What Does A Full Credit Report Look Like

A full credit report looks like a financial statement, depicting various information on an individual’s credit profile. It has personal information on the top and is broken down by the various credit that an individual has, such as credit cards, loans, and mortgages, as well as other sections such as public records.

What’s Not In Your Credit Report Information

There are a lot of misconceptions about the information your credit report contains and which factors affect your credit score. Here are a few things that don’t appear in your credit report or impact your score in any way:

- Your occupation or employment history

- Your level of education

- Your bank account balance

- Your shopping habits

The information in your credit report is strictly related to your history of credit management and does not contain any information unrelated to credit, apart from the basic identifying information outlined above.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Also Check: Does Balance Transfer Affect Credit Score

You May Like: How Long Before Bankruptcy Is Removed From Credit Report

Best First Credit Cards

If you dont qualify for a traditional unsecured credit card, you may be eligible for a student credit card, which typically has looser credit requirements, or a secured credit card, which requires an upfront deposit. Even some unsecured cards are designed for people with no credit history to begin building credit, and can help you work toward a great credit score. Choose the best option available to you in terms of rates, fees, credit limit, perks, and rewards. Here are a few of our top picks.

Read Also: How Do You Get Your Credit Report

Whats Your Credit And Why Does It Matter

When people talk about your credit, they mean your credit history. Your credit history describes how you use money. For example:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

How you handled your money and bills in the past will help lenders decide if they want to do business with you. Your credit history also helps them determine what interest rate to charge you.

- If lenders see that you always pay your bills on time and never take on more debt than you can pay back, theyll generally feel more confident doing business with you.

- If they see that youre late on your payments or owe more on credit cards or loans than you can repay, they might not trust that you will pay them back.

Read Also: What Is The Maximum Credit Score

Your Interest Rates And Any Penalties Incurred Are Private Information

Your credit report names your accounts, such as credit cards, lines of credit, and instalment payments such as car loans. They include when the account was opened, its status with the lender, the highest amount owing, the currently reported balance, and the number of payment periods past due. It will also state the date of last activity, such as when you made a payment or used the account .

It doesnt, however, list any caveats tied to these accounts, such as steep interest rates and penalties incurred because of missed payments. These are details that are shared between you and your creditor.

Read Also: How To Get A 720 Credit Score In 6 Months

A Rental History Report Gives Potential Landlords A Comprehensive Timeline Of Your Time As A Tenant Including Any Outstanding Rent Or Evictions

As a potential tenant, you can expect to be thoroughly scrutinized. Good landlords will do , conduct personal interviews, and also request a copy of your rental history report. Its important to make sure you know whats on itand to dispute any errors you may findas these reports can be a deciding factor in your rental application.

Also Check: What Is Syncb Ntwk On Credit Report

Also Check: What Is A Good Credit Score To Get A Car

What Does A Credit Report Include

The information that appears on your credit report includes:

- Personal information: Your name, including any aliases or misspellings reported by creditors, birth date, Social Security number, current and past home addresses, phone numbers, and current and past employers.

- Accounts: A list of your credit accounts, including revolving credit accounts, such as credit cards, and installment loans, such as mortgages or auto loans. The list includes creditor names, account numbers, balances, payment history and account status .

- Public records: Bankruptcies.

- Recent inquiries: Who has recently asked to view your credit report and when.

Note that your credit report does not include information about your marital status , income, bank account balance, or level of education. Your credit report could include your spouse’s name if reported by a creditor. After a divorce though, the only way to remove a spouse’s name from your credit report is to dispute the information.

Each of the three credit bureaus may also have different information about you. Creditors are not required to report information and may not furnish data at all, and if they do, it may only be to one or two of the credit bureaus.

How New Credit Can Increase Fico Scores

If the new line of credit helps diversify the types of accounts you currently have, this can increase the credit mix factor of your credit score. It shows lenders you can obtain and manage different kinds of credit, which can lower their risk of lending you money.

Lets say you open a new credit card account and then dont use that card for any new purchases. Over time, this can lower your credit utilization which could mean an increase in your credit score.

If you have a bad payment history and are starting from scratch to create a positive one, then opening new credit can help with that. If you can prove to lenders that you can pay your bills on time, this will help increase your score in the long run.

You should carefully consider if you need a new credit account. In the next section, you can learn about how to improve your FICO Score.

