Cost To Set Up A Credit Freeze

In the past, the cost of imposing a credit freeze varied between states. It typically ranged between $3 and $10 for each credit reporting agency. Lifting the freeze temporarily or removing the freeze altogether also used to cost a fee.

Now, though, thanks to the federal Economic Growth, Regulatory Relief, and Consumer Protection Act , placing and lifting a credit freeze is free in every state. .

Placing a Fraud Alert on Your Credit Files

You might also consider placing a fraud alert on your files. That way, even if you lift a freeze so that a creditor can access your credit history, that creditor still has to take reasonable steps to verify that the credit request is valid.

Pros And Cons Of Locking Your Credit File

According to Alayna Pehrson, digital marketing strategist at the consumer review site BestCompany, Its a lot easier to unlock and lock credit than it is to unfreeze and freeze credit.

Credit lock services typically cost a monthly or annual fee, Pehrson says. However, some bureaus now offer the service for free in light of recent data breaches.

Just remember, youll no longer be able to lock your credit report if you get rid of the service or product with a bureau.

As we briefly mentioned above, you should also note that credit locking isnt governed by law as credit freezing is in most states. This means that a credit freeze generally has more protections guaranteed by law, so you may have more rights if fraud occurs after a credit freeze as opposed to a credit lock.

Pros And Cons Of Freezing Your Credit File

On the bright side, credit freezes can last for a long time. Most states allow credit freezes to stay in place until you remove them, but other states allow freezes to expire after seven years. With credit freezes, you dont have to worry about your subscription expiring and removing your lock.

As noted above, new federal law will make freezing and unfreezing your credit reports free across the country.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How To Freeze Your Credit Report After Identity Theft

Freezing your credit report is sometimes necessary. It can help prevent identity thieves from opening new lines of credit and other accounts in your name. Its often recommended when youre dealing with the ramifications of identity theft.

A credit freeze allows you to restrict access to your credit report. When you freeze your credit file, you prevent potential creditors from accessing certain financial and personal information. Creditors are unlikely to let you or an identity thief open, say, a new credit card, if they cant access your credit report. Thats because they wont be able to assess your creditworthiness.

If you need to freeze your credit, you can get a free credit freeze by requesting one at each of the three major credit reporting agencies. More on that later.

How To Freeze Your Credit

You must contact each credit bureau separately to freeze your credit report with that company.

When requesting your credit freezes, you must provide:

- Your Social Security number

- Your ability to use existing credit

- Your ability to make loan and credit card payments our creditors will continue to report your activity to the credit bureaus

- Regular updates to your credit report, reflecting your credit usage and payments

