Secured Vs Unsecured Credit Cards

If you cant qualify for a small business credit card due to bad credit, you may want to consider a secured credit card. These cards require a security deposit as collateral. Pay on time and can build credit, eventually qualifying for an unsecured card.

However, there are not a lot of issuers offering secured business credit cards. Wells Fargo is one of the few major issuers that does so. Learn more about business secured cards here.

Your Income And Expenses Matter Too

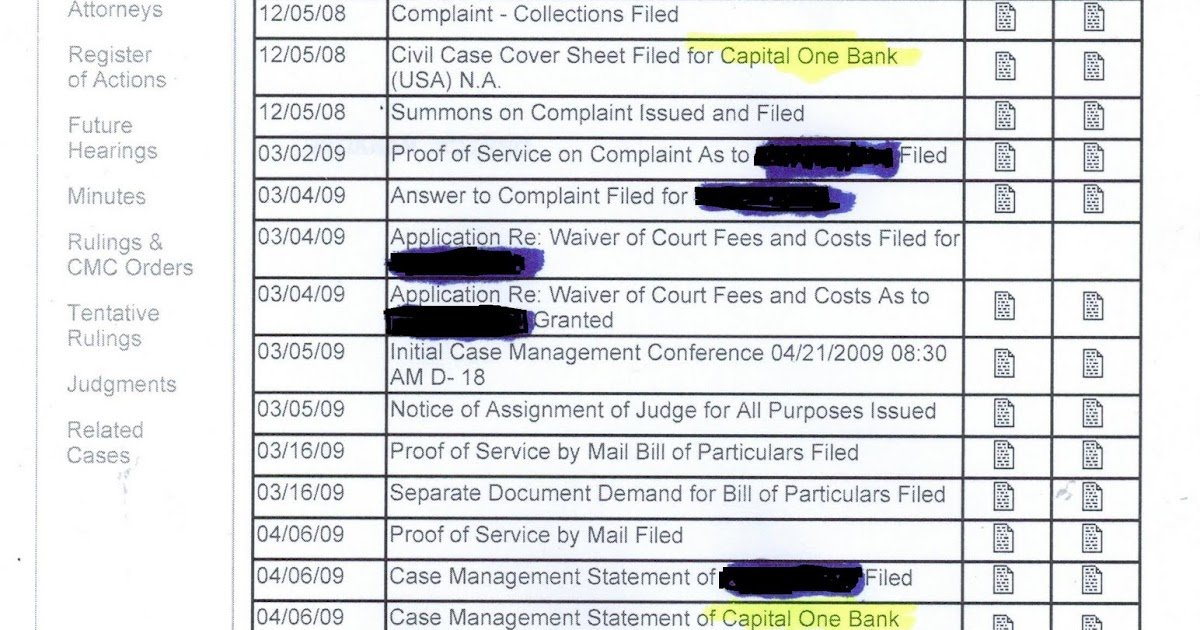

Your credit score isnt the only important thing when it comes to getting approved for a card. Your income and expenses will play a role too.When you apply for a card, Capital One will ask you about your annual income and monthly housing payments.

This is because lenders really only care about getting paid back for loans they make.

If you make $1,000 per month and spend $750 on housing, its unlikely you can pay the bills on a new credit card. If you make $10,000 a month and spend $4,000 on housing, theres a much better chance you can make payments.

Ive had good luck with an increased income increasing my luck with card companies. I have a Capital One Quicksilver card, which I use because it doesnt charge a foreign transaction fee. One day when I logged into my account, it asked me to update the annual income listed for me in the companys records.

Once, I had provided my updated income after receiving a raise, and a few weeks later Capital One offered to increase my credit limit due to my higher income. This caused a small jump in my credit score.

Its clear that making more money and spending less means its easier for you to pay your debts. Thats exactly what Capital One wants to see. Just be sure, to tell the truth about your application because Capital One will occasionally request proof of income or housing expenses.

Bank Of America Business Advantage Cash Rewards Mastercard Credit Card

The Bank of America® Business Advantage Cash Rewards Mastercard® credit card offers tiered rewards: Earn 3% cash back on your choice of one of the following six categories: gas stations , office supply stores, travel, TV/telecom & wireless, computer services or business consulting services. Automatically earn 2% cash back on dining and unlimited 1% cash back on all other purchases. Youll earn 3% and 2% cash back on the first $50,000 in combined category/dining purchases each calendar year, 1% thereafter.

