What Is A Good Credit Score For My Age

Depending on your age group, you should have the following average credit score:

- Millennials : 680

- Baby Boomers : 736

- Silent Generation : 758

In addition, there are other factors that can influence your credit score, such as the state and the city you live in. For example, the Southeast region has the lowest average credit scores, whereas the Midwest and Northeast have the highest credit scores on average.

Is 840 A Good Credit Score

A FICO® Score of 840 is well above the average credit score of 711. An 840 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

There Is No Incremental Value To Being Higher Than 780

Other than bragging rights, theres really no reason to stress out about your scores if theyre already over 780. Even in todays credit environment a 780 puts you about 20 points to good and youve now found yourself squarely among the credit elite. You will likely get whatever youre applying for at the best rates and terms the lender or insurance company has to offer.

As of September 2010, a 780 FICO score gets you a credit card at 7.9% . It also gets you auto financing from a captive lender for as low as 0% on selected models. And even if captive financing isnt an option for you, a 780 gets you rates as low as 5.2% for a new car. And if youre trying to buy a home, a 780 gets you a rate around 4%, which is crazy low.

The point is, your rates, premiums and terms will be no better at FICO 810, 830 or 850 than they are at 780.

You May Like: Does Medical Debt Affect Credit Score

What Fico Says About Having The Perfect Credit Score

Even a representative at FICO the scoring model most lenders use to check applicants’ creditworthiness says that having a credit score in the top 2% of the U.S. population won’t further benefit you, so there’s no need to stress. It’s also important to remember that it’s impossible to earn a credit score above 850.

“The reality is that, from the standpoint of qualifying for credit, it doesn’t matter whether you have a perfect 850 or a score just below that,” Ethan Dornhelm, VP of FICO® scores and predictive analytics, tells Select. “To lenders, a consumer with a score in the 800s is a sparkling applicant.”

What Is The Average Credit Score By Generation

|

Silent Generation |

|---|

|

Wyoming |

Throughout the United States theres really no noticeable trend to the average FICO score. The states where cost of living is higher and creditworthiness might be expected to be lower, like New York and California, actually have good credit scores and are about middle of the pack compared to the rest of the states. Some lower populous states, like South Dakota, Vermont and New Hampshire, have great credit scores which might be attributed to the smaller population, but that might be the only trend that sticks out at all.

Recommended Reading: How Accurate Is Creditwise Credit Score

What Are The Benefits Of The 850 Credit Score

Maintaining an 850 FICO score is one of the good financial habits. Here are the benefits of an 850 credit score. People with poor credit scores often cant get a mortgage for a long enough term for it to make financial sense. An excellent credit score can get you a higher credit limit than someone of a similar income with a lower credit score. This can help you survive more difficult financial times by giving you access to credit when you need it.

Startling Credit Score Statistics And Facts

The average FICO score is 699. Is it possible to have a perfect score? And how many Americans have no credit at all? See how you stack up with this list of remarkable credit facts.

Like your Social Security number, your credit score is one of those numbers you need to know. Those three little digits determine if you’ll qualify loans and affect the interest rates you’ll pay.

Find out how much you truly know about credit scores with these surprising statistics.

You May Like: Is American Express Good For Your Credit Score

What Is The Highest Credit Score Can You Get A Perfect Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The highest credit score you can have on the most widely used scales is an 850. For common versions of FICO and VantageScore, the scale ranges from 300 to 850 and lenders typically consider anything above 720 excellent credit.

Even if you succeed in getting the highest credit score possible, you’re unlikely to keep it month after month. Scores fluctuate because they are a snapshot of your credit profile, which changes over time.

The widely-used FICO 8 scoring model and the VantageScore 3.0 are both on a 300-850 scale. Credit scoring company FICO says about 1% of its scores reach 850. VantageScore spokesman Jeff Richardson says fewer than 1% of its credit scores are perfect.

The way people get perfect scores is by practicing good credit habits consistently and for a long time. As you might expect, older consumers are more likely to have high scores than younger ones.