- Access to your own credit scores or free annual credit reports

You May Like: How To Remove Repossession From Credit Report

How Do I Place A Freeze On My Credit Reports

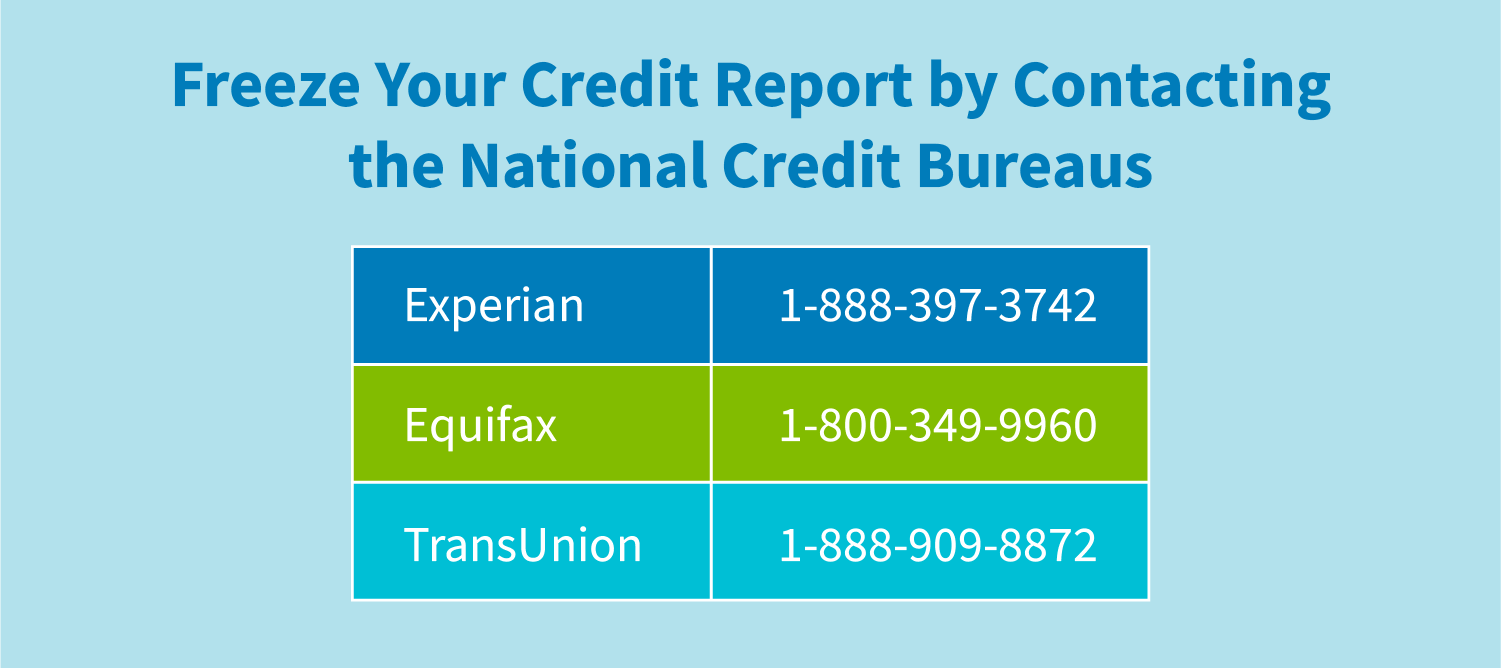

Contact each of the nationwide credit reporting companies:

- TransUnion 1-888-909-8872

You’ll need to supply your name, address, date of birth, Social Security number and other personal information. Fees vary based on where you live, but commonly range from $5 to $10.

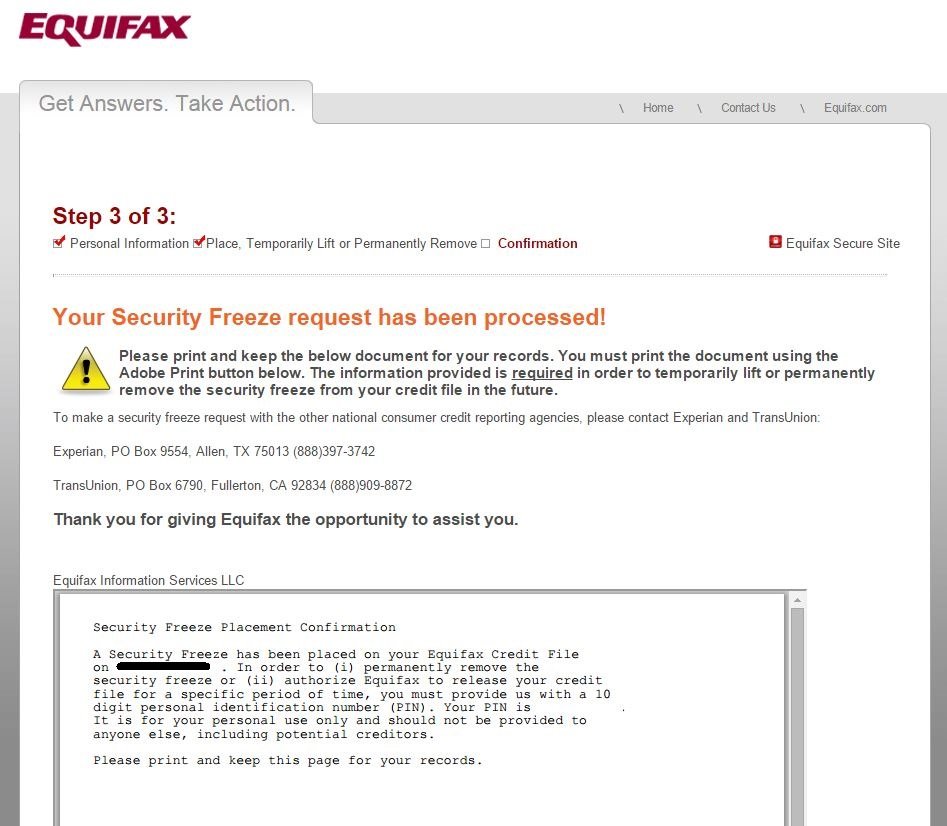

After receiving your freeze request, each credit reporting company will send you a confirmation letter containing a unique PIN or password. Keep the PIN or password in a safe place. You will need it if you choose to lift the freeze.

