Add A Note To Your File

If there were difficult circumstances when the default happened, you can ask the CRA to add a note onto your file. For example, if you fell into debt and your account defaulted because you were made redundant, or suffered a serious illness, you could add a note to help lenders understand the situation. This could help to offset the defaults negative impact if you need to apply for credit.

How You Will Know About A Cifas Warning

If there is a CIFAS warning against your name you will be able to see this on your credit file. If you are an innocent victim of fraud, CIFAS members must also send you a letter telling you that there is a CIFAS warning against your name.

A CIFAS Member is not allowed to refuse an application or cancel a service you are getting, such as an overdraft agreement, just because there is a warning on your credit reference file. They must make further enquiries to confirm your personal details before making a decision.

You can get tips and useful information from CIFAS on how to avoid identity theft and what to do if you are a victim of it.

Can I Remove A Ccj From My Credit History

In some circumstances, you can remove a CCJ from your credit file. If you think a CCJ has been registered on your account unfairly or by mistake, you can contact the three credit reference agencies Experian,Equifax and TransUnion to remove a CCJ from your credit profile.

You need to be able to prove that:

-

You paid the full amount within one month of the CCJ being issued

-

Its been six years since you received the CCJ

-

An insurance company was responsible for the debt

-

You disputed the CCJ and it was cancelled or set aside by the court

Don’t Miss: Where To Get The Best Credit Report

% Collections Foreclosure & Bankruptcy

An account thats in collections can severely damage a credit score, since its reached the point that a borrower has given up paying their bills and now, their lender has asked a collection agency to intervene and get the debt paid. A bankruptcy never has a positive impact on your credit score, but the severity which it affects your numbers depends on your own individual credit profile and situation.

Get Your Credit Report

You can ask each credit reference agency to give you a free copy of the credit report they hold about you. This is called your statutory credit report. Hover over the country where you have taken out credit and click on the logo of the ACCIS member that provides credit reports in that country. You will be taken to the dedicated area of their website.

Note: ACCIS cannot accept any responsibility or liability for the information provided on the website of its members, or for the use to which it is put to or for any resulting loss.

