How To Get A Judgment Removed From Your Credit Report

Created by FindLaw’s team of legal writers and editors| Last updated June 20, 2016

Your consumer credit score, as noted in a credit report, can have serious negative effects on your ability to secure a loan, obtain housing, or even get a job. Judgments recorded on your credit report for any unpaid or late debts will lower your consumer credit score. As a result, it’s important to understand the process for getting a judgment removed from your credit report, so that you may eventually move on from this burden and repair you consumer credit score.

We Can Help You Get Rid Of Your Judgment

If you have a judgment against you please fill out the form below, call us at 888.668.9071 for a free consultation, or use the chat option to speak with one of our experienced attorneys. Our rates are low and our consultations are free. We make debt relief easy. We may be able to help you vacate your judgment. Please note we do not handle tax, landlord/tenant, family law, or criminal related judgments. After youve contacted us, continue scrolling to learn more about what it means to have a judgment and how we can help. Please check out our reviews as well to see how weve helped many others in your situation. We look forward to hearing from you.

How Long Does Negative Information Remain On Your Credit Report

Other information that may appear on our credit report includes:

- Trace. A trace alert is placed on your credit report by a credit provider who has been unable to make contact with you and has asked to be notified when any updated contact information is loaded on to your credit report.

- Consumer remarks. You can ask that TransUnion include an explanation of facts or conditions that affect you on your credit report. For example, if your identity document has been stolen, you may want this information included in your credit report to try and prevent your identity being used fraudulently.

If you believe there is any information on your credit report that should not be there, or that should have been removed, you should immediately lodge a dispute with the credit bureau. The bureau is obliged to investigate and respond within 20 days.

You May Like: How To Get A Free Credit Report Mailed To Me

How Do Collections Affect Your Credit Scores

A collection account is a negative item that can hurt your credit scores. But the impact on your score can depend on the type of credit score and whether you’ve paid off the collection.

For example, the latest FICO® Score and VantageScore® models ignore paid collection accounts, while previous score versions may count paid collections against you.

But when you’re applying for a loan with a lender that uses older scoring modelssuch as a mortgage lenderpaying down your collections could still be important. Credit scores aside, the lender may review your credit history, and having unpaid collections could make it more difficult to qualify. While even paid collection accounts are negative, they may be viewed more positively by lenders than an account that remains unpaid.

The Fair Credit Reporting Act

To understand how long a judgment can stay on your credit report, it is necessary to know about the Fair Credit Reporting Act . Passed in 1970, the FCRA is a federal law designed to help consumers understand the information collected and reported on by credit reporting agencies . It dictates rules around consumer debt and privacy, accuracy, and reporting. One of the rules established by the FCRA is how long bad debts like bankruptcy or other debt-related civil judgments can remain on your credit report. So how long does bad debt like a judgment stay on your credit report?

Also Check: Will Paying Off Derogatory Accounts Raise Credit Score

The Differences Between A Short Sale And A Foreclosure

A short sale and a foreclosure are slightly different in how they affect your credit and future mortgage prospects, but both will remain on your credit report for at least seven years, Helali says. One key difference between them: A short sale is homeowner-generated, while a foreclosure is initiated by the bank.

Lenders initiate a foreclosure when the homebuyer has fallen behind on loan payments usually three to six months. The lender must take legal action to seize the property of a delinquent borrower and sell it at auction. Foreclosures are common when the homeowner has abandoned the home. If the occupants are still in the home, they can often be evicted by the lender. Once the lender has possession of the home, an appraisal will be scheduled so the property can be liquidated quickly.

With a foreclosure, the bank assumes ownership of your home, relieving you of many selling tasks. But a homeowner must use a real estate agent to do a short sale, Griffin says. You cant do it on your own. One reason is that only an agent can list the property on the MLS, but youll also want an agent to help navigate the river of paperwork and negotiate with the lender on your behalf.

According to Griffin, it takes five to seven years after a foreclosure before you can apply for a new mortgage.

To summarize:

How Long Do Late Payments Affect My Credit Score

Once a late payment is listed on your credit report, it can stay there for seven years. Thats a long time. However, the impact of a late payment decreases with time. Recent late payments affect your credit score more than late payments from years ago.