A Credit Freeze Can Protect You From Identity Theft

Having your identity stolen is no stroll along the beach. Victims of identity theft often suffer months and even years after it occurs. Clearing your name takes a lot of time and effortand sometimes money. It can seem like youre the one doing time even though you werent the one who committed the crime.

To prevent your identity from being stolen, or to prevent further identity theft after your identity has already been stolen, you might consider freezing your credit report, a free service that all three major credit bureaus offer.

Read Also: Ccb/mprcc

Understand The Credit Freeze Process

You’ll need to file a credit freeze request with all three major credit bureaus for it to be effective. During the process, you’ll need to answer a handful of questions to verify your identity.

You’ll also need to provide your Social Security number, a copy of a photo ID and proof of residence, such as a recent utility bill. Depending on the bureau, you may get a PIN you can use to freeze and unfreeze your report in the future.

If you plan to apply for credit with a security freeze on your credit reports, you’ll need to lift the freezes, either temporarily or permanently, before you apply to ensure the lender can view your reports during its credit check.

Who Can Access My Credit Once It’s Frozen

When you freeze your credit, you limit who has access to your credit report. Fraudsters won’t be able to open new accounts in your name regardless of whether they have access to your social security number and other personal information.

Any banks that you already have relationships with will continue to have access to your credit report. For example, if you request a credit limit increase with the Citi® Double Cash Card, Citi may review your credit report.

Debt collectors and marketers will also have access. If you want to stop getting prescreened credit offers, opt out by going online or calling 888-567-8688.

You’ll still have access to your credit and can check your credit report for free.

Don’t Miss: Mprcc On Credit Report

When Should I Freeze My Credit

A credit freeze is necessary if nefarious activity is happening. If youve been the victim of identity fraud, you should freeze your account immediately. If you are concerned about the risk of identity theft, due to a data breach or the loss of personal identity information, you may want to freeze your reports. To avoid the risk of negatively affecting your credit score further, freeze your credit the moment you find out about any of the following:

- New, unauthorized credit accounts appear on your report

- Your bank contacts you about fraudulent activity on your account

- Suspicious collection notices or bills appear at your address

- You receive a data breach notification

You Might Experience Credit Delays

Companies typically won’t extend credit if one or more of your credit reports are frozen. If you request a credit thaw online or by phone, the credit bureaus are required by law to complete the request within an hour. Requests via snail mail can take a few days, however.

Even with a fast turnaround time, it can cause delays if you forget to thaw your credit before you apply for something that requires a credit check. Delays can also result if you forget or lose your required PIN or password and need to work with a bureau to recover it. You can avoid these delays by thinking ahead and lifting your credit freeze before you submit an application for a credit card, loan, lease or insurance policy.

Also Check: Does Speedy Cash Report To Credit Bureaus

When To Get A Credit Freeze

If youre not actively shopping for a credit card or loan, freezing your credit is wise. Now that freezing credit and unfreezing credit are free, NerdWallet recommends that all consumers protect themselves in this way.

If you think your data may have been compromised, for instance in a data breach, get a credit freeze. Its especially key if your all-important Social Security number may have been disclosed.

What Is The Difference Between A Security Freeze And A Fraud Alert

A fraud alert is a special message on the report that a credit issuer receives when checking a consumers credit rating. It tells the credit issuer that there may be fraud involved in the account. A fraud alert can help protect you against identity theft. A fraud alert can also slow down your ability to get new credit, but it should not stop you from using your existing credit cards or other accounts.

A security freeze means that your credit file cannot be seen by potential creditors or others accessing your credit, unless you give your consent. Most businesses will not open credit accounts without first checking a consumers credit history.

You May Like: Is 778 A Good Credit Score

How Credit Locks Work

When you lock your credit file with a specific credit bureau, lenders can no longer access your credit file from that bureau.

While the timing for each bureaus product varies, credit locks allow you to quickly lock and unlock your reports in a relatively painless manner . Locks may be removed instantly or take up to 48 hours to be removed.

Does A Credit Freeze Affect My Credit Score

No. A credit freeze does not affect your .

