How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.50 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

How To Get A Free Credit Report

A is a statement with information about your credit activity, current credit score, loan paying history, and account status. Credit Bureaus, consumer reporting agencies, or other credit reporting companies collect financial information and submit them to creditors. Most people require more than one credit report in a year. However, the creditors do not have to report every credit reporting company.

The lenders use this information to determine the technicalities of the loans you apply for. For example, it could include the amount they can lend you, as well as the interest rates for these loans. Similarly, insurance providers may take this information to determine the kind of vehicle or house insurance they should provide you.

Free Weekly Credit Reports Just Got Extended Through 2023

Good news: Youll now be able to pull your once a week, for free, through the end of 2023.

Thats because the three major Equifax, Experian and TransUnion are extending a policy enacted in the early days of the pandemic to help alleviate financial hardship caused by the crisis. This is major, because previously, Americans were limited to one free credit report per agency per year.

Beyond that, they had to pay. Credit reports can cost up to $13.50, so having free access to them was helpful for consumers who pull them frequently in order to stay on top of their finances.

Though the free weekly credit reports policy was initially supposed to end in April 2021, that deadline has been pushed back repeatedly.

This time, the three bureaus are pointing to inflation as the reason. Prices are, on average, more than 8% higher than they were a year ago, and that surge has made everyday life significantly less affordable for millions of people.

The rising cost of living in the wake of COVID-19 has created economic consequences felt by many Americans, the Equifax, Experian and TransUnion CEOs said in a joint statement Friday. Credit reports play an important role in financial health, and providing weekly reports for consumers at no charge is another way that we can support financial education and stability for people across the U.S. at this critical time.

Don’t Miss: Can You Dispute Hard Inquiries On Your Credit Report

Do I Have To Pay For My Credit Report

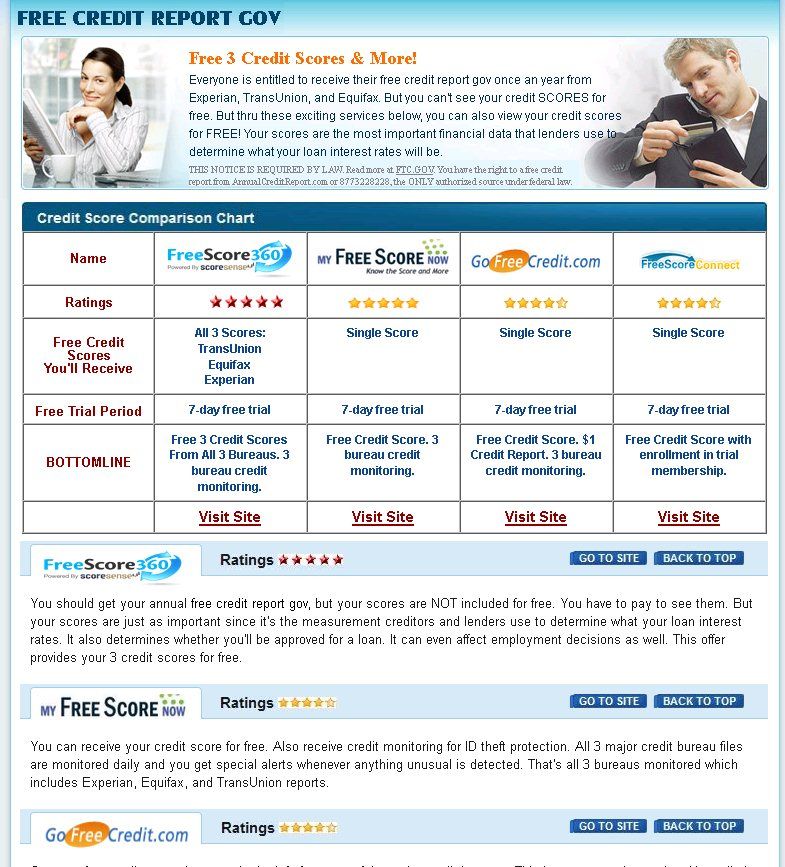

It depends. There are many free credit report resources available, but there are several that also charge fees. With so many free resources available, there really isn’t any need to pay for your credit report. Just make sure you access your credit report through a verified site, such as those listed in this guide and sites that start with “https.”

Verify Your Identity With The Credit Bureau

Once you click the next button, the portal will take you to the website of the first credit bureau you selected. Each credit bureau will ask you to verify your identity based on the information contained in your credit report.

This is the step where people can get tripped up. Youll be asked personally-identifying security questions to verify your identity, such as:

- The name of a lender or creditor that you have a loan or credit card with

- The monthly payment on a loan you have

- The date you opened an account

- A previous address that you had

The questions are multiple-choice and every question has an option for none of the above/does not apply. This is a valid answer. If none of the choices offered seem accurate, then the answer can be none of the above.

