How To Check Your Credit Scores

There are a few ways to check your credit scores:

Dual Bureau Credit Alerts

Two bureaus are better than one when it comes to spotting potential fraud.

Lenders are not required to report applications for credit to every bureau. Meaning, applications for credit may go unnoticed if you’re only keeping up with one bureau. When something meaningful changes on either your Experian or TransUnion® credit report, CreditWise will send you a credit alert.

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

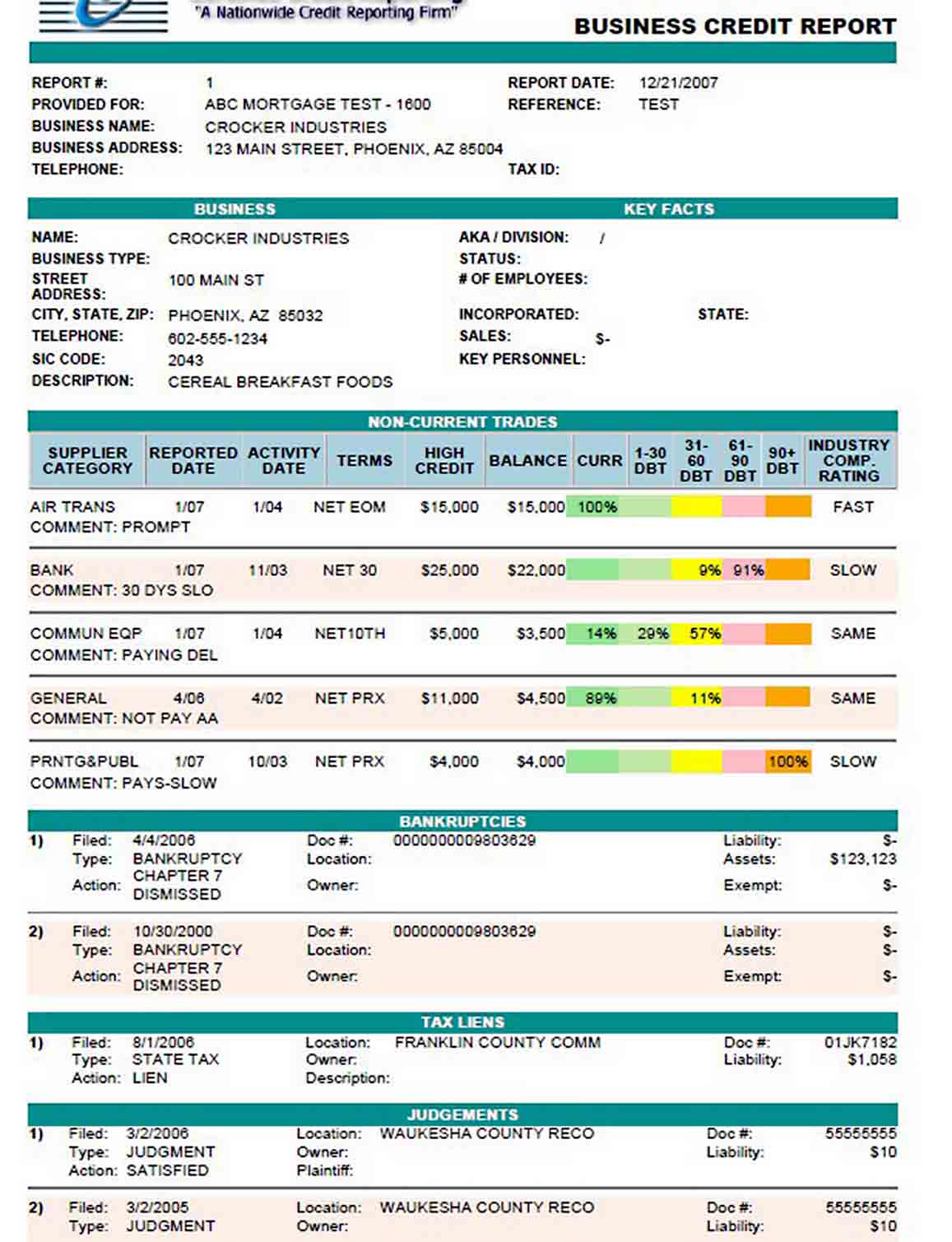

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Recommended Reading: When Does Debt Fall Off Credit Report

