How Credit Scores Affect Va Loan Approval

Years of your payment history on your debts is put into a formula to calculate your credit score. A lower score means you have more problems with your credit history. A low credit score can be hard to handle for many VA lenders. But not all VA lenders deny Veterans with 620 or lower credit scores.

Can You Get A VA Loan With 620 Credit Score?

Some Veterans think they will never qualify for a VA loan because they have a low credit score. Most lenders require a minimum credit score of 620 or higher before approving VA loans. But there are some VA lenders like HomePromise that may approve lower FICO score VA loans.

What Is The Minimum Credit Score Required For Approval?

The Veterans Administration has no minimum credit score requirement. VA lenders have their own minimum credit score requirements for VA loan approval. For more information about getting a VA loan approved with tough credit call 800-720-0250 to speak with a VA Loan & Refinance Expert with HomePromise.

FAST & EASY

A couple quick questions and youre on your way to getting a free quote. Done before your cup of coffee is.

SAFE & SECURE

We will NEVER share or sell your information. All submissions encrypted for your security and peace of mind.

EXPERT TEAM

Let our team of experts help you find the best loan at a great rate. Use the form above to contact us today!

coming soon

How To Apply With The Best Va Loan Lenders

The worst thing you can do when applying for a VA loan is to go with a Lender who isn’t specialized in VA Loans.

It’s also not a great Idea to go with some of the larger VA Lenders that don’t always close on time.

We have a solid 3 step plan called the Tactical Va Loan Blueprint that we take each of our customers through.

Apply For A Credit Limit Increase

This might sound counter productive, but hear me out, when you apply for a credit increase, that doesn’t require a hard pull on your credit, it lowers your credit to debt ratio, which is a factor in calculating your credit score.

The credit to debt ratio is a number that creditors use to determine how much of your credit you are currently using.

If you are using too much credit, your score will start to go lower however, if you get a credit limit increase, this would decrease that amount and help your score improve.

The main factor with choosing this route is to NOT use the new credit.

Read Also: Is 666 A Good Credit Score

Is A Va Loan Better If I Have Bad Credit

If youre looking for the lowest rates and down-payment requirements, the answer is yes. Because the VA guarantees a portion of the loan, the lender can give you better terms. Although you may need to work on your credit before qualifying, its worth it. For veterans a VA loan is usually the first choice.

What Are The Rules For Down Payment Mortgage Insurance And Other Fees

VA loans do not require you to put down any money to obtain a loan, and dont require you to pay mortgage insurance. However, youll owe a funding fee, with the amount based on

- Whether youre in the military, are in the national guard, are a qualifying spouse, or are a veteran of the military or national guard

- The amount of your own down payment, if any

- The type of loan

- Whether youre a first-time borrower or youve had a past VA loan

Funding fees vary depending on whether youre buying or refinancing and other factors. This funding fees table on the VA website will help you figure out what youll owe.

Surviving spouses of deceased veterans who died because of their service dont have to pay a funding fee, nor do certain eligible veterans entitled to compensation for service-connected disabilities. When owed, the funding fee can be paid upfront or financed.

Lenders may also charge additional fees, including any of the following:

- Discount points to reduce your interest rate

- Loan origination fees

Fees and costs vary by lender.

Recommended Reading: What Is A Good Credit Score To Refinance A House

Other Ways To Address Low Credit Scores

If youre more patient, or you can wait a few months before you start looking for a home, you can take the longer-term strategy to raising your credit score:

These are solid ways to improve your score, but it may take a few months before you see a significant boost in your score.

Is Credit Score All That Matters

In addition to credit score, your lender will consider past credit patterns to determine willingness to repay. A borrower who has made timely payments for at least the last 12 months demonstrates their willingness to repay future credit obligations. Conversely, a borrower with late payments, judgments and delinquent accounts may not be a good candidate for loan approval.

Also Check: Does Getting Pre Approved For A Mortgage Affect Credit Score

How Low Va Rates Can Help Those With Low Credit Scores

We specialize in loans for veterans. If you talk with one of our loan specialistssome who are veterans like youhe or she will look at several factors in your background.

One of the first and most important is your honorable military service is first. The next important qualification is the stability of your income, which can be from a job, VA disability payments, or investments.

They’ll also help you add up all your expenses, including debt payments and the potential VA loan, to make sure you’ll have enough money left over at the end of each month. This is a VA guideline, which helps the VA loan program to be safer for you and for all veterans.

