Moving Past A Fair Credit Score

While everyone with a FICO® Score of 650 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 41% of Americans with a FICO® Score of 650 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

Is Experian More Accurate Than Credit Karma

Experian vs. Credit Karma: Which is more accurate for your credit scores? You may be surprised to know that the simple answer is that both are accurate. Read on to find out what’s different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

Why Are My Credit Karma And My Fico Scores Different

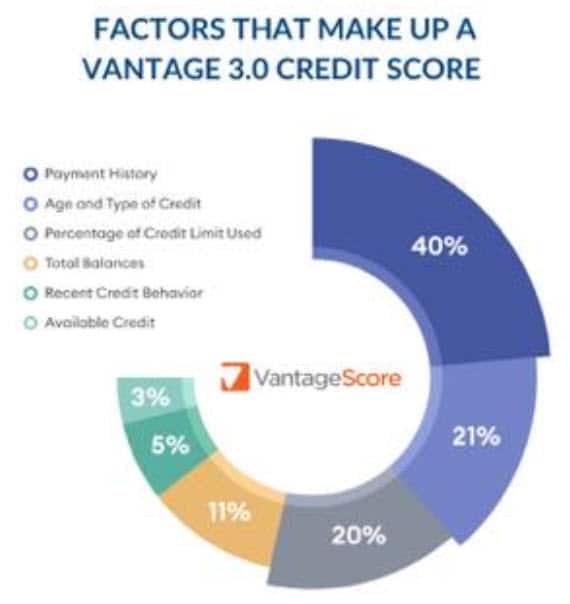

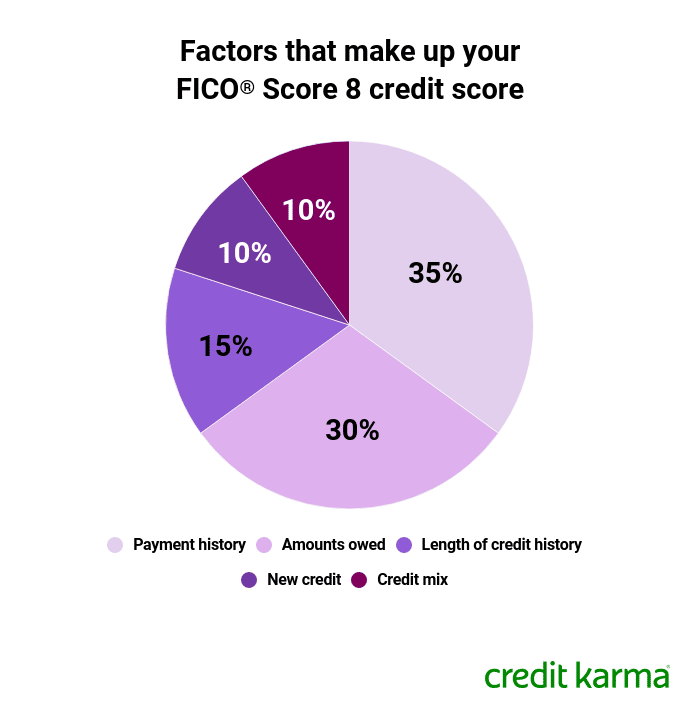

VantageScore and FICO are the two big rivals in the credit rating business. Credit Karma uses VantageScore. Their models differ slightly in the weight they place on various factors in your spending and borrowing history.

On the customer review site ConsumerAffairs, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores. Whether these posts are reliable is unknown, but it is worth noting.

If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.

Also Check: What Is A Revolving Account On Your Credit Report

My Experience Using Credit Karma

This is one of the simplest fintech sites Ive signed up for. Its interface is incredibly clean and uncluttered, so I could see all the data I needed in one or two glances. Ive always known I needed to monitor my credit regularly but had trouble following through, and Credit Karma makes this part easy.