Why Should I Check My Credit Report

Your credit report has information that can affect whether you’re approved for a loan or credit card and the amount you’ll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

How To Get Your Free Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Steps

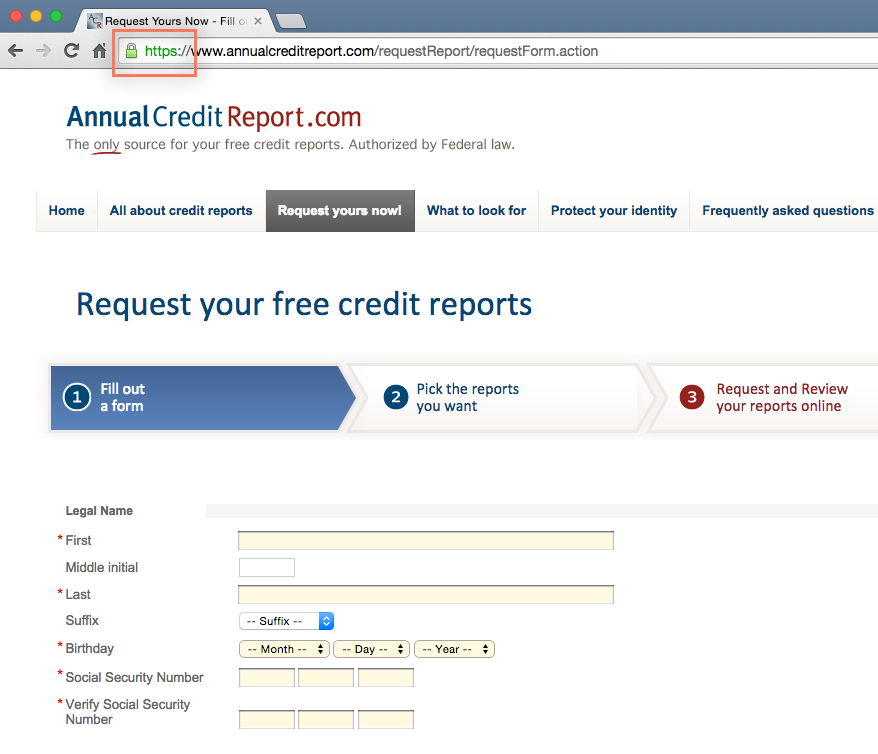

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until the end of the year, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

You May Like: What Is A Good Fico Credit Score

Answer Security Questions To Verify Your Identity

On the final page, youll need to answer a few security questions about your finances, such as what your monthly mortgage payments are . You may need to repeat this step for each report you request.

AnnualCreditReport warns that you may need to check your records to answer these questions because theyre deliberately designed to be difficult to answer so that no one except you can access your credit reports.

Safely Request Your Credit History

The most common website from which consumers can receive free credit reports is AnnualCreditReport.com. In 2003, the Fair and Accurate Credit Transactions Act was passed, allowing every consumer access to an annual free credit report. The three major credit bureaus worked together to create AnnualCreditReport.com for this purpose.

The website has SSL encryption and is considered a secure site. You may request your credit report from each agency yearly, and some consumers request one from each one every four months to receive free reports on a quarterly rotation.

Experian is the only credit agency that also provides your FICO score for free. If you want a credit score from either Equifax or TransUnion, you will have to pay a fee to the agencies.

Many major credit card issuers, like Bank of America and Wells Fargo, offer cardmembers free credit scores. Interestingly, a growing number of credit card issuers are now offering free credit scores to anyonenot just cardmembers. For example, you don’t have to have a credit card or an account with Chase or Discover to check your credit score for free.

Your credit history is different from your credit score.

