Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay them all off. Then you’ll just have one payment to deal with and, if you’re able to get a lower interest rate on the loan, you’ll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period during which they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 35% of the amount of your transfer.

Pay Bills On Time And In Full

“Making payments on time and keeping your balances low are the two most important factors when it comes to building credit,” Griffin says.

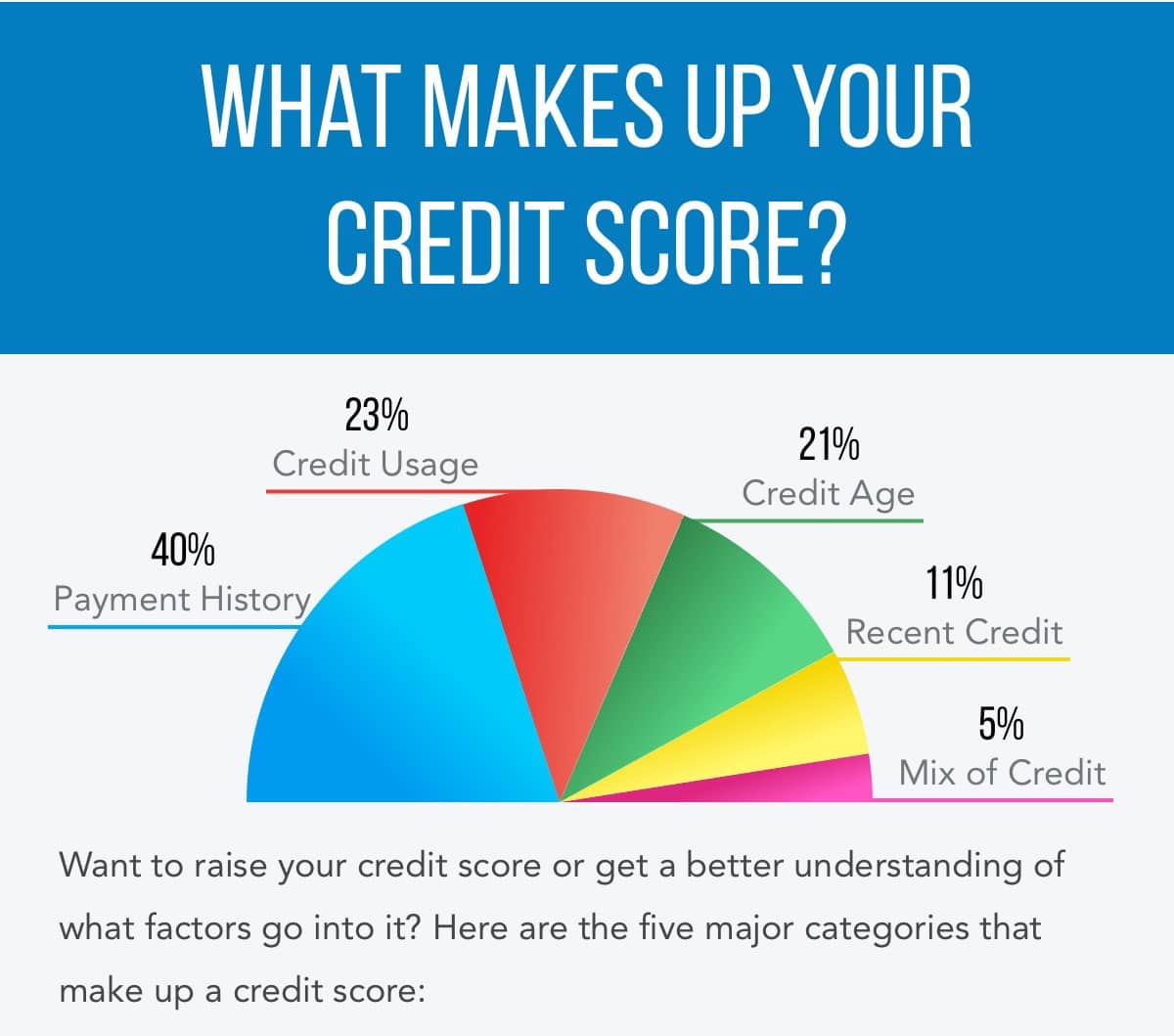

In fact, payment history is the most important factor making up your credit score. Your credit score considers whether you make payments on time or late and if you carry a balance month to month or pay it off in full.

