How Many Points Can My Credit Score Increase If A Collection Is Deleted

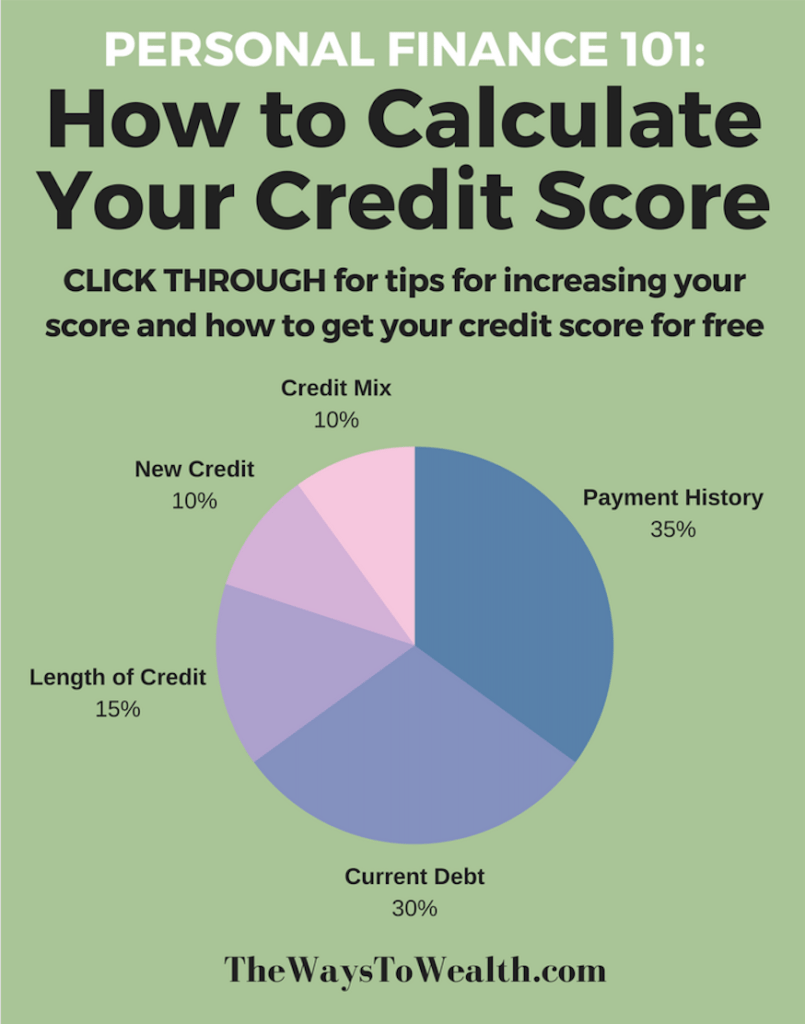

Late payments, skipped payments, and collection accounts are all factored into your credit score. Accounts that get to the collection stage are considered seriously delinquent. They will have a significant, negative impact on your credit score.

There is no fixed number of points that a credit score can increase if a paid collection is removed from your credit report. Each individuals credit score will be differently affected.

However, if the collection has lowered your score by 100 points, getting it removed from your credit report can increase your score by 100 points.

Whats In Your Credit Report

Your credit report typically holds the following information:

- A list of your credit accounts. This includes bank and credit card accounts as well as other credit arrangements such as outstanding loan agreements or utility company payment records. Theyll show whether youve made repayments on time and in full. Items such as missed or late payments or defaults will stay on your credit report for at least six years.

- Details of any people who are financially linked to you for example, because you’ve taken out a joint loan with your partner.

- Public record information such as County Court Judgments , home repossessions, bankruptcies, Debt Relief Orders and individual voluntary arrangements. These stay on your report for at least six years.

- Your current account provider, but only details of overdraft information from your current account.

- Whether youre on the electoral register.

- Your name and date of birth.

- Your current and previous addresses.

- If youve committed fraud, or if someone has stolen your identity and committed fraud, this will be held on your file under the Cifas section.

Your credit report doesnt carry other personal information such as your salary, religion or any criminal record.

Negotiate With Debt Collectors

If a debt collector refuses to remove a collection entry in exchange for payment or you cant afford to pay off the amount owing in full, you might look into a debt settlement. A debt settlement means that youre able to settle your debts by paying a lesser amount than is owed. This wont always get rid of the collection entry from your credit report, but it will show that the debt is paid, improving your credit score.

Remember, if youre doing a debt settlement, make sure to get everything in writing. Youll want something in writing to prove the account is current with the debt collector.

