Do Taxes Affect My Credit Score

If you have to pay taxes this year, you may be wondering how that could impact your credit. Tax bills do not affect your credit scores directly, but if you use credit to pay your taxes or fail to pay your taxes in full, your credit score can be affected indirectly, and your eligibility to borrow money can suffer in other ways.

Read on to find how your tax payment could play a role in your credit.

What Comes After A Soft Credit Check

By utilizing soft credit checks, lenders can tell potential borrowers if theyre likely to be approved for credit before they complete a hard credit pull that could ding a credit score. Another upside is that borrowers can do soft credit checks on themselves, and regularly checking your own credit report can help you stay on top of your financial health.

There are many free services that allow you to check your credit whenever you want. Many of these services will even alert you if something suspicious happens on your credit report so that you can take action when necessary. If youre trying to improve your credit , a soft credit check could be your new best friend.

How Can I Improve My Credit Rating

You can improve your credit rating by paying your bills on time, paying your credit card off in full each month cancelling unused credit cards, limiting credit applications and payday loans.

Be wary of sharing bills with other people like flatmates as their failure to pay bills can affect your rating.

You May Like: Do Insurance Quotes Affect Your Credit Score

What To Do After Being Rejected For Credit

Getting rejected is never fun, but you can take steps to avoid denials and improve your chances next time.

First, try to find out why your application was denied. It could have been due to many factors, including your credit score, credit history, income or employment status. Or, some creditors may have unique rules that lead to the denial.

When you are denied credit, the lender is required by law to send you an adverse action letter explaining why. It must also provide instructions on how you can receive a free copy of the credit report it used to make its decision. If the lender used your Experian credit report, you can request a free report at Experian’s Report Access page.

Depending on the reason, you may want to try applying for a loan or credit card from a different issuer. Or, if you continue to hit roadblocks, you may want to take a step back and focus on improving your credit and paying off debt first. While some creditors offer loans for people with bad credit, the loans tend to have high interest rates and fees, and may be best left as an emergency option.

About Consumer Protection Bc

We are responsible for regulating specific industries and certain consumer transactions in British Columbia. If your concern is captured under the laws we enforce, we will use the tools at our disposal to assist you. If we cant help you directly, we will be happy to provide you with as much information as possible. Depending on your concern, another organization may be the ones to speak to other times, court or legal assistance may be the best option. Explore our website at www.consumerprotectionbc.ca.

Also Check: How To Put A Lock On My Credit Report

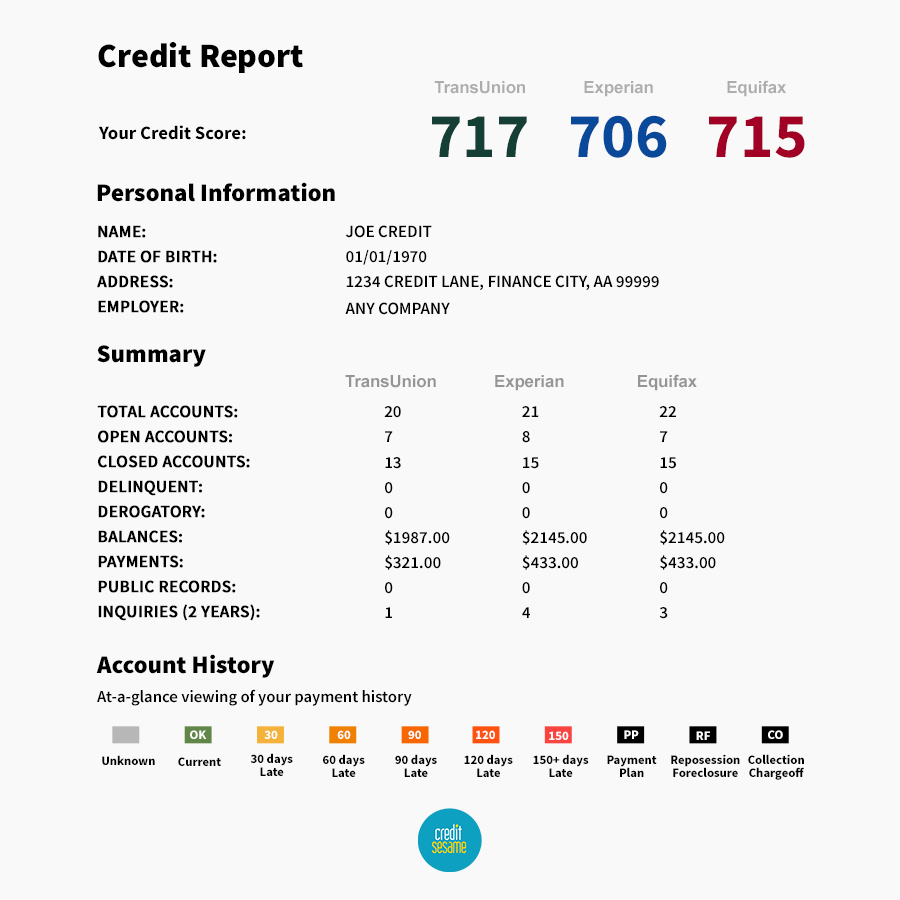

Whats In Your Credit Report

Your credit report typically holds the following information:

- A list of your credit accounts. This includes bank and credit card accounts as well as other credit arrangements such as outstanding loan agreements or utility company payment records. Theyll show whether youve made repayments on time and in full. Items such as missed or late payments or defaults will stay on your credit report for at least six years.

- Details of any people who are financially linked to you for example, because you’ve taken out a joint loan with your partner.

- Public record information such as County Court Judgments , home repossessions, bankruptcies, Debt Relief Orders and individual voluntary arrangements. These stay on your report for at least six years.

- Your current account provider, but only details of overdraft information from your current account.

- Whether youre on the electoral register.

- Your name and date of birth.

- Your current and previous addresses.

- If youve committed fraud, or if someone has stolen your identity and committed fraud, this will be held on your file under the Cifas section.

Your credit report doesnt carry other personal information such as your salary, religion or any criminal record.

Getting A Copy Of Your Credit Record

Privacy Act 2020, s 22, Principle 6, s 1

You have the right to ask for a copy of your credit report. If any of the information isnt correct, you can apply in writing to the credit reporting companies for it to be corrected.

Three credit reporting companies operate in New Zealand. To check your record, or to correct any information, youll need to contact them all .

A credit reporting company must give you a copy of your report within 20 working days after you ask for it. They cant charge you for this unless you ask for them to provide it within five working days, in which case they can charge you up to $10 .

You May Like: How Often Is My Credit Score Updated

Does Rejection Impact Your Credit Score

Surprisingly, the outcome of your application doesnât impact your credit score. It makes no difference if youâre accepted or rejected by the lender.

The actual act of applying for credit, however, does have an impact. Lenders will perform a hard search on your credit report every time you apply. . A single hard search can cause your credit score to drop temporarily, but this is to be expected.

However, making multiple applications within a short space of time can reduce your credit score further. It could give lenders the impression that you are struggling financially. As a result, they may decide itâs too risky to lend you money, from their point of view.

Can I Avoid Hard Credit Checks

To minimise the number of hard searches on your report, youâll need to make as few credit applications as possible. But you can ensure the applications you do make have a higher chance of acceptance, by only applying for credit youâre eligible for.

You can check your eligibility rating for credit cards and personal loans when you compare them with Experian. Itâs free and only a soft search will be recorded on your report, meaning your score wonât be affected unless you actually apply.

Also Check: How To Obtain Credit Score

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Does Opening A Checking Account Affect Credit Score

The answer is sometimes. Most banks have a simple application process, and some take it a step further by evaluating your creditworthiness. Depending on the bank, if your credit score isnt up to par, they may deny you for a checking account.

Also Check: What Is The Best Credit Score

Who Looks At Your Credit Report

When you apply for credit, youll usually be expected to give your permission to the credit provider to check your credit report.

The term credit provider doesnt only include banks and credit card companies. It also includes mail-order companies and, for example, providers of mobile phone services if you have a phone contract .

Employers and landlords can also check your credit report. However, theyll usually only see public record information such as:

- electoral register information

- County Court Judgements .

Check Your Credit Report For Fraud

Look for accounts that don’t belong to you on your credit report. Accounts that you don’t recognize could mean that someone has applied for a credit card, line of credit, mortgage or other loan under your name. It could also just be an administrative error. Make sure it’s not fraud or identity theft by taking the steps to have it corrected.

If you find an error on your credit report, contact lenders and any other organizations that could be affected. Tell them about the potential fraud.

If it’s fraud, you should:

- report it to the Canadian Anti-fraud Centre

The Canadian Anti-Fraud Centre is the central agency in Canada that collects information and criminal intelligence on fraud and identity theft.

You May Like: How To Get Annual Free Credit Report

What Is Credit Scoring

- Employment Status

- Missed payments

- Other applications for finance e.g. loans and

A company will gather this information they need to credit score you from the information you provide and the information provided by the Credit Reference Agencies.

To ensure the credit score you are given is the right one make sure the information you give is accurate e.g. current and previous addresses, and the information you have on the credit file held on you by the is correct and accurate. Having the wrong information may mean you either cant get the finance you wanted or you pay too much for it.

Does Running A Credit Check Hurt Your Credit Score

Credit checks can and do affect your credit score. But perhaps not in the way you might expect.

In this article, well demystify credit scores, and explain what steps you can take to protect your score when a third party checks it, for example when you apply for a personal loan.

Koyo uses Open Banking technology, not just information from a credit reference agency so that we can base our lending decisions on your real financial situation rather than what someone else says about you and an initial application doesnt hurt your credit score. Find out more at www.koyoloans.com. Representative APR 27%.

Also Check: What Is The Highest Credit Score Possible

Missed Or Late Payments

Payment history is the most important factor of your credit score, which makes it essential to pay every bill on time. Late or missed payments have a significant negative impact on your credit score and can be the reason you’re denied.

How to fix it: Set up autopay for at least the minimum payment so your account is kept current. However, aim to pay the balance in full by your due date to avoid carrying a balance and incurring late fees. You can also consider opening a , such as the Apple Card.

Can A Soft Credit Check Affect My Credit Score

A soft credit search won’t impact your credit score as it doesn’t appear on your credit report and you are not formally applying to anything.

Lenders complete credit checks like this all the time, as borrowers pre-qualify to see their chances of approval. Some people also want to see their own credit score or how their credit record may appear to potential lenders, which is why they often have soft credit checks done.

Also Check: Does Student Debt Affect Credit Score

How Do You Check Your Credit Score

Your credit score gives lenders a general picture of how trustworthy you are as a borrower. It is calculated based on information in your credit report, including how much money youve borrowed, your repayment history and the number of applications for credit or loan products youve made.

Its a good idea to check your credit score regularly. If you do have a low score, there are steps you can take to help improve it and potentially increase your chances of getting approved for credit or a loan in the future.

You can check your credit score for free

What Is A Credit Check

A credit check or a credit inquiry is essentially a search that is run to look into the information present in your credit report with the goal of better understanding your financial behaviour.

When you apply for a big financial commitment like a credit card, loan, utility service, or a lease, the lender will first check your credit report to decide whether you are the right applicant or not. This in turn allows them to pull credit reports from any of the major credit bureaus.

While these organisations or companies donât always need your consent to ask the credit bureau to see your credit report, they do need a legitimate reason to do so, always.

Organisations that can conduct credit checks on you for several reasons, include:

As part of the credit check, they can look into whether you have paid back the previous or existing line of credit issued to you, how much credit you already have with you, and how well you are managing it. They may also look into any financial associations if you have any joint accounts or loans.

You May Like: Does Tmobile Report To Credit Bureaus

Dont Apply For Multiple Credit Applications Together

Applying for multiple loans or credit cards all together can severely hurt your score, especially if you donât have a good enough score to be approved for all of them. That is why, it’s important you keep a gap of 30-90 days before applying for different credit products.

At the same time, you should do your research before applying. Go through the eligibility criteria for each credit application and estimate how likely you are to get approved. If your current credit history and score are way off and do not align with the eligibility criteria of the credit product you want to apply for, it’s best to not apply for it at all.

Checking Your Own Credit

You can check your credit report or score as many times as youd like and your credit score wont drop a single point as long as you check it through a reputable source, like AnnualCreditReport.com, the credit bureaus, FICO, or a legitimate third-party. However, having a lender check your credit score for you would appear as a hard inquiry, which would affect your credit score the same as an inquiry for a new application.

Donât Miss: Does Requesting A Credit Report Hurt Score

Recommended Reading: What Credit Report Does Capital One Use

Too Many Recent Credit Applications

It can be tempting to sign up for new credit cards that offer an attractive bonus for your business. Banks may offer tens of thousands of points or airline miles, while retailers provide in-store discounts when you apply for their credit card. A single application may have little effect, but too many in a short time period can lower your credit score. So limit your number of applications for credit, especially if you are getting ready to shop for a home, car, or student loan, where a strong credit score could be extra important.

If The Information On A Credit Reference File Is Wrong

If you think any of the information held on your credit reference file is wrong, you can write to the credit reference agencies and ask for it to be changed. But you can’t ask for something to be changed just because you don’t want lenders to see it.

You can also add extra information about your situation. For example, you can add information if you have had a past debt but have now paid it off. This is called a notice of correction. This might help you if you apply for credit in the future.

Also Check: How Do You Remove A Freeze On Your Credit Report

Not Regularly Checking Your Credit Report

To that end, its a good idea to regularly check your credit report and make sure the information is correct. You can get a copy of your credit report from a credit reporting body, such as Equifax, Experian and Illion. You can typically get a free copy once a year.

You can check your credit score as often as you like, so you might want to do this regularly as well. Canstar offers a free credit score checker, through which you can check your score each month.

If you are finding it difficult to manage your bills or loan repayments, you can ask your lender or service provider for financial hardship assistance. You might also want to contact a financial counsellor for help. You can speak to a financial counsellor for free by calling the National Debt Helpline on 1800 007 007.

This article was reviewed by our Sub Editor Tom Letts and Finance Editor Sean Callery before it was updated, as part of our fact-checking process.

Main image source: Kite_rin .

Follow Canstar on and for regular financial updates.

Thanks for visiting Canstar, Australias biggest financial comparison site*

Looking to find a better deal? Compare car insurance, car loans, health insurance, , life insurance and home loans with Canstar. You can also check your for free.

This content was reviewed by Sub EditorTom Letts and Deputy Editor Sean Callery as part of our fact-checking process.