But scores fluctuate because they are a snapshot of your credit profile. Even if you succeed in getting the highest credit score, youre unlikely to keep it month after month.

The Likelihood Of Achieving An 850 Credit Score

Of those people with credit scores, the number with a perfect score is pretty slim. Though it varies from year to year, it is approximately 1.5%. For instance, in 2019, 1.2% of all FICO Scores were perfect. That number increased to 1.6% in 2021.

So, while it is possible to achieve a perfect credit score, it takes a lot of work to move from a good credit score to a perfect credit score.

Also Check: How Good Is A 700 Credit Score

How To Get An 850 Credit Score

If youre not yet a member of the 800+ credit score club, you can learn how to join by checking your free personalized credit analysis on WalletHub. Well tell you exactly what you need to change and exactly how to do it. Paying your bills on time every month and keeping your below 15% are the keys to success in most cases. But you cant beat a customized credit improvement plan.

But good advice can be priceless when it comes to your credit, so we asked a selection of WalletHub users with 800+ credit scores to share the secrets of their success. You can check out their tips below.

Build A Good Credit Mix Over Time

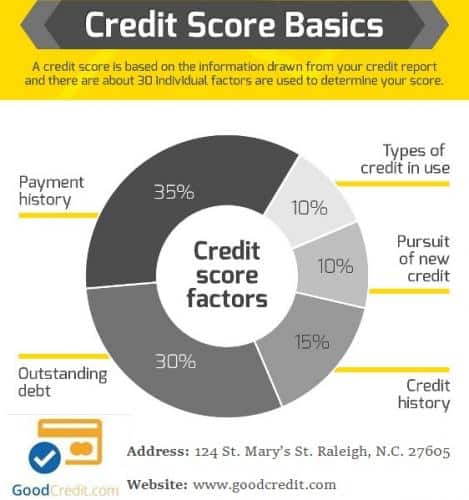

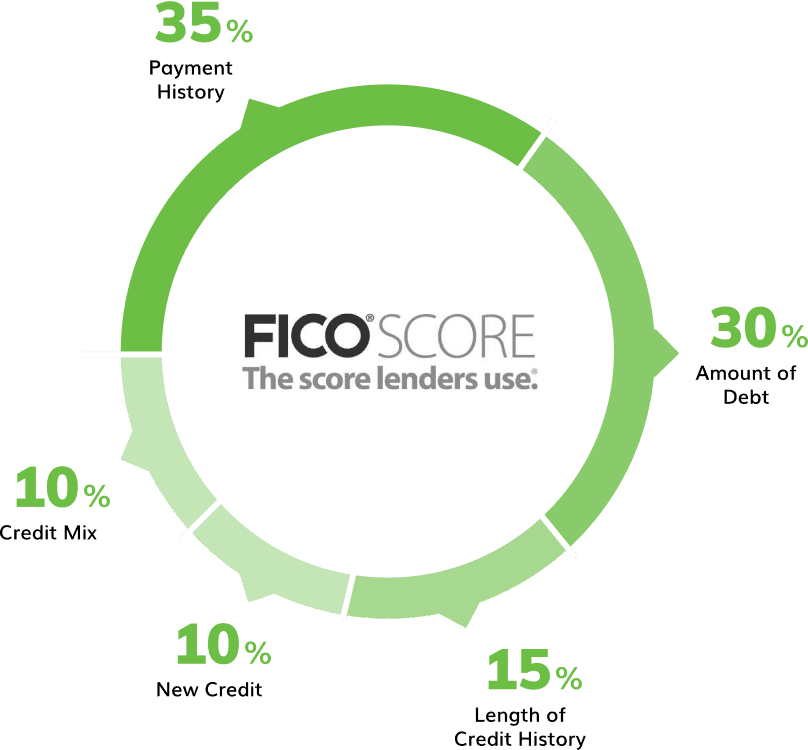

The different types of credit accounts under your name for your credit score. If you have both revolving credit and installment credit, your credit score will increase by a few points.

You can build and maintain a good credit score even if you only have credit cards, so if you dont have much of a credit mix you dont need to worry about it.

This doesnt mean going out and getting a student loan, car loan, and a mortgage all at the same time Instead, youll want to take on different types of debt one at a time, while having various types of debt within 7 years.

You May Like: What Is The Minimum Credit Score To Buy A Car

What Are The Benefits Of 850 Credit Score

Everyone dreams of having an 850 credit score. Its the highest score possible under most FICO scoring formulas. Its been listed as one of the most common wishes that American adults would make. Get to know the benefits of 850 credit score?

Very few people in the United States actually have a credit score of 850, though. So we set out to answer the question: what does an 850 credit score actually get you? But first, lets break down some information about credit scores and why an 850 is so good.

Also Check: Paypal Credit Score Requirement

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Recommended Reading: Does Affirm Affect Your Credit Score

Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

My Credit Score Is 850 What Do I Do

Following the tips above will improve your credit over time. Your credit will improve as you get more financially responsible. Paying down debt will help, too. Remember, your payment history matters the most, so make sure to make your payments on time.

If your credit has been marred by years of financial mistakes, errors on your credit report, and bad luck, there could be helpful for you. You may benefit from credit repair.

Credit repair services like The Credit Pros help people dispute errors on their credit report, help them get bad marks on their credit removed, and give financial services to help them build their credit score.

The Credit Pros has years of experience dealing with credit bureaus and lenders and helping people repair their credit. Our credit experts will help you through any situation, and were only a phone call away. They also offer credit monitoring using their AI-powered credit management tool that you can check on your phone.

Give a call toThe Credit Pros to see how they can help repair your credit: no matter what your situation is!

Recommended Reading: Which Of These Is Not A Valid Fico Credit Score

Use Your Credit Cards Responsibly

Dont carry large balances month over month. If you can afford to, pay off your credit cards in full every month. Contrary to popular belief, you dont need to carry a balance over to maximize your benefit: you just need to use it and pay the payment when its due.

Your credit utilization ratio is what truly matters, which is equal to your balance divided by your available credit limit. Keep your credit utilization ratio below 30% if you can help it!

Read More:

Do You Need A Perfect Fico Score

While a perfect FICO® Score may get you bragging rights, you don’t really need one to qualify for the best rates, access to the best rewards credit cards, or maximize your loan approval chances. A score of 800 or higher is considered to be exceptional, while a score of 740 to 799 is classified as very good.

In 2019, 45% of all American consumers had scores that were classified as either very good or exceptional, while an additional 21% of consumers had scores considered to be good. This means that a majority of Americans shouldn’t have a difficult time borrowing at good rates, even if they aren’t one of the elite few with an 850 score.

Don’t Miss: How To Get Official Credit Report

What Can I Do About My Bad Credit

If you have bad credit in the form of negative credit reports and poor credit scores, then your path to good or better credit is actually very clear. Youll need to improve your credit reports, which means making all of your payments on time, every time. This will lead to better credit scores and more access to competitively priced credit.

Most negative credit report entries can remain on your credit reports for no longer than seven years. The credit bureaus must eventually delete them. And you wont have to wait a full seven years for your credit scores to begin improving.

Your credit scores will begin to improve organically as your negative entries age. Just be sure you dont keep missing payments because new negative entries will begin to tarnish your credit reports and start the process over again.

Keep Watch Over Your Hard

A FICO® Score of 850 is an accomplishment built up over time. It takes discipline and consistency to build up an Exceptional credit score. Additional care and attention can help you keep hang on to it.

Whether instinctively or on purpose, you’re doing a remarkable job navigating the factors that determine credit scores:

Utilization rate on revolving credit. Utilization, or usage rate, is a measure of how close you are to maxing out credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

If you keep your utilization rates at or below 30% on all accounts in total and on each individual accountmost experts agree you’ll avoid lowering your credit scores. Letting utilization creep higher will depress your score, and approaching 100% can seriously drive down your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Time is on your side. Length of credit history is responsible for as much as 15% of your credit score.If all other score influences hold constant, a longer credit history will yield a higher credit score than a shorter one.

Read Also: Which Credit Report Is Used Most Often

Raising Your Credit Score Improves Your Financial Outlook

With both FICO Score and VantageScore, the highest possible credit score that you can obtain is 850. However, only about 1.6% of Americans have a perfect credit score. Achieving a perfect credit score takes time and patience. And while it is something to work toward, it is not of utmost importance.

If you can achieve an excellent credit score, you’ll find that youre putting yourself in a great position for success. Doing so allows lenders to extend you the best offers on credit cards and loans, which can save you money on interest.

Looking for more personal finance advice? Be sure to . The newsletter is full of financial news, tips and tricks that can potentially help you improve your financial outlook and put you in a better position for success.

To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. The APR will be between 7.90% and 29.99% per year and will be based on your credit history. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 – $300.

Tally Technologies, Inc. . Lines of credit issued by Cross River Bank, Member FDIC, or Tally Technologies, Inc. , as noted in your line of credit agreement. Lines of credit not available in all states.

Loans made by Tally pursuant to California FLL license or other state laws.

Privacy Policy Terms & Conditions Accessibility

6The portion of your credit line that can be paid to your cards will be reduced by the amount of the annual fee.

Why Do I Need A High Credit Score

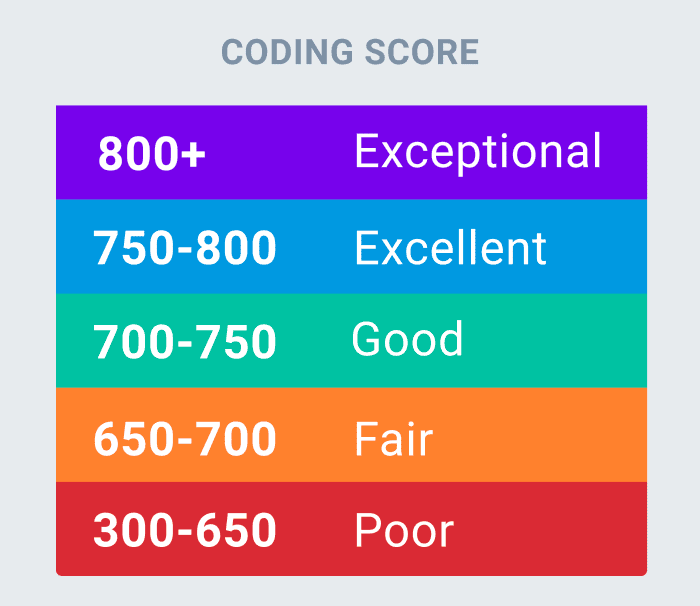

Each credit bureau has its own scoring range from low to high. The higher your score, the better your credit. The better the credit, the lower the financial risk.

If you ever plan on borrowing money to buy a house, a new car, go on vacation, consolidate debt, open a credit card, or whatever the case may be, youre credit will be pulled to determine the financial risk of lending to you.

Credit scores arent just for loans. Credit is also used to determine the risk of renting a home or apartment. Potential employers may even pull your credit information. Although they dont see your score, they can see some of the factors that contribute to it, so if you have a high score, its likely that the information that is pulled from potential employers will be positive .

Don’t Miss: What Does A Good Credit Score Mean

Why You Should Be Pleased With An Exceptional Fico Score

Your 850 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates. Credit card issuers are also likely to offer you their most deluxe rewards cards and loyalty programs.

Late payments 30 days past due are rare among individuals with Exceptional credit scores. They appear on just 0% of the credit reports of people with FICO® Scores of 850.

An Exceptional credit score can mean opportunities to refinance older loans at more attractive interest, and excellent odds of approval for premium credit cards, auto loans and mortgages.

Dont Miss: How Long Does Repo Stay On Credit Report