Read Also: What Is A Good Credit Score To Get A Loan

In This Post We Cover:

- What collections are and how they affect your credit

- How to check your credit report for collections

- How to remove collections from credit report in Canada

- Tips to help manage credit going forward

Your credit reports and scores are an important part of your financial life. When collection items land on your it can cause your score to drop, making it harder to get approved for car loans or other types of credit. You might be wondering how to remove collections from credit reports and whether that could help your score. There are some steps you can take to minimize the impact of collections on a credit report. If youre successful, this could make it easier to qualify for a car loan and/or get a better rate when you borrow.

How To Get Personalized Credit Restoration Help For Free Without Using A Credit Repair Company

Hopefully you found enough direction here to begin your own credit restoration process. Weve basically provided you with the essentials of what the expensive credit repair companies offer only weve given it to you for free. Its not possible to cover absolutely everything here. If you still have some questions, heres how to get them answered for free from an expert. If youre thinking of getting a mortgage any time in the next few years, you could find a good mortgage broker, explain your situation, tell them youd like to get a mortgage through them, and ask for their advice on how to fully restore your credit. If theyre a quality professional, theyll help you out and then hopefully you can reward them with you business in time. You could also ask to speak with a loans officer at your bank, let them know some of your future plans that involve working with them, and ask them for advise on how to repair or rebuild your credit. If your credit is really bad, feel free to contact a non-profit credit counselling agency. One of their professional credit counsellors will likely be happy to help your figure out how to fix your credit score for free . Below are a few more resources that you may be interested in too.

Related Topics

Also Check: When Do Collections Fall Off Credit Report

Monitor Your Credit Report

Federal law entitles you to a free copy of your credit report once every 12 months from each of the major credit-reporting agencies: Equifax, Experian and TransUnion. You can get a free copy of all three bureaus versions of your credit report at AnnualCreditReport.com. Order one at a time and space them out over the year so you can check your credit report every few months.

If youre getting acquainted with your for the first time, you may opt to order all three at once. If youre turned down for a job or credit, or you dont get the best interest rate on a loan, you have a legal right to review your credit report at no charge. The letter you receive notifying you of the decision will include a number for you to call for more information.

Check All Three Credit Reports For Errors

Through the end of 2022, youre entitled to free weekly credit reports from the three major credit reporting bureaus: Experian, Equifax and TransUnion. Request them by using AnnualCreditReport.com.

There may be small differences among your reports, because some creditors dont report your account activity to all three bureaus. But if negative information has popped up on one report, its wise to see whether its also on the other two.

There is no cost to dispute credit report errors, and you can dispute as many items as you like. Filing a dispute does not hurt your credit score, but the result of the dispute may have an effect on your score.