And, while they’ll also look at your credit score, we know that a high credit score doesn’t always guarantee that someone can handle a new mortgage because their situation may have changed.

We also know the opposite is true, so even if you have a low credit score, you can qualify for a good VA loan as long as you can show your willingness and ability to afford and pay for it.

So, whether you choose to improve your credit score first or you want to buy your home right away, Low VA Rates will be here to help.

Best Va Loan Rates For 600 To 630 Credit Score

Buying a home is stressful enough, let alone trying to find a mortgage when your credit score is 630 or less.

To make matters worse, most VA lenders won’t give you ballpark rates!

Not here!

In this article, you can get sample VA rates and monthly payments based on your credit score from 600 to 605, 610, 620, 625, and 630.

We’ll also discuss practical tips on how to increase your credit score quickly and how this can greatly benefit your pocket book.

Note: VA loan rates vary greatly based on your state, down payment, and credit score. Our recommendation for the most personalized, accurate quote is to start with your state.

Recommended Reading: Does Afterpay Affect Credit Score

My Credit Score Is Pretty Low And I Have A Rocky Credit History What Do I Do

Apply anyway. Again, private lenders can use their discretion when it comes to approving VA loans. Your score might be low, but your income and savings could make up for it.

Best-case scenario, youll qualify for the loan and can start shopping for a house!

But even if you dont qualify this time, your loan professional can offer guidance on how to better your chances down the road.

They may also be able to refer you to a credit counselor who can help you get your finances on track. Then youll be in a stronger position to buy a house the next time you apply.

Write a letter of explanation

Maybe youre worried about late payments, foreclosures, or bankruptcies on your credit history. Its still worth applying.

Depending how long ago those events occurred, the loan officer may simply ask for a letter of explanation. Thats your chance to explain the circumstances surrounding those issues and why theyre unlikely to happen again.

If those events were more recent, some lenders may want to see a longer period of on-time payments and strong credit habits before they approve you.

But again, different private lenders have different requirements. Some may work often with veterans recovering from bankruptcy or foreclosure, and they may have loan options that suit your circumstances.

The bottom line: If homeownership is your goal, a low credit score wont necessarily stand in your way.

How Do Va Loans Work

The VA doesnt make loans, so borrowers must find a private lender that is part of the VA loan program and willing to offer affordable financing.

Different lenders have different qualifying criteria. But the VA encourages lenders to make VA loans available to all qualified veterans that apply. The government guarantees a portion of the loan to pave the way to easier approval. In most of the U.S., the government guarantees loans of up to $510,400 as of 2020 the guarantee means that if you dont pay, lenders are unlikely to lose money.

But that government guarantee doesnt protect you, the borrower, if you dont pay your mortgage. You can still lose your home to foreclosure if you dont repay your loan. If you do run into trouble as a VA mortgage holder, theres a dedicated VA staff to help.

Don’t Miss: Is 652 A Good Credit Score

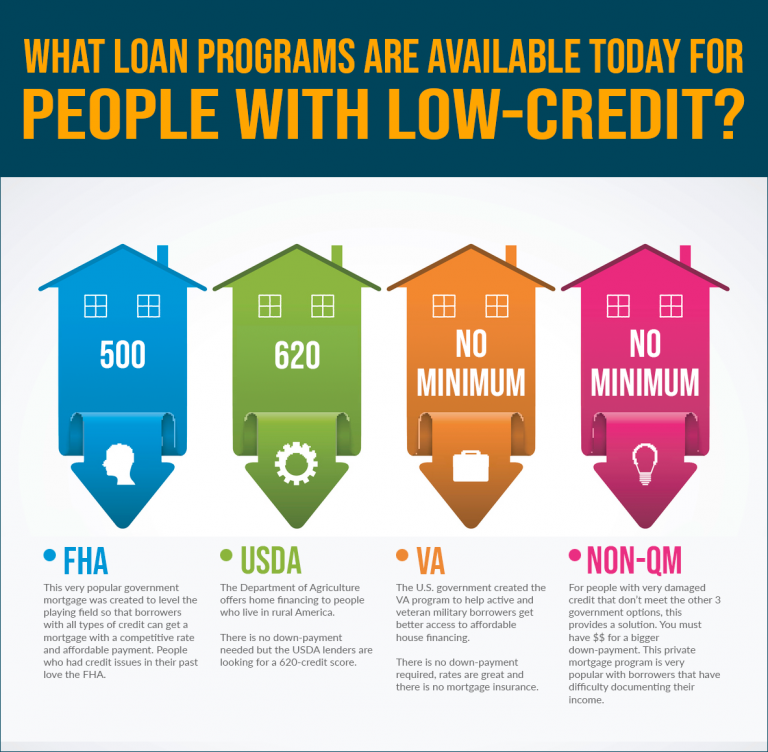

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

Who Else Is Eligible For Va Home Loans:

- Active-duty Service

- Service persons on active duty who have served for 90 consecutive days of active service are eligible.