And if youre a BofA customer, you can earn even greater rewards. You can earn up to 75% more cash back on every purchase, if you have a business checking account with Bank of America and qualify for its highest Preferred Rewards for Business tier. At that level the card is a top contender for cash back rewards. And right now its offering a 0% Introductory APR on purchases for the first 9 billing cycles.

Note:

Read Also: Aargon Agency Payment

How Can I Raise My Credit Score By 100 Points In 30 Days

How to improve your credit score by 100 points in 30 days

Tips For Building Business Credit With Credit Cards

If one of your goals is a good business credit rating, consider getting a business credit card. Many entrepreneurs think their business has to be well-established and profitable to qualify, but that is not always the case. Card issuers are often more interested in the personal credit score of the owner who applies, and will often consider income from a variety of sources, not just the business itself.

To build strong business credit using a business credit card, make sure you:

Read Also: How To Get Credit Report Without Ssn

What Happens If You Have A Card That Doesnt Report To All Three

If you have a card that doesnt report your activity to any of the three credit bureaus, youll get no benefit from using it responsibly. And if it reports to only one or two, the credit benefit of using the card will be limited.

For example, lets say you have a credit card that reports to Experian and TransUnion, but not to Equifax. Over time, youve used your card responsibly and established a good history on your credit reports with those bureaus.

But if you go to apply for a loan or a new credit card and the lender calculates your credit score based on your Equifax credit report, it will be as if you never had the credit card. Again, youll get no benefit.

Platinum Select Mastercard Secured Credit Card

No credit check or credit history is needed to apply for the Platinum Select Mastercard® Secured Credit Card, so you may qualify even if you have derogatory items on your credit report or are new to credit.

Card issuer First Progress offers three secured credit cards with similar features but different annual fees: The higher the fee, the lower the card’s APR. The Platinum Select Mastercard® Secured Credit Card is the mid-range card, with a $39 annual fee and a 13.99% variable APR on purchases and cash advances, which is lower than many other cards in this category.

This card reports to all three major credit bureaus and offers a credit limit of $200 to $2,000 with a refundable deposit of equal amount. However, it’s not available to residents of Arkansas, Iowa, New York or Wisconsin.

- No Credit History or Minimum Credit Score Required for Approval!

- Receive Your Card More Quickly with New Expedited Processing Option

- Quick and Complete Online Application No credit inquiry required!

- Full-Feature Platinum Mastercard® Secured Credit Card Try our New Mobile App for Android Users

- Good for Car Rental, Hotels Anywhere Credit Cards are Accepted!

- Includes Free Real-Time Access to Your Credit Score and ongoing credit monitoring powered by Experian

- Monthly Reporting to all 3 Major Credit Bureaus to Establish Credit History

- Get a Fresh Start! A Discharged Bankruptcy in Your Credit File Will Not Cause You to Be Declined.

- Get Approved Fast – Just Click Below to Start the Process!

Don’t Miss: Bby Cbna Credit Card

Re: When Does Capital One Report

wrote:For me they reported on the second statement date.

Same here. I was wondering when they were going to show up on the credit reports. It took a full two months for it to show up.

Conversely, Barclaycard reported literally the day after I applied and was approved. How’s that for polar opposites.

