What Does Mr Mean On A Credit Report

MR Designation Whenever a creditor reports a credit transaction to one of the three main companies that creates consumer credit reports, the reporting creditor includes certain details. These include such details as any balance you carry on a credit card, the status of your account and the last activity date.

How A Hard Inquiry Impacts Your Credit Score

Although hard inquiries remain on your credit report for two years, FICO only considers inquiries from the last 12 months when calculating your credit score.

For example, if you see a hard inquiry listed on your credit report but it was from over a year ago, it wouldnt influence your credit score or deduct any points from it.

Your credit history also plays a role in how much a hard inquiry would impact your credit score.

According to FICO, one credit inquiry on most peoples credit reports will take less than five points off of their FICO score. They say most people because not everyone has the same credit history. If you have a healthy credit history and credit score to begin with, its likely that any hard inquiry on your credit report would do very little damage to your score, or even none at all.

Hard inquiries tend to have a greater impact on the credit scores of people with a short credit history or few credit accounts. This means that for those just starting to build their credit, a hard inquiry can knock off more points from your credit score than it would for someone who has a long credit history. But dont let that prevent you from applying for credit. Its OK to have inquiries periodically it indicates you are trying to build credit but you just dont want too many hard inquiries on your credit report in a short amount of time.

Who Is Corelogic Credco Bank Of America Credit Report

Credco is a consumer credit reporting agency that merges your Experian, Equifax, and TransUnion credit report for mortgage lenders. Who is Corelogic Credco Bank of America? Corelogic Credco is a credit reporting agency backed by Bank of America. They provide merged credit reports to mortgage lenders nationwide.

Also Check: Credit Wise Is Not Accurate

Why Do Credit Scores Matter

Ultimately, your credit score is important in many ways. To give just a few examples:

- Your credit score determines the types of loans you can get

- It determines the mortgage interest rates you pay

- It affects how large of a house or how expensive of a car you can afford

- Insurers in most states use credit scores to set premiums for auto and homeowners coverage. Policyholders with bad credit scores often pay more

- Landlords use credit scores to decide who gets to rent their apartments

- Cell phone companies might require a deposit if your credit is too low

Whether youre looking for a mortgage or any other financial product, your credit score makes a big difference. Thats why its so important to know yours before you apply.

Can Your Bank Reverse A Payment

If the supplier will not refund your money and you paid using a credit or debit card, your card provider usually your bank may agree to reverse the transaction. This is called a chargeback. … If you request a chargeback and you are not happy with the response from your bank or card provider, you can make a complaint.

Also Check: Paypal Credit Report To Credit Bureaus

Who Uses Credcos Services

Credcos services are primarily used by mortgage lenders, but the company could also be on your report for other types of loan applications, like an auto loan or dealership, for instance.

Credco might also run a soft inquiry when you try to prequalify for a loan. Though it wont affect your score, you may still see Credco on your report when this happens.

Well break down the differences between soft and hard inquiries below.

What Is Credco On Credit Report

CoreLogic Credco is a third-party consumer credit reporting agency that provides merged credit reports to a number of mortgage lenders. So a CREDCO inquiry on your credit reports could simply mean that you recently applied for a mortgage with a lender that relies on CoreLogic Credco for its credit-report needs.

You May Like: Who Is Syncb/ppc

How Many Credit Reporting Companies Are There

Most people only think of the top three credit reporting agencies: Equifax, Experian, and TransUnion. There are nearly 50 different companies that report specific data about consumers, from banking information to utilities. You are entitled to a yearly report with all of this information on it to be aware of your financial and credit report standing.

How To Get Experian Credit Score Free

Category: Credit 1. Free Credit Report Experian Experian offers free credit reports, credit scores, and daily monitoring. Check your updated credit report and always know where your credit stands. How Can I Get My Free Credit Report? You can get your free credit report from many sources, including Experian.