Several other factors determine the impact of a late payment. If the payment amount is large, it will count against your credit score more than a small payment would. If you frequently miss payments, or are late paying more than one credit account, you can expect larger drops in your credit score. And if your credit score is high, a late payment will have more impact than if your credit score was low to begin with.

You May Like: Is 524 A Good Credit Score

What Are Other Ways To Improve Your Credit Score

You canbuild healthy credit over time by starting with these steps:

- Make on-time payments. This is one of the most important factors that impacts your credit scores. If you think you cant afford a payment, reach out to the lender right away. It may be willing to work out a payment plan and keep your account in good standing.

- Check your credit reports. This will help you understand and track your overall financial health. Also look for errors, such as incorrect credit card balances, trade lines that arent yours and accounts that are incorrectly marked as delinquent.

- Dispute and fix errors. About 20 percent of consumers have an error on at least one credit report, according to a Federal Trade Commission study. Getting an error removed may help your credit score improve.

- Consider a debt consolidation loan. A debt consolidation loan unites all your debts into a single balance, often at a lower interest rate that can save you money. A debt consolidation calculator can help you evaluate whether this type of loan is right for you, as debt consolidation can temporarily hurt your credit.

Sign up for a Bankrate account to analyze your debt and get custom product recommendations.

How Does It Affect My Credit Report

The effects of judgment can be felt even after the statute of limitations has expired or it has been paid off. For example, it’ll give you a weak credit score that will take time to rebuild.

Even after the statute of limitations is past, your judgment can live on in your .

A lot of people are confused about this. It’s because the statute of limitations is often confused with what’s called a credit reporting time limit.

The Fair Credit Reporting Act states that a judgment will stay on your credit report for at least seven years. This number is the same across states because the FCRA is a federal law.

So, even if your statute of limitations is less than seven years, your judgment will still show up on your credit report for that full seven-year period. Once seven years are up, the judgment will finally fall off your credit report.

If your state’s statute of limitations is longer than seven years, the mark will stay as long as the statute of limitations.