A credit freeze also does not:

- prevent you from getting your free annual credit report

- keep you from opening a new account, applying for a job, renting an apartment, or buying insurance. But if youre doing any of these, youll need to lift the freeze temporarily, either for a specific time or for a specific party, say, a potential landlord or employer. The cost and lead times to lift a freeze vary, so its best to check with the credit reporting company in advance.

- prevent a thief from making charges to your existing accounts. You still need to monitor all bank, credit card and insurance statements for fraudulent transactions.

You May Like: Unlock My Experian Credit Report

When Credit Freezes Work Best

It may make sense to freeze your credit when you want a high level of protection, youre willing to live with the tradeoffs and you continue to monitor financial accounts for problems that credit freezes cant prevent.

Freezing your credit is one of the most powerful ways to protect your credit. But a freeze makes it hard to use your credit and you might need your credit information available more often than you realize. As a result, its crucial to understand the conditions that work best with credit freezes.

No need for credit: When you dont plan to use your credit for anything in the foreseeable future, freezing your credit may be an excellent idea. If you dont need that information available, why leave it out there? For example, if you recently bought a car and you dont plan to move or buy property any time soon, there arent many reasons for new inquiries into your credit.

For children and incapacitated consumers: You can also freeze credit for children under the age of 16 and incapacitated people under guardianship. In many cases, those individuals arent applying for loans or using their credit frequently, so theres no need to make it available to the world.

Occasional unfreezing is easy enough: Even if you plan to use your credit soon, its relatively painless to freeze it and temporarily unfreeze whenever you need it. In many cases, you can temporarily remove the freeze online, by phone, or by mail, and you choose how long the lift should last.

Protected Person Security Freeze

As part of an ongoing effort by the Attorney Generals Office to help consumers protect themselves from identity theft and safeguard their credit, the Legislature in 2014 passed a new state law, Senate Enrolled Act 394 of 2014, creating the Protected Person Security Freeze. Because identity thieves could attempt to steal the information of individuals such as children or disabled adults who have a clean credit history in order to assume their identities and perpetrate fraud, the 2014 law offers a security freeze for protected consumers, similar to the credit freeze for adults. Parents can use it to protect their children from identity theft even if the minors dont have credit yet. For mentally disabled adults who also should be protected against identity theft, their legal guardians can register them for the security freeze.

Below are links to the three credit bureaus Protected Person Security Freeze sites. For the free service, each of the three credit bureaus requires that consumers register a minor or a protected consumer in writing, by mail, rather than online. And each credit bureau has a slightly different format for registering for a security freeze for a minor or another protected consumer, so read the directions carefully.

Equifax

Read Also: Syncb/ppc Credit Inquiry

How To Freeze Your Credit For Free

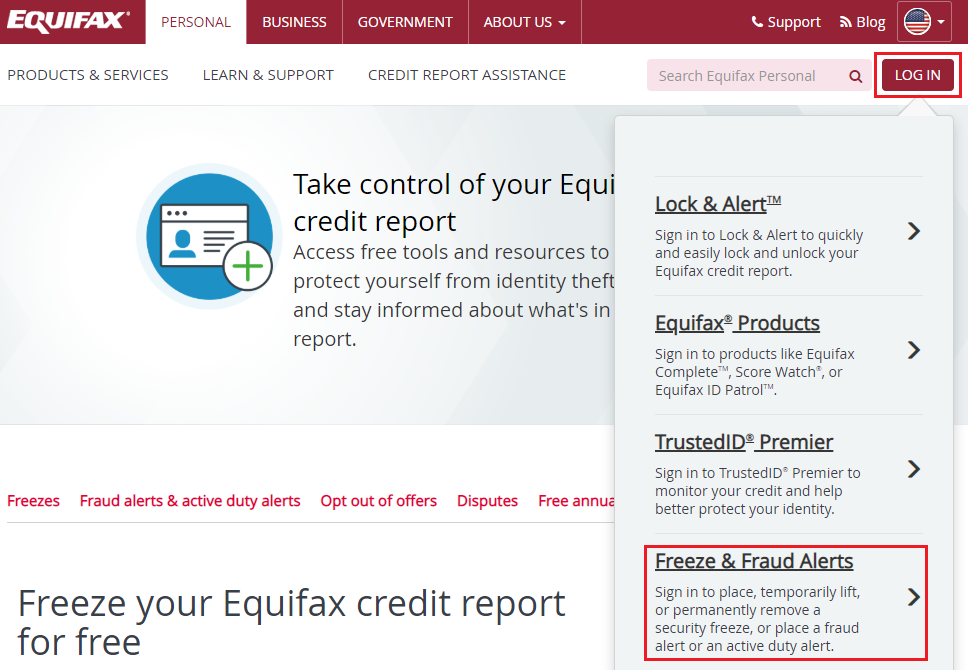

You’ll want to place a free credit freeze on all three of your credit reports, including from Experian, Equifax and TransUnion. That said, the process can vary from agency to agency.

