The Problem With Credit Reporting

Looking to establish your credit history or boost your credit scores before buying a house or making a large purchase? Youll want to make sure your positive credit history is reported.

But heres the thing: Not all lenders report your activity to credit bureaus. If they do, they might not report to all three of the major credit bureaus, either. Credit reporting is a voluntary practice, and credit card companies dont always reveal which credit bureaus they report to. Some companies, like Capital One, explicitly state that they report your credit standing to the three major credit bureaus. Others may not reveal that information so openly.

All in all, its best to keep your credit in good standing across the board. You can do this by making on-time payments in full and keeping your balances low.

How To Get Your Credit Report

There are a few ways to get your credit report. One way is to get your reports free once a year through AnnualCreditReport.com. The Fair Reporting Credit Act makes every resident entitled to a free copy of their credit report from all three reporting bureaus , but only through AnnualCreditReport.com. Anything requested within 12 months of your last inquiry or outside of AnnualCreditReport.com requires a fee. However, there are exceptions. If you have experienced identity theft, fraud, credit denial or are currently unemployed and planning to seek employment, then you can request another free copy.

You can get all three at the same time or you can space them out by requesting one report from a different bureau every four months. The former approach is good for tackling issues like identity theft or fraud. The latter helps you stay updated on new entries.

If youre not comfortable requesting your free report online, you can request one over the phone at 322-8228. You can also print off a mail-in application from the website and send it to the following address:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

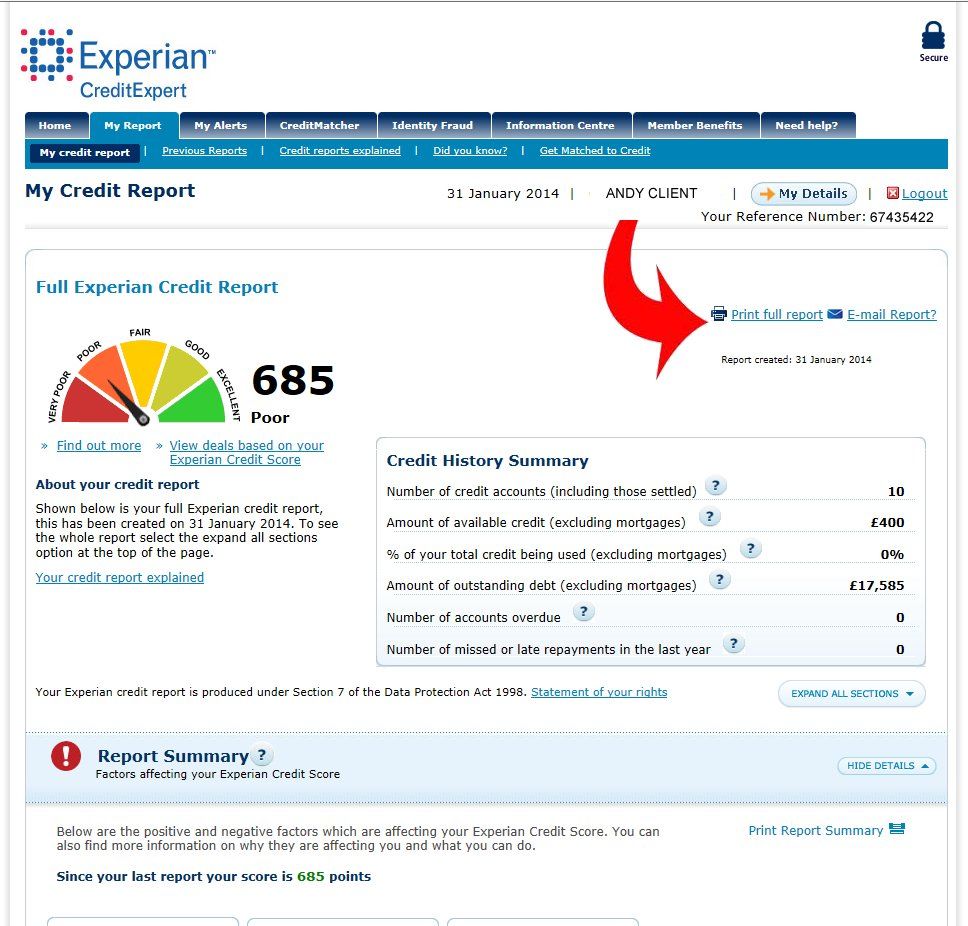

Another way to get your report involves paying for it. You could go to any bureaus website and request your report for a fee. For example, Experian will charge you $39.99 to get all three credit bureau reports plus your FICO credit score.