It’s a good idea to pay off your bill in full each month to avoid potential late payment fees, penalty and interest charges that often result from carrying a balance.

“Before you open a credit account, you should know why you’re opening the account, what you will use it for and how you will pay the balance off,” Griffin says.

As a rule of thumb, set up autopay for at least the minimum payment, so you can avoid unnecessary mishaps. You can also schedule email, text or push notifications through your card issuer.

How Do I Get And Keep A Good Credit Score

Tip: If you are new to credit, consider getting a product designed to help you establish and build credit. Financial institutions have developed an array of products and services, such as secured credit cards and credit builder loans, tailored to helping consumers new to credit to establish and build credit.

Read Also: What Credit Report Does Comenity Bank Pull

Simple Steps Can Lead To A Bright Financial Future

. And having good credit can make it easier to rent an apartment, take out a car loan and buy a home, among other things. But it can be hard to know how to establish credit for the first time.

You might have no credit history, otherwise known as âcredit invisibility.â Or you might have thin credit, which means you donât have enough credit history to be scored. Whatever the case, there are several ways to establish credit. The general idea behind each strategy involves building a solid history over time with responsible credit use.

Strive To Never Miss A Payment

Payment history accounts for up to 40% of your credit score. This doesnt directly disadvantage credit novices, as the percentage of payments you make on time is what matters most. But mistakes are magnified when you have limited or no credit history. For example, youre batting just 83% if youre late with one of your first six monthly credit-card payments. But making 599 out of 600 payments on time leaves you with an average over 99%.

There are two ways to improve. One is to keep your spending under control. Spending only what you can afford to repay in full each month on a credit line makes missed payments less likely and encourages responsible credit utilization. The other way is to set up automatic monthly payments from a bank account and scheduling them a few days after your paycheck comes in. This ensures that youll have enough money to cover the payment and helps you prioritize bills over unnecessary purchases.

Read Also: How Long Does It Take For Opensky To Report

Why Do You Need Good Credit

When you start using credit responsibly, your improves and you will gain enormous advantages from both a convenience and financial perspective.

And when was the last time you saw someone pay for a restaurant meal with a check?

Having a credit history is crucial for bigger purchases, too. If you want to buy a car and need a loan, the dealership will run a credit check and look at your credit score.

If youre planning to rent an apartment, expect a credit check as part of the vetting process. Cable companies and utilities check your credit and, if you dont have a solid credit history, will require a security deposit.

Sometimes, prospective employers will access your credit rating when they are deciding whether to offer you a job.

So, having a credit history, and the credit report and credit score that go with it, is vital to your financial future. Here are some ways to get out of the credit invisible or unscorable categories.

Companies Continually Test Build And Update Their Credit

You may occasionally see headlines when credit-scoring companies like FICO or VantageScore release a new credit-scoring model. There might be a discussion in the media about how those new models could affect consumers credit scores and ability to get approved for loans and credit cards. Thats only part of the picture, though.

Unknown to many consumers, large financial services companies are continually creating and updating custom scoring models. They may use these models instead of, or in combination with, scores created by credit-score-industry heavyweights FICO or VantageScore.

Today, companies are able to gather and analyze vast amounts of data, which they can use to help determine your score using custom scoring models.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

Pay Your Balance In Full Every Month

The best habit you can build is to pay your card in full every month. If you nail this habit while youre learning to establish first-time credit, youll be light-years ahead of many long-time credit users.

Remember, it only takes a few casual swipes on your credit card to raise your balance to more than you can afford. While small charges dont feel like theyll add up to much, they do and fast.

Whats more, if you carry a balance over from month to month, then the interest charges can multiply your balances more than you could have imagined. So do yourself a favor and pay off your secured credit card every month.

Need help reading and understanding your credit statement? This template from the Consumer Financial Protection Bureau helps you see what to look for on your monthly credit card bill.

Get Your Free Annual Credit Report

Everyone is entitled to their credit report once a year from all three credit reporting agencies. You can get yours at AnnualCreditReport.com.

Because you have access to your credit report from each of the three CRAs, you could check several times per year by spacing them out. For example, you could check your Experian credit report early in the year, TransUnion a few months later and Equifax a few months after that.

That way youre getting your eye on your credit regularly without having to pay anything extra to do it. Just keep in mind that these credit reports can vary slightly as different creditors might not always report to all three CRAs.