Don’t Miss: How To Report Payments To Credit Bureau

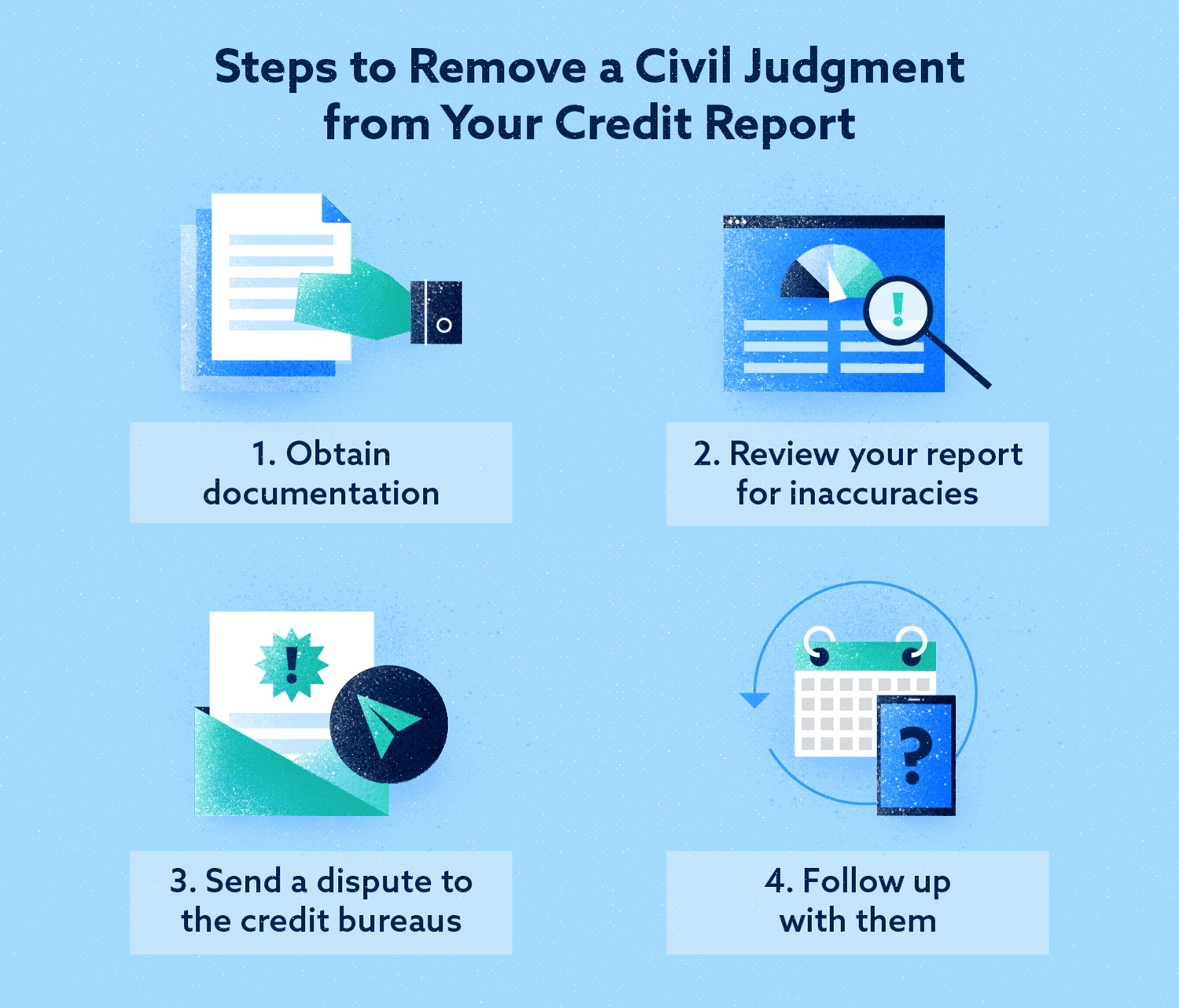

How To Remove A Judgment From Your Credit Report

Removing a judgment from your credit report may sound like a less successful venture than fighting City Hall. But I have some good news for those who aspire for credit redemption: judgments on your credit report dont always have to take seven long years to disappear.

Experian spells it out pretty clearly on their website: if a judgment is accurate, you cannot remove it. It will remain on the report for at least seven years.

While this is true, its also fair to assume that not every judgment is accurate. Thats where the opportunity for removal exists.

You may even think a judgment is rock solid. But why not go ahead and dispute it anyway?

If you do nothing, you will definitely carry that blemish for seven years. So it cant hurt to give it a shot.

UPDATE: All civil judgments are coming off all credit reports, for good. All 3 major credit reporting agencies are dropping civil judgments from their reporting after a Consumer Financial Protection Bureau study found issues with the ways that organizations reported these derogatory items to credit bureaus.

The rest of this article is in place for reference purposes. However, you should no longer need to remove a civil judgment from your report.

There are plenty of resources available to help you get a judgment removed. I know this because I once hired a firm myself.

I was deployed in a war zone at the time and was determined to have good enough credit to qualify for an auto loan by the time I got back to mainland.

What Is A Judgment Anyway

As the late, great Stephen Covey used to say, Seek first to understand Without getting too deep into the details, lets begin with the four types of judgments that can appear on your credit report:

- Unsatisfied Judgments are the worst kinds of judgments. They are big red flags on your credit report. That is because they are essentially a public record of an unsettled debt.

- Satisfied Judgments are less damaging to your credit than unsatisfied judgments. That is because they indicate that you at least managed to settle the judgment against you. However, they still remain on the report for seven years.

- You should remove Vacated Judgments from your report. That is because they indicate that a finding of a previous judgment was overturned, usually as a result of a successful appeal. Therefore, it is legally void, as if the judgment never happened.

- Re-filed Judgments are judgments that refuse to die! Most people know that judgments stay on credit reports for seven years from the filing date, organizations can re-file an unsatisfied judgment. Therefore it stays on your report for another seven years, depending on when they expire, which varies state-by-state.

If you have an unsatisfied judgment against you, I would strongly advise you to consider disputing it. Throw the challenge flag. What have you got to lose?

There are several ways to go about disputing an unsatisfied judgment. Ill cover the whos and hows in the next section.

