Why Is My Fico Higher Than My Vantagescore

More often than not, you may find that theres significant variation between the two models. This is to be expected because they take a look at different things and weigh them differently.

There are also different models of FICO® being used between bureaus along with different models of VantageScore®. FICO® models vary and they can have a different formulation depending on where the lender sources them from. Currently, VantageScore 3.0® is a very commonly used version. With this variation, its not uncommon for one score to be higher or lower than the other.

How Does The Vantagescore Credit Model Work

Before credit scores were created, a lender would have to read through a borrower’s credit history and make an individual determination of an applicant’s likelihood of repaying a loan. This took not just a lot of time, but also a significant amount of training and skill. Credit scores streamline this process by summarizing a person’s entire credit history to a single number, and therefore lenders are able to automate a portion of the process of approving a loan while ensuring a consistent, objective formula is always being used to make these decisions.

Other Credit Scoring Models

Outside of the conventional and well-known outlets, there are several other credit scoring models.

TransRisk Its based on data from TransUnion and determines an individuals risk on new accounts, instead of existing accounts. Because of that specialized nature, theres not much information available about the TransRisk score. Accordingly, it isnt utilized by many lenders. It has been reported that an individuals TransRisk score has generally been drastically lower than their FICO score.

Experians National Equivalency Score It assigns users a score of 0-1,000 with the typical criteria of payment history, credit length, credit mix, credit utilization, total balances and the number of inquiries but Experian has never publicized the scores criteria or weight. The scoring seems counterintuitive for consumers accustomed to the FICO system. In Experians system a score of 100 means a 10% chance that at least one account will become delinquent in the next 24 months, while a score of 900 means a 90% chance of that. There is an alternative scoring method of 360 to 840 (840 is good, 360 is bad, making it more compatible with the FICO model.

It was developed to help businesses approve new account candidates. It inspects credit reports for ways to raise its score quickly or detect false information. By improving those scores, that should lead to more loan approval for customers.

Don’t Miss: What Credit Report Does Apple Card Pull

Pay Revolving Accounts In Full

Credit utilization and the amounts you owe factor heavily into your credit score, so keeping balances low on your revolving accounts is critical to maintaining a great credit score. If you can pay off all of your revolving credit accounts, do it. A common misperception is that you need to keep some balance on your credit cards to build credit. This is false. Paying the entire balance off your credit cards every month is one of the best ways to build your credit.

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyone, not just those who have a Capital One credit card. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

You May Like: Can You Get Charge Offs Removed From Credit Report

Scoring Models Keep Secrets

Companies that develop scoring models prefer to keep details of the models behind closed doors because they consider them privately held and because they make money by selling results of the models. However, given the information that banks and credit card companies ask on their applications, it is not difficult to interpret some factors that weight heavily on your score.

Among the factors considered are:

- Bankruptcies, collections, missed payments and foreclosures listed on your credit report.

- Your occupation and your time at your current job.

- Whether you own or rent your residence.

- Amount of time living at your current location.

- The number of inquiries into your credit over a period of time.

- The balances of your used credit to your available credit.

- Your age.

- The length of your credit report.

- The length of time your credit history has been in the bureaus database.

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Also Check: Can Private Landlord Report To Credit Bureau

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Why A New Credit Scoring System

So why did the three credit reporting companies, Experian, Equifax and Transunion, develop the new system in the first place? They say one reason is for consistency – FICO scores frequently vary when reported by the three different bureaus. They also say the new system is easier to understand every hundred point range in the VantageScore system corresponds to a letter grade – A, B, C, D or F – that gives the consumer an instinctive feel for where their credit stands.

However, skeptics note that the main reason FICO scores vary among the three credit bureaus is because lenders don’t always report the same information on a borrower to all three – some lenders and creditors may only report borrower performance to one of them, for example. The new system doesn’t fix that.

A bigger reason is likely because the three credit agencies have to pay FICO’s parent company, the Fair Isaac Co., licensing fees for using the FICO system. Since they developed the VantageScore system, they don’t have to pay another company for using it – provided they can get lenders to embrace it instead of FICO as the primary system for evaluating consumer credit worthiness.

That doesn’t seem likely to happen, at least in the immediate future. Fannie Mae, Freddie Mac and the FHA all use rely on FICO scores for evaluating credit, and as they go, so goes the mortgage industry. At the same time, you may still encounter the VantageScore system from time to time, so it helps to understand how it works.

Read Also: How Long For Collections To Fall Off Credit Report

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Other Credit Rating Systems

Be aware, though, that the credit bureaus also offer other types of credit scores as well – Transunion offers the TransRisk score and Experian the PLUS score, for example. Both of these roughly approximate the range of FICO scores, but you should be aware of exactly which product you’re ordering.