- Reservists and members of the National Guard

- Cadets of the U.S. Military, Air Force, or Coast Guard Academy

- World War II Merchant Seamen

- Midshipmen at the U.S. Naval Academy

- U.S. Public Health Service officers

- National Oceanic & Atmospheric Administration officers

Read Also: How To Send A Credit Report By Email

Bottom Line: Is A Va Loan Right For You

A VA loan may be a good choice if you dont have perfect credit, or you want to buy a home without a down payment but dont want to pay mortgage insurance. Just be aware that you need proof of military service to be eligible and youll likely have to pay a funding fee that could add significant cost to your loan.

About the author:

Read More

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

Don’t Miss: Will A Sim Only Contract Improve Credit Rating

How Your Credit Score Affects Your Mortgage Rate

Although its up to specific lenders to determine what score borrowers must have to be offered the lowest interest rates, sometimes even the difference of a few points on your credit score can affect your monthly payments substantially. For example, the difference between a 3.5 percent interest rate and a 4 percent rate on a $200,000 mortgage is $56 per month. Thats a difference of $20,427 over a 30-year mortgage term.

A low credit score can make it less likely that you would qualify for the most affordable rates and could even lead to rejection of your mortgage application, says Bruce McClary, spokesman for the National Foundation for Credit Counseling. Its still possible to be approved with a low credit score, but you may have to add a co-signer or reduce the overall amount you plan to borrow.

You can use Bankrates loan comparison calculator to help you see interest rates for credit scores.

Using myFICO.coms loan savings calculator, heres how much youd pay at the current rates for each credit score range. These examples are based on national averages for a 30-year fixed loan of $300,000.

| Source: myFico. APR rates as of Nov. 5, 2021. Assumes a $300,000 loan principal amount. |

| How your credit score affects your mortgage rate |

|---|

| FICO score |

| If your score changes to 640-659, you could save an extra $34,017. |

Usda Home Loan: Minimum Credit Score 640

USDAloans are popular for their zero down payment requirement and low rates.

Youll typically need a 640 FICO score to qualify fora USDA loan, though minimum credit score requirements vary by lender.

Thesemortgages are backed by the U.S. Department of Agriculture with the goal ofincreasing homeownership in rural areas. To qualify, you must buy a home in aqualified rural area though some suburbs make the cut.

A USDA loanalso wont work if you make too much money. Your household income cant be morethan 15 percent higher than the median household income in your area.

Also Check: Does Credit Check Affect Credit Score

Va Loan Credit Score Under 620

Some mortgage programs have minimum credit score requirements imposed by the government agency that mandates the program. For example, applicants for the FHA loan must have at least 580 to qualify, unless the borrower wants to put down a larger down payment.

Veterans Affairs doesnt establish minimum requirements, but most lenders require a minimum credit score of 640. Nonetheless, there are mortgage lenders that will approve candidates with lower credit scores. The Department of Veteran Affairs doesnt mandate any requirements, so if a lender lowers its standard, its at their discretion.

On the VA eligibility page, the borrowers must meet satisfactory credit, sufficient income, and a valid COE to qualify for a VA guaranteed home loan. Homebuyers with a credit score below 620 should work with a lender to find out whether they qualify and how to bump their credit score. A handful of VA lenders will allow poor credit scores, even below 580, to get approved for a loan.

Your credit score fluctuates, for better or worse, and improving your score can be a long road. Paying your bills, staying on budget, and avoiding high balances on credit cards can help you achieve homeownership. However, that doesnt mean that youre out of luck if you have bad credit.

Contact the Cain Mortgage Team to find out about your eligibility!

Image source: Pixabay

How Can I Improve My Credit Score

There are many useful financial resources online. These can provide detailed information on improving your credit including, Consumer.gov. Let’s focus on some of the basics.

You May Like: How To Access Free Credit Report