How Your Credit Report Works

Your is primarily a record of your payment history on your various credit accounts. These accounts include , car loans, mortgages, student loans and similar debts. Credit reports also include reports on things like bankruptcies and tax liens, and can even include rent or bill payments.

Essentially, your credit report encompasses everything reported to the consumer credit reporting agencies, from payments made to requests for new credit. The three principal credit reporting agencies are Equifax, Experian and TransUnion.

The information in your credit report is used to come up with your credit score. Without a credit history, theres no credit score. However, your creditors arent required to report your payment history to every credit reporting agency. Thats why a credit score can vary depending on which credit reporting agency provides the score.

You May Like: Delete Inquiries From Credit Report

What Types Of Things Can I Report To The Credit Bureaus

Some types of financial accounts are almost always automatically reported to the credit reporting agencies. These include, for example, mortgages, auto loans, student loans, personal loans, major credit cards, and most other revolving credit accounts. You can find out which of your accounts are currently being reported to which credit bureaus by reviewing your credit reports. Youâre entitled to a free credit report from each of the three credit reporting agencies every 12 months. Due to COVID-19, you can access all three of your reports for free each week through April 2022.

If you have an account that isnât listed on your credit report, you can contact the lender and request that they report your account and payment activity to the credit bureaus. Keep in mind that not all report to all three bureaus. So, each of your three credit reports could contain different information.

The credit reporting bureaus will also accept payment and account information about nontraditional accounts. Recurring expenses, such as rent payments, are an example of a nontraditional account. An officially recognized data furnisher must report the information for it to be accepted by the credit bureaus.

Send A Deceased Notice

The most official way to notify the credit bureaus of death is via certified mail. In your letter, youll need to include:

- A certified copy of the death certificate as mentioned above

- Proof that youre authorized to act on behalf of the deceased

- The deceaseds information such as their full legal name, Social Security number, birthday, and date of death

If youre the surviving spouse, you dont need proof that youre authorized to act for the deceased. Otherwise, youll need to show that youre the executor or administrator of the estate. The probate court will provide an appointment or letters testamentary after you open the estate.

Your letter should have all of the required information. It should be sent via certified mail to ensure its delivered safely. From there, wait for approval from the credit agency. This could take several weeks.

For some credit agencies, there is an online submission form for death notifications. Experian has an online portal for uploading death certificates and other related documents. No matter what method you choose, make sure you provide all the required documents.

Read Also: What Credit Score Do You Need For Amazon Prime Visa

Dispute Your Credit Reports Errors

Under the Fair Credit Reporting Act, both the credit reporting bureau and the company that reports the information about you to the credit bureau are required to accept disputes from consumers and correct any inaccurate or incomplete information about you in that report.

The U.S. Federal Trade Commission recommends taking these actions:

- Tell the credit bureau, in writing, what information you think is inaccurate. The Federal Trade Commission provides a sample dispute letter that makes this step easier. The letter outlines what information to include, from presenting the facts to requesting that the error be removed or corrected.

- Include copies, not originals, of materials that support your position.

- Consider enclosing a copy of your credit report with the errors circled or highlighted.

- Send your letter by certified mail with return receipt requested to ensure the letter is delivered. Keep your post office receipt.

- Keep copies of everything you send.

Help Your Customers Build Business Credit

By reporting those payments to commercial credit agencies you can help your clients build positive business credit references that help them build strong business credit scores. Your customersgood payment histories will be reflected in their credit scores. Not all companies report to these agencies, and as business owners learn about the importance of establishing strong business credit, they often seek out and do business with companies that report.