You May Like: Affirm Loans Credit Score

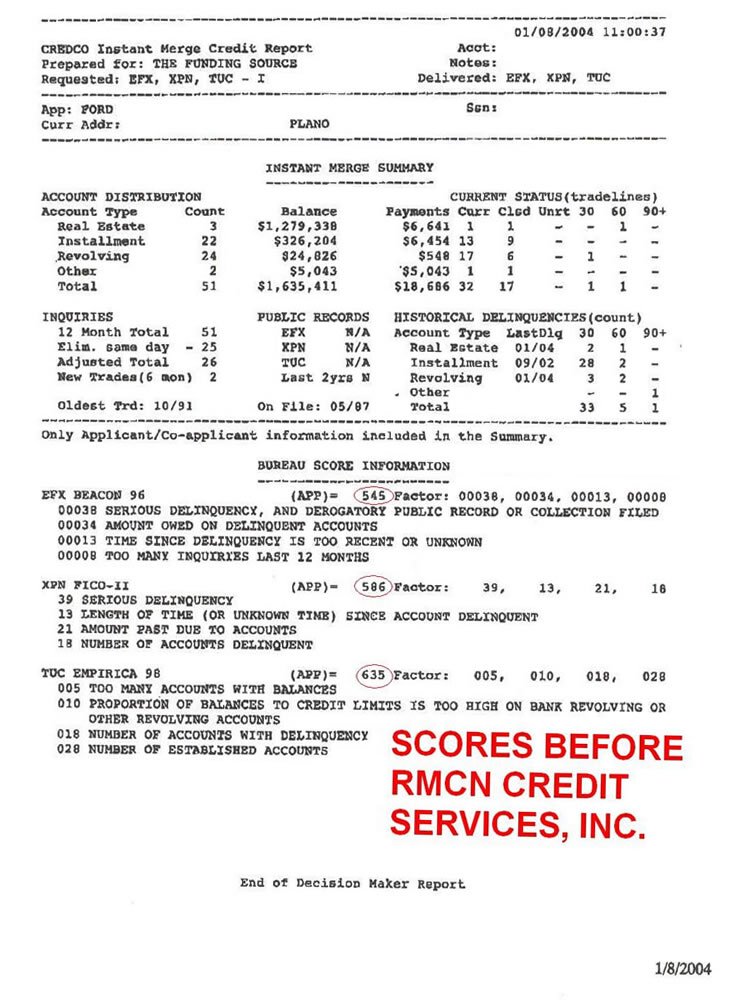

Hire A Credit Repair Company To Help With Hard Inquiries

Did you know you can hire a credit repair company to solve your credit problems?

Whether you are the victim of identity theft, have hit financial hardship and gotten behind on payments, or your credit is suffering as a result of your financial decisions, a credit repair company can help.

These companies can assist you with a range of credit problems, such as:

- Bankruptcies

- Judgments

- Liens

They can also help to dispute hard inquiries, contacting the bureaus and Credco on your behalf.

If you arent fond of the idea of chatting with representatives of the company or the credit bureaus, you can leave the task in the capable hands of a credit repair service.

Moreover, theyll help you tackle the most damaging aspects of your credit report to get you and your score back on track.

Ads by Money. We may be compensated when you click on this ad.Ad Find Locally Licensed Experts Select your state to get started Hawaii Alaska Florida South Carolina Georgia Alabama North Carolina Tennessee RI Rhode Island CT Connecticut MA Massachusetts Maine NH New Hampshire VT Vermont New York NJ New Jersey DE Delaware MD Maryland West Virginia Ohio Michigan Arizona Nevada Utah Colorado New Mexico South Dakota Iowa Indiana Illinois Minnesota Wisconsin Missouri Louisiana Virginia DC Washington DC Idaho California North Dakota Washington Oregon Montana Wyoming Nebraska Kansas Oklahoma Pennsylvania Kentucky Mississippi Arkansas Texas Contact an Expert

Lawsuit Or Judgment: Seven Years

Both paid and unpaid civil judgments used to remain on your credit report for seven years from the filing date in most cases. By April 2018, however, all three major credit agencies, Equifax, Experian, and TransUnion, had removed all civil judgments from credit reports.

Limit the damage: Check your credit report to make sure the public records section does not contain information about civil judgments, and if it does appear, ask to have it removed. Also, be sure to protect your assets.

Read Also: Comenity Bank Credit Bureau

How Long Does It Take To Reverse An Ach Payment

Upon rejection, an ACH payment is usually returned within two business days. In some cases, ACH returns occur due to unauthorized debits or authorized debits that have been revoked by the customer. In both cases, a written statement is needed to and processing for these returns can take up to 60 calendar days.