At present, VantageScores are only used by a small number of lenders – legal filings last year put the figure at under 6 percent of the market. However, that figure will grow if the three credit reporting companies are successful in making it the preferred system for evaluating consumer creditworthiness. In the meantime, as a consumer, you just need to be aware that there are different credit scoring systems out there and know approximately how scores from each relate to the other.

Follow us on and .

Also Check: Does Creditwise Affect Your Credit Score

Factors That Affect Your Credit Score Range

There are many factors that can affect your credit score and your credit score range. These factors break down into five categories of information .

- Payment history35% of your FICO Scorelooks at whether you have late payments on your credit reports. If you do have payment delinquencies, the severity and frequency of these will affect your credit range.

- Amounts owed30% of your FICO Scoreprimarily considers your credit utilization ratio. When your credit report shows that youre using a bigger percentage of your available credit card limit, it could cause credit score damage that might move you to a lower credit score range. Another factor that matters here is your number of accounts with outstanding balancesfewer is better.

- Length of credit history15% of your FICO Scoreexamines factors like the average age of accounts on your credit report and the age of your oldest and newest accounts, among others. The older your accounts, the better the impact should be upon your credit score range.

- Types of credit used10% of your FICO Scoreassesses the variety of accounts that appear on your credit report. A combination of account types such as revolving and installment is ideal.

- New credit10% of FICO Scoreconsiders factors such as how often you apply for new credit. Too many credit inquiries in a short period of time could have a negative impact on your credit rating range.

The bottom line

Age And Type Of Credit

VantageScore 3.0 also factors in how long youve had different types of credit accounts open.

Ideally, lenders like to see long-term, established lines of credit. Having a variety of account types is a bonus as long as you stay up-to-date on your payments as lenders also typically like to see that youve used a mix of accounts on your credit responsibly.

Read Also: Does Bankruptcy Affect Credit Score

Why Does My Score Vary Between Bureaus

There are differences in the models, but you may be wondering why your score can be different between the credit bureaus even when the same FICO® or VantageScore® is looked at.

One key thing to be aware of is that not every lender or creditor reports to every bureau, so you may have some loans or accounts that show up on one report and not others. The score for each bureau is only based on the information its able to collect.

Put Your Credit Card Debt In The Past.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Also Check: How Long To Improve Credit Score

Average Credit Score By Income

The higher ones income level, the higher their average credit score tends to be.

While debt-to-income ratio doesnt play a direct role in determining one’s credit score, it does have an indirect one. One of the factors lenders consider when modeling an individual’s credit risk is their credit utilization the percentage of total available credit a consumer is using month to month.

To improve one’s credit score, credit utilization should generally be kept below 30%. The lower one’s income is, the more a consumer may rely on their credit for their expenditures.

Another way income may play into credit utilization, and ultimately one’s credit score, is by determining one’s . Credit issuers look at borrowers incomes when deciding on the amount of revolving credit that should be issued.

The lower one’s income, the lower their line of credit is likely to be.

In turn, by having significantly lower credit limits, it becomes easier for lower-income individuals to eat up a larger portion of what’s available, increasing their credit utilization.

The graphic belows shows that median credit scores are highly correlated to income.

For context:

- Low income: Up to 50% of the area median income

- Moderate income: Greater than 50% and up to 80% of the area median income

- Medium income: Greater than 80% and up to 120% of the area median income

- High income: More than 120% of the area median income

Fico Credit Score Range Distribution

| FICO Score Range |

|---|

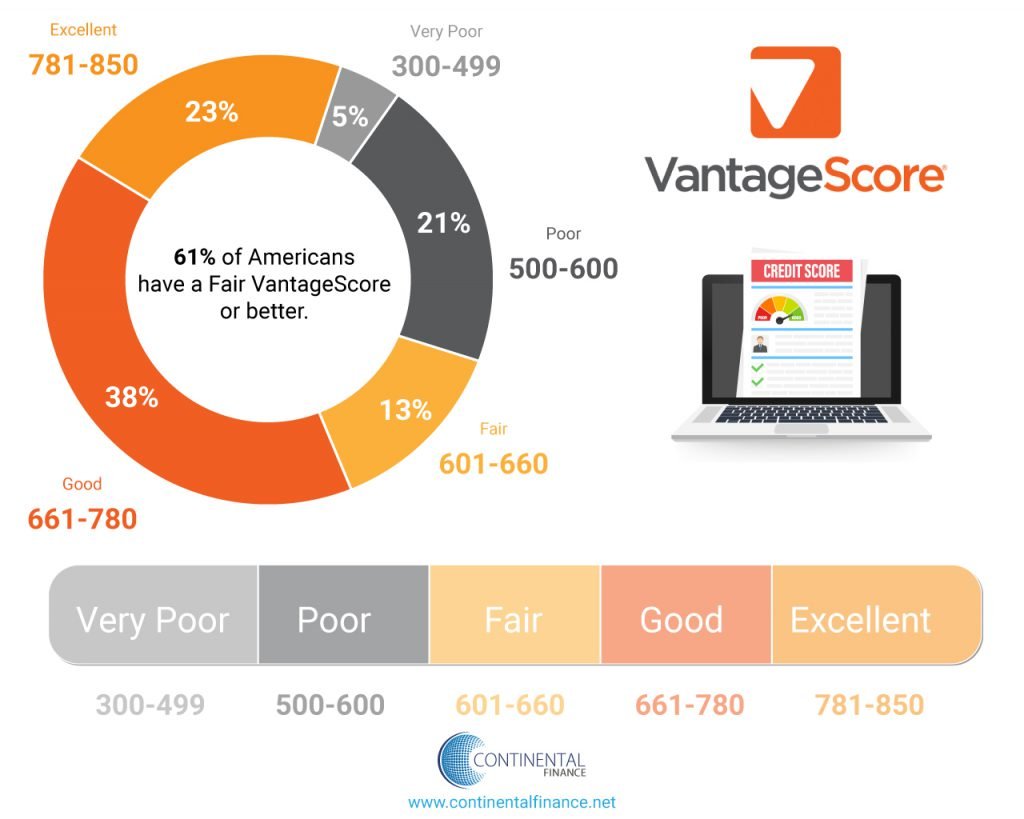

| VantageScore Credit Score RangeVery Poor | Percentage of Consumers5% |

Here are a few more interesting statistics about U.S. credit score ranges.

- 67% of consumers in the United States have a FICO Score that falls into the Good range or better.

- 61% of consumers in the United States have a VantageScore credit score that falls into the Good range or better.

- Only 30.9% of U.S. consumers had a subprime FICO Score in the year 2020. That percentage was down 3% from the previous year.

Also Check: What Credit Report Does Rooms To Go Pull

Why Are My Credit Karma And My Fico Scores Different

VantageScore and FICO are the two big rivals in the credit rating business. Credit Karma uses VantageScore. Their models differ slightly in the weight they place on various factors in your spending and borrowing history.

On the customer review site ConsumerAffairs, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores. Whether these posts are reliable is unknown, but it is worth noting.

If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.

Consumers In The Same Credit Score Range Share Common Characteristics

If your credit score falls into a certain range, its likely that your credit report is similar to others who are in the same credit score range as you. The following charts show some interesting data about consumers that fall into the subprime credit score range , the very good credit score range , and the exceptional credit score range .

| Subprime Credit Score Range Characteristics | |

|---|---|

| Average FICO Score | 577 |

| Average Overall Credit Utilization Ratio | 4% |

If youre hoping to move up to the exceptional credit score range, it can be wise to try to emulate the credit management habits of people that are already in that group. Likewise, taking a look at the habits of people with credit scores in the subprime range can give you a clue about which credit behaviors its best to avoid.

Recommended Reading: How To Unfreeze Your Credit Report Equifax

Who Uses Vantagescore

A wide variety of financial institutions and other companies use VantageScore. Credit card companies make up the largest category of users, followed by banks, personal and installment loan companies and mortgage and auto lenders.

Outside of financial institutions, the largest category of users is consumer websites where you can access your scores. VantageScore is also used for screening tenants and telecommunications and utility customers.

What Is Credit Karma

To use Credit Karma, you have to give the company basic personal information, usually just your name and the last four digits of your Social Security number. With your permission, Credit Karma then accesses your credit reports, compiles a VantageScore, and makes it available to you.

The score range for Credit Karma’s credit score is between 300 and 850. Their credit ratings are broken into three types, as follows:

- Poor: 300 to low 600s

- Fair to good: Low 600s to mid 700s

- Very good and excellent/exceptional: Above mid 700s

You May Like: Is 673 A Good Credit Score

How Is Your Vantagescore 30 Calculated

VantageScore 3.0 credit scores range from 300 to 850. Earlier iterations of the VantageScore® model featured a different range, but VantageScore 3.0 adopted the 300 to 850 range the same range as most FICO® scores to make it easier for lenders to use.