You May Like: How To Get Credit Report Mailed

Ignore The Summons And Complaint And You Lose

Unless you file a written answer with the court within 20 days of being served, a judgment can be entered against you without your side of the story. You should also send a copy of the answer to the attorney who sued you. All that due process requires is that you get good notice that you are being sued. Do nothing and the creditor wins. So what if you never got notice? See #6.

How Long Does A Judgment Stay On Your Credit Report

SUMMARY: Understand what a judgment is, how long it remains on your credit report, and more.

Your credit score is that unassuming three-digit number calculated and shared upon request by credit bureaus to tell potential lenders how likely or unlikely you are to repay a loan. If your credit history includes a judgment, you have probably noticed it has the effect of lowering your creditworthiness. If you are wondering how long a judgment stays on your credit report and what you need to do about it, read on.

Don’t Miss: What Is A Good Credit Score In California

How Long Does Bad Credit Stay On Your Credit Report In California

Californiabe kept on your credit report

In California, how long can bad debt remain on your credit report?

Four years

You may also be curious about what items remain on your credit reports for the longest. Here’s a list of the most frequent items that remain on credit reports for 7 years after the date of the initial delinquency. Civil judgments: 7 year from the date of filing. Chapter 7 bankruptcy: 10 year from the date of filing.

Keep this in mind, is it true that your credit will be clear after seven years?

Although debts may still exist seven years later, it can help your credit score by having them removed from your credit report. Only negative information is removed from your credit report within seven years. Credit reports that have open positive accounts will remain indefinitely.

What length of time can real estate loans remain on your credit report?

Seven years

How Judgments Can Still Affect Your Loan Options

Even though judgments wont appear in your credit file, theyre still a matter of public record. This means that lenders will be able to see your judgment if they run a more intensive background check on you when you apply for a credit card or loan .

If you apply for a major loan, such as a mortgage, you can expect your prospective lender to run a full background check and in-depth assessment of your finances. 6 Unpaid judgments might cause them to reject your application.

To be eligible for certain government-backed loans, such as FHA and USDA loans, youll need to pay off your judgment before applying or provide a letter of explanation. Otherwise youll face automatic disqualification. 78

Recommended Reading: What Should Your Credit Score Be To Buy A House

Statute Of Limitations On Judgments

The statute of limitations on judgments is very long. Usually 12 to 20 years, and many are renewable therefore, the judgment could follow you around forever. Even if you pay it, you will be stuck with a ‘satisfied judgment” for seven years from the date satisfied not filed! This can be hopeless, so avoid being sued at all costs.

Be sure always to check your SOL for debts if you have been served because if it is expired , you can use that to dismiss the case. Many debtors are served every day for debts they simply do not show up in court, and a default judgment is entered against them – big mistake! Had half of them simply checked their SOL, they would have found that the debt may have expired years before, but since they did not dispute this, the judgment was awarded. You can use an expired SOL as a solid defense in court against a creditor/collector to stop a judgment.

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

- Most negative information generally stays on credit reports for 7 years

- Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type

- Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax ? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report :

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account can stay on your Equifax credit report for up to 10 years from the date it was reported by the lender to Equifax.

Read Also: Can You Remove Hard Inquiries From Your Credit Report

How Long Can A Judgment Stay On My Credit Report

A judgment can remain on your credit report as long as it is valid or active. In Texas, judgments are valid for at least 10 years and they can be renewed for another 10 years after that, and then another 10 year after that, and so on, indefinitely.

So, legally, the judgment could remain on your credit report forever, or until you settle it or pay it.

Learn how it works from our Dallas debt relief attorney:

The general 7-year rule

Under the Fair Credit Reporting Act , the general rule is that bad debts can remain on your credit report for 7 years.

There is a different rule for judgments

The FCRA has a different rule for judgments: a judgment can remain on your credit report for 7 years from the date of the judgment or until the governing statute of limitations has expired, whichever is the longer period.

What that means is: the judgment can remain on your credit report until it expires or until you pay it or settle it.

The judgment might drop off your credit report after 7 years even it is still active

The FCRA does not say that the judgment has to remain on your credit report until it expires it only says that the judgment may remain on your credit report until it expires.

You might be thinking: Why would the judgment drop off sooner? If it can legally remain on my credit report for 10 years or longer, why would it drop off after sooner than that?

Even if the judgment drops off your credit report, you still owe it and they can still collect on it