How Soft Inquiries Affect You

Not only do soft inquiries not affect your credit score, theyre not even visible to lenders when they check your report. Theyre only visible to you when you pull your own credit report.

Keep in mind, though, that if you pull a copy of your credit report and provide it to a business to review, the soft inquiries will appear, since it is your version of your credit report.

Read Also: Bby Cbna Credit Card

What Is A Soft Inquiry On Your Credit Report

A soft inquiry is usually a check performed by a lender who wants to invite you to apply for a loan. Generally, when you receive those prequalified offers in the mail for loans and credit cards, a soft inquiry has taken place before your name was added to that mailing list.

Sometimes soft inquiries show up on your credit report, but they do not affect your score. An example of a soft inquiry is when you check your credit score. Another example is the background check a potential employer may perform.

How Do You Choose Which Credit Score To Use

-

During pre-approval, we typically use the Experian FICO-II credit score from Experian. This is a soft credit check and won’t affect your credit score. If you apply with a co-borrower, we use the lower of your two scores.

When you want to continue with your loan application, with your authorization we pull your credit scores from all three major credit bureaus and use the median of the three scores received.

Ready to get pre-approved?Get started

Related questions

Home lending products offered by Better Mortgage Corporation. Better Mortgage Corporation is a direct lender. NMLS #330511. 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007. Loans made or arranged pursuant to a California Finance Lenders Law License. Not available in all states. Equal Housing Lender.NMLS Consumer Access

Better Real Estate, LLC dba BRE, Better Home Services, BRE Services, LLC and Better Real Estate is a licensed real estate brokerage and maintains its corporate headquarters at 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007. A full listing of Better Real Estate, LLCs license numbers may be foundhere. Equal Housing Opportunity. All rights reserved.

Better Settlement Services, LLC. 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007

The Better Home Logo is Registered in the U.S. Patent and Trademark Office

Better Cover is Registered in the U.S. Patent and Trademark Office

Don’t Miss: Comenity Bank Shopping Cart Trick

Why Is Credco On My Credit Report

If you recently applied for a loan , the lender may use Credco to get the information. And If you didnt recently apply for a new loan, read the section below on How to Remove Credco from your Credit Report.

If you applied for a loan, your lender likely used one of the following CoreLogic Credco services:

What Is Corelogic Credco Llc

Credco LLC is the consumer credit information division of CoreLogic Inc. CoreLogic is an information intelligence operation steeped in analytics. At its core is the mining and analysis of data by a team of computer scientists and economists. The company helps its global clients spot opportunities for financial growth. It also uses data to instruct businesses on how to mitigate risk.

CREDCO has become the primary source for merged credit reports in the United States. Previously, lenders had to wade through the individual reports provided by a credit reporting agency such as Experian, Equifax, or TransUnion. CREDCO, over the past few decades, has become a popular middleman and consolidator of consumer information. It combines the three reports into one comprehensive product, often referred to as a three-bureau merged credit report.

Recommended Reading: Syncb Qvc

What Is Coaf On My Credit Report

Asked by: Dr. Fermin Eichmann

COAF stands for Capital One Auto Finance. Prequalifying for a COAF loan will only result in a soft credit pull, which doesn’t affect your credit or stay on your report. If you decide to move forward with a loan from COAF and complete your loan application, this will result in a hard credit pull.

We’re Here To Serve You

Credco is a consumer reporting agency that assembles and evaluates consumer information and provides consumer reports to third parties for the purpose of extending offers of credit, and/or other purposes as permitted by law. The Consumer Assistance Department at Credco can provide you with a copy of the information we maintain about you that may be used in determining this information.

Also Check: How To Get Rid Of A Repo On Your Credit

File A Dispute To Remove The Credco Hard Inquiry

If you dont want to pay the credit repair service monthly fee, I get it. Then youll have to do the hard work yourself. Its not impossible, but it requires dedication, patience, and a lot of follow up.

First, you have 30 days from the date of the inquiry to dispute the inquiry. The Fair Credit Reporting Act gives you 30 days to formally dispute it, aka write a letter.

