Review The Results Of The Investigation

The credit bureau involved must provide you with results of the investigation in writing and also a free copy of your credit report if the dispute results in a change to that report. The credit bureau must also provide you with the name, address and phone number of the furnisher that reported the incorrect information.

If a furnisher continues to report a disputed item, it is required to notify the credit bureau involved about your dispute. If the disputed information is found to be inaccurate, the furnisher must tell the credit bureau to update or delete the item. The furnisher must also notify all the credit bureaus to which it sent the incorrect information so that the bureaus can correct their records.

Even if the furnisher insists that the disputed information is accurate, you can still request that the credit bureau include a statement in your credit file explaining the dispute.

Why Is There An Error On My Credit Report

Checking your credit reports and finding an error can be a frightening experience, though it isnt an uncommon one. The most recent study by the Federal Trade Commission found some 26 percent of participants spotted errors on at least one of their credit reports. You may be wondering how or why an error found its way onto your credit report. There are several reasons why an error may end up on your credit profile, varying from the more benigna creditor that didnt send updated info to the three credit bureaus, for exampleto the severe, like fraudulent activity captured on your credit reports.

Some errors that could have a significant impact on your credit score include:

- Incorrect balances on accounts

- Derogatory marks that are older than seven years

- Incorrect credit limits

- Bills reported as late or delinquent when your account should be in good standing.

Errors on your credit reports that lead to lower credit scores can impact your approval odds for home loans, auto loans and credit cards. Even if you are approved, youll be burdened with higher interest rates. To be sure your credit reports are accurate, check them consistently and quickly dispute any errors.

Which Credit Report Errors Aren’t Worth Disputing

Small errors that dont affect your score like a misspelled former employer name or an outdated phone number dont hurt anyones assessment of your creditworthiness and aren’t worth disputing.

And sometimes a negative mark might surprise you but is not an error. If its accurate, don’t use the dispute process. Instead, try to resolve the problem directly with the creditor. For example, if you accidentally missed a payment, contact the creditor, arrange to pay up and ask if it will rescind the delinquency so it no longer appears on your reports.

The credit agencies are not obligated to investigate “frivolous” claims.

You May Like: Will A 2 Day Late Payment Affect Credit Score

Takeaways: How To Dispute Credit Reports And Win

- Youre entitled to accurate and verifiable information on your credit report

- You can file a dispute with the credit bureaus by phone, mail, or online

- When filing a credit dispute, include as much information as possible to support your claim

- If your dispute is rejected, you can choose to re-dispute the claim with the credit reporting bureaus

Do you have a credit questions for John Ulzheimer? Head over to the and ask away!

Save more, spend smarter, and make your money go further

How Does The Dispute Process Work

If you submit a dispute to a nationwide consumer credit reporting company, the company may make changes to your credit report based on the documents and information you provided. Otherwise, they will contact the business reporting the disputed information, supply them all relevant information and any documents you provide with your dispute, instruct them to investigate your dispute, and:

- Review all information you provided about your dispute

- Verify the accuracy of the information they are reporting to the credit reporting company

- Provide the credit reporting company with a response to your dispute, including any changes to the information reported

- Update their records and systems as necessary

- The credit reporting company will then notify you of the results of the investigation

If you submit a dispute with a business, they will conduct an investigation and will send you the results of the investigation directly. They will notify the credit reporting companies of any changes that need to be made to the information as a result of the investigation.

If a dispute results in a change to your credit report, you will have up to 12 months to order a second free report through AnnualCreditReport.com in order to review the changes.

You May Like: How To Check Credit Score Bank Of America

How To Dispute Accurate Information In Your Credit Report

Accurate items in your record can’t be removed before the term set by law expires, which is seven years for most negative items. For example, if you truly missed payments on your credit card, your dispute to remove that information will be denied. However, the information will automatically fall off your credit report seven years from the time you missed the payments.

If you do have valid negative items on record, here are some things that might help:

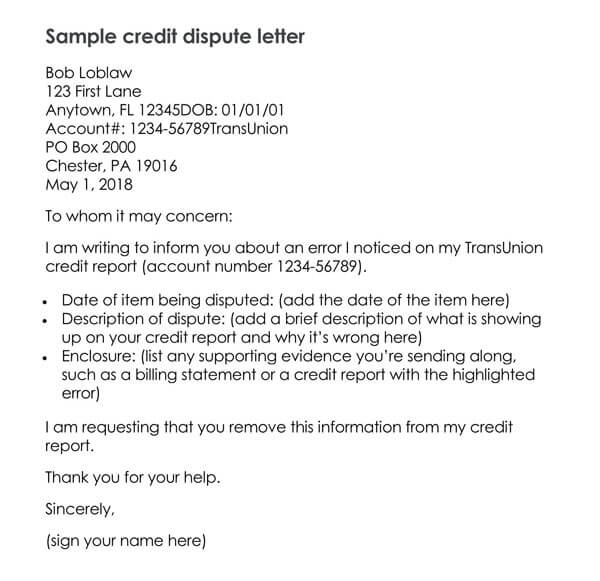

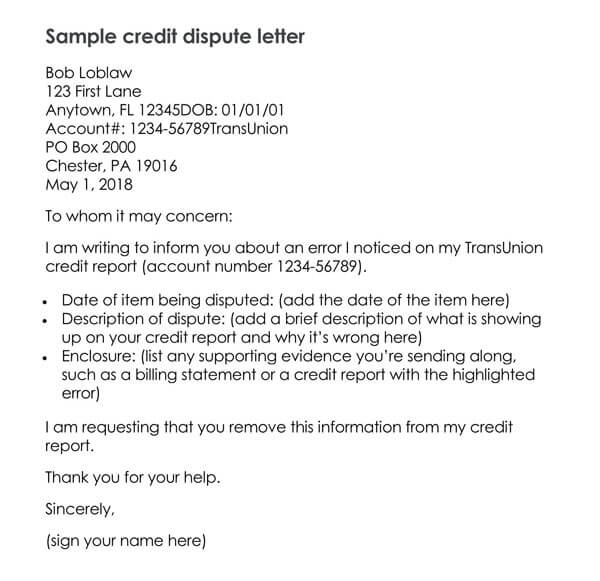

What Information Do I Need To Provide When Submitting A Dispute

Types of information you should be prepared with:

- Your full name, including middle initial and suffix, such as Jr., Sr., II, III

- Social Security Number

- Current address

- All addresses where you have lived during the past two years

Depending on how you submit your dispute , you may also be asked to provide the following additional information:

- A copy of a government issued identification card, such as a driver’s license or state ID card

- A copy of a utility bill, bank or insurance statement

You should list each item on your credit report that you believe is inaccurate, including the creditor name, the account number and the specific reason you feel the information is incorrect.

You may also submit documents to support your dispute. Depending on the type of information disputed, the following documents may be helpful in resolving your dispute:

- Police reports or an FTC Identity Theft Report, showing that an account was the result of identity theft

- Bankruptcy schedules showing that an account was included in or discharged in bankruptcy

- Letters from creditors showing how an account should be corrected

- Student loan disability letters showing that a student loan has been discharged due to disability

- Cancelled checks showing that a collection account has been paid

- Court documents regarding public records

Read Also: Will Closed Credit Card Affect Score

Summary Of Moneys Guide For Getting Negative Items Removed From Your Credit Report

- Order a copy of your credit report through AnnualCreditReport.com and search for inaccurate information, like missed payments or accounts that don’t belong to you.

- If you find any, file a dispute online or through the mail with the credit bureaus Equifax, Experian and TransUnion.

- You should also notify your bank or credit card issuer. They can help you verify that the information in your report is, in fact, erroneous and notify the bureau.

- Be on the lookout for a response from the bureau. It should arrive in around a month or less. If they accept your dispute, request your credit report again to make sure the negative information was removed.

- If your report is riddled with errors or you’re finding the dispute process difficult, consider hiring a .

How To Dispute Credit Report Errors

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Steps

Errors on your credit reports can cause your credit scores to be lower than they should be, which can affect your chances of getting a loan or credit card and how much interest you pay. Disputing credit report errors and getting those negative items removed can be a quick route to a better score.

Here’s how to dispute credit report errors and have them removed in four steps.

Read Also: What Credit Score Is Needed For A Conventional Loan

Statute Of Limitations For Reporting:

Negative entries on your credit report have different reporting limits. Typical retention periods are stated below, and may vary by state:

- Chapter 7 Bankruptcy: 10 years from the date of entry of the order of relief or adjudication.

- Chapter 13 Bankruptcy: 7 years from the date of filing if discharged. However, if the case is dismissed for non-payment and the Chapter 13 plan was not completed, the derogatory trade line item could then stay on for seven years from the date it became delinquent.

- Unpaid tax liens: report indefinitely while unpaid.

- Paid tax liens: report for 7 years from the date of payment.

- Unpaid child support: varies by state and does not always report but in general will show as a judgment while unpaid. The judgment may be renewed in some states, so it will continue to report as long as a balance remains. Once paid, may remain for 7 years.

- Civil suits and judgments: 7 years from the date of entry or 7 years from the paid date.

- Late payments: 30, 60, 90 or 120 days late payments may be reported up to 7 years from the date of delinquency.

Knowing these limits is an important step to determine if the information is obsolete and if a dispute is an appropriate course of action to pursue.

Mistake #1: Applying For New Credit

If youre trying to repair your credit, the chances of being approved for additional credit, especially unsecured credit, are not great. You could be wasting a hard inquiry that ends up lowering your credit score right at the time youre trying to raise it. Its best to save applying for new credit for laterafter your credit has been repaired.

Also Check: Is It Bad To Dispute Credit Report

Can You Erase Bad Credit Overnight

The short answer is no. Fixing bad credit is a time-consuming process that often takes months. It involves contacting credit agencies and lenders to dispute inaccurate information, and they can take up to 30 days to respond to your request. They may also ask for more documentation to validate your dispute, further prolonging the process. Additionally, note that accurate negative items cannot be deleted from your report and will remain on your record for at least seven years.