The site security is on point the browser logs you out after several minutes of inactivity, and two-factor authentication automatically kicked in before I checked out the savings account page. You can opt to save your log-in info or take the extra step of two-factor logins each time.

The identity theft monitoring tools are as basic as they come , but not bad for a free platform.

The product recommendations arent really a perk of the platform the way Credit Karma suggests, but they arent extra annoying either. I pretty much ignored the ads. Unless you click on the Recommendations tab, theyre easy to overlook.

If I were in the market for a new credit card or an auto or home loan, I might take a look at Credit Karmas offers, but I recommend supplementing these offers with your own independent research. Credit Karma doesnt show you every option thats out there, only the options available through their partners.

That said, the recommendations are a helpful way to suss out what kind of interest rates and loan amounts you can expect based on your credit, without filling out a million pre-approval offers.

What Is A Vantagescore

VantageScore was created by the three major credit reporting agenciesExperian, Equifax, and TransUnion. It uses similar scoring methods to FICO but yields slightly different results.

Featured Topics

One of the primary goals of VantageScore is to provide a model that is used the same way by all three credit bureaus. That would limit some of the disparity between your three major credit scores. In contrast, FICO models provide a slightly different calculation for each credit bureau, which can create more differences in your scores.

You May Like: What Credit Score To Buy A House

Why Is My Fico Score Lower Than My Credit Score

Your credit score can impact many things in life. Besides affecting your ability to get a loan, buy a house, or buy a vehicle, your can affect what you pay for insurance and if you can get a cell phone.

If youre wondering why your FICO score is lower than your credit score, the answer depends on what credit scoring model is being used and what factors that scoring model looks at.

Youll have better luck getting a loan with a than 500. If youre able to get a loan with a low score, that loan will probably come with a higher interest rate.

Also Check: Paypal Credit Soft Pull

Why Credit Scores Matter

Your credit scores are three-digit values assigned to you by different credit reporting bureaus. There are three distinct reporting bureausTransUnion, Equifax, and Experian. Each one might use slightly different information available to calculate the scores.

Lenders refer to these scores to determine a persons creditworthiness, or how safe it is for them to offer you a loan. A higher credit score can mean a better interest rate on a home loan or auto loan, which could save you a lot of money in the long run.

VantageScore generally uses the same customer information in calculations as FICO, but it might weigh each factor differently, which could result in a different score. VantageScore and FICO look at factors like your payment history, length of credit history, amounts owed, credit utilization, and types of credit.

Don’t Miss: What Credit Score Do You Need To Rent A House

Which Credit Scores Does Credit Karma Offer

The model used for credit scores on Credit Karma is VantageScore® 3.0.

While VantageScore® credit scores arent used as widely as FICO® scores for credit decisions, they can still give you a good idea of where your credit stands. Remember, the VantageScore® model incorporates many of the same factors that are used when calculating your FICO® scores, although it may assign a different weight to certain factors.

Credit Karma shows you the different credit factors that can affect your scores and where you can work to try to improve your credit. And if you opt for , Credit Karma will also send you alerts when there are important changes to your credit reports, which may help you spot potential errors or fraud. Using a service like this can give you tools to help you improve your credit.

Types Of Credit Scores Available

In the world of consumer credit, there are several different credit scores that may be used by creditors to evaluate the risk of a new borrower.

Regardless of the type used, information like an individuals account payment history, number of accounts open and used, credit utilization percentage, and any negative credit issues are all included in the calculation of ones credit score.

An in-depth algorithm is applied to these details to derive a three-digit number ranging from 300 to 850, in most cases. The higher the credit score, the more sound a borrower the individual is perceived to be when a new application for credit is submitted.

While Credit Karma boasts its free credit score to anyone who wants it, the company provides access to an individuals VantageScore 3.0, not the FICO Score that the majority of lenders use to evaluate an individual. The VantageScore 3.0 has the same credit score range as FICO and uses some of the same information a FICO Score does, but the way in which the information is used to determine ones credit score is different.