Recommended Reading: Does Paypal Credit Affect My Credit Score

To Whom May Complaints Be Directed If A Consumer Has A Complaint Regarding A Credit Report What Can I Do If I Have A Complaint/there Is An Error In My Consumer Report

If there is a complaint such as dispute over the accuracy or completeness of a credit report, a consumer may make a complaint in person or in writing to the credit bureau. If the consumer is dissatisfied with the outcome after reporting it to the credit bureau, he or she may submit the complaint in writing to the supervising authority .

Use A Credit Card To Pay Your Rent

While your rent payments wont be listed as a separate tradeline on your credit report, using your credit card for your rent still can boost your credit score. Check to see whether your landlord accepts credit card payments, and note any service fees that might be charged for using a credit card. If youre using a rewards credit card to pay your rent, you can earn points or cash back on your rent payments.

When you use a credit card to pay your rent, make sure to pay off your full balance just as if you were paying rent. Thats the best way to stay out of debt, improve your credit score, and get the full benefit of making timely rent payments.

Also Check: Does Apple Card Pull Credit Report

How To Report To Creditsafe

If your business wants to report information on your clients payment histories, you can join . To take advantage of this free program, you will claim your business on their website and then authenticate through one of many commonly used accounting tools, such as QuickBooks, Freshbooks or Xero. With most accounting tools, this will automatically submit relevant tradelines, removing the need for manually submitting them each month. Note: Creditsafe has a manual option for adding tradelines that is not self-service, although fees may apply to that service.

If you are a business owner looking to add accounts you pay on a regular basis to your own Creditsafe business credit report, you can take advantage of Creditsafes free Stay Safe program. This will allow you to add tradelines to your business credit reports. Youll also get access to free business credit monitoring along with other benefits. Get started here.

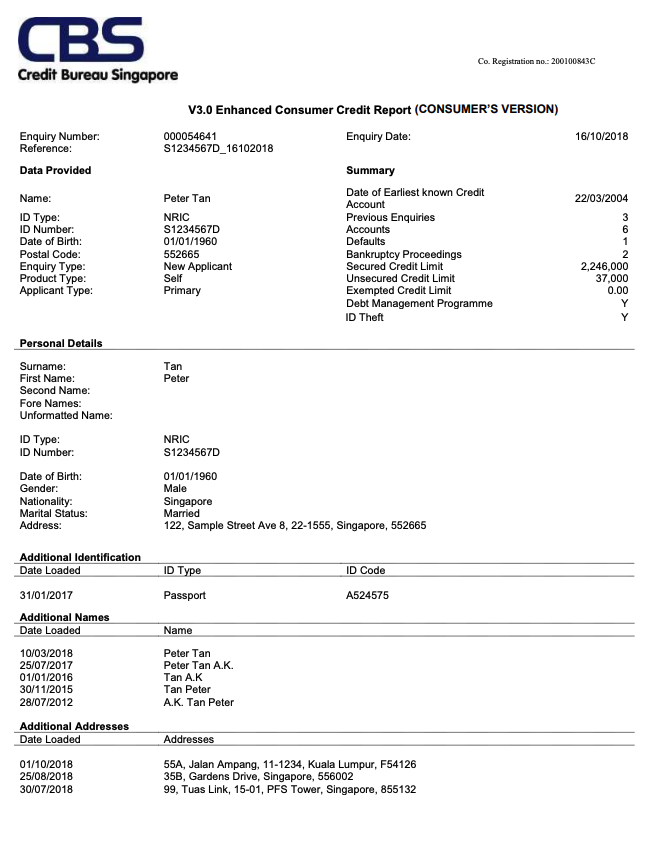

What Is A Consumer Entitled To Know Regarding His Or Her Credit Report Or Personal File At A Credit Bureau

A consumer is entitled to a clear and complete disclosure of the following information:-All information pertaining to the consumer that is in the credit bureaus custody, possession or control -The sources of the gathered information -The name and address of every person to whom such information has been disclosed by or on behalf of the credit bureau during the six month period immediately preceding the date of the consumers request.

Also Check: What Credit Score Do You Need For Affirm

Your Options Will Vary Depending On What You Want To Report

There are a number of services available that allow you to proactively add information to your reports or self-report your data to a lender.

They all work slightly differently and use different information to bulk up your financial profile. Experian Boost, for example, zeroes in on your cable, phone and utility payments. UltraFICO pulls an even wider variety of information from your account, including your cash flow, spending habits and account history.