Also Check: How Do You Unlock Experian Credit Report

Don’t Miss: How To See A Free Credit Report

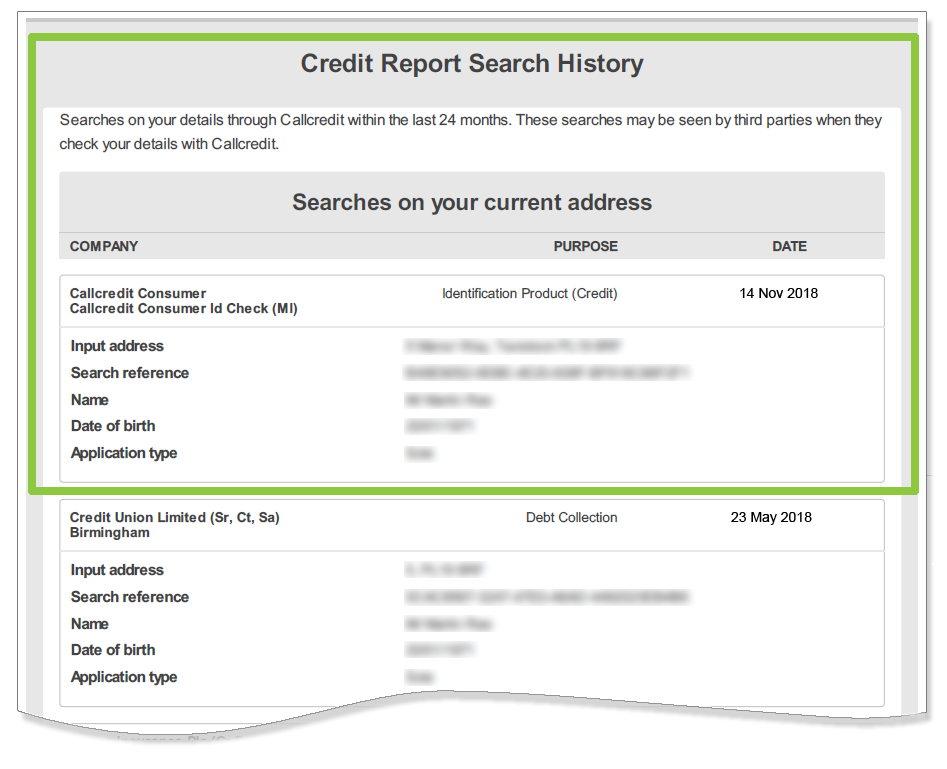

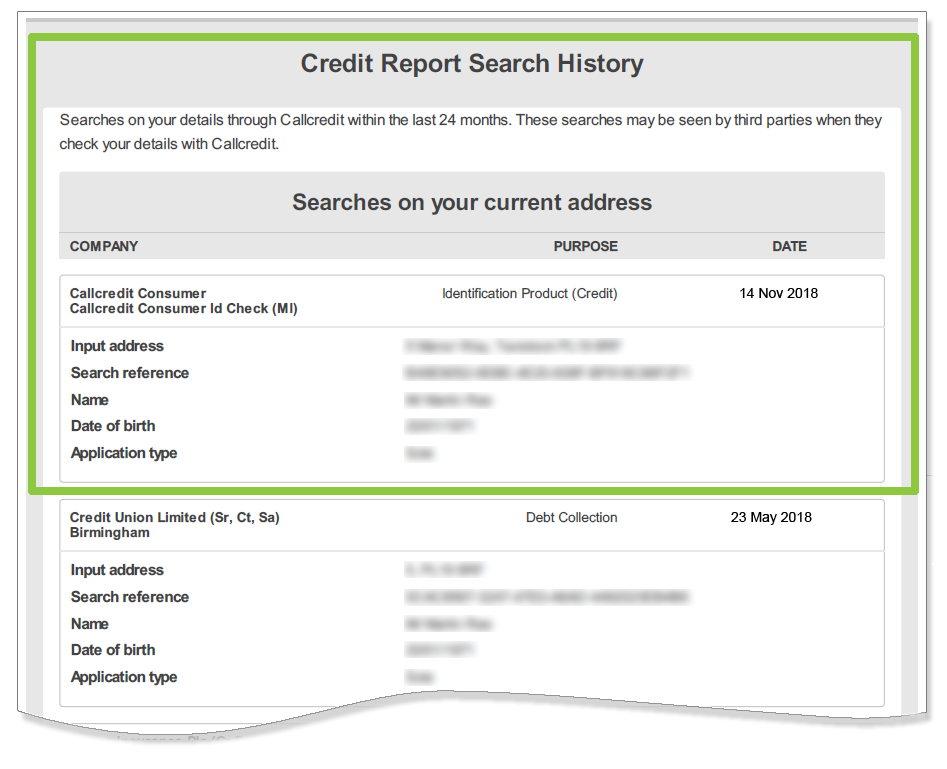

Scan Your Corrections Section

The âCorrectionsâ section shows you any notices of correction youâve added to your report within the last 6 years. A notice of correction can be used to explain any information on your report that you donât think accurately represents your financial situation, for example, if you missed a payment because you were ill and couldnât pay. Itâs a short statement you can submit to credit reference agencies, whoâll add it to your report for prospective lenders to see.

This section is unlikely to be of any use when searching for fraud, as itâs made up of information youâve submitted – fraudsters are unlikely to take the time to submit a notice of correction on your behalf. We suggest you skip this section and head to âSearchesâ.

Improving Your Credit Score

Its always worth taking steps to improve your credit score when youre considering entering a credit agreement.

Theres lots of ways you can improve your credit score if you need to. Some are super simple like making sure youre on the electoral roll. Others are longer term, like managing your credit in general.

Also Check: How To Request Credit Report

How Do You Get A Cifas Marker

As discussed in the different types of markers, there are a multitude of reasons why CIFAS might put a marker next to your account. However, you might be most surprised about getting a CIFAS marker if you have been a victim of fraud. These types of markers are purely for your protection and can be easily removed with the correct guidance.

A CIFAS marker may only become known to you when you make an application for credit, such as a mortgage or insurance package.

What do CIFAS markers affect?

CIFAS markers will be shared with other financial institutions, so they will be likely to affect applications that you make from any lender, such as a bank, loan company, insurer, or mortgage broker.

These are just a few ways that a CIFAS marker might affect you:

- One of the most common impacts is struggling to have credit applications accepted such as a mortgage, car insurance, an overdraft or a mobile phone contract

- The bank declining your new account application

- You may also struggle to get a student loan as you will need a bank account the student loans company is a member of CIFAS

- Financial institutions that become aware of your marker may close your account

- If you are employed in the financial sector, you may lose your job with a marker held against your name

Is your business losing money due to a CIFAS marker?

Dont worry, were here to give the advice you need when you need it. Just contact us to arrange an appointment.

Lines open 24/7

Check Your Balances Under Accounts

Your âAccountsâ section contains information about any credit and current accounts you hold. Theyâre split into sections like âcredit cardsâ, âloansâ, âmortgagesâ etc., to give you the important details at a glance.

Firstly, check the overdraft balances on any current accounts listed. If anything looks strange here, itâs best to compare the figures to your bank statement, and speak to your bank if youâre still suspicious.

Then check that everything else is in order, such as the mortgage and utility sections. If you see something you donât recognise, like a telecoms account thatâs been recently opened but you donât remember opening it, get in touch with the provider for further information. It might be a mistake on your credit report, but itâs possible that someoneâs opened an account using your details.

Also Check: Does Care Credit Report To Credit Bureaus

Does Your Credit Score Show Up On A Background Check

Its the question everyone is asking: does your credit score show up on a background check?

Or maybe theyre asking why would I have to have a background check?

Well, those questions and more will soon be answered for you! Buckle in, because youre about to go on a roller coaster. A roller coaster of knowledge!

Also Check: How To Get Negative Stuff Off Credit Report

Who Looks At Your Credit Report

When you apply for credit, youll usually be expected to give your permission to the credit provider to check your credit report.

The term credit provider doesnt only include banks and credit card companies. It also includes mail-order companies and, for example, providers of mobile phone services if you have a phone contract .

Employers and landlords can also check your credit report. However, theyll usually only see public record information such as:

- electoral register information

- County Court Judgements .

Don’t Miss: When Does Discover Report To Credit Bureaus

How To Check Your Credit Report For Free

Use the above steps to check your credit report for free on AnnualCreditReport.com. Remember, you can access your reports from all three bureaus weekly through April 2022, so take advantage while you can.

Experts recommend checking each bureaus report about once a year and the FTC reports one out of five people finds an error when they do. Thats why its important you check your report regularly and dispute and fix any errors, which can help boost your score.

What Signs Should I Look Out For

There are a number of signs to look out for that may mean you are or may become a victim of identity theft:

- You have lost or have important documents stolen, such as your passport or driving licence.

- Mail from your bank or utility provider doesnt arrive.

- Items that you dont recognise appear on your bank or credit card statement.

- You apply for state benefits, but are told you are already claiming.

- You receive bills or receipts for goods or services you havent asked for.

- You are refused financial services, credit cards or a loan, despite having a good credit rating.

- You receive letters in your name from solicitors or debt collectors for debts that arent yours.

Also Check: How Long Should Inquiries Stay On Credit Report

How Long Will An Iva Stay On My Credit Report

When the IVA is completed, your details will be removed from the Individual Insolvency Register after three months. Details of the IVA will be held onto your credit file for six years from the date the IVA was issued. So, even when your IVA is completed itll still be visible to lenders on your credit file.

Recommended Reading: When Does Comenity Bank Report To Credit Bureaus

Negative Impacts To Your Credit Score

- Missed payments: This can be everything from loans to bill payments.

- Defaulting on payments: A default is where a payment over $125 is overdue by more than 30 days and the lender has tried to recover the money. This stays on your credit record even if you repay the amount in full.

- Insolvency: Filing for one of the three types of insolvency â debt repayment plan , no-asset procedure or bankruptcy.

- Applying for too much credit: Applying for multiple sources of credit in a short space of time, eg applying for four credit cards in three months.

- Multiple credit checks: Many agencies/organisations checking your credit score shows you may be seeking more loans or credit than you can afford.

- Shifting debt from one credit card to another.

- Debt collections: You owe money and your debt has been passed on to a debt collector.

- Hardship applications: If you applied for hardship with a previous loan, eg repayment holiday.

- Payday loan and quick finance applications: With their high interest rates, other lenders may consider these a last resort.

- No credit: Having no credit history means theres no way for future lenders to see if you are a risk or not. This can have the same negative impact as having bad credit.

Read Also: How To Update Your Credit Report

What Information Is Kept By Credit Reference Agencies

Credit reference agencies are companies which are allowed to collect and keep information about consumers’ borrowing and financial behaviour. When you apply for credit or a loan, you sign an application form which gives the lender permission to check the information on your . Lenders use this information to make decisions about whether or not to lend to you. If a lender refuses you credit after checking your credit reference file they must tell you why credit has been refused and give you the details of the credit reference agency they used.

There are three credit reference agencies – Experian, Equifax and TransUnion. All the credit reference agencies keep information about you and a lender can consult one or more of them when making a decision.

The credit reference agencies keep the following information:

If there has been any fraud against you, for example if someone has used your identity, there may be a marker against your name to protect you. You will be able to see this on your credit file.

Get A Copy Of Your Credit Reference File

You can ask for a copy of your credit reference file from any of the credit reference agencies. If you have been refused credit, you can find out from the creditor which credit reference agency they used to make their decision. Your file shows your personal details such as your name and address, as well as your current credit commitments and payment records.

You have a right to see your credit reference file – known as a statutory credit report. A credit reference agency must give it to you for free if you ask for it.