When Credit Karma users see their credit score details on the site or the mobile app, they are viewing their VantageScore 3.0.

In addition to using a different type of credit score than most lenders and financial institutions, Credit Karma also offers access to only two credit scores from two of the credit reporting agencies.

You May Like: How To Get My Credit Score Up Fast

Re: Credit Karma Score Was Way Off

Less than 10% of lenders actually use the vantage score. Now, with that being said…. some lenders will use it on their apps for their site. Capital one is an example. Credit karma is all marketing ploys to get you to apply for cards they’re contracted with.

The FICO scores are the most widely using scoring models out there. For credit cards, predominantly the FICO 8, though there are lenders that use a bankcard 8 version and some have even crossed over into the FICO9 models. Just as auto loans have Auto 8 or even Auto 5 though the Auto 5 is older version. Same thing with mortgages.

Older versions of the fico like Fico 2 or bankcard 2 or whatever… are almost non existent.

Focus on improving your Fico 8 scores for now.

Whats In My Credit Reports

Your are records of your past dealings with creditors and other credit history. They include information such as your name, addresses, employers, the history and status of various credit accounts, and inquiries from companies checking your reports. If applicable, youll also find information from public records, such as bankruptcies, tax liens and civil judgments.

Recommended Reading: How Long Does It Take For Credit Report To Update

How Many Credit Scores Do You Have

Many borrowers think they only have three credit scores one for each bureau . But even though the consumer information comes from the three main bureaus, different scoring algorithms are used to develop the score. Thats why there are hundreds if not thousands of credit scores. Some are industry-specific, like in the auto industry.

Add to the confusion that scoring models are updated all the time. The moral of this story is if youre getting a mortgage dont think your Credit Karma score is accurate.

How Do Public Records And Judgments Impact Fico Scores

Public records are legal documents created and maintained by Federal and local governments, which are usually accessible to the public. Some public records, such as divorces, are not considered by FICO® Scores, but adverse public records, which include bankruptcies, are considered by FICO® Scores. FICO® Scores may be affected by the mere presence of an adverse public record, whether paid or not. Adverse public records will have less effect on a FICO® Score as time passes, but they can remain in your credit reports for up to ten years based on what type of public record it is.

Dont Miss: Aargon Collection Agency Scam

Recommended Reading: What Is Credit First On My Credit Report

What’s The Difference Between Fico Scores And Non

Not all credit scores are FICO Scores.For over 25 years, FICO Scores have been the industry standard for determining a person’s credit risk. Today, more than 90% of top lenders use FICO Scores to make faster, fairer, and more accurate lending decisions. Other credit scores can be very different from FICO Scoressometimes by as much as 100 points!

What’s in a name? When it comes to FICO Scores versus other credit scores, the answer is “quite a lot.”

FICO Scores are used by 90% of top lenders to make decisions about credit approvals, terms, and interest rates. Chances are when you apply for a mortgage, an auto loan, credit card, or a new line of credit, the bank or lender is looking at your FICO Score.

The reason? Lenders know what they are getting when they review a FICO Score. FICO Scores are trusted to be a fair and reliable measure of whether a person will pay back their loan on time. By consistently using FICO Scores, lenders take on less risk, and you get faster and fairer access to the credit you need and can manage.

FICO Scores use unique algorithms to calculate your credit risk based on the information contained in your credit reports. While many other companies design their credit scores to look like a FICO Score, the mathematical formulas they use can vary greatly.

Who Should You Trust

When youre going to get a mortgage, have your credit pulled by the lender youre going to use. Theyll get all three of your scores and take the middle one. If your score is too low, a good lender will tell you how to raise it. Knowing your score and whether you have good credit or great credit is important. Thats because your ability to get a mortgage and what type of interest youll be paying is connected to your score.

Also Check: Is Mint Credit Score Accurate

Clearing Up Confusion: Why Your Credit Score May Be Different Depending Where You Look

Keeping track of your credit score is important. Before you apply for a credit card, car loan or other type of credit, you likely want to know your score.