Never dispute anything verbally. Even if they agree that the account is invalid, nothing holds them to remove it.

Write a letter to Credco AND the credit bureau reporting the inquiry. State the reasons you think the inquiry is invalid. Also, ask for credible proof of the reason for the inquiry.

They should be able to provide you with proof of the loan application, date, and reason for the application.

If they cant prove the reason for the inquiry, they must remove it. If you find that someone applied in your name, you have more significant issues. You may need the help of a credit repair service and/or .

What Does Corelogic Credco Do For Your Credit Report

CoreLogic Credco is a third-party consumer credit reporting agency that provides merged credit reports to a number of mortgage lenders. These are called merged credit reports because they combine data from the single reports of the three major consumer credit bureaus: Equifax, Experian and TransUnion.

Read Also: How To Notify Credit Reporting Agencies Of Death

How Do Credit Scores Work Anyway What Is A Credit Inquiry Letter

A credit score is a considerable aspect of your financial life. It plays a crucial role in a lenders decision to state yes or no to your loan or credit card application. For instance, individuals with credit rating listed below 640 are usually considered to be subprime borrowers.

Loan provider often charge interest on subprime home loans at a rate higher than a traditional home mortgage in order to compensate themselves for handling a high danger borrower. Depending upon how low your credit score is, they might likewise require a much shorter payment term or a co-signer.

On the other hand, a credit score of 700 or more is usually thought about good and could lead to you receiving a lower rate of interest. On loans like home mortgages, a somewhat slower rate of interest can end up conserving you 10s of thousands of dollars over the repayment term!

Scores greater than 800 are thought about outstanding. Its worth keeping in mind that while every creditor defines its own varieties for credit scores, the following FICO score variety is often used:

- Excellent: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

In short, your credit score is a mathematical analysis of your creditworthiness and straight affects just how much or how little you may spend for your credit. Your credit score can also figure out the size of a deposit needed on products like phones, utilities, or apartment or condo rentals.

You May Like: Does Paypal Credit Report To Credit Bureaus

How The Two Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person.

But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first generalpurpose credit score in 1989.

Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game.

The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

According to VantageScore reports, there were approximately 10.5 billion VantageScores used between June 2017 and June 2018.

Also Check: Capital One Rapid Rescore

Why You Should Never Pay A Collection Agency

On the other hand, paying an outstanding loan to a debt collection agency can hurt your credit score. … Any action on your credit report can negatively impact your credit score – even paying back loans. If you have an outstanding loan that’s a year or two old, it’s better for your credit report to avoid paying it.

Why Did My Bank Reverse A Payment

A payment reversal is when the funds a cardholder used in a transaction are returned to the cardholder’s bank. This can be initiated by the cardholder, the merchant, the issuing bank, the acquiring bank, or the card association. Common reasons why payment reversals occur: The item ended up being sold out.

Also Check: Does Carmax Pre Approval Affect Credit

What Happens After 7 Years Of Not Paying Debt

Unpaid credit card debt will drop off an individual’s credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the person’s credit score. … After that, a creditor can still sue, but the case will be thrown out if you indicate that the debt is time-barred.

Next Steps: What To Do If Theres An Inquiry Or Account You Dont Recognize On Your Credit Reports

If youre digging around trying to find out why a name like CREDCO is showing up on your credit reports, youre practicing good credit hygiene. Congrats! Identity theft and fraud are things to take seriously, and we commend you for doing the research to stay on top of your credit.

Then again, you shouldnt assume an inquiry or account is fraudulent just because you dont immediately recognize the name. In some cases, lenders may partner with third-party services and companies like CoreLogic Credco. So its worth doing a bit of extra research before you take steps to dispute it as a credit report error.

Heres an extra bit of good news: Credit Karma offers a number of free tools and services to help you protect your credit. These include

- Free credit-monitoring This service can alert you to important changes on your credit reports. Along with checking your credit scores regularly, this feature sends you an alert so you can check any suspicious activity and report any instances of identity theft.

- Free identity monitoring This service notifies you when Credit Karma learns theres been a data breach in which your information may have been compromised. Well also give you tips on how to lock your credit with the three major consumer credit bureaus.

About the author:

Read More

Also Check: How To Remove Hard Inquiries From Credit Report Fast