Dont Miss: How Much Will Paying Off Collections Raise Credit Score

Recommended Reading: Is 818 A Good Credit Score

How Many Credit Hours Is A Full Time Student

1. How Many Credits Are Required for Full-Time Enrollment? Schools generally consider you to be a full-time student if you are taking 12 credit hours per semester. Depending on your college, that can mean a course load Since the federal government defines full-time enrollment as 12 credits per semester for

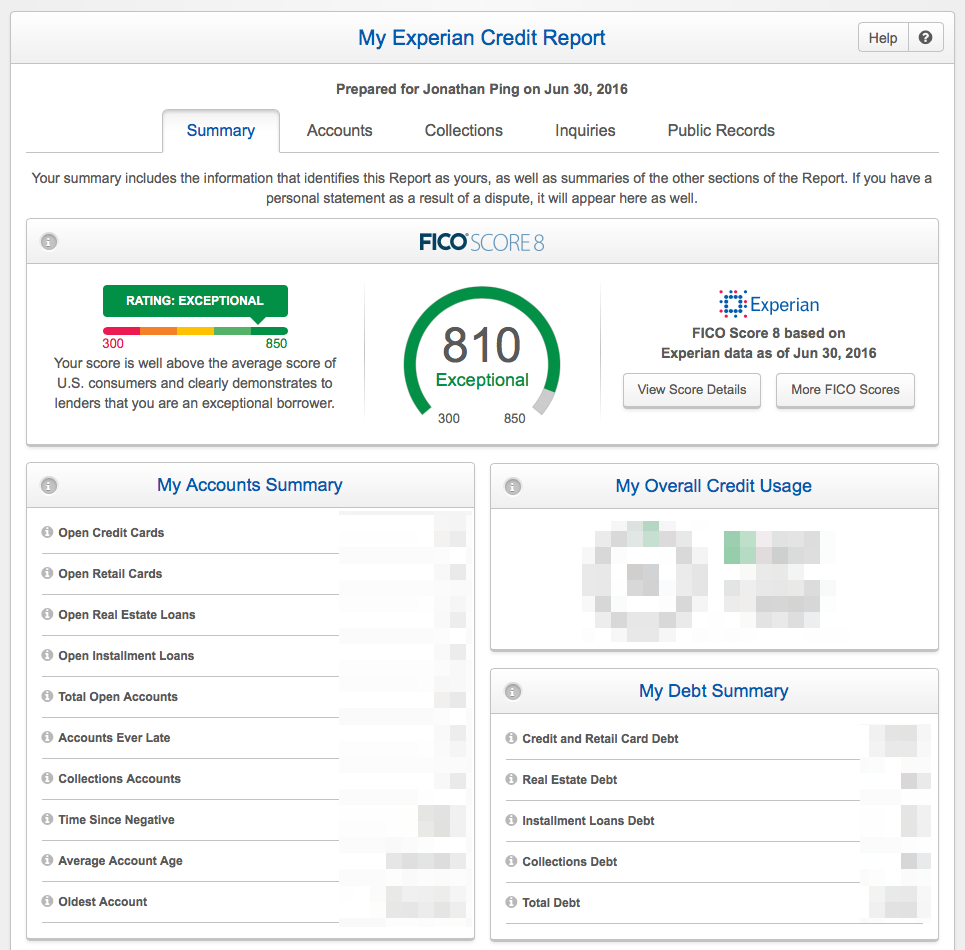

Your Credit Report And Credit Scoring

Knowing how to read the information in your credit report is important for several reasons. First, it can give you a better understanding of what affects your score, positively or negatively. FICO scores, for example, are based on five specific factors:

- Payment History

- Recent Credit Behavior and Inquiries

- Available Credit

Once you know whats in your report, it can be easier to recognize behaviors or trends that could be helping or hurting your score. From there you can adopt credit habits that could help you build better credit. If you notice that you owe high balances on several of your credit cards, for example, paying down some of your debt may add points to your score.

The three main credit rating agencies are Experian, Equifax, and TransUnion.

Reviewing your credit report regularly is also important for detecting errors or spotting potential signs of identity theft. New accounts opened that you dont recognize could signal that someone is using your personal information to obtain credit. And if you see that your payments arent being reported properly, you have the right to dispute those errors under the Fair Credit Reporting Act.

You May Like: Is 752 A Good Credit Score

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO® Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO® Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

Also Check: Is American Express Good For Your Credit Score

What’s In A Credit Report

A credit report is a documented record of all of your credit and debt accounts with a three-digit designation of your entire credit and debt repayment history, which is known as a credit score.

Here’s what’s included in your credit report:

- Collection accounts. Any debts that remain unpaid will appear in this section of your credit report. Any debt that is sent for collections, even a $50 credit card debt or a $25 unpaid phone bill, can appear on your credit report as a negative, unpaid item and can thus be a negative factor on your credit report.

When To Request A Credit Report

Anytime you are considering a major purchase that will require a loan, such as a home mortgage, car loan or home improvement project, you should start by requesting and reviewing your credit report.

The interest rate you receive from any lender is based on your credit score and the information contained in your credit report. If there are mistakes, it could affect the interest rate you receive and cost you thousands of dollars.

A recent government survey says that 20% of consumers found at least one error on their credit report that makes them look riskier than they are. Thats one reason its so important to check your credit report regularly.