But with all of the sites offering credit scores these days, which ones can you trust?

As you’ll see, some scores might make your heart stop.

Let’s go through the types of credit scores. I’ll explain why they can look so different, along with where you can get your scores for free.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

Is Credit Karma Accurate

Though the FICO score is arguably the best-known credit score , many people aren’t aware that FICO doesnt actually collect information. FICO is a model used to create a score by looking at your files from the three major .

Credit Karma’s VantageScore follows much the same process, except that its scoring model was actually created by the credit bureaus. Although VantageScore is less known to the public, it claims to score 30 million more people than any other model. One advantage is that it scores people with little , otherwise known as having a thin credit file. If you’re young or have recently come to live in the U.S., that could be an important factor.

The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those credit bureaus.

Read Also: Do Apartment Credit Checks Hurt Your Credit Score

Does A Fico Credit Score Accurately Predict A Borrower’s Future Ability To Repay Debt

FICO did a study on how well its credit scores mirrored borrowers’ risks for defaulting on their debt, and according to an analysis for the Federal Reserve, it looks like its credit score does correlate with a borrower’s ability to repay debt in the future. It looked at the actual performance of borrowers between 2008 and 2010, relative to their credit scores and found this:

|

FICO® Score |

|---|

Why Fico Scores And Credit Scores Matter

A bad credit score can haunt you by making it difficult to rent an apartment, get an affordable mortgage, or land a job. Even if youre able to qualify for a loan, your interest rates will be higher than if you had good credit scores.

And that has costly ramifications: On a $150,000 mortgage, for example, a 1% higher interest rate could cost you $31,000 over 30 years.

On the other hand, good credit scores open all kinds of doors. Not only will you find it easier to borrow money when you need it, theyll also qualify you for lucrative credit card offers.

Yes, irresponsible credit card use can lead to a damaging debt spiral but responsible credit card use can reward you immensely for your everyday spending.

If you have high credit scores, you could get cards like the Chase Sapphire Reserve® , which offers a signup bonus worth hundreds in travel, or the Citi® Double Cash Card 18 month BT offer , which offers 2% cash back on every purchase .

Not there yet? Dont worry. Focus on building credit slowly and strategically. The best credit cards will be waiting for you when youre ready.

Also Check: Why Is There Aargon Agency On My Credit Report

Read Also: When Does Self Lender Report To Credit Bureaus

Should I Enroll In Fico Score

In short, it puts a number on the likelihood that you’ll pay back your loan. Your credit score can help a lender decide whether to charge you higher interest rates on, say, a mortgage, than it would charge if you had a better score. … You’ll be eligible for credit at lower interest rates, a potentially big money-saver.

Experian Vs Credit Karma: Whats The Difference

Experian is one of the three major credit bureaus, along with Equifax and TransUnion. These companies compile information about your credit into reports that are used to generate your credit scores.

Instead, we work with Equifax and TransUnion to provide you with your free credit reports and free credit scores, which are based on the VantageScore 3.0 credit score model. We also offer recommendations for credit cards, personal loans, auto loans and mortgages.

Don’t Miss: Is Fico Score Different From Credit Score

The Other Side Of The Coin

While the continued improvement in U.S. consumer credit profiles in aggregate is encouraging, it is important to note that there are millions of consumers for whom the financial strain of the last year has been observable in their credit files. In fact, some 17% of the FICO scorable population experienced a score decrease of 20 or more points between April 2020 and April 2021 . For many, this decrease has been driven by the inverse of the aggregate credit trends that are driving the national average FICO® Score upwards: the impacts of COVID-19-related income disruptions has led to missed payments and/or ramped up debt levels, as personal loans and credit cards are used as a lifeline to cover life necessities.

Figure 4. 37% of FICO Scorable Population Experienced Year-Over-Year Score Decrease

To learn more about FICO® Scores, check out these resources: