What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

Reasons You May Not Have A Medical History Report

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Hire A Credit Monitoring Services

Various companies and online platforms offer credit monitoring or score-monitoring services, either for free or through subscription. Examples include and .

The update frequency depends on the individual service. Some also provide you with a copy of your credit report. However, its worth bearing in mind that free services usually provide your VantageScore rather than your FICO score, which is a bit less useful .

Recommended Reading: How To Check My Experian Credit Score

Start Monitoring Your Credit For Free Today

Itâs possible to check your credit reports more often. One way to monitor your credit is with . CreditWise gives you free access to your TransUnion credit report as often as you log in to your CreditWise account. Plus, you can check your VantageScore® 3.0 credit score for free any time.

And the CreditWise Simulator can give you an idea about how different financial decisions might affect your credit score. For instance, the tool may help simulate how your credit score might change if you pay off a credit card balance. Best of all, using CreditWise wonât hurt your credit score. Thatâs because it uses soft inquiries to monitor things. CreditWise is free for everyone, not just Capital One cardholders.

You can sign up for CreditWise today to keep a closer eye on your credit report and score.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

The information contained herein is shared for educational purposes only, and it does not provide a comprehensive list of all financial operations considerations or best practices.

Check Your Report Every Year To Keep It Accurate

Request your free credit report every 12 months to make sure its accurate, and youll be ready whenever the time comes to apply for a loan. If you need business financing, Pursuit can help! Explore the 15+ business loans we offer throughout New York, New Jersey, and Pennsylvania, and get in touch with us to learn more.

Read Also: What Us A Good Credit Score

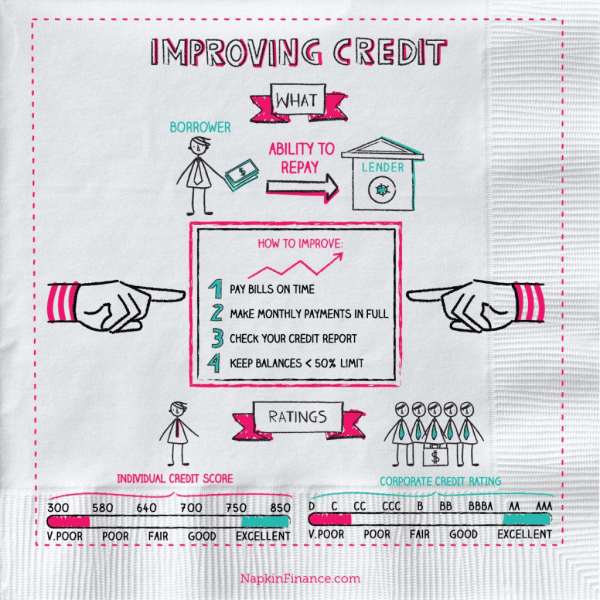

What Is A Credit Score

A credit score is a three-digit number lenders use to determine whether or not a borrower is a good candidate for credit. The number ranges between 300 to 850, and the higher the credit score, the better, meaning borrowers will get approved for more loan products at lower interest rates than borrowers with low credit scores.

Ordering Your Free Credit Report

You can get a free every 12 months from each major credit bureaus. This includes Experian, TransUnion, and Equifax.

The easiest way to get a copy of your report is through www.annualcreditreport.com. Youll need to fill out a form with your basic information, then select which reports youd like from the bureaus. To finalize the request, youll need to answer some additional security questions that might require some information from personal and financial records. Once you have your reports, its time to review them for any errors or negative remarks!

Your free annual credit report doesnt include your , but you can purchase your FICO score when you request your free annual credit report.

You can also request your credit report and score at no charge through sites like , , LendingTree, and Bankrate. Remember that the credit score youll get through these websites may not be the same one a lender will use when reviewing your application. Lenders are more likely to use your FICO score.

Recommended Reading: What Does Closed Derogatory Mean On Credit Report

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

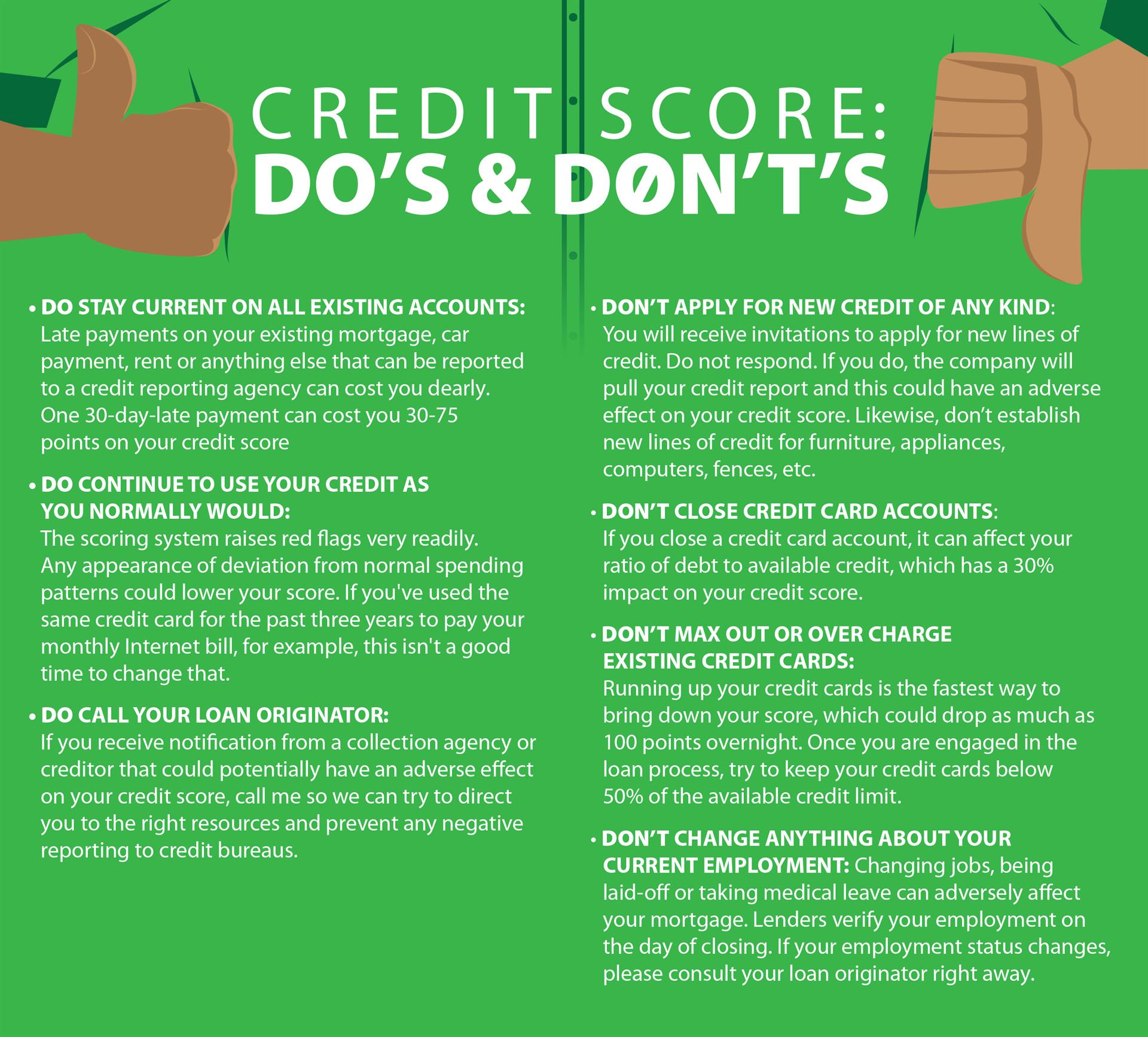

Review Your Credit Report Annually

Another big part of your overall credit health is making sure that everything on your credit report is accurate, as this is what dictates your score. Its a good idea to check your credit report at least once a year to look for any apparent errors. You may find that a lender has made a mistake in reporting a transaction to one of the credit bureaus. If thats the case, you should proactively work to get the error corrected.

Checking your credit report annually is also a good way to watch for fraud and identity theft. If theres a loan account on your credit report that wasnt opened by you, you may be a victim of identity theft, which is what happens when someone uses your personal information to open a loan account. When the loan becomes delinquent, it affects your credit score. Checking your credit report regularly can help you catch these problems early.

Recommended Reading: What Does Collection Mean In Credit Report

How Often Do Credit Scores Update

Your credit score will increase or decrease as changes are made to your credit report. Depending on what financial transactions you make, bills you pay or new accounts you open, this information can change more frequently. On average, however, you can expect your credit score to update about once a month.

You might also notice that your number varies across different credit bureaus. This is typically caused by creditors submitting new information to the credit bureaus at different times. For example, your score may reflect one number on your TransUnion® report, but another on your ExperianTM report.

How Does Credit Work

Your ability to borrow money or use credit depends on several factors including the availability of money, your previous experience borrowing money, and your history of repaying credit obligations. Availability of money is determined by general conditions in the economy. Rising interest rates generally lead to less money for individuals and businesses to borrow. This means that individuals will not only pay higher interest rates, but it takes a better credit history to qualify for loans.

Often, people do not know what their credit report says until they are turned down for credit. You may not get a loan because of negative information reported in your credit file. Or you might be turned down for a variety of other reasons such as not employed long enough or new to an area. If you have always paid cash for purchases and havent borrowed money before, you have no history or proof to indicate the type of credit risk you would be. Lenders have fewer clues in deciding whether to give you a loan. They may take longer to decide to approve a loan, charge you higher interest rates, or turn down your loan application altogether.

You May Like: How Long Does Bad Credit Stay On Your Credit Report

How Frequently Can You Ask For A Credit Increase

Your small business credit card might not offer you as large a line of credit as you need. The solution is often to request a larger line of credit, but you cant do that every day. Theres also no industry-wide limit on how often you can request a credit line increase on your small business credit card. So how often you can make a request for a larger credit limit will vary based on the card issuer. Read on to learn more!

Recommended: Learn How to Build Business Credit to help establish your businesss fundability, get lower interest rates on loans, higher lines of credit, and sign up for all of this in your businesss name, instead of yours.

2021-08-27

Dont Miss: How To Report To Credit Bureaus As A Landlord

Is There A Limit To How Often You Can Check Your Credit Score

Technically, you can check your credit score as often as you want. With that said, the company providing your credit score may impose a limit to how often they provide you with an updated score.

Thankfully, checking your credit wont hurt your credit score in any way. This is because credit checks you perform on yourself are classified as soft credit checks rather than hard inquiries .

Also Check: What’s The Best Way To Check Your Credit Score

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO® Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO® Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

What If The Cifas Marker Is There By Mistake

If you think a Cifas warning has been put on your credit file in error, you can contact the lender who put it there to see if theyll remove it.

Be aware that credit rating agencies are unlikely to remove any entry on your report if they believe the reason the marker was put on your credit file was justified. Lenders are legally obliged to report any fraudulent attempt on your account to the credit reference agencies.

Find out more about Cifas markers on the Cifas website

Read Also: Who Can Order A Credit Report

How To Request Your Credit Reports

You can request a free copy of your credit report from each major credit bureauâTransUnion®, Equifax® and Experian®âonce a year by phone, mail or online. You can find out more at AnnualCreditReport.com or by calling 877-322-8228. And you can either check your credit reports from the three bureaus all at once or spread them out throughout the year. If you reach the limit, you can request additional reports, although you may have to pay for them.

The CFPB says youâre entitled to free credit reports at other times too. These include the following:

- If an âadverse actionâ is made against you because of information in your credit report, youâre entitled to request and receive a copy of that report. Keep in mind that you would need to make the request within 60 days of receiving the adverse action notice. An adverse decision could be a lender denying your credit application, an employer deciding not to hire you or an insurer deciding not to provide you with coverage.

- You believe your credit reports contain errors due to fraud, or youâve requested one relating to a fraud alert placed on your credit file.

- Youâre unemployed and plan to apply for a job within the next 60 days.

- You receive public welfare assistance.

- Your stateâs laws allow you to request a free credit report.

How To Check Your Credit Score

There are various online websites which give you credit score, but the source of such credit scores would be one of the four RBI regulated credit bureaus such as CRIF. When it comes to finances, you ought to trust the expert and give importance to data security.

One of the trusted way to do so is check it from CRIF, a RBI regulated credit bureau. You are entitled to check a credit score and credit report FREE once in a calendar year from CRIF. Checking your credit score is easy three step process ? fill your personal details, confirm your identity and download the https://blog.crifhighmark.com/wp-admin/tools.phpreport.

There is no right time or right day to start keeping a track on your financial credibility. Informed or Unaware, choose wisely

Don’t Miss: What Will Affect My Credit Rating

How Often Should I Get A Credit Report If I Want To Check My Credit Score

Each credit reporting agency updates their files regularly, but the updates may be a few months old, depending on the type of information involved. For this reason, its important to note that even the most recent credit report may not be updated with all the relevant information.

If you are hoping to see your credit score rise and it hasnt moved, it may be that some of the good things youve done to improve your score may not yet have been processed into the algorithm. Checking back once every couple months will help you to keep a closer eye on the changes in your credit score as your financial position gets steadily better.

However, pulling your credit report to check your score on even a monthly basis may be like weighing yourself multiple times per day when youre trying to lose weight. Its a better idea to check in often enough to know whats happening on your credit report and with your credit score, but spend most of your time focusing on the actions that will build your credit score back up more quickly. This includes actions like paying down debt, making payments to open accounts on time, and limiting the number of hard inquiries into your credit as much as possible.

When Not To Check Credit Score

There is no such time when to avoid the credit score. The importance of credit score has been talked about in every other financial article. It has to be a part of your yearly routine at least to stay updated and informed.

Even when you have good credit score, it is important to keep an eye on any drops in score or inaccurate information on your credit report and to ensure that it is maintained above acceptable thresholds. If it is on the lower end, make sure you change your habits and take conscious steps to bring it up. Also, minor changes on your credit report or credit score should not be a cause of concern as these are expected to happen. So checking credit score daily can be avoided.

Recommended Reading: Is Fico The Same As Credit Score

If Youve Already Obtained All Of Your Free Yearly Credit Reports You Can Buy Another

Get Free Weekly Credit Reports During the Coronavirus Crisis

Equifax, Experian, and TransUnion are offering free weekly online credit reports during the COVID-19 pandemic. Go to AnnualCreditReport.com to get your free reports.

Every 12 months youre entitled to a free from each of the three nationwide credit reporting agencies and, in some cases, even more. And, if you need another copy from Equifax, Experian, or Transunion after youve exhausted your free copies, you can pay for one.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Recommended Reading: How Do You Increase Your Credit Score

How Often Can I Get A Free Credit Report

The frequency at which you can obtain a free will depend on how and why you are requesting it. In the United States, you can request one from each of the national credit reporting agencies at least once per year. You may also request a report each time you are denied credit because of your .

In the U.S., you may get one credit report each year, from each national credit-reporting bureau, without spending a dime. Upon your request, TransUnion, Equifax, and Experian must each provide you with one free credit report every 12 months. You may request it online, over the phone, or by mail.

You could request a credit report from each at the same time. However, it may be advantageous to spread your requests out, obtaining a different one every few months. In doing so, you may find it easier to stay abreast of changes in your credit file.

Keep in mind that you may find information on one credit report that is not present on a report from another agency. This is due to the fact that are not required to share or list the same information. As such, it is wise to obtain a report from each agency, especially if you will be applying for a large amount of credit in the near future.

Problems With Credit Reporting

Heres where it gets complicated. Some businesses only provide information to the CRAs when an account is past due or has been written off and/or turned over to a collection agency. Creditors will write off a debt when it is deemed uncollectible.

Some of these creditors include:

- Utility companies

- Doctors and hospitals

- Lawyers and other professionals.

The three reporting agencies are making increasing efforts to gather monthly information from utility companies, phone companies and local retailers. That increases the amount of data in an individuals credit profile, which cuts down on the guesswork.

Read Also: Does Snap Finance Report To The Credit Bureau

Also Check: How To Remove Bad Items From Credit Report