Another is to see if you are the victim of identity theft. A survey from Javelin Strategy and Research says that a record 16.7 million Americans were victims of identity theft in 2017, resulting in $16.8 billion stolen. Over 5.5 million were victims of credit card fraud and about two million were victims of bank fraud.

Applying for a job is another reason to review your credit report. A study by the Society of Human Resource Management said that 47% of employers look at a candidates credit report. If there is incorrect information there, it could impact your hiring.

You May Like: What Hurts Your Credit Score The Most

How To Monitor Your Credit For Free

You can use a credit monitoring tool such as . Itâs free for everyoneâwhether or not you have a Capital One product. And with CreditWise, you can access your TransUnion® credit report as often as you would like without hurting your credit. Plus, youâll get alerts when there are meaningful changes to your TransUnion® and Experian® credit reports.

You can also check your VantageScore® 3.0 credit score for updates. And the Credit Simulator can give you an idea about how financial decisions could affect your credit. Best of all, using CreditWise will never hurt your credit. Thatâs because it uses soft inquiries to monitor things.

You can today to get a look at whatâs in your credit report and more.

How Do I Monitor My Credit Score

It’s important to regularly monitor your credit health and the information that’s found in your report. Catching and fixing mistakes on your credit report early can help you protect yourself before it escalates. It’s recommended that you check your credit report at least once a year to track your credit journey and correct any discrepancies in a timely manner.

You can use our Chase Credit Journey to help you manage, monitor and protect your credit. You don’t need to be a Chase customer to get started.

You May Like: How Much Does A Hard Inquiry Affect Your Credit Score

How To Get Your Credit Score

Unlike your free annual credit report, there is no free annual credit score. Some companies you do business with might give you free credit scores. Other companies may give you a free credit score if you sign up for their paid credit monitoring service. This kind of service checks your credit report for you. Sometimes its not always clear that youll be charged for the credit monitoring. So if you see an offer for free credit scores, check closely to see if youre being charged for credit monitoring.

TIP: Before you pay to get your credit score, ask yourself if you need to see it. Your credit score is based on whats in your credit history if you know your credit history is good, your credit score will be good. It might be interesting to know your score, but you can decide if you want to pay to get it. For more on credit scores, see the article .

What Should You Look For In A Report

First, make sure all of your personal information is correct. Then zero in on your credit history, especially the subsection called adverse accounts. It can show potentially negative items like a past-due credit account or a debt that was sent to collections, which can hurt your credit.

You may find errors in this section that youll want to correct. Reach out first to the creditor and then to the credit bureaus. The Consumer Financial Protection Bureau, a federal agency, has a guide for disputing errors, including sample letters.

If an error looks fraudulentfor example, you see a mortgage for a house you dont ownact quickly. Contact the credit bureaus and ask them to put a fraud alert on your account. Youll also want to file a report with the police and the Federal Trade Commission.

Also Check: What Does A Credit Report Look Like

What Is A Credit Report

When you apply for a credit card, mortgage or loan, the lender will most likely request access to your credit report. Your credit report provides important insights into your financial background and gives your lenders a look at your payment history and creditworthiness so they can determine your eligibility for credit.

How To Get Your Credit Report

You have the right to get a free copy of your credit report every year from the three nationwide credit bureaus: TransUnion, Equifax, and Experian. Some financial advisors suggest staggering your requests over a 12-month period to help keep an eye on your reports and make sure they have accurate information. The best way to get your free credit report is to

- go to AnnualCreditReport.com or

Through December 2023, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

And everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

Don’t Miss: How To Get A Public Record Off Your Credit Report

Soft Pull Business Credit Cards

There are many business credit cards that allow you to do a soft pull, which means that you can check your creditworthiness without affecting your credit score. This is a great way to see if you qualify for a particular card without having to worry about a hard inquiry impacting your score. Some of the best soft pull business credit cards include the Capital One Spark Cash for Business, the Chase Ink Business Cash Credit Card, and the American Express Blue Business Cash Card.

Soft pull credit cards allow you to check for pre-approval before requesting a credit limit increase. Most soft pull cards require you to answer a series of questions before you can open a new account. There are a few secured credit cards that allow you to pull a soft pull, but it is not a viable option for all. Soft pull credit cards are not accepted by any other credit card company. They require applicants to be at least 18 years old and have a U.S. mailing address and Social Security number. WalletHubs editors selected several of their favorite credit cards from issuers that offer pre-approval and a soft pull. Certain types of general-use credit cards do not require a credit check.

Read Also: Does Simm Associates Report To Credit Bureaus

Who Looks At Credit Reports

The Fair Credit Reporting Act and some state laws attempt to restrict who can access your credit report and how that information can be used, but generally speaking, any business you seek credit from or anyone who has legitimate business need, can request to see your report.

Businesses with access to credit reports:

One thing worth noting: by law, you have the right to know who has inquired about or requested your credit report in the last six months. When you request a copy of your report, a list of all businesses or individuals should be on it.

You May Like: Does Sprint Report To Credit Bureaus