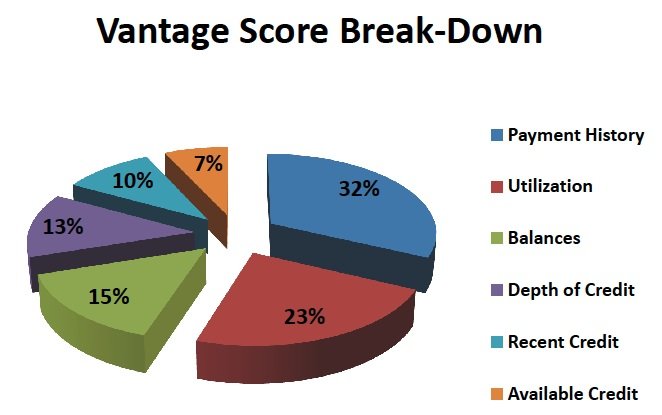

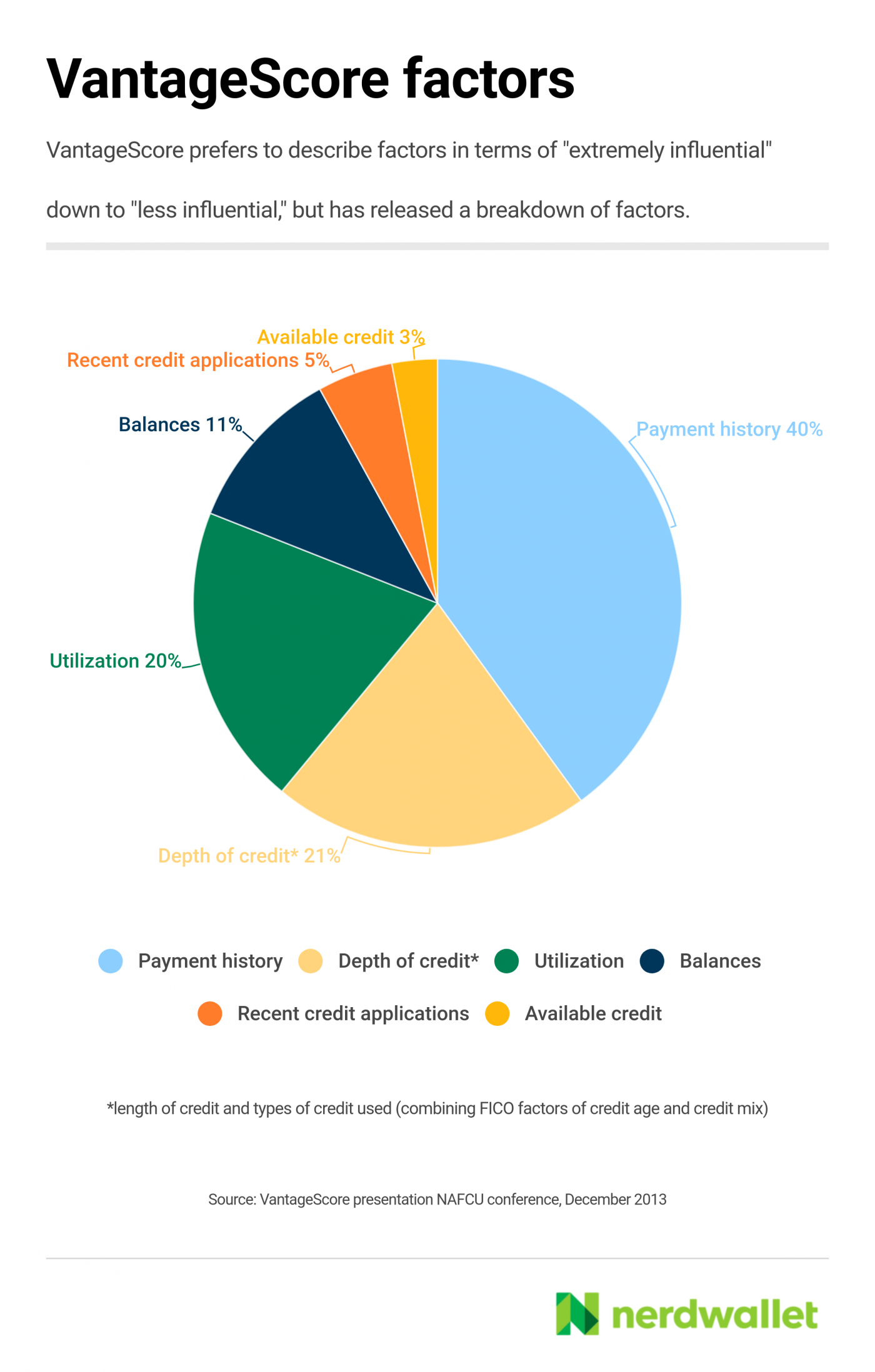

Though individual credit scores are based on a complex series of calculations, VantageScore does offer some insight into how the various are used to calculate a VantageScore 3.0 score.

Generally, heres how the categories can break down.