How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

What Is A Tax Lien And How Does It Affect My Credit

Tax liens can vary depending on your individual situation. A tax lien can be one of the worst items to appear on your credit report, and can cause your credit score to drop significantly. Essentially, when you fail to pay your tax debt on time, the government can claim all or some of your assets. It can occur at the local, state or federal level.

Its important to remember that any tax penalty against you becomes a matter of public record, and will negatively affect your credit score. Worse still, under federal law, unpaid tax liens can remain on credit reports indefinitely, though more often, credit bureaus tend to remove them after a decade or so. Once youve paid off the debt and the lien is released, it will be removed from your score seven years from the date it was filed.

Because no two credit histories are alike, there is no way to state equivocally how much change removing the tax lien will have or even what an average change might be for any given scoring system. Further complicating the issue is that there are many different credit scoring systems. So, the impact on one system could be very different from another because the numeric scales are different.

How To Get Proof That Tax Liens Have Been Paid

If you fail to submit payment for an outstanding tax debt within the time frame the Internal Revenue Service gives you, it reserves the right to file a tax lien against you. Tax liens give the IRS a security interest in all personal property and assets you own. After you pay off your tax lien, the IRS will send you a Certificate of Lien Release as proof that you satisfied your tax obligations. If you do not receive the certificate within 30 days after paying off your liens, you can request a new Certificate of Lien Release from the IRS.

Read Also: Does Paypal Credit Report To Credit Bureaus

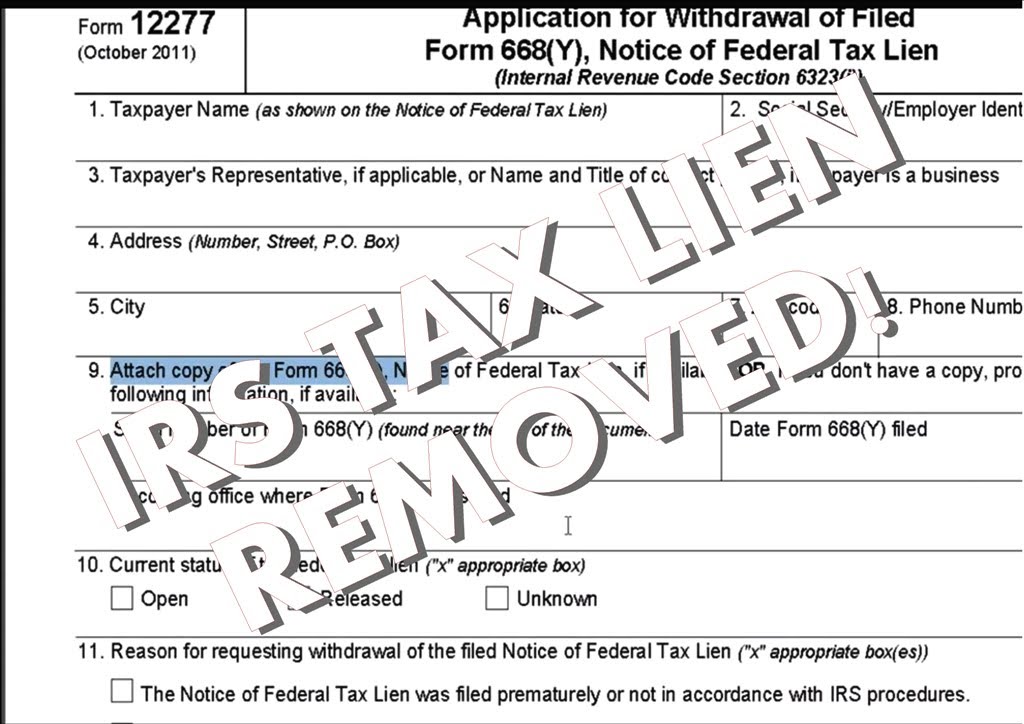

Apply For Withdrawal Of Lien

Under the Commissioners 2011 Fresh Start initiative, which aims to help struggling taxpayers, you may be eligible for a tax lien withdrawal. It means that the government will remove the public notice of your tax lien and it will no longer compete with other creditors claims to your property. However, you still owe and must pay the tax debt.

General qualifications include the following:

- Youve filed diligently all your tax returns over the past three years

- Your tax payments and federal tax deposits are updated and current

How To Dispute Tax Liens Yourself

To pay the lien, contact the appropriate state or federal tax office to confirm your outstanding debt. The IRS will sometimes let you set up a payment plan or installment agreement. Once you agree to a payment plan, stick with it until the lien has been paid in full.

If a tax lien is still listed on your credit report, or other unfair negative credit items are hurting your credit score, Lexington Law is here to help. Our credit repair specialists do the hard work and organization required to remove unfair entries from your credit report.

Learn more about our or contact us today so we can discuss your credit score goals and how we can help.

Read Also: Bp Visa Syncb

Do Irs Payment Plans Affect Your Credit

One way to avoid a tax lien or other collection action is to establish a payment plan with the IRS when you receive a tax bill. Taking the step of setting up a payment arrangement with the IRS does not trigger any reports to the credit bureaus.

As mentioned above, the IRS is restricted from sharing your personally identifiable information. While a Notice of Federal Tax Lien could be discoverable by lenders, the payment plan itself would not. Learn about all the IRS payment options you may have if you owe taxes and cant pay.

Tax Liens Removed From Credit Reports

Tax liens used to appear on your credit reports maintained by the three national credit bureaus . Even if you paid the lien, it stayed on your reports for up to seven years, while unpaid liens remained on your reports for up to 10 years.

In 2017, however, all three credit bureaus implemented changes to eliminate civil judgment records and half of all tax lien data. By April 2018, all tax liens were removed from credit reports by the bureaus.

The updated rules are the result of a Consumer Financial Protection Bureau study that found issues with reporting such information correctly.

“A lot of judgments and liens were linked to the wrong people, so someone may share your first and last name, maybe live in a different part of the country, and they might have a lien or judgment that might get linked to your file,” said Ankush Tewari, senior director of credit risk assessment at data firm LexisNexis Risk Solutions, in American Banker.

Don’t Miss: Syncb/ppc Closed Account

How To Remove A Tax Lien From Your Credit Report

Tax liens are subject to the same Fair Credit Reporting Act laws that govern all debts. You can dispute them, and if the government cannot prove that you owe the debt, the credit bureaus will remove the tax lien from your credit report.

The government is less likely to ignore a dispute based on erroneous information, especially when the debt is substantial. What most often happens is that the IRS will confirm or update the information, and youll still be stuck with the tax lien on your credit history.

If you pay the tax debt in full, the IRS will release the tax lien, but the released lien still gets reported for seven years after you make payment in full.

Fortunately, it is possible to dispute and remove a tax lien even when it hasnt been paid in full. Heres an example of tax liens that were disputed and deleted from a TransUnion report:

To do this, you have to request a specific remedy known as a withdrawal. This is different from having a tax lien released after payment has been completed. You can even request a withdrawal while you are still making payments on the lien.

The only catch is that you have to pay the amount in full. The IRS wont withdraw a federal tax lien for settlement offers, and you must keep up with the payment plan or installment agreement.

Despite having to pay the total amount over time, this can be an attractive option when you need to qualify for new credit or sell your home and must have all tax liens cleared.

Liens Are Public Records

Tax liens are public record because they’re on file with your local government. They’ll appear in the public records section of your credit report. They’re considered to be one of the most negative credit report entries and they can damage your credit score as much as a bankruptcy or foreclosure.

A tax lien entry on your credit report can keep you from being approved for future loans, credit cards, apartment rentals, or even a job.

The normal doesn’t apply for unpaid tax liens. They can remain on your credit report indefinitely, but a credit bureau might remove it within 10 to 15 years, depending on their policies. Unfortunately, this is discretionary, not mandatory.

Paid tax liens can remain for seven years unless they’re withdrawn by the IRS, which should happen when the tax debt is paid. It’s almost like the lien was never filed in the first place when it’s withdrawn. No hint should appear on your credit report, but mistakes can happen. You might have to send the credit bureaus proof of the tax lien withdrawal in order to have it removed from your credit report.

Also Check: Credit Score Of 672

Tax Liens Can Be Filed Against You If You Fail To Pay Your Taxes On Time However As Of April 2018 Tax Liens Should No Longer Be Showing Up On Credit Reports

All tax liens were removed from credit reports as of April 2018, due to the frequency of incorrectly reported judgments and liens. However, although tax liens are no longer reported on credit reports, its possible that the bureaus could roll back this policy at a future date.

In this guide, well help you understand what a tax lien is and how it could potentially affect you financially. In the case that tax liens are added to credit reports once again, or if you discover a tax lien currently on your credit report, this guide will help you work to remove it.

Removal Of Liens On Credit Reports

Can you get this tax lien removed from my credit report? For many years, this has been one of the more common questions we hear from clients and potential clients at Haynes Tax Law. Some are people that have already resolved their tax problems and had the Notice of Federal Tax Lien released, but the credit reporting agencies have, for many years, continued to report the past existence of a federal tax lien on a consumers credit report. But this may be about to change.

In recent years, consumer advocates have begun to fight back against the non-governmental credit-reporting agencies, most notably for the frequency of inaccurate information on many reports, and the difficulty of getting such inaccuracies fixed. It appears that such efforts have born some fruit. As recently reported, the three credit-reporting agencies will be more strict when selecting information for inclusion on a consumers credit report. Starting July 1, 2017, they will no longer include any records that do not include the consumers name, address, and either Social Security Number or date of birth. Neither the complete Social Security number or taxpayers date of birth appear on a Notice of Federal Tax Lien. Such information is also often missing from civil judgments in most jurisdictions in the United States. Some analysts believe that these new standards will result in past federal tax liens and civil judgments being eliminated from consumer credit reports .

Read Also: Does Affirm Report To Credit Agencies

What Is A Tax Levy

The next step after a lien is often a federal tax levy.

Once the governments interest in your property is secured, Raanan says, the government can levy or seize your property as a means of collection. The IRS is notorious for issuing levies on bank accounts and wages if they dont hear back from a taxpayer in time, or if requested documents are not received.

Its important to understand that a tax lien is different from a tax levy. A lien gives the IRS the authority to make a claim against your assets. For instance, if you owe back taxes and put your home up for sale, a lien establishes that the IRS has first claim on any proceeds from the sale of your house.

A levy is a separate action by which the government actually seizes your property or assets to satisfy a tax debt youve failed to pay. For instance, the IRS may levy your bank account, withdrawing the amount needed to satisfy your tax debt. It doesnt matter if you planned to use the money in your account to pay your mortgage or make a car payment. By way of a federal tax levy, the IRS has the right to seize the funds as payment for what you owe prior to anyone elses claim.

How To Get A Tax Lien Removed From Your Credit Report

To get a tax lien removed, you may have to pay your taxes in full or have an agreement in place. Talk to the government agency about payment and work with them to create a payment plan you can afford before you attempt to have the lien deleted.

The next step is to request a credit report to find out if the lien has been reported. This also tells you the amount you owe to ensure you pay it in full. You can request a free credit report from each of the credit reporting agencies or from AnnualCreditReport.com.

Once you enter into an agreement to pay your tax bill, get the details in writing. This helps to protect you from further action as long as you meet the obligations outlined in the agreement.

For federal taxes, contact your local IRS office. Contact the state, county, or city website for other tax bills owed. Once you have paid off the tax debt, request a letter that states your taxes have been paid in full. This information will be important when you attempt to get the lien deleted from your credit reports.

Also Check: Does Paypal Credit Report To Bureaus

Getting Out Of A Tax Lien

The simplest way to get out of a federal tax lien is to pay the taxes owed. However, if this is not possible, there are other ways to deal with a lien with the cooperation of the IRS.

- The IRS will consider releasing a tax lien if the taxpayer agrees to a payment plan with an automatic withdrawal monthly until the debt is satisfied.

- The taxpayer may be able to discharge a specific property, effectively removing it from the lien. Not all taxpayers or properties are eligible for discharge. IRS Publication 783 details regulations about discharging property.

- Subordination does not actually remove the lien from any property but it sometimes makes it easier for the taxpayer to obtain another mortgage or loan. IRS Form 14134 is used to apply for such action.

- Yet another process, withdrawal of notice, removes the public notice of a federal tax lien. The taxpayer is still liable for the debt, but under withdrawal, the IRS does not compete with any other creditors for the debtors property. Form 12277 is the application.

If repaying the taxes is simply impossible, the taxpayer must pay as much of the debt as possible and seek dismissal of the balance in bankruptcy court.

Pay Off Your Tax Debt In One Lump Sum Or In Smaller Installments

This is the most direct way to get rid of a federal tax lien. Even if the Notice of Federal Tax Lien is not impacting your credit, it will impact your ability to sell or obtain property. Any time a debt exists to the IRS, there is a statutory lien in place making the IRS a priority creditor. There are a ton of options to get into an IRS program that will resolve the tax lien.

Read Also: How To Get Credit Report With Itin Number

S To Remove A Lien From Your Credit Reports

You should know that Experian in particular will send information regarding exactly what documents you should send to verify that the lien has been released. By doing this, they should be able to update the lien status.

Why Is My Fico Score Lower Than My Credit Score

Category: Credit 1. How are FICO Scores Different than Credit Scores? | myFICO Remember, non-FICO credit scores can differ by as much as 100 points. Other credit scores may vary from your FICO Score by several points. This variance could When the scores are significantly different across bureaus, it

Read Also: Remove Repo From Credit

What Can Negatively Impact Your Credit

Though liens themselves are not included in your reports, if the lien was involuntarily, it’s likely due to nonpayment. In that case, if the creditor that filed the lien reports payment information to the credit bureaus, a record of nonpayment could be listed in your reports and negatively impact your scores.

Here are some of the main score factors that you should monitor when working to maintain a good score:

- Maintain a good payment history. Making on-time payments is the most important thing you can do to maintain or improve your credit score. Even one late or missed payment can cause your score to drop, so make sure to pay all your bills on time to avoid any negative impact.

- Keep your credit card balances low. is another important aspect of your credit. Credit scores can suffer when your credit balance approaches or exceeds 30% of your credit limit maxing out your credit cards could put a big dent in your scores. Those with the best credit scores tend to keep their credit utilization in the low single digits.

- Keep a good credit mix. Lenders might want to know how you’ve handled various types of debt . Which means a diversified credit report that includes different types of credit can help your scores.

If you haven’t checked your credit recently, get a free copy of your reports and scores from Experian to see what’s in your credit file and how it’s impacting your scores.