The reason that this information often trips people up is because you may not know the exact names of your lenders, especially if the account is several years old. It can be helpful to have account information on hand, such as statements, so you can confirm the information as you go.

If you are correct with your answers, you will be able to access the credit report. If you dont answer the questions correctly, youll be shown a page that will give you contact information, including a phone number and an address. This will allow you to verify your information over the phone so you can still get your reports.

Read Also: Which Credit Report Is Most Important

How To Get A Free Annual Credit Report:

- Online: Visit AnnualCreditReport.com and click on Request Your Free Credit Reports, then fill out the request form, which will require your name, address, Social Security number, and date of birth. Then, choose which bureau you want a report from to view them online.

- : Call 1-877-322-8228 and press 1, then follow the prompts. You will need to provide the same information as the online method.

- : Print and fill out the Annual Credit Report Request Form. Then, mail it to Annual Credit Report Request Service / PO Box 105281 / Atlanta, GA 30348-5281.

If you get a report from AnnualCreditReport.com, its best not to check your Experian, Equifax and TransUnion reports all at the same time. Review one of them now, and save the others for later, spreading them out across the year. Pulling your reports in rotation will help you ensure that youre not missing anything for an extended period of time.

Just bear in mind that using only AnnualCreditReport.com would be a mistake, as it would normally blind you to credit-report changes for much of the year. Due to the COVID-19 pandemic, however, all three credit bureaus are offering free reports weekly on AnnualCreditReport.com through April 2021.

While WalletHub and AnnualCreditReport.com are the best options for getting a free credit report, there are plenty of other choices, too.

Best For Daily Updates: Wallethub

WalletHub

-

Access to TransUnion report only

-

Account required

Your credit report information can change frequently as your creditors send in updates to the credit bureaus. Weekly or monthly updates can keep you a bit out of touch with your credit report details. WalletHub is the only site that provides free daily updates to your full credit report information along with a summary of important changes to your credit information.

Youll have the most updated information from your TransUnion credit report, allowing you to act quickly to changes or suspicious activity on your credit report. WalletHub also provides personalized credit advice based specifically on your credit information.

In addition to your free credit report, youll also have access to your free credit score , which allows you to quickly see where your credit stands and how potential lenders might view your credit risk. Theres no credit card necessary to sign up and you wont damage your credit by using the service, even if you check your credit report every day.

Recommended Reading: Does A Soft Pull Affect Credit Score

Enter Your Personal Information

Once youre on the correct website, click on the button near the top of the page or bottom left that says, Request your free credit reports. Afterward, click on the button with the same words below the line that reads, Fill out a form. Finally, complete the form by entering your name, birthdate, current address and Social Security number .

If you havent lived at your current address for at least two years, youll have to enter your previous address, too.

Does Checking My Credit Report Hurt My Credit

No, checking your credit report does not hurt your credit. And checking your credit score doesn’t hurt your credit either. These actions are considered “soft pulls” which don’t affect your credit score. Actions, such as applying for a credit card, which require a “hard pull,” temporarily ding your credit score.

Learn more: Check your odds of getting approved for a credit card without hurting your credit score.

Read Also: What Is On Your Credit Report

Free Equifax Credit Report In Spanish

Additionally you can receive your Equifax credit report in Spanish. Equifax is the first and only credit bureau to offer a free, translated credit report in Spanish online and by mail.

There are two ways to request your Spanish credit report, online or by phone.

You can visit: www.equifax.com/micredito or call Equifax customer service 888-EQUIFAX and press option 8 to begin requesting your free credit report in Spanish.

Nationwide Consumer Reporting Agencies

The three nationwide consumer credit reporting agencies, also called credit bureaus, are Equifax, Experian and TransUnion. They compile credit histories on consumers. Your credit history contains information from financial institutions, utilities, landlords, insurers, and others. The credit bureaus provide information on you to potential credit granters, insurers, landlords, and employers. You have the right to get a free copy of your credit history in several situations:

You also have the right to a free copy of your report from each of the credit bureaus every year.

Read Also: What Is A Good Credit Score To Get A Loan

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

How To Get A Free Credit Report: Bottom Line

Your credit report contains useful information about your credit history, which is what lenders use to determine whether you should qualify for more credit. You have access to a free credit report from each credit-reporting agency at least once per year from AnnualCreditReport.com take advantage of this to ensure there are no surprises.

Don’t Miss: Does Checking Your Credit Score On Credit Karma Lower It

Is Everyone Eligible To Get Their Free Statutory Annual Credit File Disclosure

Yes. As of Dec. 1, 2005 all consumers are eligible to request their statutory annual credit file disclosure once every twelve months.