If you sign up to a free trial and decide its not right for you, remember to cancel before the trial ends or you might be charged.

Don’t Miss: When Does Usaa Report To Credit Bureaus

Access To Credit Reports Across Borders

One of the challenges facing anyone moving to another country is financial. You could have a great credit history but no way to leverage that credit to get housing or consumer goods in your new destination. To solve that problem, the ACCIS has actively encouraged the reciprocal exchange of credit information among its members. Since the 1990s, ACCIS members can sign bilateral Credit Bureau Data Exchange agreements on the exchange of information, in order to improve the cross-border accessibility and transferability of your credit data and to support their clients .

In the CBDE model, in order for a lender to get access to your credit data from another country, the lender accesses CRAs located in that country through the CRA with whom it usually works in its own country. As a borrower, you may want to inform your lender that such service may be available with the CRA it uses for creditworthiness assessments.

Why Mortgage Lenders Dont Like Payday Loans

Regular payday loan use can cause issues with potential mortgage lenders, as mortgage underwriters can consider it mismanagement of finances and a potential indicator of risk, and we speak to hundreds of customers who have been declined as a result.

Thats not to say there arent lenders out there for you, as thankfully there are providers offering mortgages after payday loan use at competitive rates, and the specialists we work with already know which lenders will accept payday loan use.

Finding a mortgage with a history of payday loan use can be tricky for several reasons.

- Lack of clear lending policy:Lenders are not exactly transparent when it comes to their criteria, and many lender websites and support centres make no mention at all of how payday loan use impacts mortgage approval.

- Lack of specialist broker knowledge:Sadly even whole of market brokers dont understand the market well enough to be able to give sound advice on mortgage criteria and payday loans, as many dont come across these borrowers often enough to research lending policy across the hundred or so lenders they work with.

- A try it and see attitude to applications:As intermediaries, we have direct access to lender support teams and development managers, and often they dont even know their own stance, with many high street providers simply suggesting that you make an application and see not helpful advice.

You May Like: How To Check Credit Score For Free

Why Are Cifas Markers A Roadblock To Obtaining Credit

Richardson Lissacks consultants pick a more flexible, balanced, and satisfying job. A lot of credit applications are automatically investigated. When applying for a store credit card, vehicle financing, or even a personal loan, for example. If a CIFAS marker is recorded against you, this automated procedure will not be allowed to proceed your application will have to go through additional checks.

Furthermore, financial institutions may be more reluctant to lend to those with a CIFAS marker because of their previous history.

Cifas Fraud Markers: The Problems They Cause

This article concerns our recent experiences of advising company directors and individual, who have unwittingly found themselves with adverse fraud markers issued by banks with an organisation called Cifas. These markers have left them with the prospect of their credit rating being destroyed for up to six years, sometimes through no fault of their own.

Cifas is an organisation set up by banks and other financial institutions for their benefit it flags customers who, in their opinion, may present a risk of committing fraud, and these markers work to prevent such customers from obtaining credit. Other markers are designed to protect victims of fraud, making sure banks take extra precautions for the customer.

However, there are occasions when Cifas markers are issued with disastrous consequences, particularly when the customer is innocent of any wrongdoing. The range of issues we have experienced recently is quite alarming, and gives us grave cause for concern that some financial institutions and Cifas investigate cases to a perfunctory standard. We are also getting a better understanding of which banks are the worst culprits and are seeing repeated worrying behaviours.

We have also seen everything from applications for credit going wrong, people who have been wrongly named as fraudsters or money launderers, and employee disputes with financial institutions.

The good news is that when the banks get it wrong, they will admit their mistakes.

Contact us, we are here to help

Also Check: How To Repair Your Credit Report Yourself

What Are Cifas Markers And What Do They Signify

When a financial institution, such as a bank, insurance company, or loan firm, suspects that you or your company have been involved in a financial crime and places CIFAS markers on your credit report, it is called an adverse decision. Other organizations may then use this indicator to learn more about you and the potential hazards of lending to you.

Impact On Your Credit Score

Even though debts still exist after seven years, having them fall off your credit report can be beneficial to your credit score. Once negative items fall off your credit report, you have a better chance at getting an excellent credit score, granted you pay all your bills on time, manage newer debt, and dont have any new slip-ups.

Note that only negative information disappears from your credit report after seven years. Open positive accounts will stay on your credit report indefinitely. Accounts closed in good standing will stay on your credit report based on the credit bureaus policy.

When the negative items fall off your credit report, it also improves your chances of getting approved for new credit cards and loans, assuming theres no other negative information on your credit report.

Dont Miss: Realpage Consumer Report

Recommended Reading: Is 627 A Good Credit Score