With Experian, you can visit the Experian Freeze Center and request it online or call 888-397-3742. Provide the requested information and verify your identity to complete the process.

If you need to lift your credit in the future, you can do so by visiting your online account with each credit bureau or calling.

How Do I Thaw My Credit Report

There are two ways to remove a freeze on your credit report. You can temporarily lift or thaw the freeze so that you can apply for a loan, open a new credit account or get an extensive background check. If you know which credit agency your lender or potential employer uses, you can request a thaw for only that agency. Otherwise, youll have to use your unique PIN for each of the three credit bureaus to request a thaw from each.

A temporary thaw can take up to three days. Once its issued, the thaw will only last for a predetermined amount of time. After that, your report will go back to being frozen and inaccessible.

Your other option is to permanently remove the freeze from your credit report. Youll need to request this from all three credit bureaus using your PIN.

You can thaw or permanently remove a freeze from your account online, by phone or by mail, using the same contact information as when you initially froze your account.

What if I lost my security PIN?

You May Like: 1?800?859?6412

How To Freeze Your Transunion Credit Report

TransUnion offers a three-step process on its website to freeze your credit.

The website includes information about freezing the credit of a loved one, including a minor or dependent, spouse, deceased relative, or parent. TransUnion has a mobile app to freeze or lift your credit on the go.

Be sure to opt out, if you dont want to receive unsolicited offers of credit or insurance.

The Pros Of Freezing Your Credit

- Freezing your credit reduces the ability for someone to create a fraudulent credit account in your name

- A credit freeze gives you peace of mind knowing that your credit report is secure

- A freeze wont impact your or affect your ability to use your existing credit accounts

- Freezing your credit will prevent you from impulsively applying for a new credit card at a store since lifting a freeze will take roughly 20 minutes

- In most states, credit freezes last indefinitely, so you dont have to worry about them expiring until you lift them

Recommended Reading: How To Remove Repossession From Credit Report

How Do I Set Up A Security Freeze

The process to place a security freeze requires that you directly contact each of the credit reporting companies. You can do so online or through the mail.

Types of information you should be prepared with:

- Your full name, including middle initial and suffix, such as Jr., Sr. II, III

- Social Security Number

Does A Credit Freeze Stop Prescreened Credit Offers

No. If you want to stop getting prescreened offers of credit, call 888-5OPTOUT or go online. The phone number and website are operated by the nationwide credit reporting companies. You can opt out for five years or permanently. However, some companies send offers that are not based on prescreening, and your federal opt-out right will not stop those kinds of solicitations.

As you consider opting out, you should know that prescreened offers can provide many benefits, especially if you are in the market for a credit card or insurance. Prescreened offers can help you learn about what’s available, compare costs, and find the best product for your needs. Because you are pre-selected to receive the offer, you can be turned down only under limited circumstances. The terms of prescreened offers also may be more favorable than those that are available to the general public. In fact, some credit card or insurance products may be available only through prescreened offers.

Also Check: Does Paypal Bill Me Later Report To Credit Bureau

How Do I Unfreeze My Credit

You can unfreeze your credit by going to the same credit bureau websites that you accessed to freeze your credit, or by calling the numbers listed above. There will be the option to temporarily lift a freeze for a set amount of time, which can be used if you need to apply for a credit card, mortgage, loan or other financial product.

You also have the option to completely remove the freeze, which we don’t recommend doing unless you don’t have a finite timeline on when your credit will be pulled. If you remove a freeze, reinstate it once the application process is complete.

When you unfreeze your credit, you typically have access to your credit report within an hour, but it may vary. We’ve tested this for all three credit bureaus and were able to apply for a credit card within the hour.

The Economic Growth, Regulatory Relief, and Consumer Protection Act set an official timeline for when credit freezes need to be removed, after a consumer’s request:

- Requests by toll-free telephone or secure electronic means: One hour after receiving the request for removal.

- Requests by mail: Three business days after receiving the request for removal.