Also Check: Will Paypal Credit Affect Credit Score

Can I Build Credit By Paying My Rent On Time

In some cases, yes.

There are several companiesRental Kharma, Rent Reporters, and RentTrack, for examplethat will report your rent payments to one or more of the credit bureaus.

Unless your landlord or property manager already works with these companies, youll need to pay a monthly fee . Your landlord will also need to validate your rental payments for the system to work.

Also know that most utility bills do not count towards your credit, unless you fail to pay them.

Ways To Build Credit Fast

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If your credit score is lower than you’d like, there may be quick ways to bring it up. Depending on what’s holding it down, you may be able to tack on as many as 100 points relatively quickly.

Scores in the “fair” and “bad” areas of the could see dramatic results leading to more access to loans or credit cards, and at better terms.

You May Like: Does Carvana Build Credit

Dispute Credit Report Errors

A mistake on one of your credit reports could be pulling down your score. Fixing it can help you quickly improve your credit.

You’re currently entitled to a free report every week from each of the three major credit bureaus: Equifax, Experian and TransUnion. Use AnnualCreditReport.com to request those reports and then check them for mistakes, such as payments marked late when you paid on time or negative information thats too old to be listed anymore.

Once you’ve identified them, dispute those errors to get them removed. The credit bureaus have 30 days to investigate and respond. Some companies offer to dispute errors and quickly improve your credit, but proceed with caution before you choose this option.

Establishing A Credit Score

If you dont have any credit history, get started! A positive credit history helps out nearly every aspect of your financial future, whether its purchasing a car, renting or buying a home, or even applying for a job.

The easiest way to start is to apply for a line of credit. Credit cards for gas stations or department stores are generally easy to obtain and are good ways to build solid credit. Use them responsibly, being careful not to overcharge. The key is to pay your bill on time each month.

If you cant get approved for a traditional credit card, . These cards require a deposit, often equal to the credit limit you will be extended with the card. For example, a $500 deposit will get you a secured credit card with a $500 spending limit.

These cards act the same as unsecured cards in that you receive a monthly bill and payment is expected each month. Be sure that the spending on the secured card is reported to the credit reporting bureaus.

In most cases, as long as you pay each month, your deposit will be refunded when you are finished with the card. Your deposit cant be used to make the monthly payments.

Becoming an authorized user is another way to establish a credit score.

Being an authorized credit card user is the best position possible in the credit world: you get all the benefits and none of the responsibility. You spend, someone else pays, and everybodys credit improves.

That is the sole responsibility of the cardholder.

12 Minute Read

Don’t Miss: How To Dispute Repossession On Credit Report

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

Avoid Student Loan Default

Of all the bills in the world that can become overwhelming, student loans can certainly top the list. But you want to avoid student loan default.

Unlike other types of debt, student loans are nearly impossible to discharge through bankruptcy. Whats more, student loans getting sent to collections will damage your credit. Plus, it makes it hard for you to know whos servicing them when you are ready to start repaying.

If you have federal student loans and youre struggling to pay them back, you have access to the following options:

And if you have private student loans and the payments are too high, see if you can refinance to get a lower interest rate. Youre not likely to get approved for this on your own if youre still new to credit, but there is often the option to add a cosigner.

But if you refinance your student loans with the help of a cosigner, its more imperative than ever to pay your bill in full and on time every month. Thats because a delinquency on your part wont just hurt your credit itll hurt your cosigners credit too.

Also Check: Opensky Credit Increase

How To Build Credit Without A Credit Card

While credit cards are a great tool for building credit, they aren’t your only option. Since your credit score is a reflection of how well you’ve managed debt in the past, any accounts you have that are reported to credit bureaus in good standing have the potential to help you boost your score.

Even if you’re just starting out and don’t yet have any credit accounts, there are other ways you can build your score over time. Here are four strategies for building credit without a credit card:

Be Patient And Persistent

Patience isn’t a factor that’s used to calculate your credit score, but it’s something you need to have while you’re repairing your credit. Your credit wasn’t damaged overnight, so don’t expect it to improve in that amount of time. Continue monitoring your credit, keeping your spending in check, and paying your debts on time each month, and over time you will see a boost in your credit score.

You May Like: What Credit Score Do You Need For Affirm

Use Only A Small Amount Of The Credit You Have Available

Maxing out your credit cardsor even coming closeis irresponsible, particularly if you don’t plan to pay the whole balance off within the month. Lenders know that borrowers who max out their cards often have difficulty repaying what they’ve borrowed.

