and creditors report information to all three major credit bureaus. While many do, others may report to two, one or none at all. In addition, the credit scoring models among the three major credit bureaus are different, as well as those used by other companies that provide credit scores, such as FICO or VantageScore.

The types of credit scores used by lenders and creditors may vary based on their industry. For example, if youre buying a car, an auto lender might use a credit score that places more emphasis on your payment history when it comes to auto loans. In addition, lenders may also use a blended credit score from the three major credit bureaus.

In general, here are the factors considered in credit scoring calculations. Depending on the scoring model used, the weight each factor carries as far as impacting a credit score may vary.

Used credit vs. available credit

You May Like: What Is The Most Accurate Credit Score Site