Meanwhile, rent reporting services, such as Rent Reporters and Rental Kharma, will relay your on-time rent payments on your behalf.

Alternatively, you can work directly with a lender that uses alternative data and link your bank accounts so they can assess your transaction history. Or, you can use a nontraditional score service, such as PRBC, and ask a lender to consider it.

Depending on your goals and financial history, you could even use multiple alternative data reporting services to showcase your financial history.

If youre confident that giving lenders a more comprehensive view of your financial situation will help give you an edge, rounding out your financial profile with alternative data could be really useful especially if your credit history is thin or nonexistent.

Tip: In general, you cant remove accurate negative items from your credit report. And theyll stay there for up to seven years. But in some cases, black marks such as missed payments can be removed by contacting your creditors.

How Does Credit Reporting Work

The two nationwide consumer reporting agencies are important parts of our credit-based economy. Consumer Reporting Agencies do not determine whether you qualify for a loan or at what rate, credit or benefit. CRAs collect and maintain a timely history of your credit activity as reported by the lenders and creditors with whom you have accounts, along with certain other information such as public records and collection items. Each creditor reports the status of your account to the CRAs according to your payment history. Financial institutions and others with a permissible purpose can obtain a copy of your credit report in order to make certain types of decisions about you. For example, when you apply for a new loan or credit card, a lender may use the information in your credit report to determine whether to lend you money and at what rate based on their own risk criteria.

Don’t Miss: When Do Closed Accounts Fall Off Credit Report

Reporting Directly To Credit Bureaus

The Negative: Reporting Late Payments

If you do rental payment reporting and a tenant pays late or doesnt pay at all, this information will make it onto their credit report in various ways. You might get upset that a tenant keeps paying late and want to report a tenant to the credit bureau.

Most tenants will not want this to happen, so the knowledge that you report to credit bureaus monthly can help to keep tenants focused on making their payments on time. You may want to remind tenants that consistently paying late in the ways of this can affect them.

Even if late payments may not actually lower their credit score, every late payment issue will show up in the full report. If they plan to rent again in the future, this could be a problem for them. Ensuring that they know this can help encourage tenants to be more reliable while also protecting you and their future landlords.

Also Check: How Long Does It Take To Improve Your Credit Score

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

File A Complaint About The Creditor

If the creditor that furnished the incorrect or incomplete information fails to revise it or advise the credit reporting agency of a correction , you can file a complaint with the Federal Trade Commission . Or, if the creditor is a large financial institution, you may file a complaint with the federal agency that oversees that type of financial institution. The CFPB also oversees many types of financial agencies, so you can file a complaint there too.

If you aren’t sure which agency to contact, start with the FTC or CFPB, which will likely forward your complaint to the appropriate agency. Generally, these government agencies won’t represent you individually. But they could send an inquiry to the company, and if there are enough complaints or other evidence of wrongdoing, they might take legal action.

Also Check: Does Paypal Credit Report To Credit Bureaus

How To Report Consumer Loans To The Credit Bureaus

Below are three simple steps to show you how to report consumer loans to credit bureaus. As a credit reporting software service, Datalinx can help you navigate this process and ensure your data is reported accurately and timely with each of the 4 credit bureaus. Please contact us if you have any questions regarding the steps listed below.

How To Report To Experian

Experian is a global technology company and market leader in business data and analytics. They have a comprehensive commercial database of third-party verified data of business entities to support business credit. Companies reporting to Experian can benefit their community as well support collection efforts.

Don’t Miss: Does Increasing Credit Limit Hurt Credit Score

How To Report Your Rent To Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A lot of people who dont have much of a credit history do have a history of paying rent on time. But that information doesn’t show up on their credit reports, and doesn’t help their .

You cant report rent payments yourself. But rent-reporting services can get your credit reports to reflect your rent payments fairly easily, at a cost that ranges from free if your landlord pays it to more than $100 a year.

To use a rent-reporting service effectively, youll need to know which credit bureaus it will report your payments to and which credit scores take those payments into account.

It’s also important to understand that this may not be the most cost-effective way for you to build your credit with all three credit bureaus and to understand your alternatives.