Monitor your Experian credit report for free

No credit card required.

- Access to your free Experian credit report and FICO® Score

- Get real-time alerts to help you detect possible identity fraud sooner

- Monitor your spending and know when your account balances change

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Recommended Reading: How Does A Credit Rating Rank Individuals

Why Its Important To Check Your Credit Report

Checking your credit report should be done periodically to screen for reporting errors and unrecognized activity. The first signs of identity theft usually appear on your credit report, and the earlier you spot them, the easier it is to stop the theft. Even if all the information you find is accurate, seeing your credit activity at a glance can give insight into how to manage debt more efficiently and raise your credit score.

Requesting a free credit report should also be an early step in any upcoming plans involving applying for a loan, such as buying a home or car. Pull a copy at least six months before a major purchase because if you do need to work on your credit, dispute errors, etc., it can take several months or longer to address these issues, says Bringle.

As long as youre entitled to a free report, theres no harm in requesting one. A common myth is that getting your own report will hurt your credit scores, says Rod Griffin, senior director of public education and advocacy at Experian. It wont. This is because there are two types of credit checks: hard inquiries and soft inquiries. While the former can temporarily ding your score, the latter which includes requesting your personal credit report will not. Soft inquiries do not affect credit scores or lending decisions, says Griffin.

File A Complaint About A Debt Collector

Report any problems you have with a debt collection company to your State Attorney General’s Office, the Federal Trade Commission , and the Consumer Financial Protection Bureau . Many states have their own debt collection laws that are different from the federal Fair Debt Collection Practices Act. Your state Attorney Generals office can help you find out your rights under your states law.

Read Also: How To Increase Credit Rating Quickly

Order Your Free Credit Report

Consumers can get free copies of their credit report each year. The Fair Credit Reporting Act requires each of the three nationwide consumer reporting agencies Equifax, Experian, and TransUnion to provide you with a free copy of your credit report, at your request, once every 12 months.

At least once a year, review each one of your three credit reports to:

- ensure that the information is accurate and up-to-date before you apply for a loan, lease a car, get a credit card, buy insurance, or apply for a job.

- help guard against identity theft. If identity thieves use your information to open new account in your name, those unpaid accounts get reported on your credit.

To order your FREE reports:

Get Your Free Credit Report

- Publish date: Feb 1, 2008 12:00 AM EST

We all have the legal right to see our credit-score reports for free, but getting them can be complicated.

Teresa Yakes learned the hard way just how complicated it is to get one of those reports. When she was struggling in May to avoid bankruptcy and working with a debt consolidation company, her lawyer told her to get her free credit-score report online. Yakes went to what seemed to her like the obvious place: freecreditreport.com.

Weeks later, Yakes discovered that the site now expected her to pay a fee every month. “I thought, ‘screw that,'” Yakes says. “It’s supposed to be freecreditreport.com.”

To be sure, freecreditreport.com’s home page says in a box underneath the blond woman that if you order your free report at the site, you’ll also begin a subscription to Triple Advantage Credit Monitoring. That not only gives you those promised “free” reports, but also checks them daily at a fee of $14.95 per month if you don’t cancel your membership within a 30-day trial period.

“We do put that information in to make sure the consumer understands,” says Kelly Poffenberger, a spokesman for the Dublin credit-reporting agency Experian Group, which owns freecreditreport.com.

Whether they understand what they’re getting or not, many consumers are choosing to pay to see their credit scores these days, and agencies are earning gobs of money by selling services that take the concept of monitoring to new heights.

Also Check: How Long Does It Take To Get 800 Credit Score

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get atAnnualCreditReport.com.

How To Correct Errors In Your Credit Report

If you see anything you believe is incorrect, contact the credit bureau immediately. You can call the telephone number on the report to speak with someone at the credit bureau. If you find evidence of identity theft, the next steps to take include contacting any creditors involved to close fraudulent accounts and filing a police report. See Identity Theft Victim Checklist, on our web page for more information on what to do.

You May Like: When Does Elan Financial Report To Credit Bureaus

Free Annual Credit Report

Review your credit report often to make sure the information is accurate. If you see something on your report that you didnt do, it could mean youre the victim of identity theft.

You can get one free credit report each year from each of the three nationwide credit bureaus. The website annualcreditreport.com is your portal to your free reports.

Note: when you leave that website and move to the company website to get your free report, the company will probably try to get you to sign up for costly and unnecessary credit monitoring services.

You can also get your credit reports by phone by calling 1-877-322-8228. Under North Carolina law, credit monitoring services are required to tell you how you can get credit reports for free.

To keep track of your credit during the year, request a free report from a different credit bureau every four months. You can also pay for additional copies of your credit report at any time.