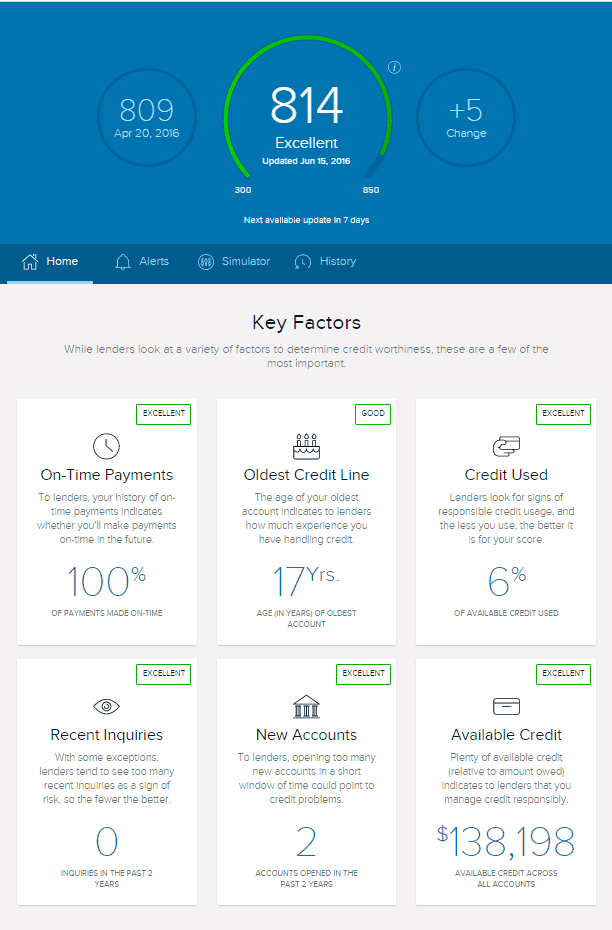

Monitor Your Credit For Free With Creditwise From Capital One

Whether youâre trying to maintain your credit or improve your credit scores, itâs important to monitor your credit regularly. Why? Because monitoring your credit can help you see exactly where you standâand how much progress youâve made.

is one way you can monitor your credit. With CreditWise, you can access your free TransUnion credit report and weekly VantageScore 3.0 credit score anytimeâwithout hurting your score. And with the CreditWise Simulator, you can explore the potential impact of your financial decisions before you even make them.

You can also get free copies of your credit reports from all three major credit bureaus. Call 877-322-8228 or visit AnnualCreditReport.com to learn more. Keep in mind that there may be a limit on how often you can get your reports. You can check the site for more details.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

You May Like: Mortgage Tri Merge Credit Report

How Many Capital One Business Credit Cards Can You Have

We contacted Capital One support directly to discuss per-person card limits, and heres what we got: You may not be approved for additional accounts if you have 5 or more open credit card accounts with Capital One. This is consistent with what appears in these cards terms.

So you can have up to five Capital One business credit cards open at the same time, as long as you dont have any other open credit card accounts with Capital One.

Recommended Reading: Carmax Credit Score Requirements

What Does Fdes Stand For In Bank Of America

FDES is an internal bank system they use to post debits/credits to accounts for a wide variety of reasons in this case yours might be related to the fraud. What sounds like may have happened is they ruled the dispute for the fake check in your favor. Either way, call them and ask to speak to a supervisor wholl be able to explain.

Don’t Miss: Does Applying For Paypal Credit Affect Score

Ways To Help Maintain And Improve Your Credit Scores

Remember: Itâs normal for your credit scores to fluctuate a little. And credit scores can change significantly over time. But you can maintain good credit scores and even improve your scores by regularly practicing responsible financial habits.

Here are some ways you can maintain and improve your credit scores:

Speaking of applying for credit: Want a better idea of whether you might be approved? Pre-approval or pre-qualification can help you find out whether you might be eligible for a credit card or a loan before you even apply.

With Capital Oneâs pre-approval tool, for example, you can find out whether youâre pre-approved for some of Capital Oneâs credit cards before you submit an application. Itâs quick and only requires some basic information. And checking to see whether youâre pre-approved wonât impact your credit scores, since it requires only a soft inquiry.

How To Check Your Credit Reports

Now that you know more about the three major credit bureaus, you might be wondering: How do I check my credit reports?

One way to monitor your credit is by using . With CreditWise, you can access your TransUnion credit report and weekly VantageScore 3.0 credit scoreâwithout hurting your score. And is free for everyone. You donât even have to be a Capital One cardholder to enroll.

You can also get a free copy of your credit report from each of the three major credit bureaus. Visit AnnualCreditReport.com to learn how. There may be a limit on how often you can get your report. You can check the site or call 877-322-8228 for more details.

Also Check: What Credit Bureau Does Usaa Use

Does Capital One Report To All 3 Bureaus Each Month

My Capital One payment history and credit limit is missing from one of the agencies. The date my account was opened shows on my report but the limit and payment history say unknown or not available. I have several years of on time payment history that I’d like credit for, as well as the utilization change. My FICO score for the omitted agency is about 50 points lower than the bureaus where Capital One does report.

Does anyone have advice or data points?

Do I simply ask Capital One to report?

Does Checking My Credit Report Hurt My Credit

No, checking your credit report does not hurt your credit. And checking your credit score doesn’t hurt your credit either. These actions are considered “soft pulls” which don’t affect your credit score. Actions, such as applying for a credit card, which require a “hard pull,” temporarily ding your credit score.

Learn more: Check your odds of getting approved for a credit card without hurting your credit score.

Also Check: Can You Get An Eviction Removed From Your Credit

Who Can Be An Authorized User

Becoming an authorized user depends on two things: the account holder and their credit card company.