Some Words Of Advice: How To Dispute Credit Report And Win

Wondering does disputing credit work? Unfortunately, its not always that simplebut there are certainly some things you can do to increase your odds. If you do file disputes with the credit bureaus, you should think about how to word your letter. Im not sure Id go so far as to tell them you want accurate information removed. Id simply ask that they verify whats already being reported.

After you file your dispute, the credit bureaus will contact the furnishing party, normally a lender or a collection agency. These parties are formally referred to as data furnishers or furnishers for short.

Its their responsibility to investigate your claim and get back to the credit bureaus, normally within 30 days, but there are some scenarios when it can take 45 days.

If they confirm the accuracy of the credit reporting, then youll likely have to live with it until the credit bureaus have to remove the item, which normally takes 7 years for the bad stuff.

Read Also: How To Report Bad Credit To Equifax

Determine If You Should Contact The Furnisher As Well

The CFPB also recommends that you contact the company that provided the information to the credit bureau. Companies that provide information to credit bureaus are also known as furnishers. Examples of furnishers include banks and credit card issuers. If the furnishers address is listed on your credit report, send your dispute to that address or contact the company for the correct address.

You can try going directly to the furnisher and asking them to correct their reporting mistake before contacting the credit bureau, says Kevin Haney, a credit bureau expert at Growing Family Benefits. That might save a step, since all the bureau can do in its investigation is communicate to the company that the consumer says its wrong, he says.

But if the error is an identity-related mistake made by a credit bureau, go to the bureau first.

Those are the most likely to get corrected, because the bureau owns the problem so it doesnt have to reach out to anyone, Haney says.

In this case, you should also check with the other major credit bureaus to make sure the identity-related error isnt on their reports as well.

Is Pay For Delete Illegal

The Fair Credit Reporting Act sets the rules for credit reporting as it applies to creditors, debt collectors, credit counseling organizations, and credit bureaus. The FCRA does not contain any language banning pay for delete, so its legal.

But before you get too excited, bear in mind that you can deploy pay for delete only on items that are incomplete or inaccurate. The FCRAs scope means you cant have accurate items removed from your credit report. If you try to use questionable techniques to remove accurate items, you may, in fact, be breaking the law.

Any pay for delete agreement you reach with a debt collector should be documented in writing in case you need to enforce the deal. Normally, you must first pay off the debt before the collector will remove the item, so a written agreement is required to ensure compliance.

Understand that without the agreement in place, the collector is under no obligation to remove items from your credit report, but theyre also not under any restriction to do so.

You May Like: How To Get Bankruptcy Off Credit Report Early

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently at the very least annually, if not more often to catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major once a year. However, because of the pandemic, all three bureaus are offering free weekly reports through the end of 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to check your reports from all three bureaus since each one can include different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service

P.O. Box 105281

Other ways to get your credit report

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance or employment in the past 60 days based on your credit

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- You’re a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

To request additional copies, contact the bureaus directly. Heres how to do it:

For a more detailed guide on how to request copies, make sure to read our article on how to check your credit report.

Wait Up To 45 Days For The Results

After you dispute credit reporting errors with a credit bureau, it typically has 30 days to investigate your claim. It must notify you of the results five days after completing the investigation. However, it can take up to 45 days under the following circumstances:

- Youve submitted a dispute after receiving a free credit report from AnnualCreditReport.com

- During the 30-day investigation window, you submit new materials and documents

You May Like: How To Boost Credit Score

Hardest Items To Remove From Your Credit Report

Some things are easier to remove from your credit report than others because these items are easier to verify. Items that are a matter of public record are more difficult to remove. This includes bankruptcy, foreclosure, repossession, lawsuit judgments, and loan default, especially student loan default. Sometimes its hard to get these removed even when theyre legitimately inaccurate.

If you have inaccurate public records on your credit report, try to work directly with the court or agency that has the item listed on your report. Once theyve updated their records to show whats accurate, it will be much easier to work with the credit bureau to clear things up. Creditors and other businesses that report to the credit bureaus have the same obligation to investigate and clear up errors.

How To Dispute Your Credit Report

The government and the credit reporting industry recognize how important, and how error-prone, credit reports are, so fair credit laws make it relatively easy to dispute your credit report. Relatively. Here are the main steps, discussed in more detail below:

- Step 1: Get a copy of your credit report and review your credit report for errors.

- Step 2: Write a dispute letter or fill out an online form for each error you uncover.

- Step 3: Collect documents that support your dispute claims.

- Step 4: File your dispute through online forms, telephone, or postal mail .

- Step 5: Allow 30 days or less to get back the results of the dispute investigation.

The three credit reporting agencies offer both in-common and unique dispute services, tools, and advice. Each bureaus site explains its error-dispute processes, including:

- Information to include in your dispute letter

- What supporting documentation to include

- How to file your completed dispute package

- How to find updates as your dispute progresses

The agencies urge online filing for more rapid resolution. Each bureau offers information for postal mail and telephone-based filings as well. You can begin the dispute process by obtaining a copy of your credit report from each bureau at annualcreditreport.com, a site established by law and overseen by the three agencies. If you detect errors, experts recommend marking them on the report, which you will copy and include in your credit report dispute package.

Don’t Miss: Is 601 A Good Credit Score