Recommended Reading: Which Credit Score Do Apartments Use

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

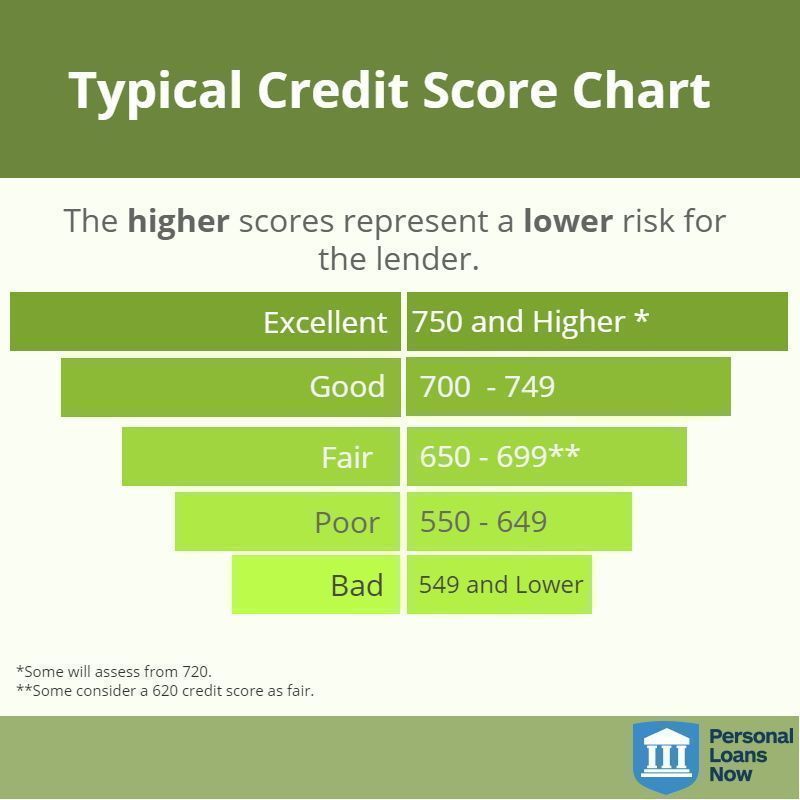

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

What’s The Difference Between A Credit Score And A Credit Report

Your credit score is different from your . A credit report is a more holistic view of your credit that shows detailed information about your credit activity and current credit situation. Credit reports detail personal information , credit accounts , public records and inquiries into your credit. The three main credit bureaus who issue reports are Experian, Equifax and TransUnion.

“Your credit scores are a proxy for the health of your credit reports,” says Ulzheimer. “So if you’re not going to take the time to pull and review all three of your credit reports, then at the very least you should check your credit scores.”

Update April 20, 2020: You can now receive 3 free credit reports each week for the next year

You May Like: What Is Credco On My Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Close A Credit Card Safely

If you’ve decided that it makes sense for you to cancel your credit card account, here are the steps to take so you have no issues:

Don’t Miss: How To Contact Free Credit Report Com

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Understanding Your Credit Score

When you receive your credit score, keep in mind that there are numerous credit scoring models, and you likely have multiple credit scores. Your credit score may vary depending on the site or bureau.

FICO and VantageScore are two widely used scoring models, but these scores break down even further. According to Debt.com, there are at least 16 different FICO credit scores and many of them are industry-specific.

Try not to pay too much attention to the exact credit score number. Instead, focus on the credit range your score falls in, as that lets you know where your credit stands and if it is poor, fair, good, very good or exceptional.

A good FICO score is between 670 and 739, while a good VantageScore falls between 720 to 780. Conversely, a FICO credit score is considered fair or bad if it falls below 670. Along these lines, a VantageScore between 658 and 719 is fair, and scores of 600 or lower are considered either poor or very poor. Here’s a breakdown to better compare the two:

Don’t Miss: How To Report Bad Credit Tenant To Credit Bureau

Whats The Best Site To Get A Free Credit Report

The best site for free credit reports depends on what you need.

If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma.

The Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer credit bureaus every 12 months. You can order them online at annualcreditreport.com.

Summary Of Moneys Guide On How To Get Your Credit Report

- AnnualCreditReport.com is the best place to start to get your free credit reports from Equifax, Experian and TransUnion all in one spot.

- Because of the pandemic, Equifax, Experian and TransUnion are all offering free weekly credit reports also available through AnnualCreditReport.com until April 20, 2022.

- If you have exhausted all of your free credit reports from the major bureaus, you may contact them directly to purchase additional reports. They legally cant charge you more than $13 per report.

- While Equifax, Experian and TransUnion are the most popular credit bureaus, theyre not the only places to provide credit reports. According to the CFPB, you are also eligible for free annual credit reports from dozens of other credit-reporting agencies, most of which specialize in a niche credit topic.

Chris Huntley contributed to this article.

Don’t Miss: How To Increase Credit Score With Credit Card Payments

Free Credit Scoring Website

One of the best ways to check your credit score for free is by visiting a free credit scoring website. These websites typically offer access to your credit report, score and/or credit monitoring and are updated anywhere from weekly to monthly. Theres no fee to sign up for basic credit score updates. However, some websites offer more advanced services for a monthly fee.

How To Order Your Free Annual Credit Reports

The three major credit reporting companies have set up a toll-free telephone number, a mailing address, and a central website to fill orders for the free annual credit report you are entitled to under law. These are the only ways to get free credit reports without any strings attached. If you order your report by phone or mail, it will be mailed to you within 15 days if you order it online, you should be able to access it immediately. It may take longer to receive your report if the credit reporting company needs more information to verify your identity.

Do not attempt to order free credit reports directly from the credit reporting agencies. Free credit reports advertised by other sources are not really free!

To order:

- – Call 877-322-8228 .

- – Complete the Annual Credit Report Request Form available online, the only truly free credit report website, and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

Also Check: Does Checking Your Credit Score On Credit Karma Lower It

Where Can You Get A Free Credit Check Online

There are several websites and financial institutions that offer free credit score information. However, its important to note that many give you a VantageScore, which provides a good idea of how healthy your credit history is. Still, its generally not used in lending decisions like the FICO score.

Here are some popular sources for a free credit check online:

- Experian: Offers free access to your FICO score based on your Experian credit report, plus free access to your Experian credit report. You can also get real-time updates when changes to your credit report occur.

- Discover Credit Scorecard: Youll get a free FICO score based on your Experian credit report you do not have to be a Discover customer to register. It also shares some basic information from your credit report, but its not in-depth.

- Your bank or credit card company: Many banks, credit unions, and credit card issuers offer a free credit score to their customers. This score can be a FICO score, VantageScore, or some other scoring model.

- NerdWallet: Provides a free VantageScore credit score based on your TransUnion credit report. You can also get free credit monitoring alerts and personalized insights.

What Are The Different Credit Scores

There are many different credit scores out there. In addition to the most popular ones, the FICO score and the VantageScore credit score, some lenders use their own custom scoring model to help underwrite loan applications.

Even with FICO and VantageScore, there are several different scoring models. VantageScore has four versions of its scoring model, and FICO has dozens, including iterations specifically for credit cards, auto loans, mortgage loans, and more.

However, when you run a free credit check online, youll typically see a FICO 8 score or a VantageScore 3.0. These are both versions of the standard scoring model from their respective companies, but theyre not the most recent versions.

This is primarily because, with each new version, credit scoring companies make changes about what they include in their calculation. If a lender is happy with the credit assessment via an older model, it has no reason to switch. In fact, mortgage lenders typically use very old versions of the FICO score because of the guidelines set by government-backed companies Fannie Mae and Freddie Mac.

Read Also: What Is An Inquiry On A Credit Report

Can I Check My Past Credit Reports On Annualcreditreportcom

No, you wont be able to access your old credit reports on AnnualCreditReport.com or on any other free credit reporting site. However, all of your historical credit information is included in your latest credit reports, so theres no need to get past reports to compare with new ones.

AnnualCreditReport.com wont give you your credit score

If you want to check your credit score, take a look at your credit card or loan billing statementsmany creditors provide free credit scores to customers. Alternatively, you can pay for a credit-monitoring service, access your FICO score for free on the credit bureaus websites, or consult a non-profit . 7

How To Review Your Credit Reports

To check your reports for errors or possible signs of identity theft, look especially at three areas.

You can view sample credit reports, with the different sections explained, on the Web sites of the three credit bureaus: experian.com, transunion.com, equifax.com/home/en_us.

Recommended Reading: How Long Public Records Stay On Credit Report

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.