Your credit score also suffers when you run up big credit card balances and don’t pay them off. Keeping your balance at a small percentage relative to your is best for building good credit.

If you charge a high balance on your credit card, pay the full balance before the account statement closing date to prevent having a high balance listed on your credit report and used for calculating your credit score.

A Walkthrough Of Statistical Credit Risk Modeling Probability Of Default Prediction And Credit Scorecard Development With Python

We are all aware of, and keep track of, our credit scores, dont we? That all-important number that has been around since the 1950s and determines our creditworthiness. I suppose we all also have a basic intuition of how a credit score is calculated, or which factors affect it. Refer to my previous article for some further details on what a credit score is.

In this article, we will go through detailed steps to develop a data-driven credit risk model in Python to predict the probabilities of default and assign credit scores to existing or potential borrowers. We will determine credit scores using a highly interpretable, easy to understand and implement scorecard that makes calculating the credit score a breeze.

I will assume a working Python knowledge and a basic understanding of certain statistical and credit risk concepts while working through this case study.

We have a lot to cover, so lets get started.

Recommended Reading: Does Zebit Report To Credit Bureaus

How Long Does It Take To Build Credit In The Us

Learning about how long it takes to build a credit history in the USA can be a daunting task. It usually takes anywhere between 3 and 6 months to build credit.

You can get a credit score of 700 in about 6 months. However, it is important to note that while building credit takes time, your score can drop drastically with just one mistake. You need to be cautious, and ensure that you make all your payments on time.

I Requested A Credit Line Increase

I dont know exactly how much of that 84-point rise was due to my goodwill letter. Because in the same month, I made another free and fast move to improve my credit.

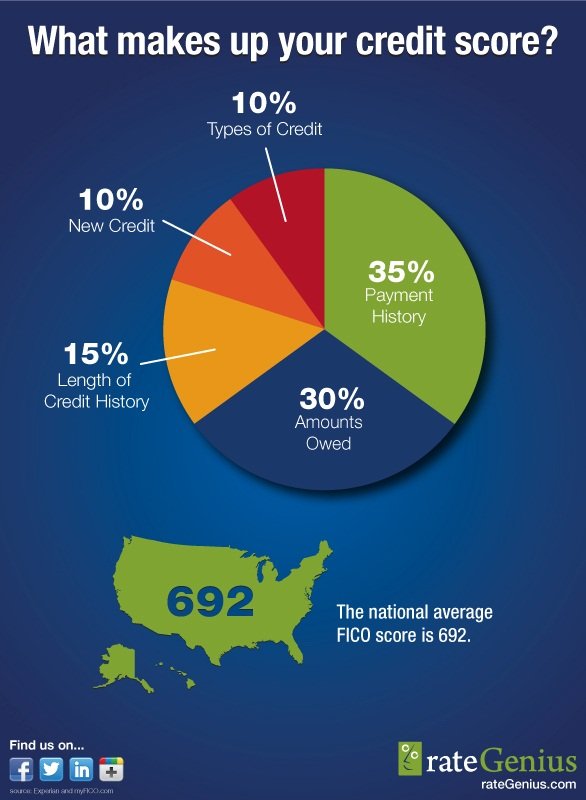

This time, I focused on the next biggest factor that goes into credit score weightings: . Its a way of comparing the amount of money you owe compared to the total amount of credit you have access to. For example, if you have $1,000 of credit card debt, and your total credit line is $10,000, you have a credit utilization ratio of 10%. The lower your ratio, the better. It accounts for 30% of your FICO score.

Apart from the new credit card I opened and promptly missed a payment on, I typically use just one card: a simple cash back card with no annual fee. It serves my needs well, so in the seven years Ive had it, I havent thought about it much beyond paying off my balance in full every month.

But as I picked apart my credit score and the factors that go into it, I realized that I could improve my utilization ratio by increasing the credit limit on my card.

To increase your line of credit, all you have to do is ask. My bank has a feature on its website where you can request a credit line increase online. I pulled it up, input some information including my employment status, my estimated yearly income, and the amount of my requested increase.

I hit submit, expecting it would begin some sort of review process. But I was wrong. On the next screen, I was notified that my credit line had instantly more than doubled.

Also Check: What Is Syncb Ntwk On Credit Report