Read Also: What Is The Credit Score Range

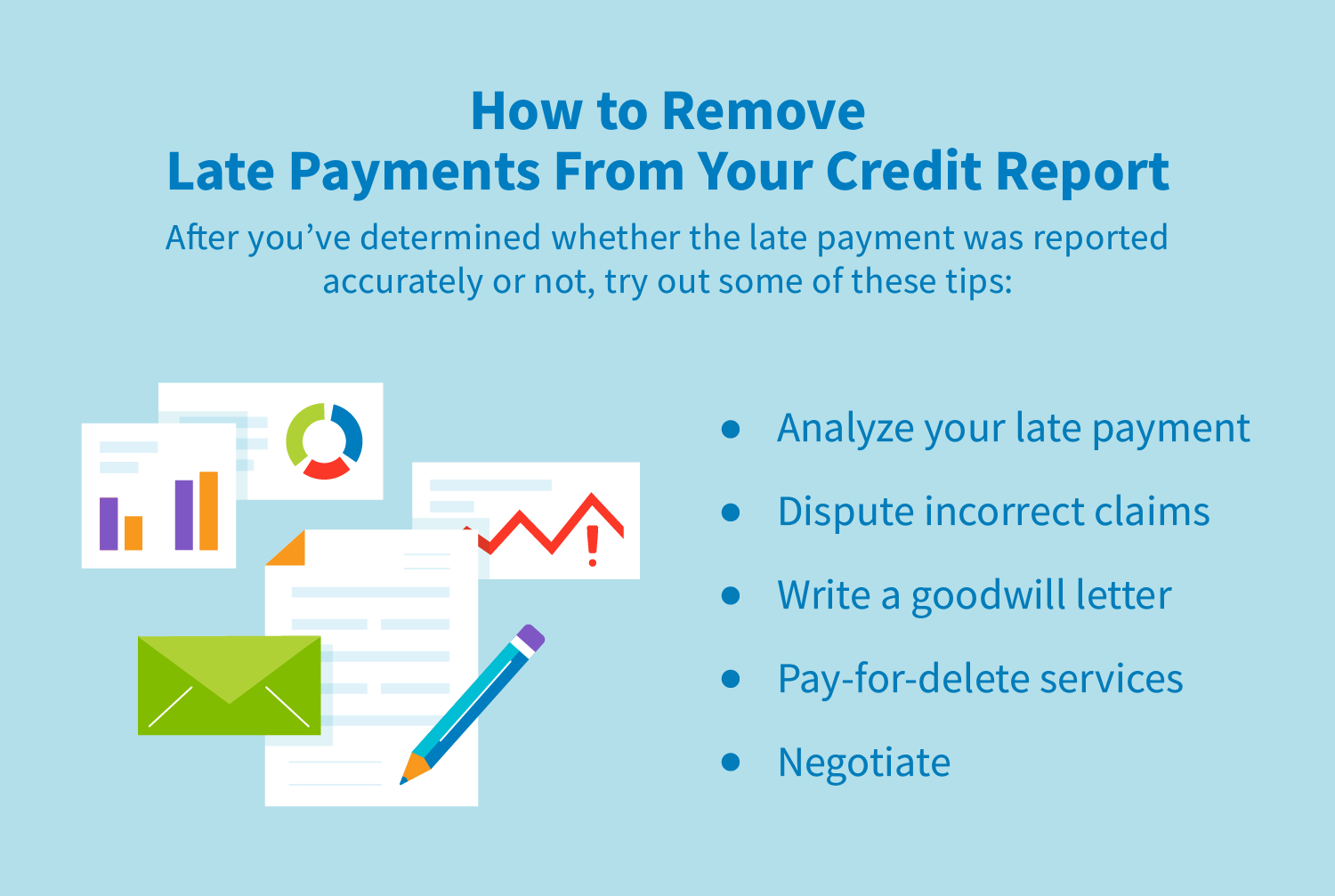

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Who Looks At Your Credit Report

When you apply for credit, youll usually be expected to give your permission to the credit provider to check your credit report.

The term credit provider doesnt only include banks and credit card companies. It also includes mail-order companies and, for example, providers of mobile phone services if you have a phone contract .

Employers and landlords can also check your credit report. However, theyll usually only see public record information such as:

- electoral register information

- County Court Judgements .

Don’t Miss: How To Get Credit Report Without Social Security Number

How To Remove Negative Items From Your Credit Report

Amarilis YeraNorma RodríguezAndrea AgostiniTaína CuevasAmarilis Yera26 min read

Your is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Requesting A Goodwill Adjustment For A Missed Payment

If you are a loyal customer with a history of making repayments on time, your lender may consider removing a one-off missed payment from your credit file. To do this, you will have to contact them asking for a “goodwill adjustment”, which will serve to erase the errant missed or late payment. Lenders can be more likely to accept this course of action if you also agree to take steps to avoid missing future payments, perhaps by setting up an automatic monthly direct debit.

Also Check: Does Amex Plan It Affect Credit Score

What Is Credit Repair

Credit repair simply refers the process of disputing mistakes and errors that can appear in your . If you think an item that appears on your report is inaccurate, you can ask the credit bureau to verify the information. They have 30 days to respond. If the information cannot be verified then it must be removed.

This process protected under the Fair Credit Reporting Act and its often necessary to ensure you have the best credit possible. Many mistakes, such as late payments, can negatively impact your credit score. This makes it harder to get loan and credit approvals at good interest rates.

Learn More About Credit Scores

If its not clear from everything above your credit score in the U.S. will be an essential part of living in America on a visa. That said, there are lots of other important topics around credit scores that it would be worth it to familiarize yourself with:

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

You May Like: How To Clean Up Your Credit Report Yourself

How Can I Quickly Clean Up My Credit History

Unfortunately, theres no way to quickly clean your credit reports. Under federal law, the credit bureaus have 30 45 days to conduct their investigations when you dispute information. If the credit bureaus can verify the information on your credit reports, it can remain for up to seven to 10 years.

Paying down credit card balances is a great way to improve your credit profile, but even then, you may not see the updates immediately. Many creditors only send information once a monthsometimes even less frequently than that.

Remember that cleaning your credit takes time, but in the end, its worth it.

Errors By The Credit Provider

A credit provider may have reported information wrongly. For example, they:

- incorrectly listed that a payment of $150 or more was overdue by 60 days or more

- did not notify you about an unpaid debt

- listed a default while you were in dispute about it

- didn’t show that they had agreed to put a payment plan in place or change the contract terms

- created an account by mistake or as a result of identity theft

To fix this kind of error:

- Contact the credit provider and ask them to get the incorrect listing removed.

- If the credit provider agrees it’s wrong, they’ll ask the credit reporting agency to remove it from your credit report.

If you can’t reach an agreement, contact the Australian Financial Complaints Authority to make a complaint and get free, independent dispute resolution.

If you’re struggling to get something fixed, you can contact a free financial counsellor for help.

Also Check: What Does It Mean When Your Credit Score Is 0

How To Improve Your Credit Score

If your credit score is low, there are steps you can take to help improve it. You can:

- lower your credit card limit

- limit how many applications you make for credit

- pay your rent or mortgage on time

- pay your utility bills on time

- pay your credit card on time each month either pay in full or pay more than the minimum repayment

As you do these things, your credit score will start to improve. So you’ll be more likely to be approved next time you apply for a loan or credit.

If you’re struggling to pay bills and are getting into more debt, talk to a free financial counsellor. They can take you through the options and help you make a plan.

Check Your Report For Discrepancies

Watch out for accounts you dont recognize and verify that any accounts containing negative information belong to you. Its possible someone elses account information is included in your credit report by mistake. Another red flag to watch out for is an account with a much higher balance than what you carry. This could indicate mistaken identity or identity theft.

Jessica Cecere, who worked at CredAbility for over 25 years, says one common credit-report error is the inclusion of old, negative information that should have come off the persons record. Most negative information stays on a credit report for seven years, and Chapter 7 bankruptcies remain for 10.

You May Like: How To Have Collections Removed From Credit Report

Common Credit Report Errors

According to the Consumer Financial Protection Bureau, these are the most common errors consumers find on their credit history:

Mistaken identity

- Wrong name, address or phone number

- Accounts from someone with a similar name

- New credit accounts opened by someone who stole your identity

Incorrect account status

- Accounts wrongfully labeled as open, past due or delinquent

- Accounts that wrongfully listed you as the owner instead of authorized user

- Wrong date for the last payment received, date the account was opened or delinquency status

- Same debt listed multiple times

Data management

- Information that is not removed, despite already being disputed and corrected

- Accounts that are listed multiple times, with different creditors

Balance

- Incorrect credit limit

What You Can’t Change Or Remove

You can’t change or remove any information on your credit report that is correct even if it’s negative information.

For example:

- All payments you’ve made during the last two years on credit cards, loans or bills, whether you paid on time or not.

- Payments of $150 or more that are overdue by 60 days or more these stay on your report for five years, even after you’ve paid them off.

- All applications for credit cards, store cards, home loans, personal loans and business loans these stay on your report for five years.

For a full list, see what’s in your credit report.

Avoid credit repair companies that claim they can clean up this sort of thing or fix your debt. They may not be able to do what they say. They may also charge you high fees for things you can do by yourself for free.

Paying a credit repair company is unlikely to improve your credit score.

Also Check: What Is A Good Credit Rating In Australia

Is Pay For Delete Legal

The Fair Credit Reporting Act governs credit reporting laws and guidelines. Anything that a debt collector, creditor, or credit bureau does regarding a credit report will be based on the FCRA, says Joseph P. McClelland, a consumer credit attorney in Decatur, Ga.

Technically, pay for delete isnt expressly prohibited by the FCRA, but it shouldnt be viewed as a blanket get-out-of-bad-credit-jail-free card. The only items you can force off of your credit report are those that are inaccurate and incomplete, says McClelland. Anything else will be at the discretion of the creditor or collector.

You Can Work To Clean Your Credit Reports By Checking Your Reports For Inaccuracies And Disputing Any Errors

Theres nothing more frustrating than inaccurate, unfair or outdated information bringing down your credit score. Its not an uncommon issuethe FTC found that one in five people has an error on at least one of their three credit reports.

It should come as no surprise that reviewing your credit and taking steps to clean it is important, especially if you have bad credit. Negative marks can drag down your credit score for years and keep you from major life milestones, like buying a car or house.

To help you get started, heres a guide with six steps for cleaning your credit reports.

You May Like: Can You Buy A House With A 620 Credit Score

How Long Does A Collection Account Stay On A Credit Report

The Fair Credit Reporting Act lays out that the collection has to stay on your credit report for up to seven years from the date of default on the original account. This is to give lenders a clear picture of your financial behavior so they know the risks of lending you money.

However, on a credit report, a paid collection can still stay on your credit report for up to seven years, regardless of whether the account has a $0 balance.

After seven years, the paid collection will automatically drop off your credit report.