First, card issuers set their own policies. So they may have rules about who can be added or how old authorized users must be. From there, a lot of it is up to the cardholder.

As long as theyâre willing, there are many reasons a cardholder might add an authorized user. One is to try to help another person build credit. Parents might do it to teach their children about credit. Or someone could add their partner to help simplify their finances as a couple.

Whatever the relationship, trust is key. Once an authorized user is given access to an account, they typically can use their cardâwith or without permissionâuntil access is revoked. So it might be a good idea to talk about budgeting and spending beforehand.

Re: When Does Capital One Report To The Credit Bureaus

wrote:They do report on statement dates but don’t be shocked if it’s not your first statement. I have a Venture1 that’s still not reporting – opened 8/9, statement cut 8/27 and still nothing. I’m hoping it gets picked up this month.

I’ve noticed that it takes two months to report. Got a card in May? It reports in July. So give it 2 months.

Don’t Miss: What Credit Score Do You Need For Home Depot Card

The Best American Express Business Credit Cards

American Express has long carved out its own special niche in the business credit card space, offering high-end rewards and perks for established businesses while also innovating its online account management tools and services to make it a natural consideration for any business credit card shopper. American Express is both the issuer of its business credit cards and the payment network on which its cards operate, and the company offers a variety of cards suited to different types of small business owners and their business card needs. Most American Express cards also offer a tremendous sign-up bonus, as well as opportunities to earn rewards points and bonus points for qualifying purchases.

A Quick Note On Credit Utilization

One way to improve your credit is to pay down revolving debt, such as credit cards, says Endicott.

You may pay down your debt and not see an improvement right away. Before applying for any new credit, you may want to make sure your lower balances are reflected on your credit. Keep in mind that many factors determine your credit scores, and paying down your revolving debt doesnt guarantee higher scores.

Recommended Reading: Serious Delinquency Credit Score

Is The Capital One Platinum Credit Card Right For You

The Capital One Platinum Credit Card could be ideal if you have average credit. The chance to earn a higher credit limit may offer the freedom to do more. The travel-friendly advantages and no foreign transaction fees can also add up to savings when you go out of town.

However, the card doesn’t earn rewards, and its high APR could make it a deal-breaker if you maintain a balance. This card is better used as a tool to improve your credit so that someday you can qualify for a card with lower interest rates. See our list of best credit cards to find the best option for you.

Increase Your Credit Limit

Raising your credit limit isn’t a particularly daunting task. Although methods vary from issuer to issuer, a few clicks within your account management portal can usually lead you to a limit raise request. You can also typically ask for an increase via phone, or with a written request.

Oftentimes, your issuer will offer a credit increase in exchange for a small piece of information or two. It’s common for issuers to bump the limit for cardholders that update their annual income figure, for instance.

It’s also worth noting that your account needs to be in good standing to get a limit bump. Issuers won’t increase their exposure to you as a lender if you haven’t demonstrated you can pay your statements on time or be disciplined about your spending.

Don’t Miss: How Can I Raise My Credit Score 50 Points Fast

Why Did My Credit Score Drop When I Paid Off Debt

The most common reasons credit scores drop after paying off debt are a decrease in the average age of your accounts, a change in the types of credit you have, or an increase in your overall utilization. It’s important to note, however, that credit score drops from paying off debt are usually temporary.

When Do Credit Card Companies Report To Credit Bureaus

One reason theres so much confusion about when report to credit bureaus is that theres no clear-cut, universally applicable answer .

The good news? There are trends to look at that can help inform us as consumers.

Your balances are normally reported to credit bureaus on your statement date, says Tina Endicott, vice president of marketing and business development at Partners Financial Federal Credit Union. However, she notes, it may take a few days or even a week for the bureau to update your information.

This may depend on the bureau. Experian, for example, claims that your credit report shows the balance on your credit card at the moment it is reported by your lender . But different bureaus may update at different speeds and frequencies.

And while you can generally expect that your credit card activity will be reported to the bureaus at the end of your billing cycle, its not a hard-and-fast rule.

How often credit card companies report to the nationwide consumer reporting agencies depends on the , explains Nancy Bistritz-Balkan, director of public relations and communications at credit bureau Equifax.

It can be anywhere from quarterly to daily for an individual consumers information, depending on the choices and practices of the lender or creditor, she says. Most lenders and creditors report information at least once a month.

You May Like: What Credit Report Does Paypal Pull

Read Also: What Credit Bureau Does Paypal Use